PDF Attached

Private

exporters reported sales of 132,000 metric tons of soybeans for delivery to unknown destinations during the 2022/2023 marketing year.

We

revised our US SBO S&D (attached) by trimming SBO feedstock for biofuel. CBOT agriculture markets started the day sharply higher but profit taking paired gains in corn and wheat. The soybean oil market was again strong, underpinning soybeans. Sep through Dec

meal settled slightly lower from product spreading. For the week, the trade saw an impressive bull run.

The

US weather outlook appears to be mostly unchanged, and the models are starting to converge showing net drying next week and ridging for the Midwest by late next week for the Midwest. Short term

rains will favor the southern areas of the Midwest through Sunday, northwest areas late in the

weekend and central & eastern areas Monday.

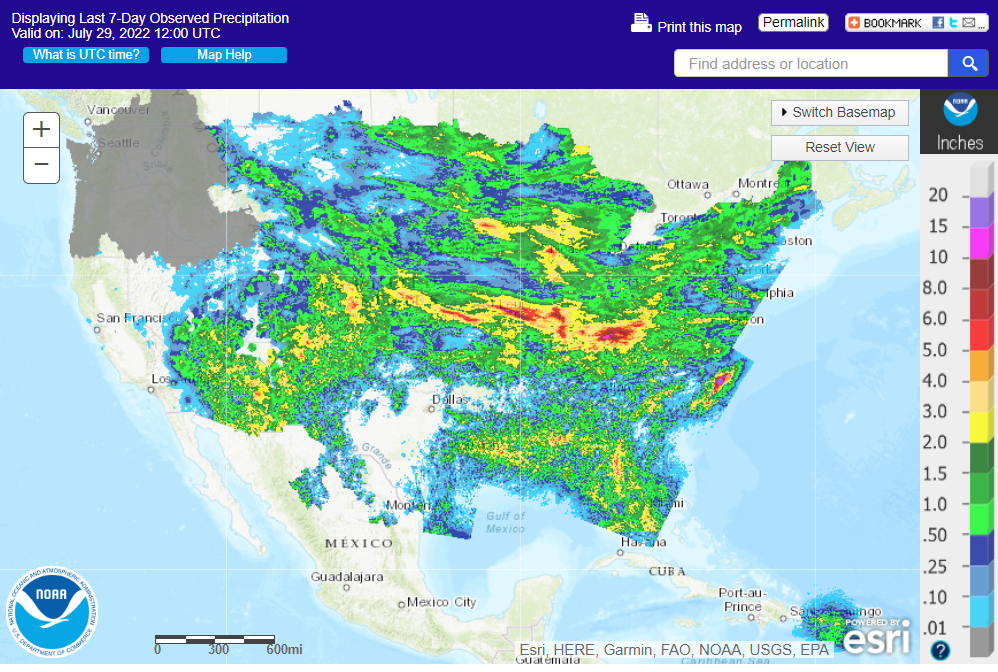

1-7

day suggest some of the thin band of rains across the middle of the US shifted slight south

Past

seven days

Reuters:

World

Weather Inc.

