PDF attached

US

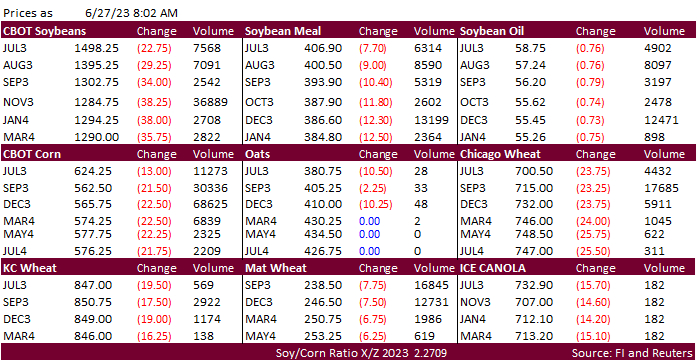

agricultures futures sank overnight on improving weather after about opening as expected post USDA crop progress report. Positioning ahead of the June 30 reports is starting to ramp up. WTI crude oil was $0.51 lower earlier. News is fairly light. Iran is back

in for meal. Overnight models suggested an increase in rainfall for the July 4-6 period for the ECB, an increase for the Northern Plains 6-8, and an increase for the heart of the Midwest next weekend.

The majority of the US Midwest

will be dry until later this week but milder temperatures should slow condition declines bias the dry areas before rising starting with the southwestern Corn Belt Wed-Fri. The Canadian Prairies will turn drier over the next week. Europe and the western CIS

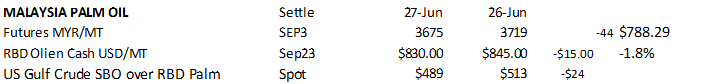

will be trending wetter this week. Third month Malaysian palm oil futures decreased 44 ringgit to 3675, and cash decreased $15.00 to $830/ton. Offshore values were leading SBO lower by about 297 points this morning and meal $3.10 short ton lower. USDA US crop

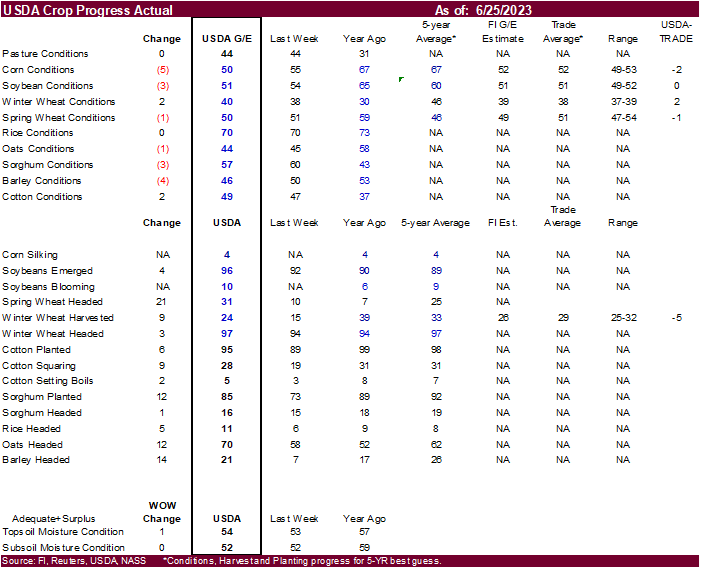

ratings declined for corn and soybeans. For corn, they were down 5 points, lower than expected, to lowest in decades for this time of year (1988 lowest). Soybeans were down 3 to 51, the lowest since 1996. The trade looked for US G/E corn and soybean ratings

to be down 3, and no change for SW and WW ratings. Spring wheat declined 1 point and winter wheat was unchanged. See tables after the text for production updates.

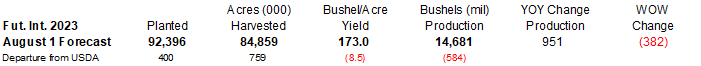

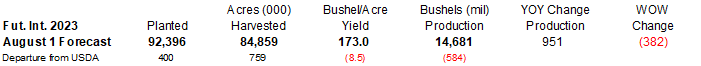

We

had a typo in our CP table for the US corn yield. It should be 173.0 bu/ac, same as what we had in the S&D published last week. We are at

50.1 for soybeans.

