PDF Attached includes FI’s snapshot for USDA’s June 30 reports.

North

American weather forecast was the main focus today. US agricultures futures were lower (exception soybean oil) after the morning models called for additional precipitation for the second week of the forecast for dry areas of the US Midwest and parts of US

wheat growing areas. Wheat also additional pressure from easing concerns of Russia political instability. Global export developments remain light. Positioning ahead of the June 30 reports was noted.

Majority

the US WCB will be dry until later this week, but milder temperatures should slow condition declines bias the dry areas before rising temperatures start with the southwestern Corn Belt Wed-Fri. ECB saw rain over the past few days. The Canadian Prairies will

turn drier over the next week. Europe and the western CIS will be trending wetter this week. USDA US crop ratings declined for corn and soybeans. For corn, they were down 5 points, lower than expected, to lowest in decades for this time of year (1988 lowest).

Soybeans were down 3 to 51, the lowest since 1996. The trade looked for US G/E corn and soybean ratings to be down 3, and no change for SW and WW ratings. Spring wheat declined 1 point and winter wheat was unchanged. See tables after the text for production

updates.

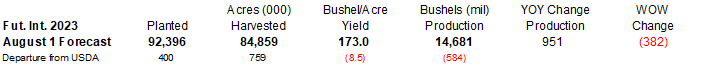

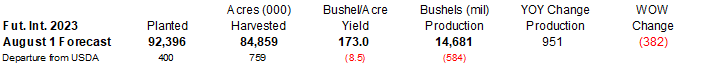

We

had a typo in our CP table for the US corn yield. It should be 173.0 bu/ac, same as what we had in the S&D published last week. We are at

50.1 for soybeans.

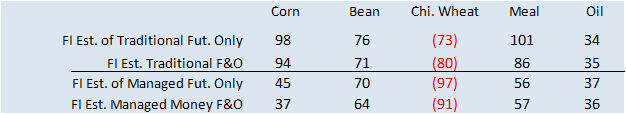

Fund

estimates as of June 27 (net in 000)