WEATHER

TO WATCH AROUND THE WORLD

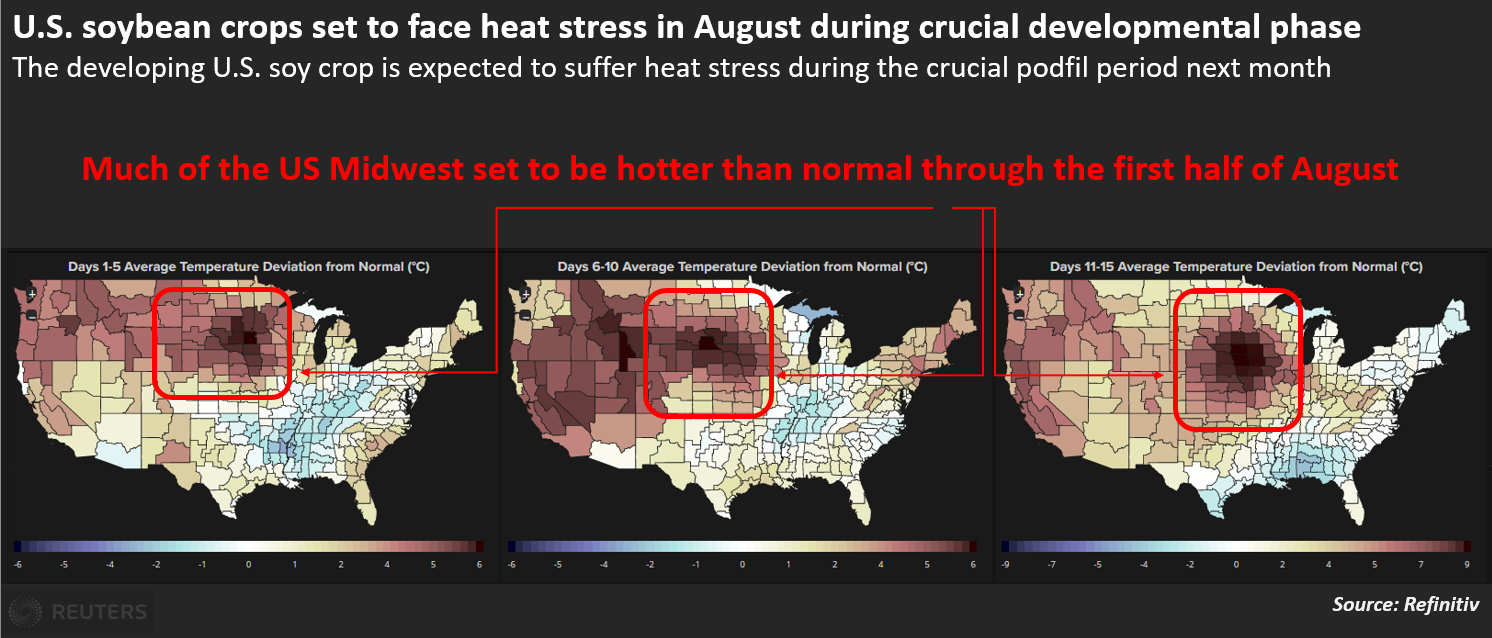

- Northwestern

U.S. Corn Belt is drying out and may experience restricted rainfall over the next ten days along with bouts of very warm to hot temperatures - Areas

from northern Missouri and northwestern Illinois through Minnesota and the Dakotas to Canada’s southwestern Prairies will receive well below normal rainfall through Aug. 10 - Temperatures

will be hot at times during the period with extreme highs in the 90s to 105 degrees Fahrenheit. South Dakota will be hottest, but readings near and slightly over 100 will occur in Minnesota and Iowa too – as early as mid-week next week

- Soil

moisture is already quite low from eastern Nebraska and western and north-central Iowa into southern Minnesota and northwest into Montana, southeastern Alberta and southwestern Saskatchewan setting the stage for greater crop stress and at least some threat

to production during the coming ten days of dry and warm to hot weather - U.S.

Delta will receive waves of rain through the weekend to dramatically improve soil moisture and some crop conditions - Drying

will resume for a while next week and temperatures will trend warmer - Southern

Kansas, Oklahoma and the Texas Panhandle will be wetter biased today and Saturday resulting in a much needed boost in soil moisture and relief for crops and livestock from persistent hot, dry, weather - Rain

totals will vary from 0.75 to 1.50 inches and local totals of 2.00 to 3.00 inches - A

more limited rainfall patter will resume ther3after - Eastern

U.S. Midwest weather will trend drier and warmer too, but mostly over a shorter period of time lasting from late next week into Aug. 8.

- Some

periodic showers will occur before and after that period to offer a slower rate of drying - Subsoil

moisture is best in this region and will carry crops favorably through the drier and warmer days that lie ahead - U.S.

southeastern states will see a good mix of rain and sunshine during the next two weeks - U.S.