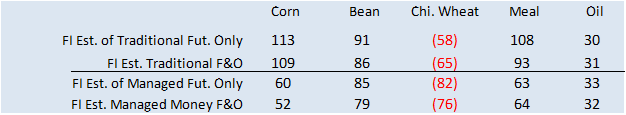

Fund

estimates as of June 26 (net in 000)

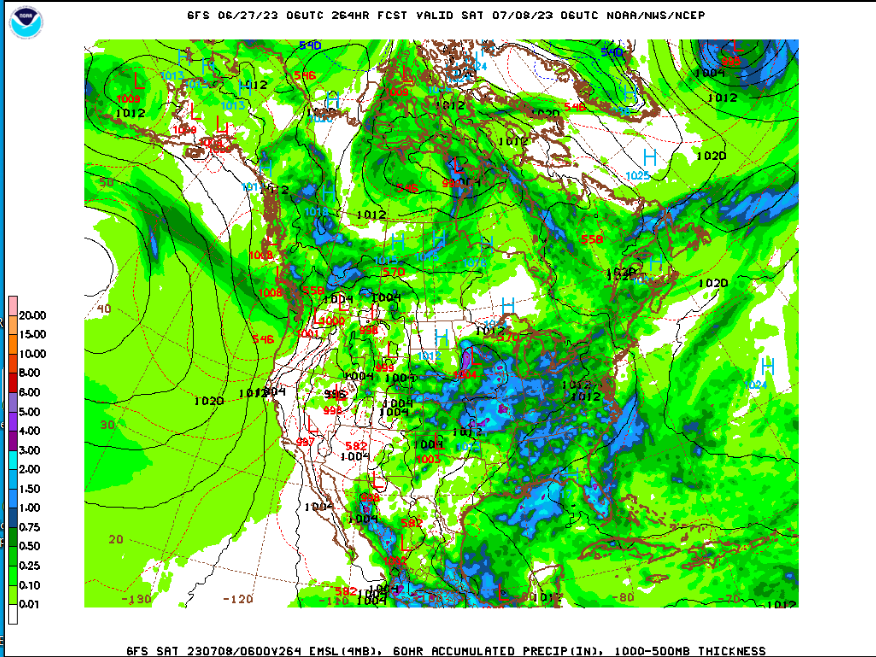

7-day

Next

weekend looks wet for the Midwest. Below is the 60-hour forecast map.

WORLD

WEATHER HIGHLIGHTS FOR JUNE 27, 2023

- Not

much changed overnight - Europe

and the western CIS will be trending wetter this week - China

will receive rain in most of the nation east of Tibet with areas north of the Yellow River staying driest, although getting some rain as well - Eastern

Australia’s best rain opportunity will be late in the weekend and early next week, but some rain will impact interior South Australia and western and some central New South Wales locations today into Wednesday

- Southeast

Asia rainfall will be more active this week improving topsoil moisture for many areas from the mainland areas into Indonesia - India’s

rainfall will be improving additionally this week with additional rain through Friday and more during the middle to latter part of next week favoring Madhya Pradesh, Chhattisgarh, Uttar Pradesh and southeastern Rajasthan as well as Haryana - Interior

west-central and southern India will receive restricted rainfall, although some timely rain is likely in early July - U.S.

Midwest rainfall will be erratic and light through the weekend and a little greater next week especially in the second half of next week and into the following weekend - Many

areas will get rain, but a serious improvement in low soil moisture is not very likely in very many areas, but any rain will be better than none - U.S.

Midwest temperatures will be hot from Kansas to Illinois Wednesday through Friday (temperatures extremes in the 90s and near 100 Fahrenheit are expected - Most

other Midwest temperatures will be more seasonable over the next two weeks

- U.S.

southern Plains will also be hot today through Thursday with cooling Friday into the weekend - West

Texas will have opportunity for some rain briefly Friday into the weekend with local amounts sufficient for some welcome relief to recent hot, dry conditions - U.S.

