PDF Attached does not include daily estimate of funds

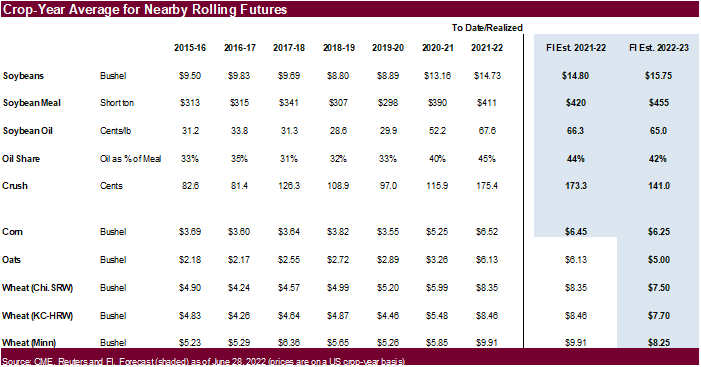

We

have a bullish outlook for 2022-23. US corn and soybean balances attached.

US

GDP Annualized (Q/Q) Q2 A: -0.9% (est 0.4%; prev -1.6%)

US

Initial Jobless Claims Jul 23: 256K (est 250K; prev 251K; prevR 261K)

Policy

outlooks and weather drove most CBOT ag contracts higher. The Inflation Reduction Act bill Wednesday includes provisions to provide an extension to the biodiesel credit and introduce a SAF credit (aviation), and this was seen bullish for soybean oil. Soybeans

ended sharply higher, best run since spring. Meal was mostly lower on technical selling/spreading. Corn and wheat were sharply higher. The USD was near unchanged as of 12:45 pm CT. US equities traded two-sided. WTI turned lower by the time CBOT ags were heading

into the close. The US weather outlook was largely unchanged. USDA export sales were uneventful with exception of new-crop soybeans beating expectations.

World

Weather Inc.

WEATHER

TO WATCH AROUND THE WORLD

- Northwestern

U.S. Corn Belt is drying out and may experience restricted rainfall over the next two weeks along with bouts of very warm to hot temperatures - Areas

from northern Missouri and northwestern Illinois through Minnesota and the Dakotas to Canada’s southwestern Prairies will receive well below normal rainfall through Aug. 10 - Temperatures

will be hot at times during the period - Soil

moisture is already quite low from eastern Nebraska and western and north-central Iowa into southern Minnesota and northwest into Montana, southeastern Alberta and southwestern Saskatchewan - U.S.

Delta will receive waves of rain through the weekend to dramatically improve soil moisture and some crop conditions - Southern

Kansas, Oklahoma and the Texas Panhandle will be wetter biased through the weekend resulting in a much-needed boost in soil moisture and relief for crops and livestock from persistent hot, dry, weather - Eastern

U.S. Midwest weather will be favorably mixed over the next two weeks, although there will be some net drying especially from Aug. 3-9 raising the need for future rain - U.S.

southeastern states will see a good mix of rain and sunshine during the next two weeks - U.S.

Pacific Northwest continued to bake in excessive heat and dryness Wednesday. No relief is expected until this weekend and gradual cooling begins - Highest

temperatures Wednesday were 100 to 108 Fahrenheit in central Washington and much of interior Oregon and 92 to 102 in the Snake River system of Idaho - Temperatures

will be more seasonably warm next week - Southern

Texas and northeastern Mexico will remain drought stricken for the next two weeks with no potential for change - Arizona

and New Mexico rainfall is expected to increase during the week next week and into the following weekend

- Some

monsoonal showers may briefly reach into eastern and southern California and the Great Basin next week, but the impact on soil moisture will be minimal - There

may be a risk of more forest fires as lightning occurs without much rainfall - Northwestern

U.S. and British Columbia heatwave will continue through the weekend stressing crops and livestock - Much

of Europe is too dry and it will continue that way despite some potential for brief bouts of rain - France

may get some rain Aug. 5-7, but confidence is low and amounts should be light - Drought

areas from Hungary through the lower Danube River Basin will receive a few showers Friday and Saturday and then trend drier for the following ten days - No

serious moisture relief is expected, although the moisture will be welcome - Europe’s

greatest rainfall will occur from the Alps into Belarus, northwestern Ukraine and the Baltic States this weekend into early next week

- Soil

moisture in northeastern Europe is still rated quite favorably - Waves

of rain are expected to continue impacting the western Commonwealth of Independent States, but greater rain is desired from southeastern Ukraine through Russia’s Southern Region to western Kazakhstan and a part of the eastern Russia New Lands - Heavy

rain fell Wednesday from the central Yellow River Basin into Hebei and northwestern Liaoning with amounts of 2.00 to 8.00 inches resulting in some local flooding.

