by Research Reports | Nov 22, 2022

The current CFSv2 for Dec has been migrating to a cooler pattern for up North, while pushing the above normal temps for the L48 further South. This is starting to set up a weather pattern that could take overall Dec temps closer to normal, rather than the warm pattern...

by Research Reports | Nov 21, 2022

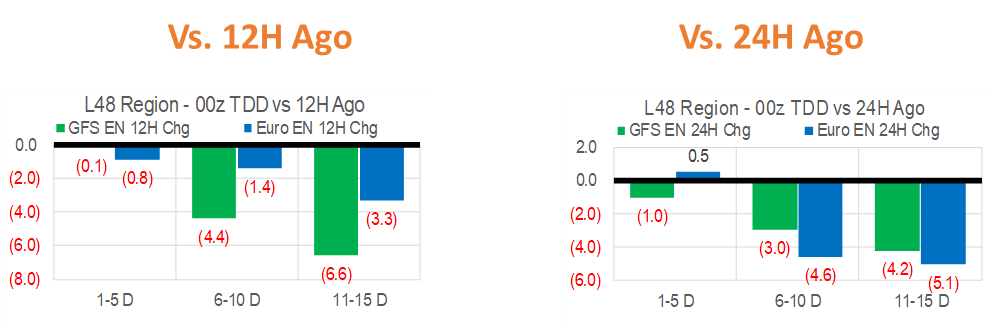

The Dec contract slightly higher this morning with much of that November cold now behind us. Much of the nation experienced temps that were 10 to 20 degree below normal last week, but with the weekend runs we now finish Nov much warmer. Both the GFS and Euro Ensemble...

by Research Reports | Nov 20, 2022

Another week, another Freeport story on Friday. At least this time it didn’t start as a rumor and end with a PR release near the end of the day. The latest release from Freeport gives some sort of timeline, but nothing definitive. The press release came mid-day...