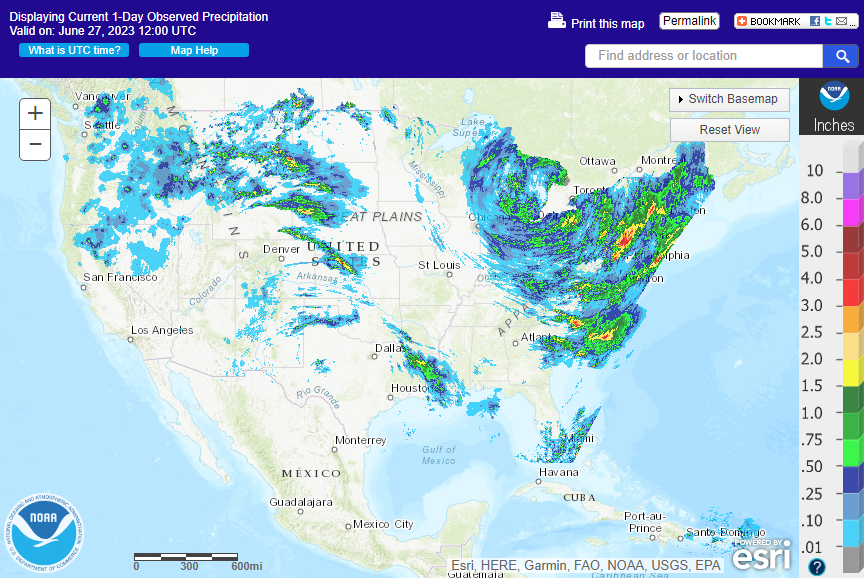

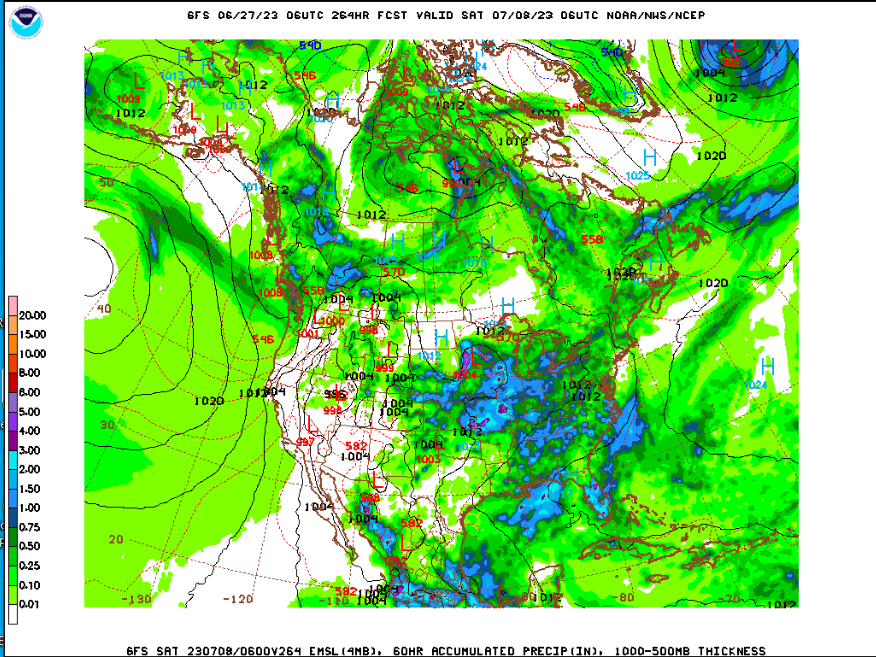

Weather

7-day

Next

weekend looks wet for the Midwest. Below is the 60-hour forecast map.

WEATHER

TO WATCH

- Not

much change occurred overnight - West

Texas rainfall is expected briefly this weekend and as excessive heat finally breaks down - Recent

hot and dry weather has depleted soil moisture and firmed up the ground enough to stress many crops and livestock especially in unirrigated areas - Cooling

late this week and into the weekend will allow for some relief, although additional rain will be needed - U.S.

southwestern Corn Belt will be hot Wednesday into Friday with highs in the 90s to near and slightly above 100 from the Kansas and Oklahoma into Illinois and the Delta - The

heat will abate after Friday except in the Delta where it will linger at least one extra day longer - The

excessive heat will add to the crop moisture stress that is prevailing across these areas and especially in Kansas, Missouri, Illinois and a few neighboring areas where dryness and drought have been expanding most significantly - U.S.

Midwest rainfall into this coming weekend will be erratic and little too light for serious changes to crops of soil moisture

- Some

increase in rainfall is possible during the middle to latter part of next week and into the following weekend - No

general soaking is likely, but the coverage rain should increase sufficiently for some temporary improvement in topsoil moisture - U.S.

Northern Plains, upper Midwest and eastern Canada’s Prairies will experience some timely rain to support normal crop development - Temperatures

will be seasonable - Southwestern

Canada’s Prairies (including southern and east-central Alberta and central and western Saskatchewan) will not receive significant rain during the next ten days, despite some impressive upper air troughs of low pressure pushing through the region - Ontario

and Quebec, Canada rainfall is expected to be favorably mixed over the next ten days supporting long term crop development potential - U.S.

Pacific Northwest temperatures will be trending hotter late this week and into early next week with high temperatures in the 90s and approaching 100 Fahrenheit in the Yakima Valley - U.S.

southeastern states will receive periodic rain and experience seasonable temperatures for a while benefiting all crops in the region - Outside

of West Texas scattered showers and thunderstorms the U.S. southern Plains will experience erratic rain that will not likely bring much relief to dryness in South Texas, the Texas Coastal Bend or the Blacklands - No

changes were noted in South America overnight - Western

Argentina still needs rain of its winter wheat crop planting and establishment - Eastern

Argentina winter crops are favorably rated - Southern

Brazil soil moisture is decreasing, but remains favorable - Brazil’s

Safrinha crops are maturing and being harvested in a favorable manner and the weather will continue to cooperate with that process - Summer

crop harvesting in both Brazil and Argentina should advance with little weather related delay.