- One

location near Beijing reported 9.13 inches of rain - China’s

Yellow River Basin should dry down over the next full week and that change will be good following Wednesday’s heavy rain event

- Most

other areas in eastern China will get waves of rain and some sunshine during the next two weeks supporting crops in many areas - No

tropical cyclones are present in the western Pacific Ocean this morning, but that will soon change with multiple storms likely in the next two weeks - A

first disturbance was evolving southeast of the Philippines today and will move to the East China Sea and Yellow Sea over the next several days eventually bringing some rain to northeastern China and/or the Korean Peninsula - Interior

southeastern China will experience net drying over the coming week and then trend wetter thereafter - China’s

Xinjiang province continues to experience relatively good weather - A

few showers and thunderstorms are expected, but most of the region will be dry with temperatures varying greatly over the week to ten days - Argentina

received some additional rain Wednesday after starting Tuesday - Rainfall

varied from0.50 to 1.30 inches in Buenos Aires and ranged up to 0.43 inch in Entre Rios while amounts were more limited elsewhere - Cordoba

has not received significant rain from this week’s precipitation and much of Santa Fe is still quite dry as well

- Argentina

will see additional a few lingering showers today and then drier until late next week when showers evolve in the northeast

- Far

southern Brazil will receive periodic rainfall during the next ten days maintaining a typically moist pattern in the soil from Rio Grande do Sul into Paraguay, southernmost Mato Grosso do Sul and parts of both Parana and southern Sao Paulo - The

moisture will be great for winter crops and should not have much impact on Safrinha crop maturation or harvesting - Safrinha

cotton and late corn harvesting in Brazil will advance well due to continued dry and warm weather - There

is no threat of cold weather in Brazil coffee, citrus or sugarcane areas during the next two weeks - Southeastern

Canada crop conditions are rated favorably with little change likely for a while - Canada’s

southwestern and central Prairies will dry down over the next week to ten days and temperatures will slowly rise above normal.

- Crop

stress will rise once again as soil moisture is slowly depleted - The

greatest stress will eventually evolve in central, west-central, southwestern and south-central Saskatchewan and southeastern Alberta, but conditions will remain favorable through the weekend - India’s

monsoonal rainfall is expected to continue widespread across the nation during the next two weeks with all areas impacted and most getting sufficient rain to bolster soil moisture and/or induce flooding - Some

areas may become too wet, but the precipitation will occur with sufficient breaks to prevent serious flooding from occurring - Nationwide

rainfall is still expected to be above normal through mid-August and additional relief should occur to the dry areas of Uttar Pradesh and Bihar. Cotton, groundnut and soybean areas of northwestern India should experience mostly good weather for crop improvements

after flooding rain earlier this month - Sumatra,

Indonesia rainfall continues a little too erratic and greater moisture is still needed in some areas, despite a little rain earlier this week - All

other Southeast Asian nations will experience an abundance of rainfall during the next few weeks resulting in some flooding in the Philippines and the Maritime provinces - Australia

weather in the coming ten days will be favorable for most winter crops - Central

Queensland received rain Wednesday and Thursday favoring a boost in topsoil moisture for a part of winter crop country

- Western

Australia will get most of the significant rain this coming week, but some rain will eventually reach the southeastern parts of the nation in time next week.

- South

Korea rice areas are still dealing with drought, despite some rain that fell recently.

