PDF Attached

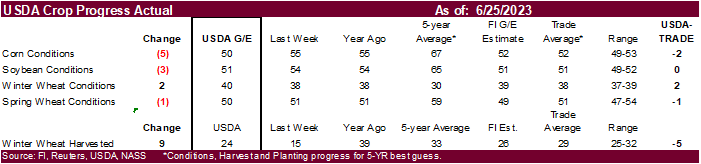

USDA

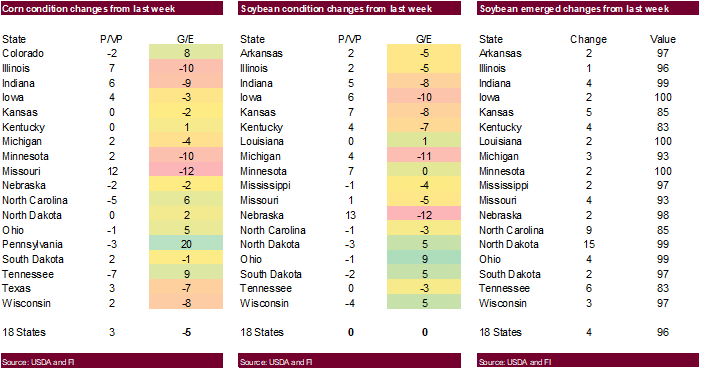

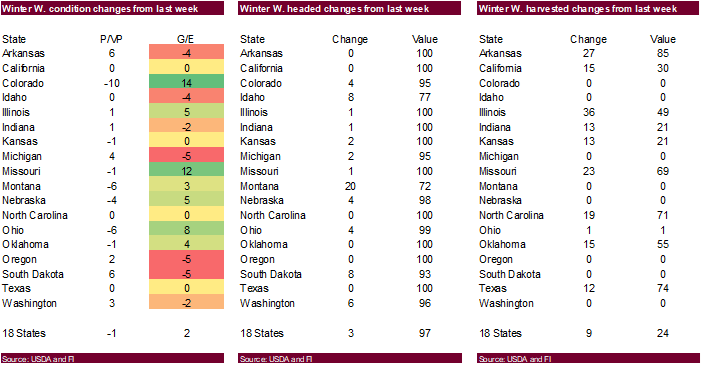

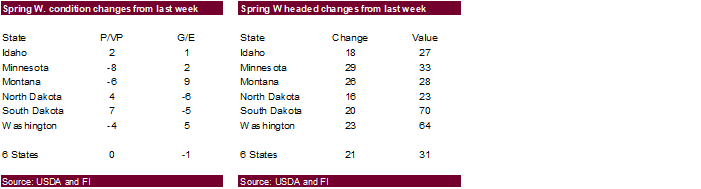

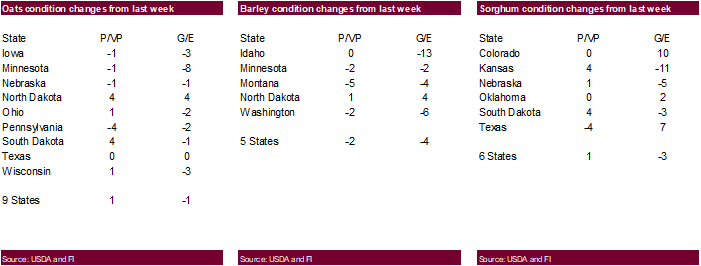

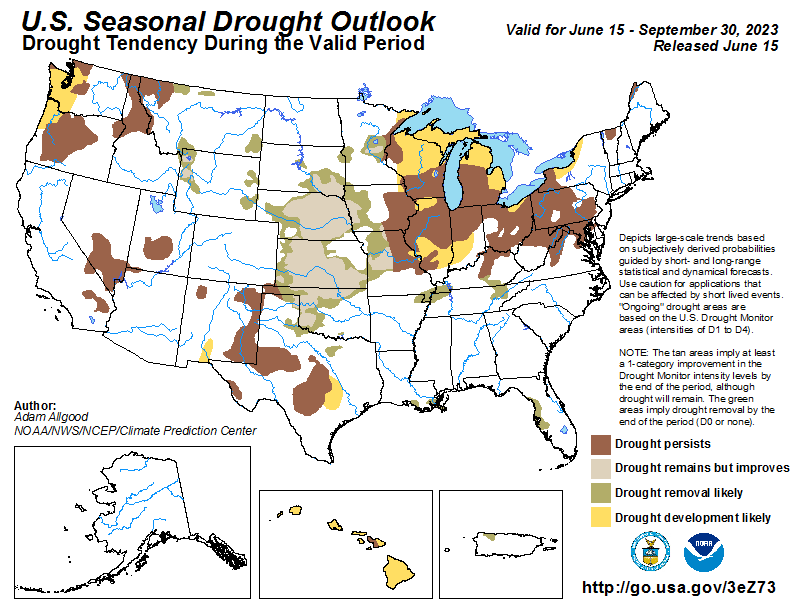

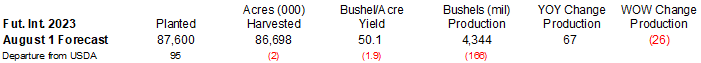

crop ratings declined for corn and soybeans. For corn, they were down 5 points, lower than expected, to lowest in decades for this time of year (1988 lowest). Soybeans were down 3 to 51, the lowest since 1996. The trade looked for US G/E corn and soybean ratings

to be down 3, and no change for SW and WW ratings. Spring wheat declined 1 point and winter wheat was unchanged. See tables after the text for production updates.

Choppy

two-sided trade for most commodity markets. Strength in many US ag markets eroded by mid-morning in part to a selloff in US crude oil. Earlier US weather and Black Sea concerns sent most CBOT ag commodity markets higher. Russia instability concerns support

wheat earlier but there was no evidence of a slowdown in Russian wheat exports. USDA export inspections were on the low side for soybeans, corn, and wheat. Global export developments were quiet over the weekend.

The

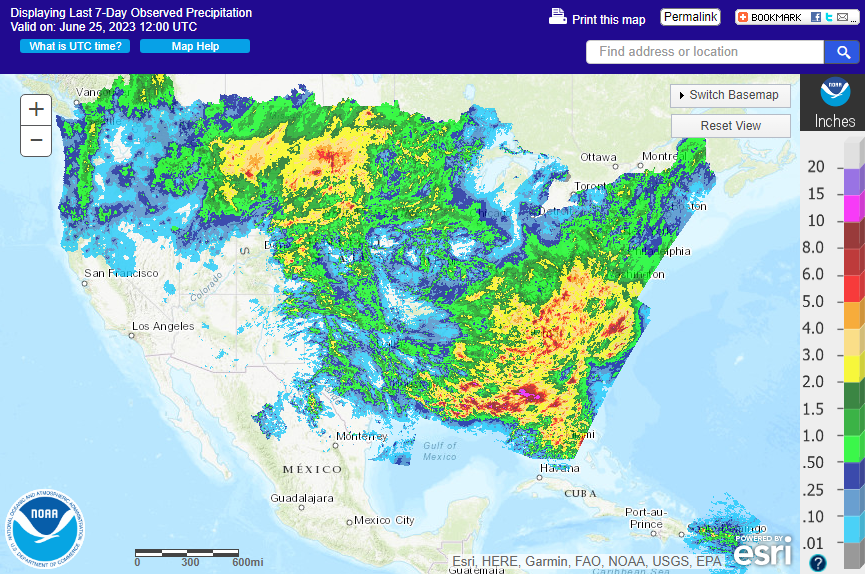

midday weather update, overall, was viewed as largely unchanged. Rain developed over the weekend across the western and northern Corn Belt but many areas missed out on widespread precipitation, including Illinois, Indiana, and Missouri. The majority of the