- Europe

is expecting a favorable mix of showers and sunshine along with seasonable temperatures during the next ten days - Some

increase in rainfall is expected and will benefit recently stressed crops, but more rain will be needed - Russia,

Ukraine, Belarus, Baltic States and northern Kazakhstan will experience a good mix of weather over the next ten days favoring normal crop development - India

will experience generalized rain in central and northwestern parts of the nation today through the weekend with Madhya Pradesh and parts of Rajasthan wettest - A

follow up rain event is expected Wednesday through Friday of next week that will impact Chhattisgarh, Madhya Pradesh and parts of Uttar Pradesh as well as southeastern Rajasthan and Haryana - Interior

west-central through southern India will not get much rain during the next week to ten days and will need to be closely monitored for the lack of rain - China

is expecting favorable weather in much of the nation - Moderate

to heavy rain is likely in east-central and northeastern parts of the nation - Light

rain is expected in north of the Yellow River, but the moisture will help to ease recent dryness and warm to hot temperatures - Xinjiang

weather will be seasonable during the next ten days with temperatures a little milder than usual initially and then warmer biased in the second week of the outlook - Recent

excessive rain in the south of China induced significant flooding in rice and sugarcane areas causing some decline in rice quality and delays in early rice harvesting - The

situation should improve over the next ten days - Mainland

areas of Southeast Asia will experience more frequent rainfall next week that may finally bring some relief to the drier areas in western Thailand and Myanmar, although the situation will need to be closely monitored - Indonesia

and Malaysia rainfall will increase somewhat over the next ten days to two weeks offering some improvement to crop and field conditions after recent erratic rain and net drying - Philippines

rainfall will continue favorably mixed for a while - No

tropical cyclones are threatening the western Pacific Ocean, South China Sea or Indian Ocean today and none is expected for a while - Two

tropical cyclones are expected to evolve off the Mexico west coast during the coming week and both will either parallel the coast or move away from land - Some

increase in southwestern Mexico rainfall I expected and that may lead to relief for sugarcane, citrus, coffee and a host of other crops - Some

sorghum and corn planting will follow the rain - Other

areas in Mexico will continue quite dry through the weekend with “some” increase in northwestern and north-central Mexico rain next week

- Drought

remains serious in parts of central, southern and western Mexico, but the developing monsoon will bring relief in July - Central

America rainfall has been timely recently and mostly good for crops, although many areas are still reporting lighter than usual amounts - A

boost in rainfall is expected over the next ten days - Drought

continues to impact Gatlin lake and the Panama Canal shipments, but some increase in precipitation is forthcoming - Eastern

Australia is expecting rain early next week; including the dry areas of Queensland and northern New South Wales - Improved

wheat and barley planting and establishment in unirrigated areas is expected - Sugarcane

harvesting will be disrupted, but the moisture will be good for ongoing cane development - Southern

Australia winter crops are rated favorable and expected to remain that way over the next two weeks as periodic rain and mild to cool weather impact those areas.

- South

Africa wheat, barley and canola areas will get some timely rainfall during the next week further supporting well-established crops - Remnants

of Tropical Storm Cindy have “some” potential to redevelop over the western Atlantic Ocean, but the system will remain over open water and not threaten the United States - There

were no other areas of disturbed tropical weather in the Atlantic Ocean, Caribbean Sea or Gulf of Mexico being monitored Sunday by the U.S. National Hurricane Center for the coming week - West-central

Africa crop conditions remain good with little change expected - Rain

will fall in a timely manner during the next two weeks - East-central

Africa weather will continue favorable for coffee, cocoa, sugarcane, rice and other crops through the next two weeks -

Today’s

Southern Oscillation Index was -5.31 and it will move erratically higher over the next few days

Source:

World Weather, INC.

