PDF Attached

USDA:

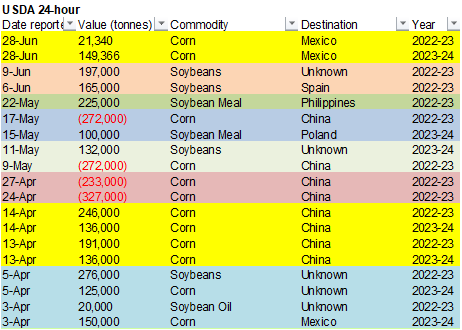

Private exporters reported to the U.S. Department of Agriculture export sales of 170,706 metric tons of corn for delivery to Mexico. Of the total, 21,340 metric tons is for delivery during the 2022/2023 marketing year and 149,366 metric tons is for delivery

during the 2023/2024 marketing year.

Follow

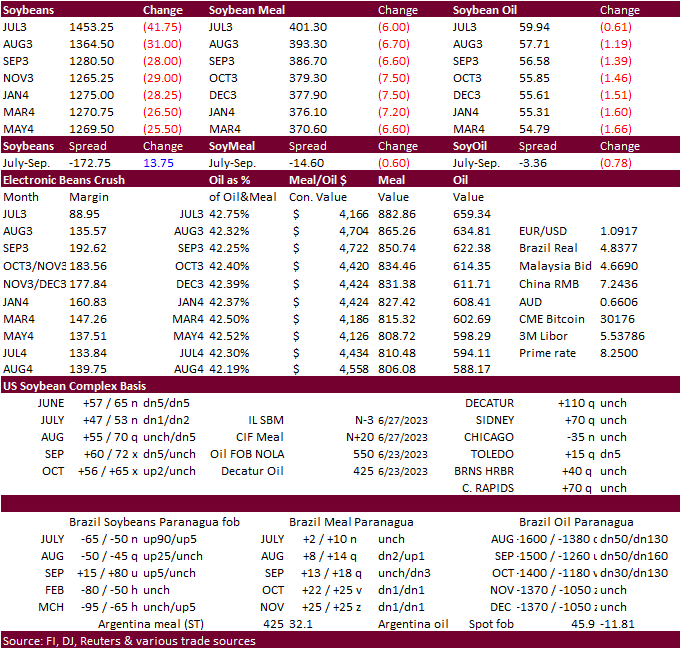

through selling in US agriculture commodities on improving US weather forecasts and slow US export demand. StatsCan Canada area update was mostly as expected. USD was up 44 points and WTI crude $1.82 higher. August oil share made news highs overnight. Malaysia’s

markets are closed for holiday June 29. November soybeans are approaching major support levels while December corn today took out its 50-day MA.

US

Midwest rainfall this weekend will be erratic before increasing mid next week into the following weekend, providing an improvement in topsoil moisture. The US Northern Plains, upper Midwest and eastern Canada’s Prairies will see timely rain. Temperatures will

be seasonable to warmer than average. Europe and the western CIS will be trending wetter for the balance of the week.

