Trade Commodities like never before with

first of its kind Voice and Electronic Trading Platform

EOXLive is High Touch trading gone Electronic. EOXLive provides traders and risk managers with unique information and liquidity by supplying commodities market access not currently available on any other screen. Our web-based platform allows users to trade efficiently from anywhere. The platform’s rich built-in pricing and analytics tools provide users with critical insight into the color of the market. Automated off-exchange trade reporting and confirmation setups streamline straight through processing. With speed and simplicity EOXLive has you covered from front to back office.

EOXLive Key Features

- Fully Web-Based Application

- Free Embedded Options Pricing and Analytics Suite

- Grid driven design allowing for workspace personalization and enhanced user experience

- Hit/Lift and Quick Entry functionality for fast order and trade entry

- Market Page Montage with Depth of Market (DOM) Views

- View, post, and manage orders through a single point and click interface

- Heat Map plug-in to analyze market activity

- Rich Option Analytics toolset equipped with Option Pricer and Volatility Viewer

- Deal Reporting Interfaces for Automatic Clearing on CME and Nasdaq

- ICE Block Trade Capture Connectivity

- Front to Back Office Trade Workflows for Straight Through Processing (STP)

- Multi-Broker Platform with built-in broker destinations

- Unparalleled Market Liquidity Access

- Standardized IM trading language for streamlined trading

- High Availability (HA) System Architecture

- Knowledgeable and responsive customer support

- Multi-Asset support across future and option block trade markets

- Fully owned and developed in-house

- Distributed architecture with Plug-and-Play Modular framework

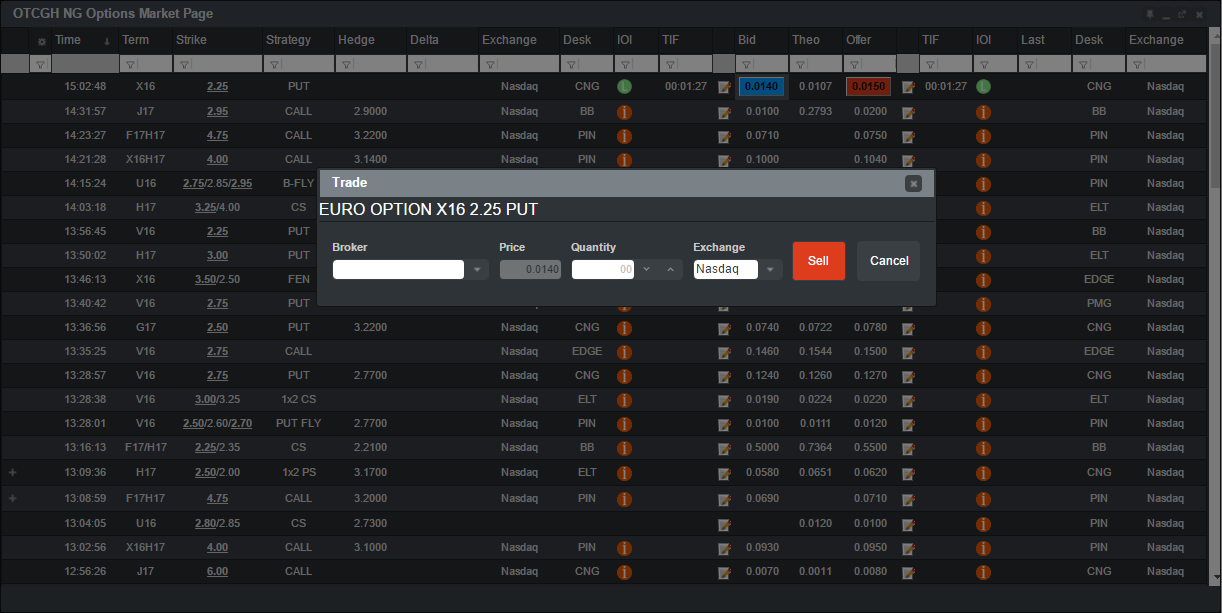

Market Page

- Consolidated Quote Board of current bid/offers across the OTC Commodity market

- Offers expandable full depth of market views for transparency beyond the best bid and offer as well as customizable filtering options

- Intuitive point and click interface, equipped with Quick order and Hit/Lift screens, for fast order entry and trade execution

- Built-in broker destinations to top liquidity providers in key commodity contracts on ICE, CME, and Nasdaq

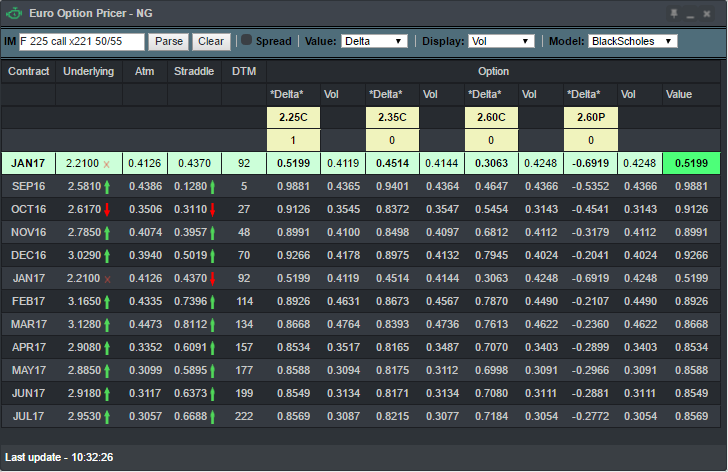

Option Pricer

- A European Style Exercise Option Pricer, constructed using the Black-Scholes model

- Allows users to toggle between option prices and delta values for both outrights and spreads

- Provides additional tenors, underlying and straddles prices, days to maturity (DTM), fair value, delta and volatility details all in a single grid view