US Midwest will be dry until later this week but milder temperatures should slow condition declines bias the dry areas before rising bias the southwestern Corn Belt Wed-Fri. The Canadian Prairies will turn drier over the next week.

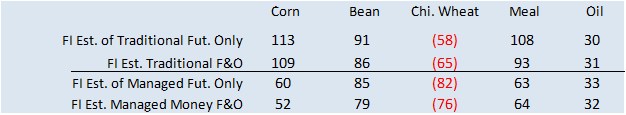

Fund

estimates as of June 26 (net in 000)

Weather

Last

7 days

7-day

WEATHER

TO WATCH

- Not

much changed overnight; however, there is more evidence that the Gulf of Mexico may open as a moisture source next week and that could bring needed moisture into the eastern Midwest to help improve future rain events - There

is also some additional evidence that the monsoon in Mexico will improve during July with some of that moisture streaming into the Rocky Mountains and eventually across a part of the Plains and into the Midwest - These

changes do not suggest immediate relief, but suggest there is potential for change as time moves along - In

the meantime, concern over low soil moisture will continue in the southwestern and central Corn Belt, despite some increased frequency of rainfall during the next two weeks

- Soil

moisture was becoming critically low across most of the northern and a part of the central Midwest Friday - Weekend

rain brought relief to the eastern Dakotas, portions of Minnesota, northern Iowa and far northern Illinois, northwestern Indiana and parts of both Michigan and Wisconsin, but most other areas failed to get significant moisture - Some

significant rain fell in central and interior eastern Kentucky - Very

warm to hot temperatures in the southwestern and some central U.S. Corn and Soybean production areas during the weekend accelerated evaporation and crop stress expanded in that direction