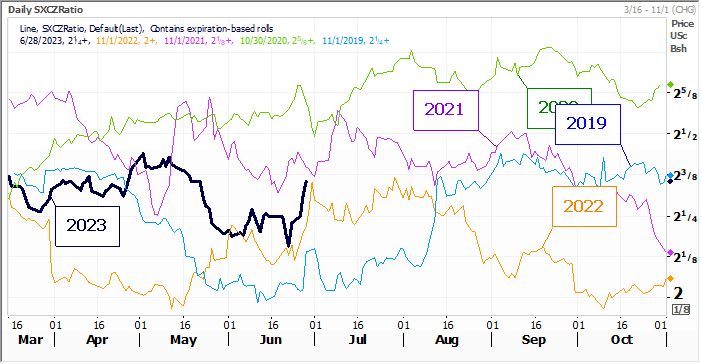

Nov

Soybean/Dec Corn ratio

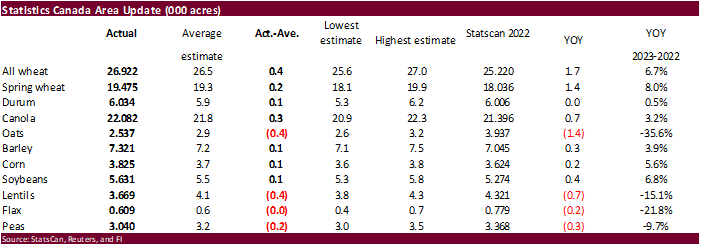

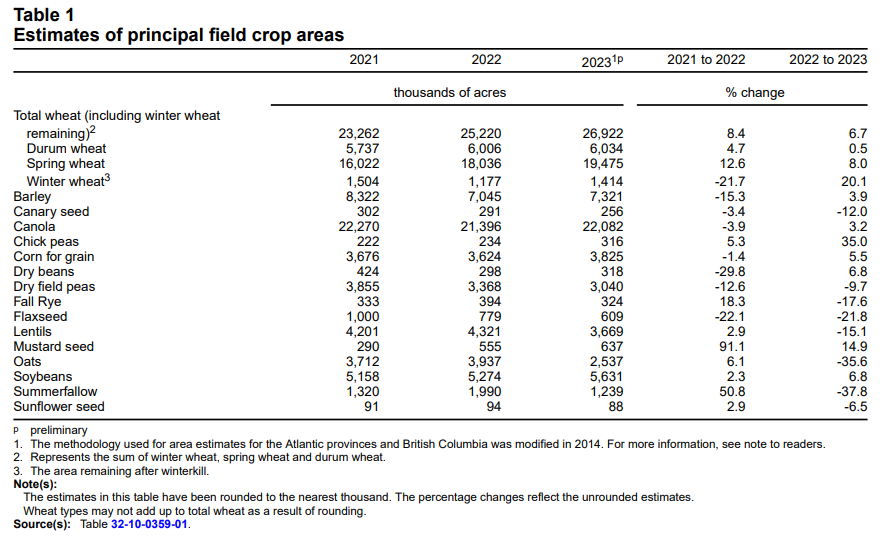

Canada

plantings

Fund

estimates as of June 28 (net in 000)

7-day

World

Weather Inc.

WEATHER

TO WATCH

- U.S.

Midwest will experience improving coverage of rain during the coming ten days to two weeks; however, the GFS model today is way overboard on some of the rain - Both

the GFS and ECMWF models are suggesting good coverage of rain for the driest areas in the Midwest next week and into the following weekend and that is probable, but some of the amounts seem a little high - It

would not be surprising to see some of the rain reduced in future model runs, but relief is expected from the chronic dryness of the past few months - Soil

moisture deficits remain significant across the Midwest and despite the model implication that sufficient rain will fall to restore normal soil moisture – it will not - There

will be sufficient rain to ease crop moisture stress and follow up rain will be needed - The

lack of excessive heat in the Midwest expected in the next two weeks fits very well with our Trend Model and we should not expect any “prolonged” bout of excessive heat during the balance of the summer - There

will be warm periods and it will be warm enough to counter rainfall frequently, but enough rain should come along to prevent the same level of stress developing as that which has occurred in recent weeks - Some

corn production damage cannot be reversed in the heart of the Midwest, but if the rain falls as advertised in the next couple of weeks a cap will be put on the loss potential - Soybeans

have not lost much production potential and could still be a big crop if weather in the next few weeks is close to normal or better - U.S.