Wednesday,

June 28:

- Canada’s

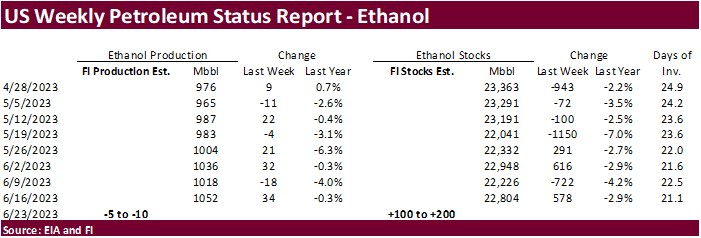

StatsCan to release seeded area data for wheat, barley, canola and soybeans - EIA

weekly US ethanol inventories, production, 10:30am - HOLIDAY:

India, Indonesia

Thursday,

June 29:

- IGC

monthly grains report - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Vietnam’s

coffee, rice and rubber export data for June - Port

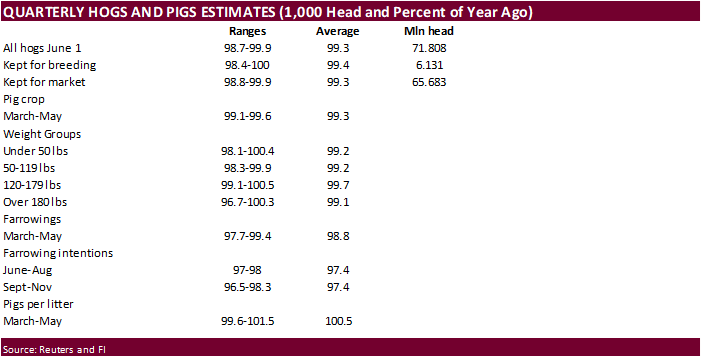

of Rouen data on French grain exports - USDA

hogs and pigs inventory, 3pm - HOLIDAY:

Indonesia, Malaysia, Singapore, Pakistan

Friday,

June 30:

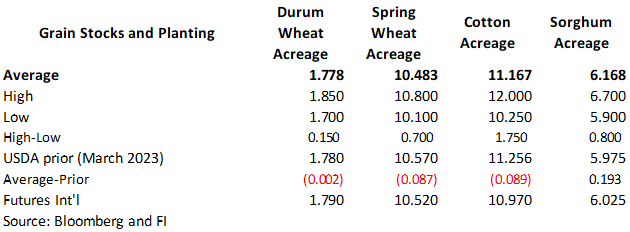

- USDA

quarterly stockpiles data for corn, soybeans, wheat, barley, oat and sorghum, noon - ICE

Futures Europe weekly commitments of traders report - US

annual acreage data for corn, cotton, wheat and soybeans - US

agricultural prices paid, received, 3pm - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - HOLIDAY:

Indonesia, Pakistan

Source:

Bloomberg and FI

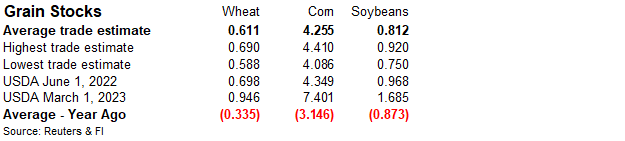

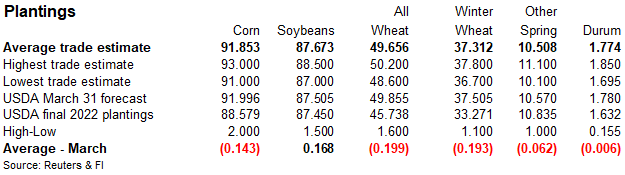

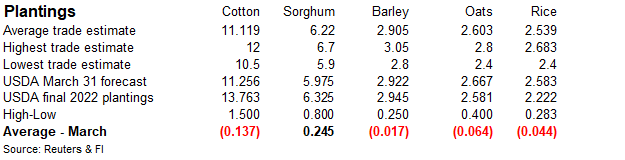

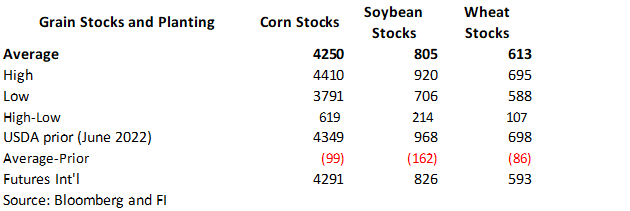

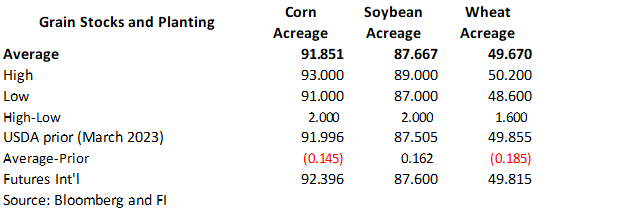

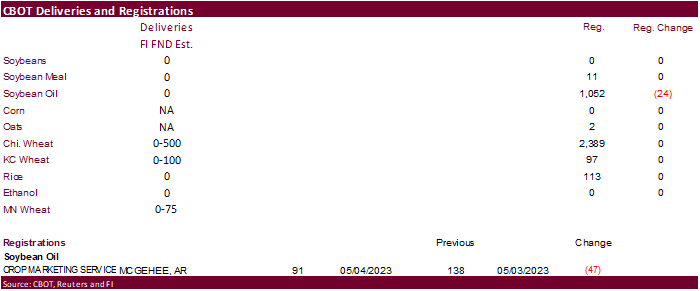

Reuters

estimates for June 30 USDA reports

Bloomberg

Estimates

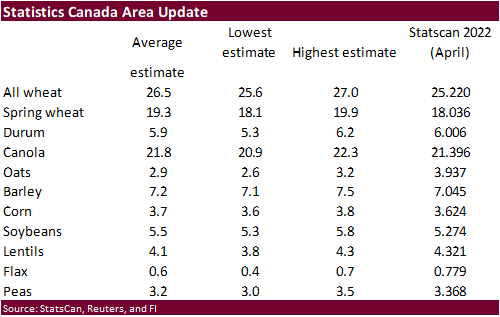

Canada

plantings. June 28 release (7:30 am CDT)

Soybean

and Corn Advisory

2023

U.S. Corn Yield Lowered 2.0 Bushels to 175.0 Bu/Ac

2023

U.S. Soybean Yield Lowered 0.5 Bushels to 50.5 Bu/Ac

Macros

101

Counterparties (prev 102) Take $1.951 Tln (prev $1.961 Tln) At Fed Reverse Repo Op.

US

Consumer Confidence Rises To Highest Level Since Early 2022 – BBG

US

Conf. Board Consumer Confidence Jun: 109.7 (exp 104.0; prevR 102.5)

Conf.

Board Present Situation Jun: 155.3 (prev 148.6)

Conf.

Board Expectations Jun: 79.3 (prev 71.5)

US

New-Home Sales Surge To Fastest Pace In More Than A Year – BBG

US

New Home Sales May: 763K (exp 675K; prevR 680K)

New

Home Sales (M/M): 12.2% (exp -1.2%; prevR 3.5%)

Median

Sale Price (Y/Y) (USD): 416.3K or -7.6% (prev 420.8K or -8.2%)

US

Durable Goods Orders May P: 1.7% (est -0.8%; prev 1.1%)

US

Durables Ex Transportation May P: 0.6% (est 0.0%; prev -0.3%)

US

Cap Goods Orders Nondef Ex Air May P: 0.7% (est 0.0%; prev 1.3%)

US

Cap Goods Ship Nondef Ex Air May P: 0.2% (est 0.2%; prev 0.5%)

Canadian

CPI (Y/Y) May: 3.4% (est 3.4%; prev 4.4%)

Canadian

CPI NSA (M/M) May: 0.4% (est 0.4%; prev 0.7%)

Canadian

CPI – Median (Y/Y) May: 3.9% (est 4.0%; prevR 4.3%)