Pacific Northwest and southern British Columbia continued to bake in excessive heat and dryness Thursday. No relief is expected until this weekend when gradual cooling begins - Highest

temperatures Wednesday were 100 to 109 Fahrenheit in central Washington and much of interior Oregon and 95 to 102 in the Snake River system of Idaho - Temperatures

will be more seasonably warm next week - Excessive

heat may return near mid-month - Southern

Texas and northeastern Mexico will remain drought stricken for the next two weeks with no potential for change unless a tropical cyclone evolves - One

of the recent GFS model runs does attempt to create a tropical cyclone in the northwestern Caribbean Sea and move it northeastern Mexico Aug 8-12, but confidence in this forecast is very low - Arizona

and New Mexico rainfall is expected to increase during the week next week and into the following weekend

- Some

monsoonal showers may briefly reach into eastern and southern California and the Great Basin next week, but the impact on soil moisture will be minimal - There

may be a risk of more forest fires as lightning occurs without much rainfall - Much

of Europe is too dry and it will continue that way despite some potential for brief bouts of rain - Drought

areas from Hungary through the lower Danube River Basin will receive a few showers today and Saturday and then trend drier for the following ten days - No

serious moisture relief is expected, although the moisture will be welcome - Western

Europe should continue dry biased through Aug. 10, despite a few showers that may evolve briefly on an infrequent basis - Europe’s

greatest rainfall will occur from the Alps into Belarus, northwestern Ukraine and the Baltic States this weekend into early next week

- Soil

moisture in northeastern Europe is still rated quite favorably - Waves

of rain are expected to continue impacting the western Commonwealth of Independent States, but greater rain is desired from southeastern Ukraine through Russia’s Southern Region to western Kazakhstan and a part of the eastern Russia New Lands - Heavy

rain that fell Wednesday from the central Yellow River Basin into Hebei and northwestern Liaoning shifted into parts of the Northeast Provinces Thursday with amounts of 2.00 to 8.00 inches resulting in some local flooding.

- China’s

Yellow River Basin should dry down over the next full week and that change will be good following Wednesday’s heavy rain event

- Most

other areas in eastern China will get waves of rain and some sunshine during the next two weeks supporting crops in many areas - Tropical

Depression Songda evolved near the Ryukyu Islands of Japan Thursday - The

system will be poorly defined as it moves through the East China Sea and into the Jiangsu and Shandong, China coastal areas early next week.

- Some

heavy rain will accompany the storm inland, but it will probably weaken to depression status and will induce very little, if any, damage - Interior

southeastern China will experience net drying over the coming week and then trend wetter thereafter - China’s

Xinjiang province continues to experience relatively good weather - A

few showers and thunderstorms are expected, but most of the region will be dry with temperatures varying greatly over the week to ten days - Argentina

will see little to no rain over the next week to ten days, but recent rain in La Pampa and Buenos Aires has been great for improved wheat establishment - Crop

areas in Cordoba and Santa Fe are still too dry and no relief is expected for a while - Far

southern Brazil will receive periodic rainfall during the next ten days maintaining a typically moist pattern in the soil from Rio Grande do Sul into Paraguay, southernmost Mato Grosso do Sul and parts of both Parana and southern Sao Paulo - The

moisture will be great for winter crops and should not have much impact on Safrinha crop maturation or harvesting - Safrinha

cotton and late corn harvesting in Brazil will advance well due to continued dry and warm weather - There

is no threat of damaging cold weather in Brazil coffee, citrus or sugarcane areas during the next two weeks - Southeastern

Canada (Quebec and Ontario) crop conditions are rated favorably with little change likely for a while - Canada’s

southwestern and central Prairies will dry down over the next week to ten days and temperatures will slowly rise above normal.