Delta will be quite warm to hot Wednesday through Saturday; temperature extremes over 100 Fahrenheit are likely - Canada’s

Prairies will remain drier biased for the next ten days especially in southern and east-central Alberta and central and western Saskatchewan - No

changes in South America weather were noted with good harvest conditions in Brazil and Argentina while western wheat areas of Argentina still need rain

Source:

World Weather, INC.

Tuesday,

June 27:

- EU

weekly grain, oilseed import and export data

Wednesday,

June 28:

- Canada’s

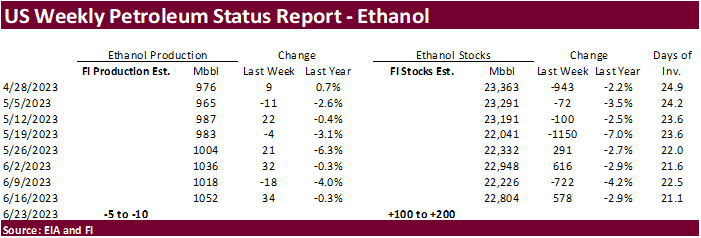

StatCan to release seeded area data for wheat, barley, canola and soybeans - EIA

weekly US ethanol inventories, production, 10:30am - HOLIDAY:

India, Indonesia

Thursday,

June 29:

- IGC

monthly grains report - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Vietnam’s

coffee, rice and rubber export data for June - Port

of Rouen data on French grain exports - USDA

hogs and pigs inventory, 3pm - HOLIDAY:

Indonesia, Malaysia, Singapore, Pakistan

Friday,

June 30:

- USDA

quarterly stockpiles data for corn, soybeans, wheat, barley, oat and sorghum, noon - ICE

Futures Europe weekly commitments of traders report - US

annual acreage data for corn, cotton, wheat and soybeans - US

agricultural prices paid, received, 3pm - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - HOLIDAY:

Indonesia, Pakistan

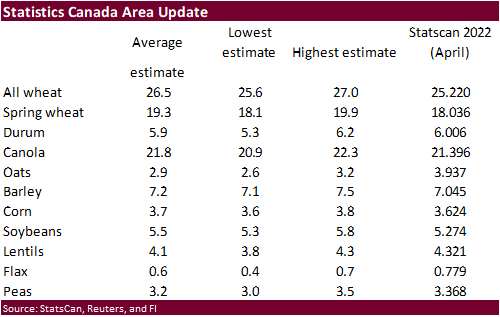

Canada

plantings. June 28 release (7:30 am CDT)

USDA

inspections versus Reuters trade range

Wheat

203,724 versus 200000-400000 range

Corn

542,727 versus 700000-1250000 range

Soybeans

141,158 versus 125000-300000 range

Soybean

and Corn Advisory

2023

U.S. Corn Yield Lowered 2.0 Bushels to 175.0 Bu/Ac

2023

U.S. Soybean Yield Lowered 0.5 Bushels to 50.5 Bu/Ac

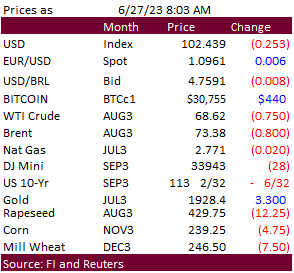

Macros

US

Durable Goods Orders May P: 1.7% (est -0.8%; prev 1.1%)

US

Durables Ex Transportation May P: 0.6% (est 0.0%; prev -0.3%)

US

Cap Goods Orders Nondef Ex Air May P: 0.7% (est 0.0%; prev 1.3%)

US

Cap Goods Ship Nondef Ex Air May P: 0.2% (est 0.2%; prev 0.5%)

Canadian

CPI (Y/Y) May: 3.4% (est 3.4%; prev 4.4%)

Canadian

CPI NSA (M/M) May: 0.4% (est 0.4%; prev 0.7%)

Canadian

CPI – Median (Y/Y) May: 3.9% (est 4.0%; prevR 4.3%)

Canadian

CPI – Trim (Y/Y) May: 3.8% (est 3.9%; prev 4.2%)

·

US corn futures started the evening session higher. Prices sold off overnight from widespread selling in the agriculture markets and lower WTI crude oil. The weather forecast calls for improving changes for rainfall next week

for the US Midwest, especially over the July 8-10 weekend.