Canadian

CPI – Trim (Y/Y) May: 3.8% (est 3.9%; prev 4.2%)

US

S&P CoreLogic CS 20-City (M/M) SA Apr: 0.91% (est 0.35%; prevR 0.42%)

US

S&P CoreLogic CS 20-City (Y/Y) NSA Apr: -1.70% (est -2.60%; prevR -1.12%)

US

S&P CoreLogic CS US HPI (Y/Y) NSA Apr: -0.24% (prevR 0.69%)

US

Richmond Fed Manufacturing Index Jun: -7 (exp -12; prev -15)

Richmond

Fed Business Conditions Jun: -12 (prev -17)

·

December corn futures settled sharply lower (by 27.25 cents) on improving US weather, with precipitation over the next two weeks across the dry areas of the Midwest that could slow the decline or at least stabilize crop conditions.

Prices initially sold off overnight from widespread selling in the agriculture markets and lower WTI crude oil. WTI ended higher on the day.

·

The weather forecast calls for improving chances for rainfall next week for the US Midwest, especially over the July 8-10 weekend. The midday maps backed off for the late second week precipitation event but our weather person

left their forecast unchanged.

·

July corn ended 14.25 cents lower. US exports have been slow.

·

The Mexican government set a 50% tariff on all white corn imports (Bloomberg). This follows a January 2023 Decree that was expected to be extended beyond June 30.

·

A Bloomberg poll looks for weekly US ethanol production to be down 7,000 thousand barrels to 1045k (1035-1059 range) from the previous week and stocks off 49,000 barrels to 22.755 million.

·

We had a typo yesterday on the table (attached) for the US corn yield. We are at 173.0.

Export

developments.

-

None

reported

Price

outlook (6/23/23)

September

corn $5.25-$7.00

December

corn $480-$7.25

·

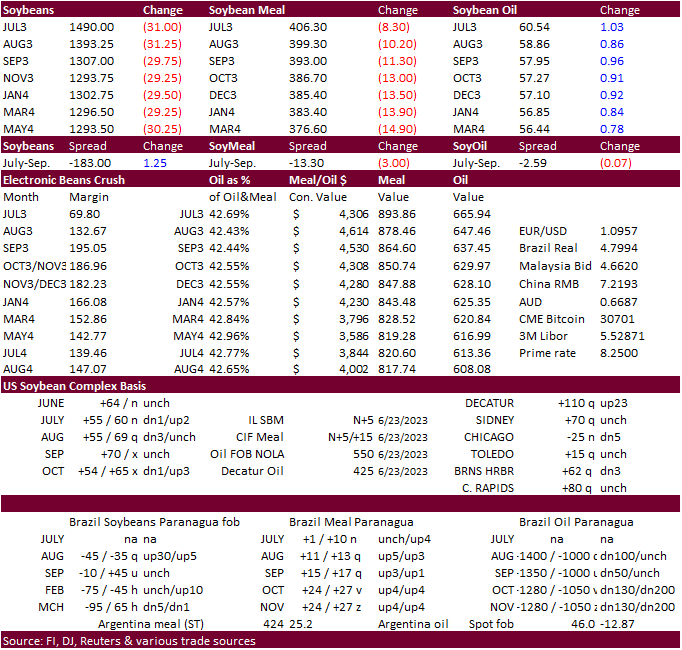

Soybeans, soybean meal and soybean oil traded lower at the start of the day session from an improving weather forecast and lower lead in outside product markets. Abiove increased their estimate for the Brazil soybean crop.

·

Soybean oil rebounded from ongoing oil/meal buying. With rain occurring across the ECB yesterday through Wednesdays and again later next week, traders faded soybeans, in turn weighing on soybean meal prices. Positioning ahead

of the USDA report is starting to pick up.

·

Iran is back in for soybean meal after passing last week.

·

Abiove: 2022-23 Brazil production 165MMT, up 1MMT from previous. Exports 97 vs. 95.7MMT, crush 53.2 vs. 53.0MMT previous, and soybean meal exports at 21.9 vs. 21.4MMT prior.

