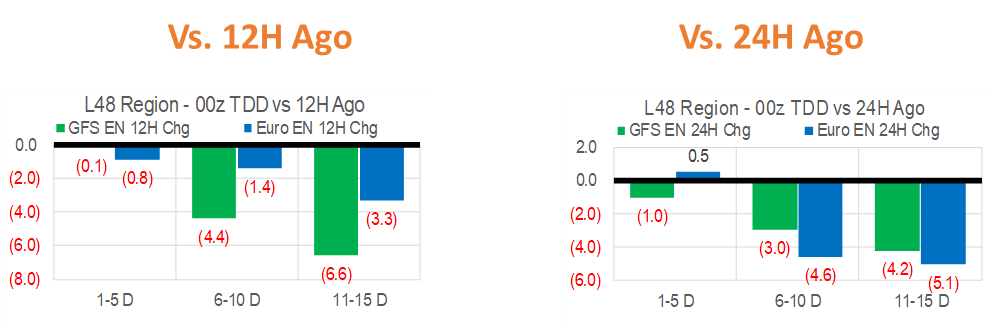

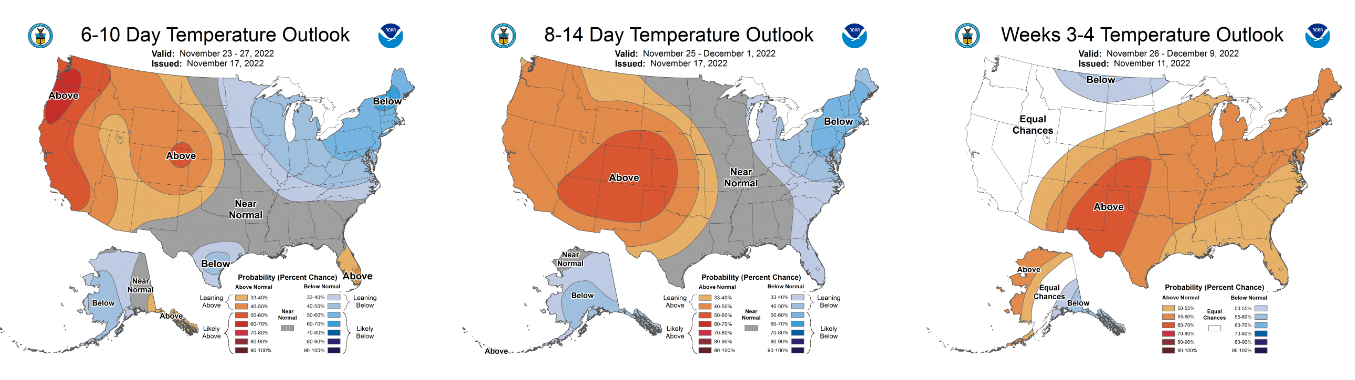

Lets start with today’s latest weather runs which have both models shedding HDDs for the backend of Nov and the first few days of Dec. The latest Euro and GFS Ensemble runs take the forecast close to the 10Y normal. This looks to be putting pressure on the gas markets this morning.