- The

heat was replaced by some cooling during the latter part of the weekend, but the air remained dry and rainfall was restricted - U.S.

rain during the weekend was most significant in the northern Plains where substantial amounts resulted varying from 1.00 to more than 3.00 inches

- Sand

Lake, South Dakota (located in north-central areas) reported 3.99 inches - The

greatest rain fell from central through northern South Dakota through southern and eastern North Dakota to west-central and northern Minnesota

- Significant

relief to dryness resulted and a much-improved outlook for corn, soybeans, sugarbeets, wheat and other crops resulted - Some

severe thunderstorms accompanied the rain resulting in a little damage from South Dakota and Nebraska into northern Iowa and northern Illinois - Crop

loss should have been very low - Additional

rain is expected periodically over the next week, although it will not be nearly as great and there is still some concern over northwestern North Dakota and northeastern Montana not getting much rain - Another

round of significant rain is possible late this week into Sunday across the Midwest, but it will be scattered and erratic most days early in the period and perhaps greater late in the period - A

majority of the Midwest will get rain at one time or another offering short term relief, but the southwestern corn and soybean production region will be driest leaving that region set for expanding dryness - Relief

elsewhere in the Midwest will be temporary with 0.30 to 0.90 inch of rain expected and local totals of 1.00 to 1.75 inches - Northern

and central areas will be wettest - The

greatest rainfall will be limited to about 30% of the region - The

relief will not last long and it will not be evenly distributed - Subsoil

moisture relief is not very likely - Improvements

in topsoil moisture are expected, but follow up rain will be extremely important - U.S.

temperatures will be cooling down in the Midwest and northern Plains through Wednesday with 70s and lower 80s Fahrenheit likely with some cooler readings in the far north and few warmer readings in the far south - Warming

is expected briefly ahead of the late week rainfall with more hot temperatures coming to the southwestern Corn and Soybean production region - Areas

from Kansas, Missouri and the Delta into southwestern Illinois will get back to the 90s and near 100 degrees Thursday and Friday ahead of the next wave of rain and cooling - Cooling

will return normal to slightly cooler than usual temperatures during the weekend - Rain

advertised for the U.S. Midwest next week will be erratic with some areas getting more rain than others and normal temperatures will be near to above normal - The

environment would not be bad for crops if there was good soil moisture in the ground and no crop stress leading into the period.

- Greater

rain must occur - The

bottom line for the next ten days includes an expansion of drought and dryness intensity in the southwestern U.S. Corn Belt and slow relief for northern, central and eastern parts of the Midwest, although most of the relief is expected to be temporary with

a big need for more routinely occurring rainfall and mild summer temperatures.

- Mexico

drought will continue for one more week and then monsoon moisture is expected to quickly evolve next week finally bringing some relief to that nation - Corn,

sorghum, rice, soybeans and many other crops will be planted aggressively as soon as significant rain falls - Citrus,

sugarcane and coffee conditions will improve with greater rainfall - Mexico’s

drought has delayed early season planting and raised much concern about 2023 summer crop production - Developing

rain will bring an end to that concern - West

Texas cotton areas may begin receiving some needed rain late this week and into the weekend, although it will be sporadic and light

- A

boost in rain is expected briefly next week so that 0.20 to 0.75 inch and locally more impacts much of the region - Follow

up rain will be imperative - U.S.

Delta and southeastern states get a good mix of weather during the coming ten days to two weeks - Some

drying has occurred in the wettest areas in the southeastern states recently and the process will continue for a little while early this week - Temperatures

will be seasonable - GFS

model is still trying to bring a tropical cyclone into the eastern or central Gulf of Mexico next week and then into the southeastern states or perhaps near the Delta around or shortly after July 4 - Confidence

in this feature is low, but not out of the realm of possibilities - U.S.

northern Plains will get additional rain periodically over the next ten days, although it will not be quite as frequent or significant as that of the weekend - Continued

benefits will come to many crops in the region - Canada

Prairies rainfall will continue limited over the next ten days in the southwest and some central locations while rain falls periodically in the far west, north and some eastern crop areas - All

of the moisture will be welcome, but possibly not quite enough to make a serious change in field conditions - Drought

will prevail in southern and east-central Alberta and western Saskatchewan - Temperatures

will be warmer than usual this week and a little closer to normal next week

- The

southeastern Prairies will least likely to get rain - Canada

Prairies weekend rainfall was limited leading to more net drying and rising crop stress in the driest areas of the central and southwest - Ontario

and Quebec, Canada rainfall is expected to be favorably mixed over the next ten days supporting long term crop development potential - Argentina

was dry during the weekend and it will remain that way for the next ten days to two weeks – especially in the west where wheat emergence and establishment has been poor