- Some

additional rain is expected over the next couple of weeks - There

are no tropical cyclones in the Atlantic Ocean, Caribbean Sea or Gulf of Mexico and none are expected during the next ten days - Tropical

Storm Frank and Georgette remained well off the southwest coast of Mexico today - Georgette

will not likely develop much and will eventually dissipate - Frank

will turn into a hurricane Friday and move away from North America - East-central

Africa rainfall is increasing and will be greatest in central and western Ethiopia, but Uganda and Kenya will get some much-needed improved rainfall - Tanzania

is normally dry at this time of year and it should be that way for the next few of weeks - West-central

Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally - Some

greater rain would still be welcome in the drier areas of Ivory Coast and Ghana

- Seasonal

rains are shifting northward leading to some drying in southern areas throughout west-central Africa - Cotton

areas are expecting frequent rainfall in the next couple of weeks - South

Africa’s crop moisture situation is favorable for winter crop establishment, although some additional rain might be welcome - Restricted

rainfall is expected for a while, but the crop is rated better than usual - Central

America rainfall will continue to be abundant to excessive and drying is needed - Mexico

rain will be most abundant in the west and southern parts of the nation - Rain

in the Greater Antilles will occur periodically, but no excessive amounts are likely - Today’s

Southern Oscillation Index was +7.08 and it will move erratically over the next week - New

Zealand weather is expected to be well mixed over the next two weeks - Temperatures

will be seasonable with a slight cooler bias

Source:

World Weather INC

Bloomberg

Ag Calendar

Thursday,

July 28:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Buenos

Aires grains exchange weekly crop report - HOLIDAY:

Thailand

Friday,

July 29:

- Vietnam

July coffee, rice and rubber export data - FranceAgriMer

weekly update on crop conditions - ICE

Futures Europe weekly commitments of traders report - US

agricultural prices paid, received, 3pm - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - HOLIDAY:

Thailand

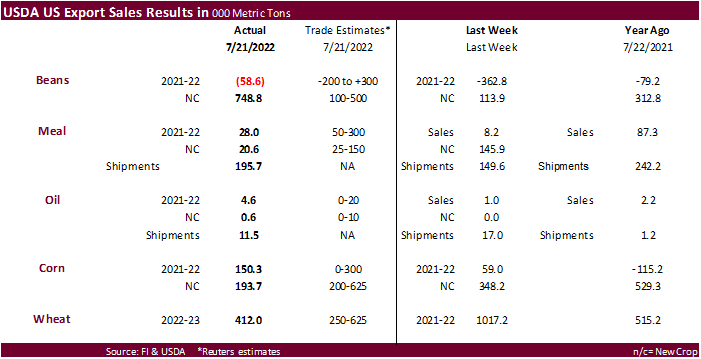

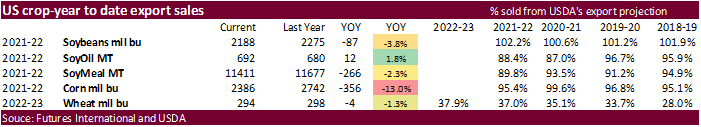

USDA

Export sales

Good

for new-crop soybean sales of 748,800 tons. China bought 538,000 tons of new-crop soybeans followed by 199,000 tons for unknown. Old crop soybean sales were negative 58,600 tons. Product sales were near of below expectations. Corn export sales were at the

low end of expectations for combined crop years. All-wheat sales were 412,000 tons, within expectations. Pork sales were 21,600 tons and included 13,100 tons for Mexico and 3,500 tons for Japan.

Macros

US

GDP Annualized (Q/Q) Q2 A: -0.9% (est 0.4%; prev -1.6%)

–

US Personal Consumption Q2 A: 1.0% (est 1.2%; prev 1.8%)

–

US GDP Price Index Q2 A: 8.7% (est 8.0%; prev 8.2%)

–

US Core PCE (Q/Q) Q2 A: 4.4% (est 4.4%; prev 5.2%)

US

Initial Jobless Claims Jul 23: 256K (est 250K; prev 251K; prevR 261K)

–

Continuing Jobless Claims Jul 16: 1359K (est 1386K; prev 1384K)

US

Mortgages Rates Dip To 5.3%, First Decline Since Early July

US

EIA Natural Gas Storage Change (BCF) 22-Jul: +15 (est +19; prev +32)

–

Salt Dome Cavern NatGas Stocks (BCF): -11 (prev -15)