southwestern Corn Belt will be hot today into Friday with highs in the 90s to near and slightly above 100 from the Kansas and Oklahoma into central and southwestern Illinois and the Delta - The

heat will abate after Friday except in the Delta where it will linger at least one extra day longer - The

excessive heat will add to the crop moisture stress that is prevailing across these areas and especially in Kansas, Missouri, Illinois and a few neighboring areas where dryness and drought have been expanding most significantly, but as noted above “some” relief

is forthcoming - Canada’s

central Prairies are still struggling with moisture shortages and that will continue for a while - The

next ten days do not look good for bringing significant moisture to the region - Crop

moisture stress will continue in southern and eastern Alberta and central and western Saskatchewan with some of that stress to deepen and expand a bit over time - No

extreme heat is expected, though temperatures will be a little warmer than usual

- Today’s

crop situation in the Prairies east of central Alberta has much variation occurring from one farm to another and in some cases one field to another - A

good production area can be sitting across the road from an area suffering from missed rain

- Assessing

the losses will be very difficult and the Prairies need to be closely monitored because of the “potential” for improved rainfall in future weeks - U.S.

Northern Plains, upper Midwest and eastern Canada’s Prairies will experience some timely rain to support normal crop development - Temperatures

will be seasonable - West

Texas rainfall is expected briefly this weekend and early next week as excessive heat finally breaks down - Recent

hot and dry weather has depleted soil moisture and firmed up the ground enough to stress many crops and livestock especially in unirrigated areas - Cooling

late this week and into the weekend will allow for some relief, although additional rain will be needed - Other

areas in Texas will also get relief from the heat, but rainfall is not likely to be very well distributed leaving need for greater rainfall to support corn, sorghum, soybean, rice and cotton production - U.S.

Delta will heat up and dry down briefly and then get timely rainfall for a while after that - U.S.

southeastern states will experience a good mix of weather during the next two weeks - U.S.

Pacific Northwest temperatures will be trending hotter late this week and into early next week with high temperatures in the 90s and approaching 100 Fahrenheit in the Yakima Valley - Ontario

and Quebec, Canada rainfall is expected to be favorably mixed over the next ten days supporting long term crop development potential - Argentina

will experience a boost in rainfall Sunday into Monday, but relief in the west will be limited - Western

Argentina still needs rain of its winter wheat crop planting and establishment - Eastern

Argentina winter crops are favorably rated - Southern

Brazil soil moisture is decreasing, but remains favorable - Brazil’s

Safrinha crops are maturing and being harvested in a favorable manner and the weather will continue to cooperate with that process - Summer

crop harvesting in both Brazil and Argentina should advance with little weather related delay.

- Europe

is expecting a favorable mix of showers and sunshine along with seasonable temperatures during the next ten days - Some

increase in rainfall is expected and will benefit recently stressed crops, but more rain will be needed - Pockets

of dryness will remain - Russia,

Ukraine, Belarus, Baltic States and northern Kazakhstan will experience a good mix of weather over the next ten days favoring normal crop development - India

will experience generalized rain in central and northwestern parts of the nation today through the weekend with Madhya Pradesh and parts of Rajasthan wettest - A

follow up rain event is expected Wednesday through Friday of next week that will impact Chhattisgarh, Madhya Pradesh and parts of Uttar Pradesh as well as southeastern Rajasthan and Haryana - This

system has been weakened from the previous forecast - Interior

west-central through southern India will not get much rain during the next week to ten days and will need to be closely monitored for the lack of rain - China

is expecting favorable weather in much of the nation - Moderate

to heavy rain is likely in east-central and northeastern parts of the nation - Light

rain is expected in north of the Yellow River, but the moisture will help to ease recent dryness and warm to hot temperatures - Much

more rain will be needed - Sugarbeet,

corn, sunseed and spring wheat north of the Yellow River – especially in Inner Mongolia will be stressed and threatened by summer heat and dryness - Xinjiang

weather will be seasonable during the next ten days with temperatures a little milder than usual initially and then warmer biased in the second week of the outlook - Recent

excessive rain in the south of China induced significant flooding in rice and sugarcane areas causing some decline in rice quality and delays in early rice harvesting - The

situation should improve over the next ten days - Mainland

areas of Southeast Asia will experience more frequent rainfall next week that may finally bring some relief to the drier areas in western Thailand and Myanmar, although the situation will need to be closely monitored - Indonesia