- Rain

in Argentina during the weekend fell from portions of La Pampa into central and southern Buenos Aires with rainfall of 0.05 to 0.39 inch - The

precipitation was welcome, but had a low impact on struggling crop establishment in the dry areas - Brazil

weekend precipitation was minimal in the south, but showers did produce up to 0.50 inch and temperatures were seasonable - Brazil

weather will be largely dry this week favoring coffee, citrus, sugarcane and Safrinha corn maturation and harvest progress - Wheat

development will improve in the south due to drier weather - Rain

will return to southern Brazil this weekend and especially next week - Waves

of warmer than usual weather will occur in South America over the next ten days - Europe

weather will be favorably mixed over the next ten days, but rainfall volume will remain a little light leaving need for greater moisture to fix long-term moisture deficits - Temperatures

will be near to above normal - Most

crops are in fair to good condition, but there is need for more rain in many areas to bring back the good the excellent ratings that have slipped away in recent weeks - A

favorable mix of rain and sunshine is expected in most Russia, Ukraine, Belarus, Baltic States and northern Kazakhstan crop areas during the next ten days - Temperatures

will become seasonable to slightly warmer biased after cool weather abates this week - Xinjiang,

China will be a little milder than usual over the coming ten days and rainfall will be minimal - Crop

conditions should stay mostly good - China

crop areas north of the Yellow River will remain drier than usual in the coming ten days to two weeks with temperatures near to above normal - Some

crop stress is expected for unirrigated crops, but mostly for spring wheat, sunseed and sugarbeets - Only

a small part of the corn crop would be impacted - Most

other areas in China will experience a good mix of weather with sufficient rain to support long term crop development - Some

delay to early rice harvesting will continue - Excessive

rain in early rice production areas of southern China during the weekend likely caused some crop damage - Rain

totals varied from 4.20 inches to more than 13.74 inches - Sugarcane

and some minor corn, soybeans and groundnuts were also impacted - Areas

from Guangxi to Zhejiang were most impacted - Outside

of far southern China, the weekend was dry and warm to hot with highs in the 90s to 104 degrees Fahrenheit across the North China Plain and areas north of the Yellow River - All

of Southeast Asia continued to deal with erratic rainfall during the weekend and this pattern may prevail for a while

- Daily

showers and thunderstorms are expected and that will help slow the drying trend, but there will be days of no rain and warm temperatures to induce some drying

- India

weekend rainfall began to increase and the moisture was welcome, although much more was needed after a slow start to the rainy season

- India

will experience greater rain more often in central parts of the nation during the next ten days to two weeks and soil moisture will be bolstered sufficiently for planting of summer crops - West-central

and southern India will experience lighter than usual rainfall which may have an impact on sugarcane and rice with some concern over late season cotton, groundnuts and other crops that are usually planted late in the monsoon season - Rain

is still being advertised for Queensland and northern New South Wales, Australia this coming weekend and early next week - The

event has been diminished from that of Friday which was needed, but there will still be some benefits for the wheat, barley and limited amounts of canola produced in these areas - Rain

is needed to improve emergence and establishment in unirrigated fields - Other

areas in Australia will not receive as much rain as in previous weeks, but winter crops should be establishing well - Central

America rainfall has been timely recently and mostly good for crops, although many areas are still reporting lighter than usual amounts - A

boost in rainfall is expected over the next ten days - Drought

continues to impact Gatlin lake and the Panama Canal shipments, but some increase in precipitation is forthcoming - Tropical

Storm Bret dissipated over the Caribbean Sea during the weekend - Tropical

Storm Cindy dissipated over open water in the Atlantic Ocean overnight - There

were no other areas of disturbed tropical weather in the Atlantic Ocean, Caribbean Sea or Gulf of Mexico being monitored Sunday by the U.S. National Hurricane Center for the coming week - Two

tropical cyclones may evolve in the eastern Pacific Ocean this week southwest of Mexico and northwest of the upper Pacific coast of Central America - Both

systems should parallel the west coast of Mexico, but no landfall is expected - South

Africa winter crops will experience a couple of waves of rain during the next two weeks that will ensure a well-established wheat, barley and canola crop this year - West-central

Africa crop conditions remain good with little change expected - Rain

will fall in a timely manner during the next two weeks - East-central

Africa weather will continue favorable for coffee, cocoa, sugarcane, rice and other crops through the next two weeks -