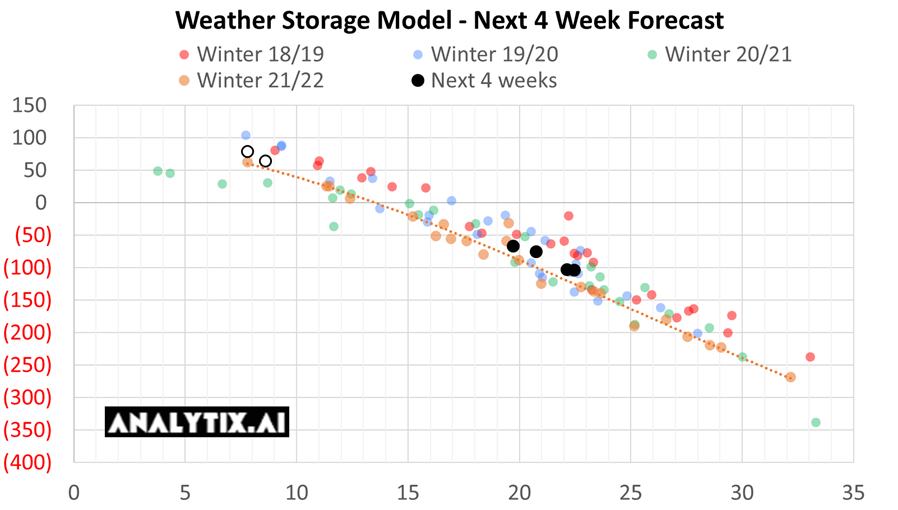

Now lets look at yesterday EIA storage report. The EIA reported a +64 Bcf injection for the week ending November 11th, which came in very close to the market expectations of ~+66 and right on our estimate of +64. Our estimate was the midpoint of our S/D model and flow model, which have both been performing well. This storage report takes the total level to 3644 Bcf, which is +4 Bcf over last year at this time and -7 Bcf below the five-year average of 3,651 Bcf. This is officially the last injection of the season. We pinged Nov 11th as the last daily net injection, with heavy daily draws hitting right after.

This past report continues to be loose relative to LY. We peg this report at being +2.5 Bcf/d loose (wx-adjusted).

Our fundamental storage model performed well this week, with the actual storage report coming in only a couple of Bcf lower than our S/D-based estimate. Here are the details we gather from the fundamentals:

- Total L48 production was lower for the reporting period with lower Canadian supply adding to the overall tighter supply condition. The total supply was 1.4 Bcf lower than the previous week. We anticipate Marcellus and Utica production to start its ramp higher with stronger regional cash prices.

- National temps were mixed week-on-week. The Midwest, East, and SC all warmed from the previous week, but the Mountain and Pacific zone cooled significantly. Overall the two sides of the country cancelled each other out. At the national level, our HDDs increased by 0.3F which translated into no real change in RC demand week-on-week.

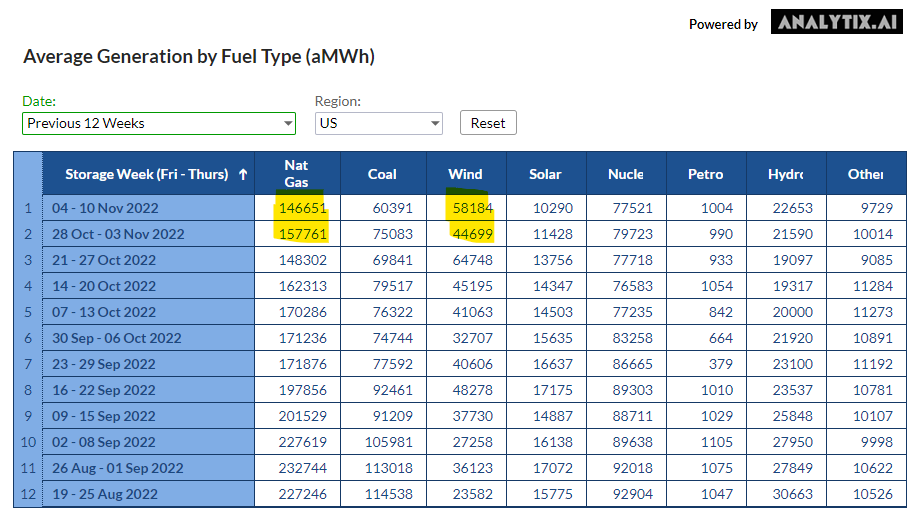

- Power burns were off this past week with wind generation rising well above seasonal expected levels.

Source: http://www.analytix.ai/generation-by-fuel-type.html

- LNG volumes were lower by 0.5 Bcf/d with Sabine Pass having lower feedgas levels due to continued operational volatility following the 4-day pipeline maintenance on NGPL at the beginning of the month. That being said, we see Sabine ramping up to levels above 5 Bcf/d.

Today’s Fundamentals

Daily US natural gas production is estimated to be 100.3 Bcf/d this morning. Today’s estimated production is +0.05 Bcf/d to yesterday, and -0.7 Bcf/d to the 7D average.

Natural gas consumption is modelled to be 109.9 Bcf today, +0.53 Bcf/d to yesterday, and +6.82 Bcf/d to the 7D average. US power burns are expected to be 32.1 Bcf today, and US ResComm usage is expected to be 42.9 Bcf.

Net LNG deliveries are expected to be 12.2 Bcf today.

Mexican exports are expected to be 6.2 Bcf today, and net Canadian imports are expected to be 6.8 Bcf today.

The storage outlook for the upcoming report is -79 Bcf today.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.