and Malaysia rainfall will increase somewhat over the next ten days to two weeks offering some improvement to crop and field conditions after recent erratic rain and net drying - Philippines

rainfall will continue favorably mixed for a while - No

tropical cyclones are threatening the western Pacific Ocean, South China Sea or Indian Ocean today and none is expected for a while - Two

tropical cyclones are expected to evolve off the Mexico west coast during the coming week and both will either parallel the coast or move away from land - Some

increase in southwestern Mexico rainfall I expected and that may lead to relief for sugarcane, citrus, coffee and a host of other crops - Some

sorghum and corn planting will follow the rain - Other

areas in Mexico will continue quite dry through the weekend with “some” increase in northwestern and north-central Mexico rain next week

- Drought

remains serious in parts of central, southern and western Mexico, but the developing monsoon will bring relief in July - Central

America rainfall has been timely recently and mostly good for crops, although many areas are still reporting lighter than usual amounts - A

boost in rainfall is expected over the next ten days - Drought

continues to impact Gatlin lake and the Panama Canal shipments, but some increase in precipitation is forthcoming - Eastern

Australia is expecting rain early next week; including the dry areas of Queensland and northern New South Wales - Improved

wheat and barley planting and establishment in unirrigated areas is expected - Sugarcane

harvesting will be disrupted, but the moisture will be good for ongoing cane development - Southern

Australia winter crops are rated favorable and expected to remain that way over the next two weeks as periodic rain and mild to cool weather impact those areas.

- South

Africa wheat, barley and canola areas will get some timely rainfall during the next week further supporting well-established crops - Remnants

of Tropical Storm Cindy have “some” potential to redevelop over the western Atlantic Ocean, but the system will remain over open water and not threaten the United States - NOAA

has reduced its level of concern over this lingering system - There

were no other areas of disturbed tropical weather in the Atlantic Ocean, Caribbean Sea or Gulf of Mexico being monitored Sunday by the U.S. National Hurricane Center for the coming week - West-central

Africa crop conditions remain good with little change expected - Rain

will fall in a timely manner during the next two weeks - East-central

Africa weather will continue favorable for coffee, cocoa, sugarcane, rice and other crops through the next two weeks -

Today’s

Southern Oscillation Index was -5.24 and it will move erratically over the next few days with some weakening expected

Source:

World Weather, INC.

Wednesday,

June 28:

- Canada’s

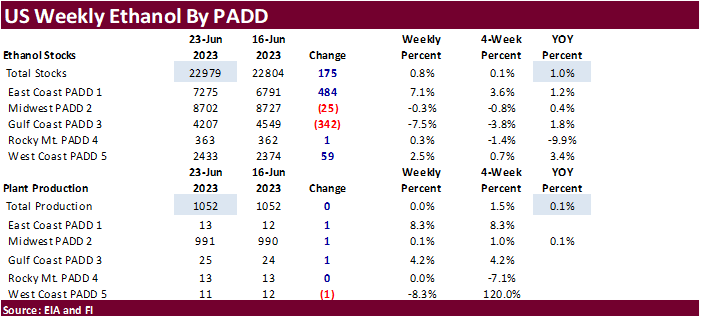

StatsCan to release seeded area data for wheat, barley, canola and soybeans - EIA

weekly US ethanol inventories, production, 10:30am - HOLIDAY:

India, Indonesia

Thursday,

June 29:

- IGC

monthly grains report - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Vietnam’s

coffee, rice and rubber export data for June - Port

of Rouen data on French grain exports - USDA

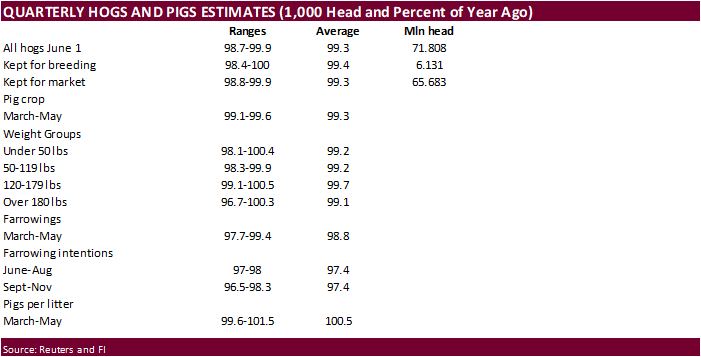

hogs and pigs inventory, 3pm - HOLIDAY:

Indonesia, Malaysia, Singapore, Pakistan

Friday,

June 30:

- USDA

quarterly stockpiles data for corn, soybeans, wheat, barley, oat and sorghum, noon - ICE

Futures Europe weekly commitments of traders report - US

annual acreage data for corn, cotton, wheat and soybeans - US

agricultural prices paid, received, 3pm - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - HOLIDAY:

Indonesia, Pakistan

Source:

Bloomberg and FI

Reuters

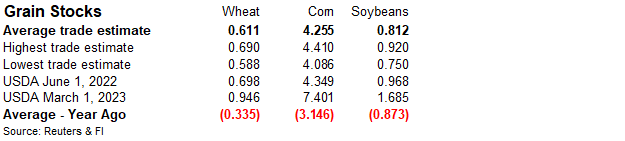

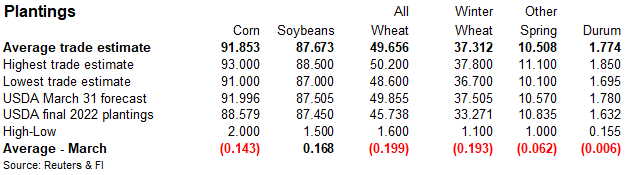

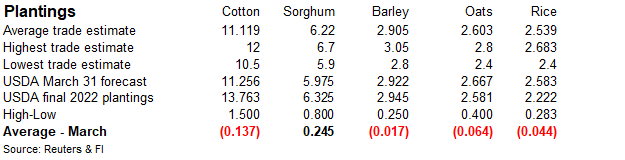

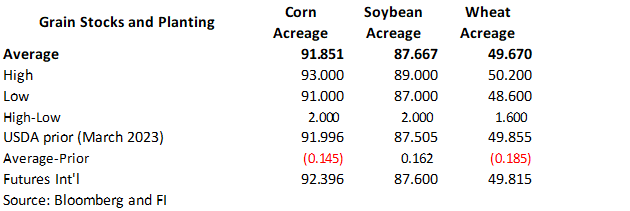

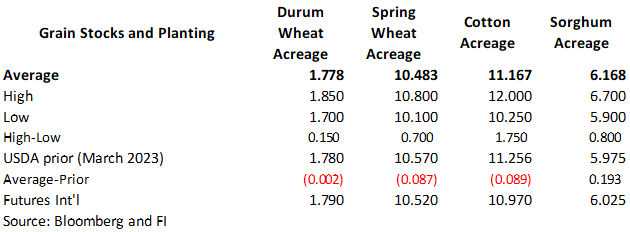

estimates for June 30 USDA reports

Bloomberg

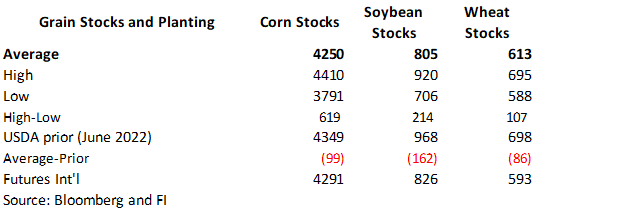

Estimates

Macros

US

Wholesale Inventories (M/M) May P: -0.1% (est -0.1%; prevR -0.3%)

101

Counterparties (prev 101) Take $1.945 Tln (prev $1.951 Tln) At Fed Reverse Repo Op.