Today’s

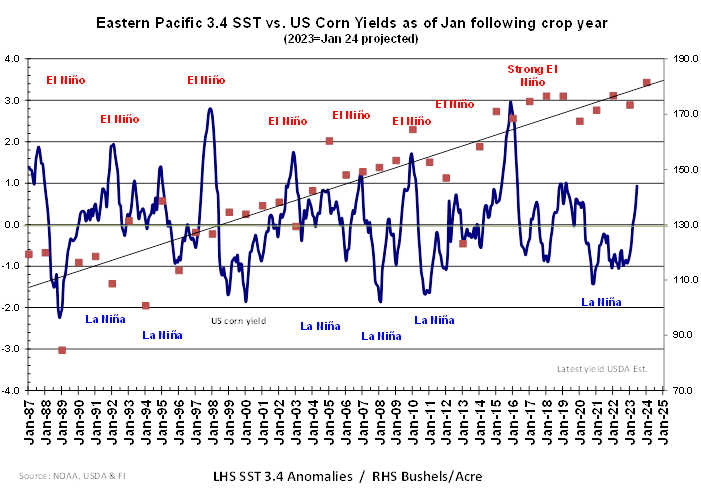

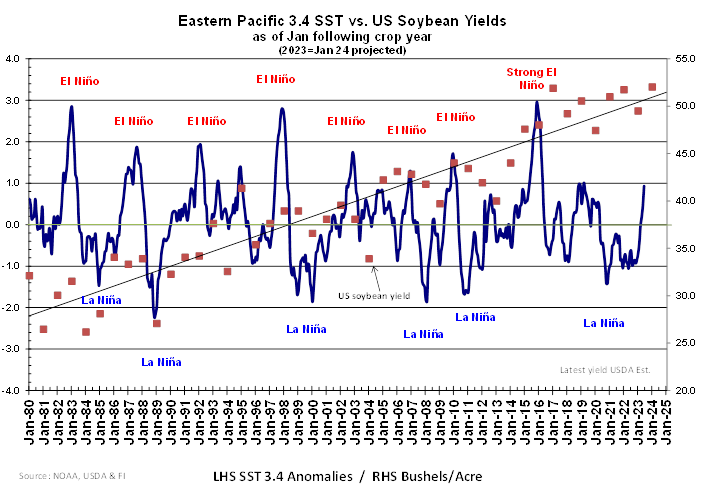

Southern Oscillation Index was -5.47 and it will move erratically higher over the next few days

Source:

World Weather, INC.

Monday,

June 26:

- USDA

export inspections – corn, soybeans, wheat, 11am - US

corn, cotton, soybean, spring wheat and winter wheat condition, 4pm - US

planting data for cotton, spring wheat and soybeans, 4pm - US

poultry slaughter, 3pm

Tuesday,

June 27:

- EU

weekly grain, oilseed import and export data

Wednesday,

June 28:

- Canada’s

StatCan to release seeded area data for wheat, barley, canola and soybeans - EIA

weekly US ethanol inventories, production, 10:30am - HOLIDAY:

India, Indonesia

Thursday,

June 29:

- IGC

monthly grains report - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Vietnam’s

coffee, rice and rubber export data for June - Port

of Rouen data on French grain exports - USDA

hogs and pigs inventory, 3pm - HOLIDAY:

Indonesia, Malaysia, Singapore, Pakistan

Friday,

June 30:

- USDA

quarterly stockpiles data for corn, soybeans, wheat, barley, oat and sorghum, noon - ICE

Futures Europe weekly commitments of traders report - US

annual acreage data for corn, cotton, wheat and soybeans - US

agricultural prices paid, received, 3pm - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - HOLIDAY:

Indonesia, Pakistan

Source:

Bloomberg and FI

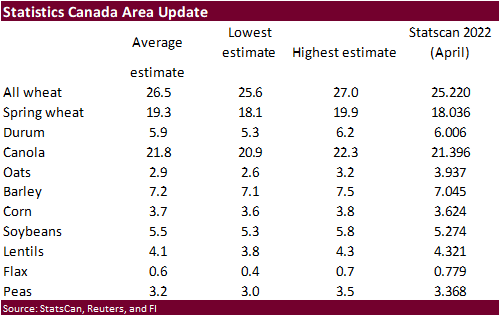

Canada

plantings. June 28 release (7:30 am CDT)

