by Terry Reilly | Jul 29, 2022

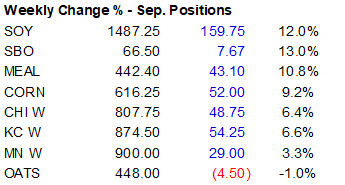

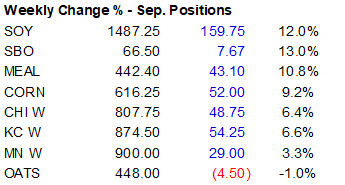

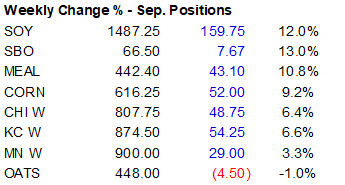

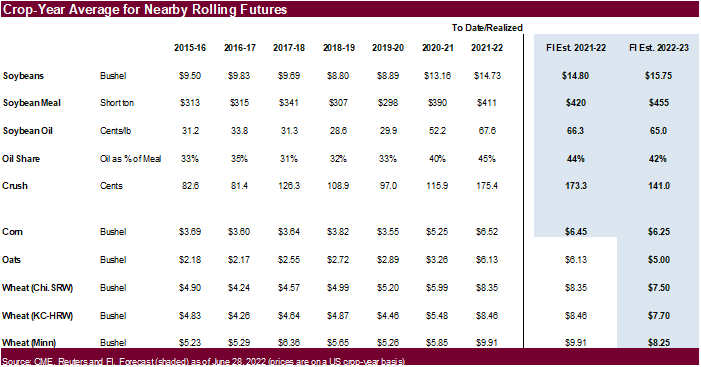

PDF Attached Private exporters reported sales of 132,000 metric tons of soybeans for delivery to unknown destinations during the 2022/2023 marketing year. We revised our US SBO S&D (attached) by trimming SBO feedstock for biofuel. CBOT agriculture...

by Terry Reilly | Jul 29, 2022

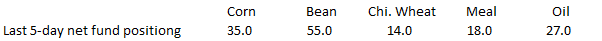

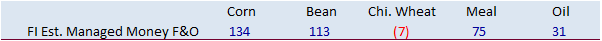

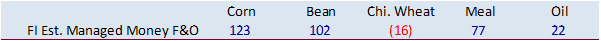

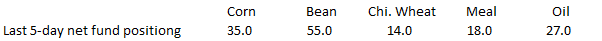

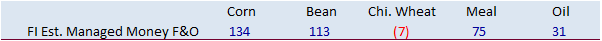

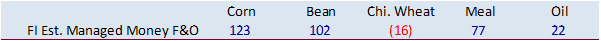

PDF attached As of last Tuesday, investment funds were busy selling corn, but not so much for managed money. Index funds continued to unwind long positions. This was likely not the case this week, however. Key takeaway is there is a lot of room for funds to...

by Terry Reilly | Jul 29, 2022

PDF attached Good morning. Private exporters reported sales of 132,000 metric tons of soybeans for delivery to unknown destinations during the 2022/2023 marketing year. CBOT agriculture markets extended their rally led by soybeans. Fundamentals...

by Terry Reilly | Jul 28, 2022

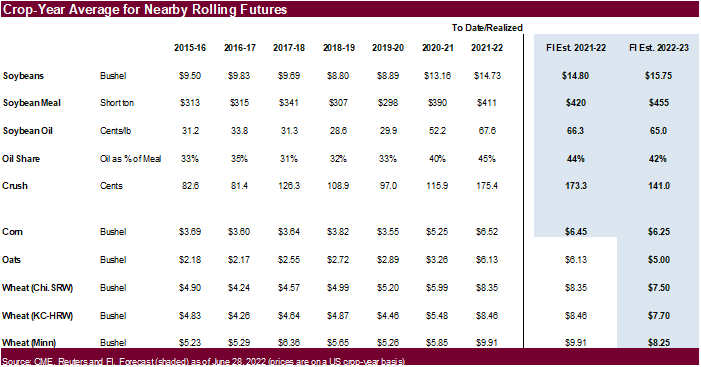

PDF Attached does not include daily estimate of funds We have a bullish outlook for 2022-23. US corn and soybean balances attached. US GDP Annualized (Q/Q) Q2 A: -0.9% (est 0.4%; prev -1.6%) US Initial Jobless Claims Jul 23: 256K (est 250K; prev 251K;...

by Terry Reilly | Jul 28, 2022

PDF attached Good morning. US GDP Annualized (Q/Q) Q2 A: -0.9% (est 0.4%; prev -1.6%) US Initial Jobless Claims Jul 23: 256K (est 250K; prev 251K; prevR 261K) The US dollar sold off post US GDP number but crude oil is still trading sharply higher....