·

Rain during the next two weeks will be below normal for parts of the Midwest, but just enough to support early pollination.

·

We had a typo on the table for the US corn yield. We are at 173.0.

·

USDA US corn export inspections as of June 22, 2023, were 542,727 tons, within a range of trade expectations, below 830,999 tons previous week and compares to 1,246,950 tons year ago. Major countries included Mexico for 248,810

tons, Japan for 182,354 tons, and El Salvador for 53,245 tons.

Export

developments.

·

Soybeans, meal and soybean oil are lower from an improving weather forecast and lower lead in outside product markets. Positioning ahead of the USDA report is starting to pick up. Iran is back in for soybean meal after passing

last week.

·

November soybean support is seen near $12.46, it current 50-day MA.

·

Watch the soybean oil share as it continues to rally after seeing a route mid last week. A temporary setback could occur this week.

·

Third month Malaysian palm oil futures decreased 44 ringgit to 3675, and cash decreased $15.00 to $830/ton.

·

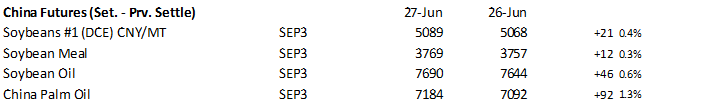

China futures were higher with soybeans up 0.4%, meal up 0.3%, SBO 0.6% higher and palm up 1.3%.

·

Nearby Rotterdam vegetable oils were mixed meal 7-9 euros lower.

·

Offshore values were leading SBO lower by about 297 points this morning and meal $3.10 short ton lower.

·

USDA US soybean export inspections as of June 22, 2023, were 141,158 tons, within a range of trade expectations, below 179,548 tons previous week and compares to 476,951 tons year ago. Major countries included Mexico for 68,683

tons, Japan for 40,828 tons, and Indonesia for 11,508 tons.

-

China

was to auction off 306,700 tons today of imported soybeans from state reserves.

-

Iran’s

SLAL seeks up to 120,000 tons of soybean meal from Brazil or Argentina, on Wednesday, for July and August shipment. They passed last week on meal.

·

US wheat futures are lower on unchanged to slightly lower US wheat crop conditions and a lower euro. Global export developments have cooled so far this week as traders monitor Black Sea prices. Russian wheat fob export prices

were unchanged from Friday but some ports in the Black Sea were up on Monday. Russia still remains cheapest origin in the world.

·

It will be hot again across the southern Great Plains July 6-10.

·

September Paris wheat futures were down 7.50 euros at 238.75 per ton.

·

USDA US all-wheat export inspections as of June 22, 2023 were 203,724 tons, within a range of trade expectations, below 235,175 tons previous week and compares to 352,894 tons year ago. Major countries included Japan for 41,741

tons, Taiwan for 36,132 tons, and Korea Rep for 35,475 tons.

CME

Variable Storage Rate (VSR) Results for Wheat and KC HRW Wheat Premium (Storage) Rates

https://www.cmegroup.com/notices/ser/2023/06/SER-9211.html

Export

Developments.

·

Morrocco seeks up to 2.5 million tons of wheat between July 1 and September 30. Origins include Russia, Ukraine, France, Germany, Argentina, and the United States.

Rice/Other

-

(Reuters) – The Philippines, one of the world’s biggest rice importers, has enough supply of the staple grain as it enters the third quarter of the year, the president’s office said on Tuesday. The government expects a “bountiful

harvest” for the January-June period rice planting season, Agriculture Undersecretary Leo Sebastian, who heads the ministry’s rice industry program, said in a statement.

#non-promo