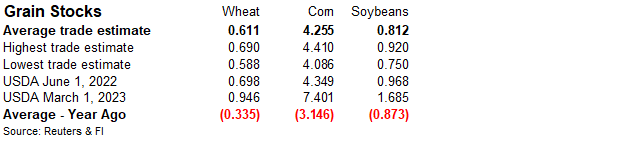

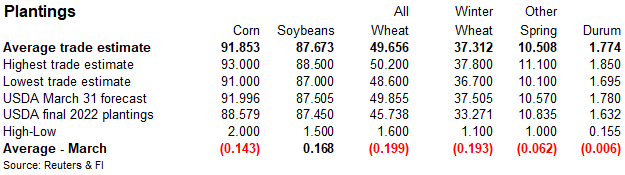

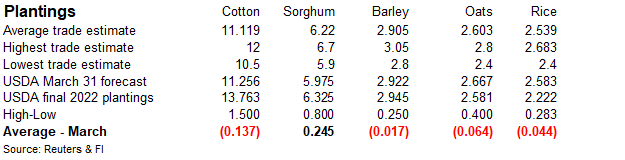

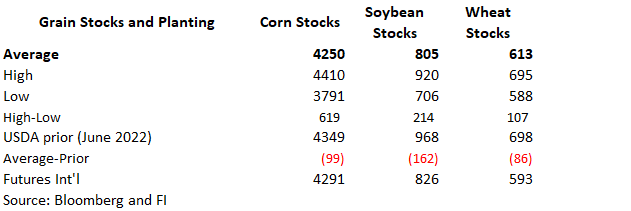

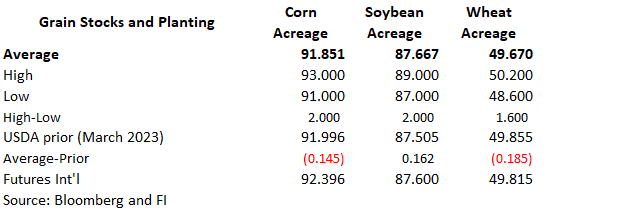

Reuters

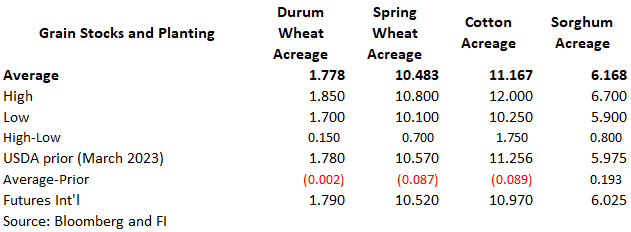

estimates for June 30 USDA reports

Bloomberg

Estimates

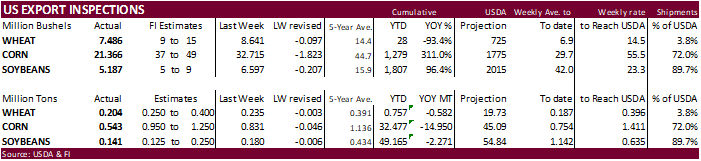

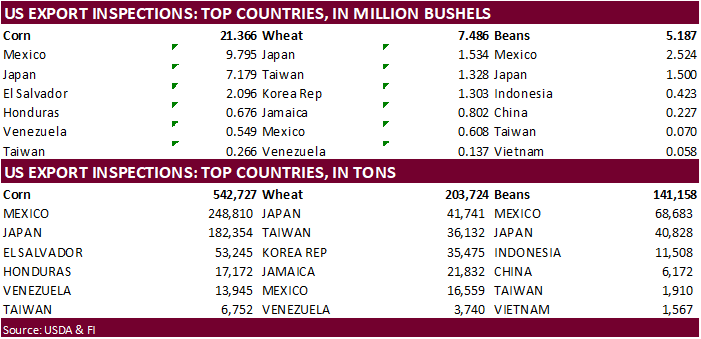

USDA

inspections versus Reuters trade range

Wheat

203,724 versus 200000-400000 range

Corn

542,727 versus 700000-1250000 range

Soybeans

141,158 versus 125000-300000 range

GRAINS INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING JUN 22, 2023

-- METRIC TONS --

-------------------------------------------------------------------------

CURRENT PREVIOUS

----------- WEEK ENDING ---------- MARKET YEAR MARKET YEAR

GRAIN 06/22/2023 06/15/2023 06/23/2022 TO DATE TO DATE

BARLEY 0 0 49 0 49

CORN 542,727 830,999 1,246,950 32,477,480 47,427,940

FLAXSEED 0 0 0 0 0

MIXED 0 0 0 0 0

OATS 0 0 1,297 799 1,297

RYE 0 0 0 0 0

SORGHUM 63,546 1,294 148,696 1,843,761 6,689,131

SOYBEANS 141,158 179,548 476,951 49,165,385 51,436,105

SUNFLOWER 0 96 0 2,704 2,260

WHEAT 203,724 235,175 352,894 757,349 1,339,828

Total 951,155 1,247,112 2,226,837 84,247,478 106,896,610

--------------------------------------------------------------------------

CROP MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED; SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES WATERWAY SHIPMENTS TO CANADA.