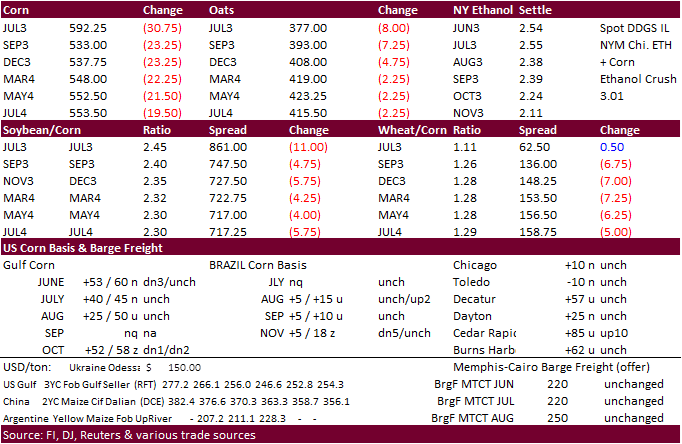

Corn

·

US corn futures traded lower again on ongoing technical selling amid improving US weather prospects for the US Midwest and positioning ahead of the USDA report.

·

The break in futures prices this week attracted some US export interest.

·

There is some debate if the USDA will downward revise the US corn yield in the July S&D update before issuing its initial official survey in the August update. This year, based on past and the CPC 3-month future weather outlook,

we think the yield could be lowered 3-4 bushels per acre.

·

Note there have been only a few years USDA adjusted the US corn yield for the July report. Those years were extreme weather events.

·

Note the Canadian corn area is telling me the trade might be wrong on looking for a US reduction in plantings for the US. Much of the trade noted late plantings for the Dakotas. We are looking for additional plantings for parts

of US HRW wheat country where abandonment was reported at very high levels. A 5.6 percent increase to 3.825 million acres from 2022 is impressive given the amount of dryness seen for lower Canada during planting season.

·

French bird flu wave ends after 10 million birds culled – Reuters News. 22 million were culled in 2021-22.

·

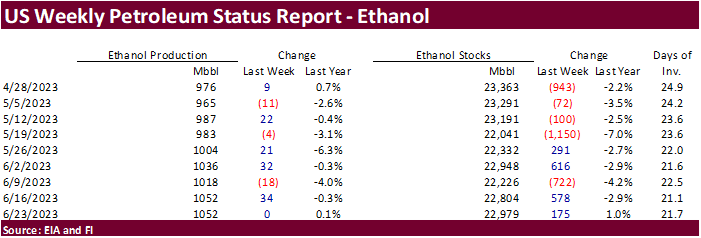

The USDA Broiler Report showed eggs set in the US up 1 percent and chicks placed down 1 percent. Cumulative placements were down slightly from the same period a year earlier.US ethanol production to be down 7,000 thousand barrels

to 1045k (1035-1059 range) from the previous week and stocks off 49,000 barrels to 22.755 million.

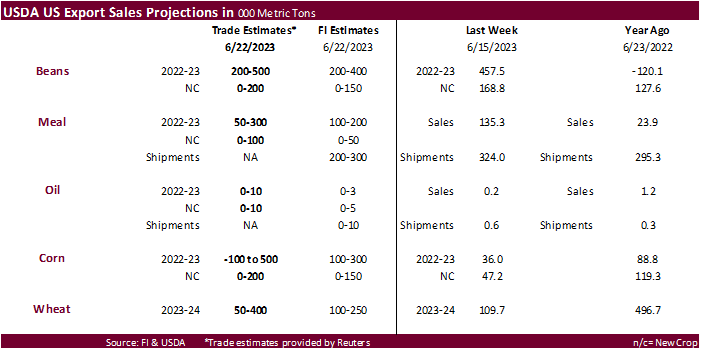

EIA

weekly ethanol production was unchanged from the previous week and stocks increased 175,000 barrels. The trade was looking for production to be down 7,000 thousand barrels and stocks off 49,000 barrels to 22.755 million.