by Research Reports | Nov 18, 2022

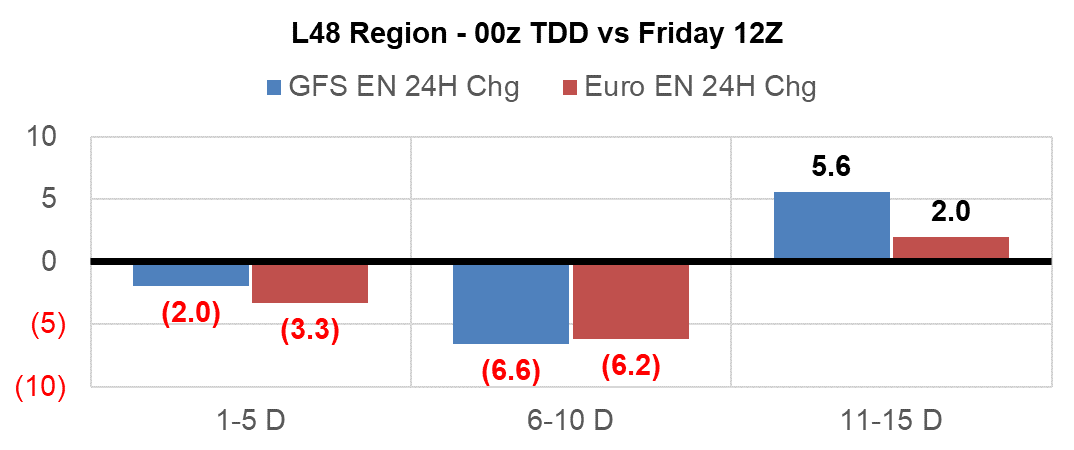

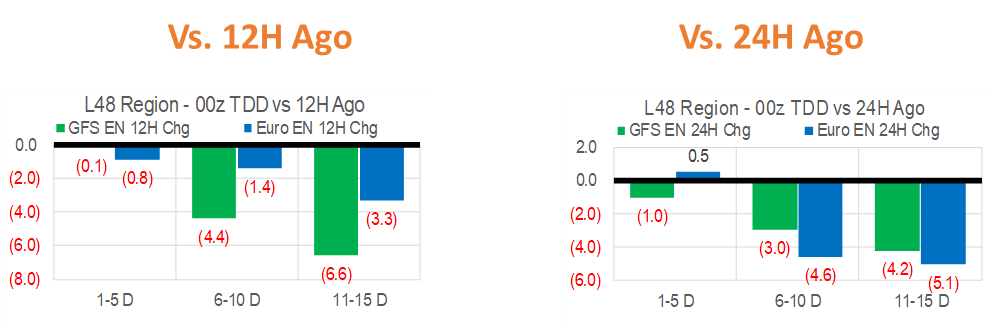

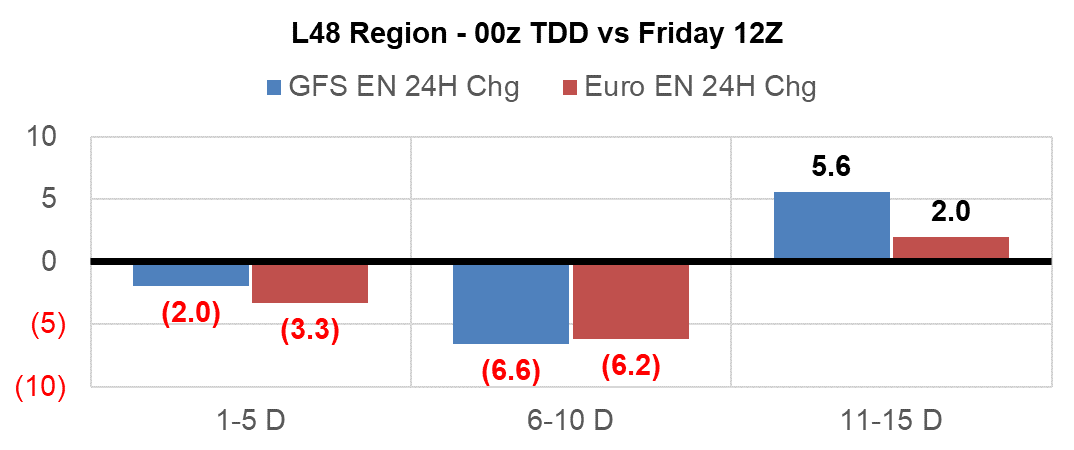

Lets start with today’s latest weather runs which have both models shedding HDDs for the backend of Nov and the first few days of Dec. The latest Euro and GFS Ensemble runs take the forecast close to the 10Y normal. This looks to be putting pressure on the gas markets...