Macros

102

Counterparties (prev 101) Take $1.961 Tln (prev $1.969 Tln) At Fed Reverse Repo Op.

Canada

Wholesales Rose 3.5% M/M In May – Statcan Flash

Canada

Factory Sales Rose 0.8% M/M In May

Putin

Extends Until The End Of 2023 Russia’s Response Measures To The Price Cap On Russian Oil And Oil Products – Decree

·

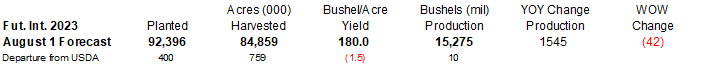

US corn futures traded two-sided, ending mostly higher as traders had mixed thoughts over past and future US weather. Some of the dry areas of the heart of the Midwest saw rain over the weekend into Monday, but much more is needed

with corn heading into the pollination stage. If the weather forecast remains drier than normal for the month of July, we would tend to think it would be a corn problem more so than soybeans, which are “made” during the month of August. Therefore, it was interesting

to see corn lose against soybeans today.

·

Corn prices were choppy today on mixed thoughts over the US weather forecast and potential Russia political instability. This was reflected in the open Sunday night for December corn which saw a 12.5 cents range during the first

60 seconds of trade.

·

USDA US corn export inspections as of June 22, 2023, were 542,727 tons, within a range of trade expectations, below 830,999 tons previous week and compares to 1,246,950 tons year ago. Major countries included Mexico for 248,810

tons, Japan for 182,354 tons, and El Salvador for 53,245 tons.

·

A good portion of the Midwest saw rain over the weekend but many hard-hit dry areas didn’t see much rain, if any. Rain was greatest from the eastern Dakotas and northeastern Nebraska to Wisconsin and northern Illinois. Monday

was mostly dry.

·

Rain during the next two weeks will be below normal for the Midwest, but just enough to support early pollination.

·

Brazil’s second crop corn harvest advanced about 4 points to 9 percent complete, well below 20 percent for this time year ago, according to AgRural. They are at 127.4 million tons for total corn production.

Export

developments.

-

None

reported

Price

outlook (6/23/23)

September

corn $5.25-$7.00

December

corn $480-$7.25

·

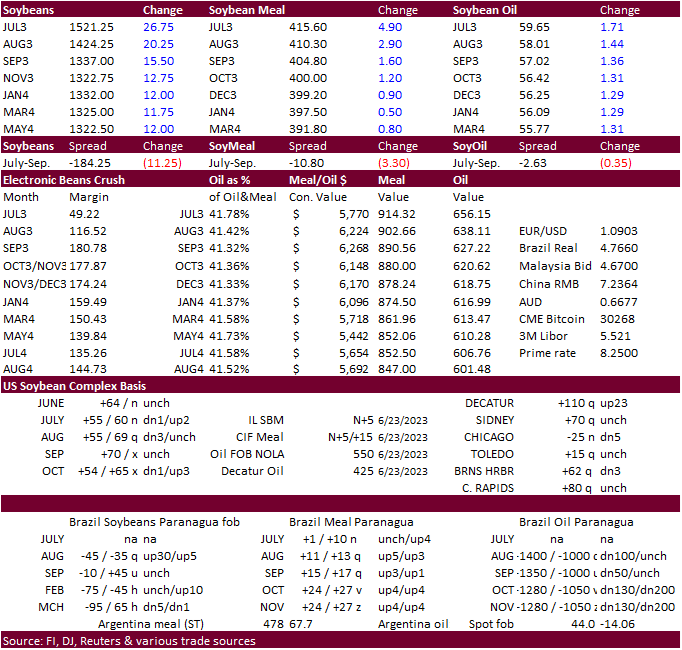

Soybeans were higher in part to less than ideal US weather and higher products coupled with rising domestic product basis as crushers enter seasonal downtime. Many of these crushing plants have been running full steam for months,

so it is no surprise to take maintenance for about a week. Meal basis in central IL rallied late last week and selected soybean oil basis locations also appreciated over the past seven days. US soybean oil basis firmed last week to 425 over from 350 for central

IL and Gulf to 550 over from 500 over previous week.

·

Vegetable oil prices were higher in Europe and Malaysia on Monday over Russia export concerns from political stability. Over the weekend the Wager Group reversed their decision to march on Moscow.

·

USDA US soybean export inspections as of June 22, 2023, were 141,158 tons, within a range of trade expectations, below 179,548 tons previous week and compares to 476,951 tons year ago. Major countries included Mexico for 68,683

tons, Japan for 40,828 tons, and Indonesia for 11,508 tons.