·

November soybeans – major support is seen near $12.45, the current 20-day & 50-day MA.

·

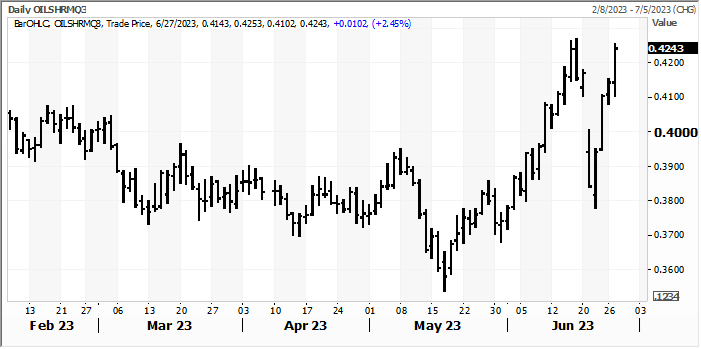

Watch the soybean oil share as it continues to rally after seeing a route mid last week. A temporary setback could occur later this week.

August

soybean oil share as of 12:50 pm CT.

-

China

did not sell any of its 306,700 tons of imported soybeans from state reserves.

-

Iran’s

SLAL seeks up to 120,000 tons of soybean meal from Brazil or Argentina, on Wednesday, for July and August shipment. They passed last week on meal.

Price

outlook (6/23/23)

Soybeans

– September $14.00-$15.50, November $12.00-$15.25

Soybean

meal – September $360-$475, December $350-$500

Soybean

oil – September 51.00-58.00, December 48.00-58.00

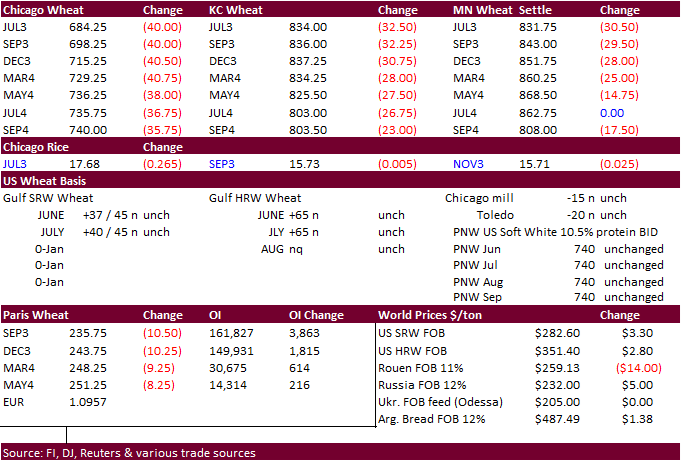

·

US wheat futures traded lower on unchanged to slightly lower US wheat crop conditions and a sharply lower Paris wheat market. Europe will see an increase in rain this week.

·

Sell stops were noted for US wheat futures.

·

Global export developments have been slow this week as traders monitor Black Sea prices.

·

Russia still remains cheapest origin in the world.

·

It will be hot again across the southern Great Plains July 6-10.

·

September Paris milling wheat officially closed 10.50 euros lower, or 4.3%, at 236.50 euros a ton (about $259.25 ton).

Export

Developments.

·

Morocco seeks up to 2.5 million tons of wheat between July 1 and September 30. Origins include Russia, Ukraine, France, Germany, Argentina, and the United States.

Rice/Other

-

(Reuters) –

The Philippines, one of the world’s biggest rice importers, has enough supply of the staple grain as it enters the third quarter of the year, the president’s office said on Tuesday. The government expects a “bountiful harvest” for the January-June period rice

planting season, Agriculture Undersecretary Leo Sebastian, who heads the ministry’s rice industry program, said in a statement.

Price

outlook (6/23/23)

Chicago

Wheat September $6.00-$8.25

KC – September $7.25-$9.50

MN – September $7.25-$9.50

#non-promo