Export

Developments

-

USDA

reported private exporters bought 170,706 tons of corn for delivery to Mexico. Of the total, 21,340 tons is for delivery during the 2022/2023 marketing year and 149,366 tons is for delivery during the 2023/2024 marketing year.

Export

developments.

-

None

reported

Price

outlook (6/28/23)

September

corn $5.00-$6.25

December

corn $480-$7.25

·

The US soybean complex was under pressure all day from weather models suggesting the heart of the US could see its best rain amounts over the next two weeks since early spring. We adjusted our September prices ranges lower. The

funds selling in corn and soybeans has been impressive, but a reminder a reversal in weather models or surprise in yields this August, possibly July, could easily ignite another candle.

·

APK-Inform lowered its Ukrainian 2023 sunflower seed harvest forecast to 12.7 million tons from 12.8 million. They increase their soybean harvest outlook to 4.5 million tons from 4.2 million a month earlier. (Reuters via APK)

·

August oil share made news highs today. Watch for a correction.

·

Indonesia set its crude palm oil (CPO) reference price at $747.23 per ton for the period of July 1-15. The price is higher than the June 16-30 price of $723.45. CPO export tax will be $18 per metric ton and levy at $75.

·

Malaysia is on holiday Thursday.

-

Today

Iran’s SLAL seeks up to 120,000 tons of soybean meal from Brazil or Argentina, for July and August shipment. They passed last week on meal.

Price

outlook (6/28/23)

Soybeans

– September $13.00-$14.75,

November $12.00-$15.25

Soybean

meal – September $350-$450,

December $350-$500

Soybean

oil – September 51.00-58.00, December 48.00-58.00

·

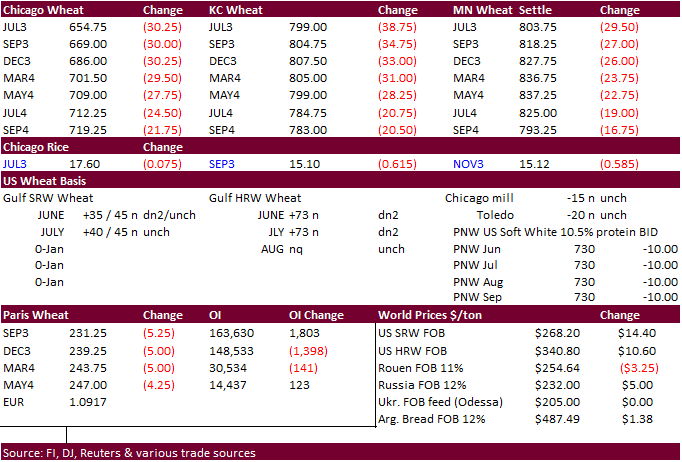

Lower follow through trade in US and Paris wheat futures from Black Sea competition and improving US spring wheat production prospects.

·

September Paris milling wheat officially closed 5.25 euros lower, or 2.2%, at 231.25 euros a ton (about $252.50 ton).

·

Global export developments have been slow this week.

·

Warmer temperatures for the central US Great Plains for the second half of the work week should facilitate harvesting progress for winter wheat. Some disruption from rain is seen Friday through Saturday for the western growing

areas.

·

Larger than expected Ukraine 2023 grain production is seen. Ukraine’s grain traders body estimated Ukraine’s 2023 wheat harvest may reach at least 24 million tons, above the AgMin17 million ton projection. UGA said the gross could

total 24.4 million tons in bunker weight, or 23.5 to 24 million metric tons in clean weight.

Export

Developments.

·

Thailand buyers passed on 55,000 tons of feed wheat (per month) for Sep through Dec shipment. Lowest price offer was around $275/ton c&f for September and around $285 for November-December.

·

Morocco seeks up to 2.5 million tons of wheat between July 1 and September 30. Origins include Russia, Ukraine, France, Germany, Argentina, and the United States.

Rice/Other

-

None

reported

Price

outlook (6/28/23)

Chicago

Wheat September $6.00-$7.75

KC – September $7.25-$9.00

MN – September $7.25-$9.00

#non-promo