·

ITS reported June 1-25 Malaysian palm oil exports at 897,180 tons from 982,605 tons same period month earlier. AmSpec reported 891,361 tons from 933,615 tons the previous month. During the regular session Monday, third month Malaysian

palm oil futures increased 99 ringgit to 3719, and cash increased $17.50 to $875/ton.

-

China

will auction off 306,700 tons of imported soybeans from state reserves on June 27.

Price

outlook (6/23/23)

Soybeans

– September $14.00-$15.50, November $12.00-$15.25

Soybean

meal – September $360-$475, December $350-$500

Soybean

oil – September 51.00-58.00, December 48.00-58.00

·

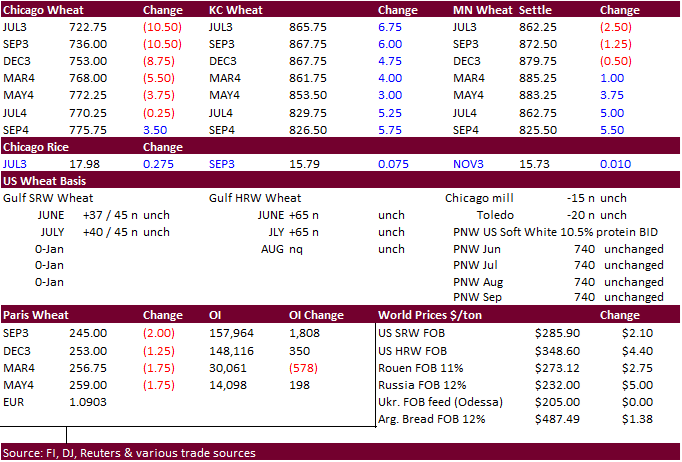

US wheat futures ended mixed with Chicago on the defensive KC higher, and Minneapolis lower in the front three contracts and higher in the back months. Earlier all three markets were higher on renewed Black Sea concerns amid Russia

instability. Earlier, this also affected vegetable oils and corn.

·

USDA US all-wheat export inspections as of June 22, 2023, were 203,724 tons, within a range of trade expectations, below 235,175 tons previous week and compares to 352,894 tons year ago. Major countries included Japan for 41,741

tons, Taiwan for 36,132 tons, and Korea Rep for 35,475 tons.

·

Much needed rain fell across the weekend for west Texas and Oklahoma, too late for wheat but beneficial for Cotton and other crops. Harvesting will increase for the central Great Plains this week.

·

It will be hot again across the southern Great Plains July 6-10.

·

September Paris milling wheat officially closed 2.00 euros lower, or 0.8%, at 246.25 euros a ton (about $268.50 ton).

·

Iraq bought more than 4.5 million tons of local wheat.

·

We don’t see any near-term impact on Russia agricultural exports from potential political instability. Some think Russia export prices will increase this week. On Monday AgriCensus reported mostly unchanged wheat prices for Russia

main ports. Russia wheat prices did increase last week. IKAR reported as of Friday 12.5 percent protein at $231 per ton, up $3.00 from the prior week.

·

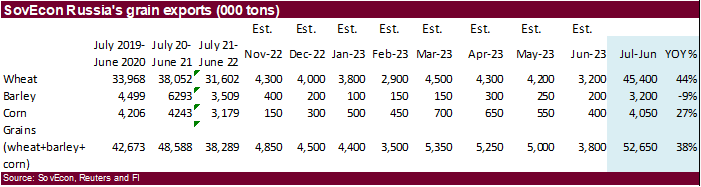

(Reuters) – The European Union’s crop monitoring service MARS on Monday forecast that Russia’s total wheat production will shed 17% compared to 2022 to 86.7 million metric tons, though that would still be 4% above the five-year

average. In a report MARS also pegged the country’s total barley output in 2023 at 20.4 million tons, down 11% on year, and the grain maize crop at 15.2 million tons, up 1%.

·

Ukraine completed spring grain and oilseed plantings.

SovEcon

raised

their June Russia wheat export outlook by 200,000 tons.

CME

Variable

Storage Rate (VSR) Results for Wheat and KC HRW Wheat Premium (Storage) Rates

https://www.cmegroup.com/notices/ser/2023/06/SER-9211.html

Export

Developments.

·

None reported

Rice/Other

China

sold 78,984 tons of rice or 8.75 percent of what was offered from state reserves at an average price of 2,559 yuan per ton.

Price

outlook (6/23/23)

Chicago

Wheat September $6.00-$8.25

KC – September $7.25-$9.50

MN – September $7.25-$9.50

#non-promo