- Uses Instant Message (IM) syntax for quick contract and strategy lookup

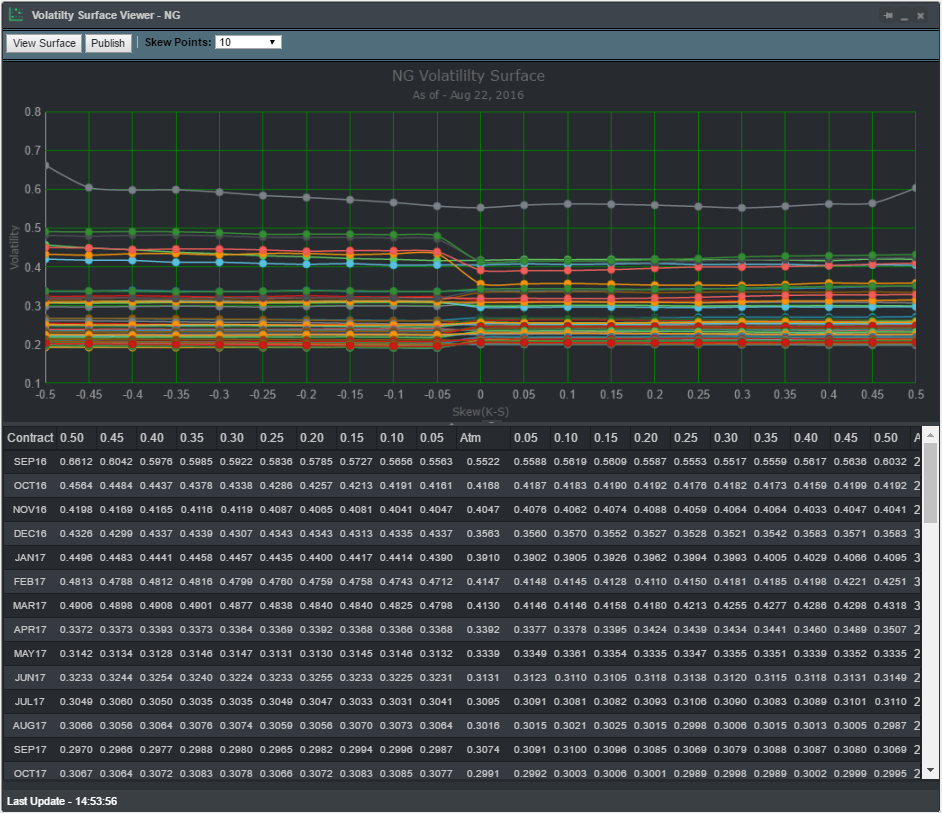

Volatility Surface Viewer

- Developed leveraging EOX’s own Market Data Warehouse the viewer comes equipped with built-in data quality control

- With EOX’s flexible plugin framework users will be able to import and publish out their own Volatility Curves

- Displays entire Market Volatility Surface with the ability to drilldown to selected contracts

- The line graph view allows traders to easily identify option volatility skews

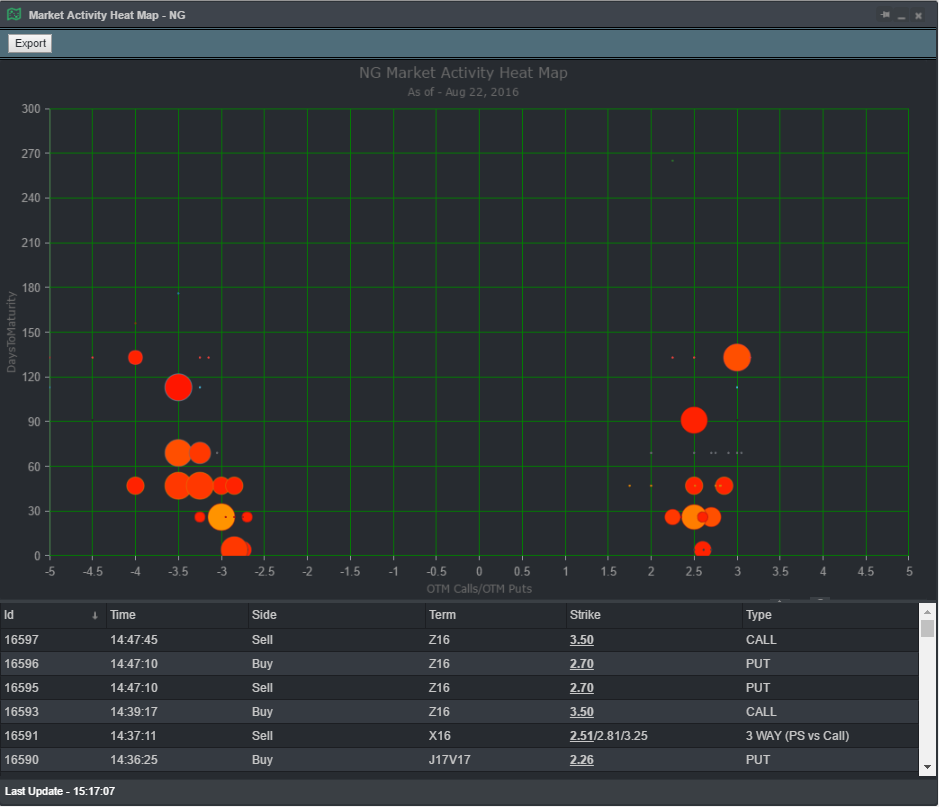

Market Activity Heat Map

- Track the latest market activity and trends from an entire market down to a single contract.

- Provides Time & Sales details for all traded tenors and strategies

- Offers an easy to understand graphical representation of out the money put and call options allowing traders to pin point the most actively traded options, spot time decay, and perform adhoc analysis