by Research Reports | Nov 17, 2022

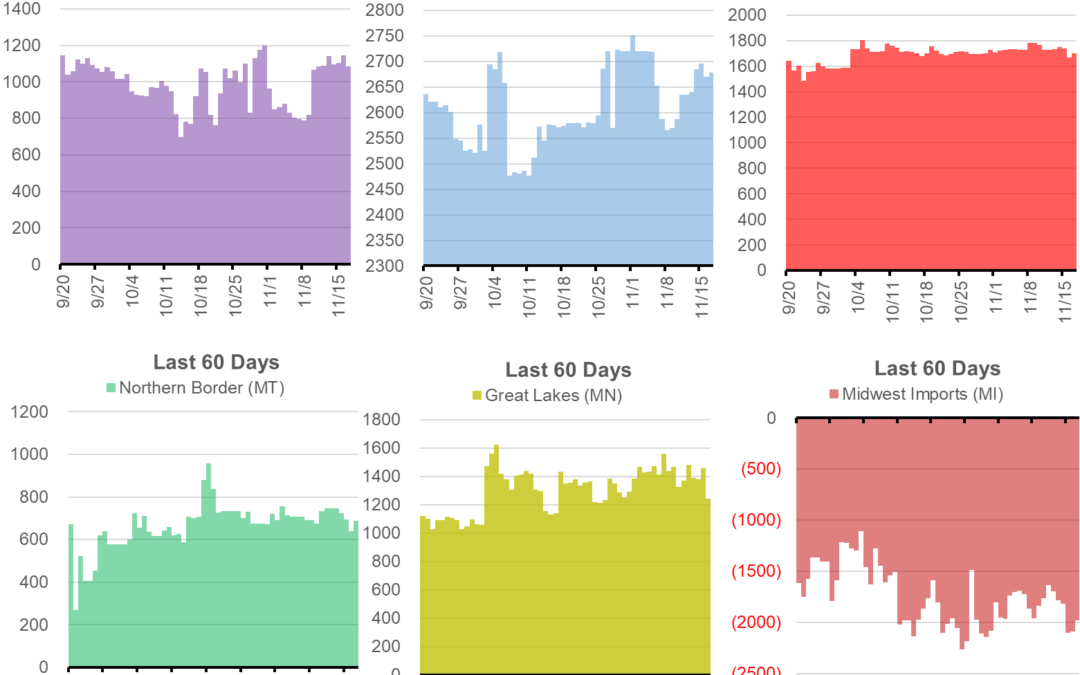

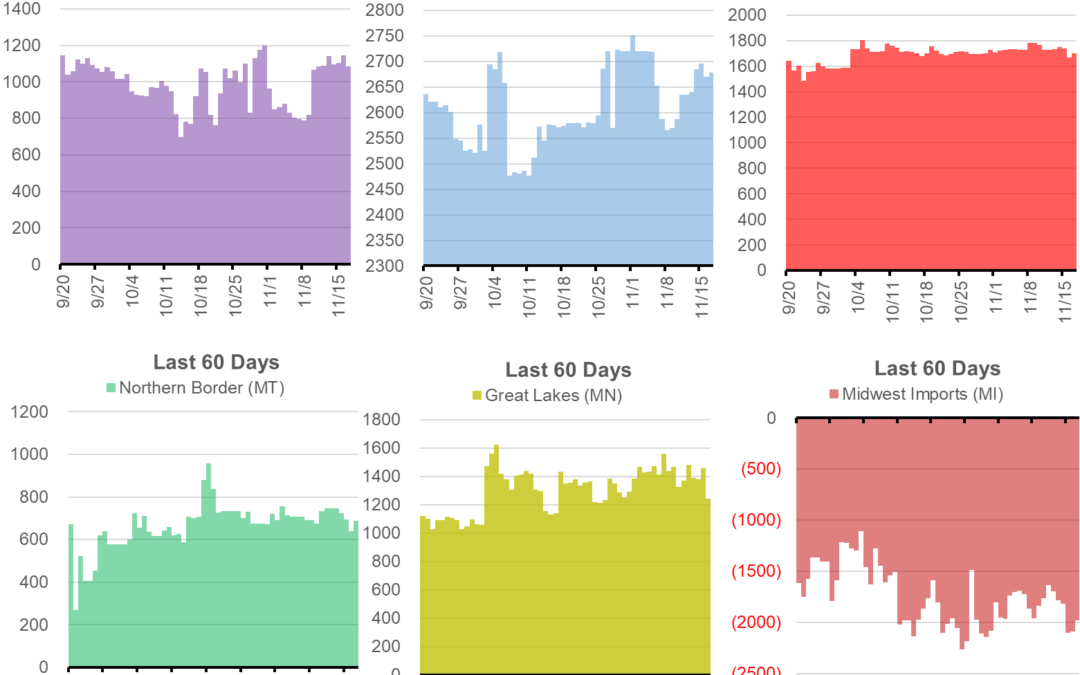

For week ending Nov 11th, the S/D storage is pointing to a +67 Bcf injection and our Flow model is pointing to +61 Bcf. We are taking the middle ground this week with an average of the two model. Our final estimate is +64 Bcf. Last year we injected only...