- Crop

stress will rise once again as soil moisture is slowly depleted - The

greatest stress will eventually evolve in central, west-central, southwestern and south-central Saskatchewan and southeastern Alberta, but conditions will remain favorable through the weekend - India’s

monsoonal rainfall is expected to continue widespread across the nation during the next two weeks with all areas impacted and most getting sufficient rain to bolster soil moisture and/or induce flooding - Some

areas may become too wet, but the precipitation will occur with sufficient breaks to prevent serious flooding from occurring - Nationwide

rainfall is still expected to be above normal through mid-August and additional relief should occur to the dry areas of Uttar Pradesh and Bihar. Cotton, groundnut and soybean areas of northwestern India should experience mostly good weather for crop improvements

after flooding rain earlier this month - Sumatra,

Indonesia rainfall continues a little too erratic and greater moisture is still needed in some areas, despite a little rain earlier this week - All

other Southeast Asian nations will experience an abundance of rainfall during the next few weeks resulting in some flooding in the Philippines and the Maritime provinces - Australia

weather in the coming ten days will be favorable for most winter crops - Central

Queensland received rain Wednesday and Thursday favoring a boost in topsoil moisture for a part of winter crop country

- Western

Australia will get most of the significant rain this coming week, but some rain will eventually reach the southeastern parts of the nation in time next week.

- South

Korea rice areas are still dealing with drought, despite some rain that fell recently.

- Some

additional rain is expected over the next couple of weeks - There

are no tropical cyclones in the Atlantic Ocean, Caribbean Sea or Gulf of Mexico and none are expected during the next week - Tropical

Storm Frank and Georgette remained well off the southwest coast of Mexico today - Georgette

will not likely develop much and will eventually dissipate - Frank

will turn into a hurricane Friday and move away from North America - East-central

Africa rainfall is increasing and will be greatest in central and western Ethiopia, but Uganda and Kenya will get some much needed improved rainfall - Tanzania

is normally dry at this time of year, and it should be that way for the next few of weeks - West-central

Africa rainfall has been and will continue sufficient to support coffee, cocoa, sugarcane, rice and cotton development normally - Some

greater rain would still be welcome in the drier areas of Ivory Coast and Ghana

- Seasonal

rains are shifting northward leading to some drying in southern areas throughout west-central Africa - Cotton

areas are expecting frequent rainfall in the next couple of weeks - South

Africa’s crop moisture situation is favorable for winter crop establishment, although some additional rain might be welcome - Restricted

rainfall is expected for a while, but the crop is rated better than usual - Central

America rainfall will continue to be abundant to excessive and drying is needed - Mexico

rain will be most abundant in the west and southern parts of the nation - Rain

in the Greater Antilles will occur periodically, but no excessive amounts are likely - Today’s

Southern Oscillation Index was +6.89 and it will move erratically over the next week - New

Zealand weather is expected to be well mixed over the next two weeks - Temperatures

will be seasonable with a slight cooler bias

Source:

World Weather INC

Bloomberg

Ag Calendar

Monday,

Aug. 1:

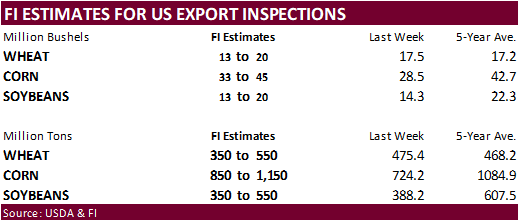

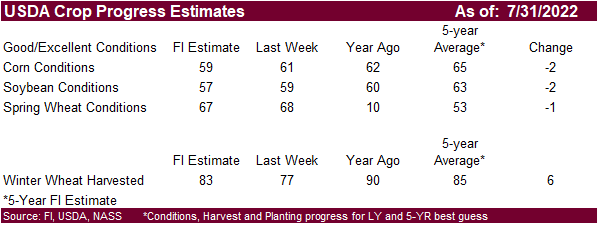

- USDA

export inspections – corn, soybeans, wheat, 11am - US

crop conditions for wheat, corn, soybeans and cotton; spring wheat harvest, winter wheat crop progress, 4pm - USDA

soybean crush, DDGS production, corn for ethanol, 3pm - Honduras

and Costa Rica monthly coffee exports - International

Cotton Advisory Committee releases monthly outlook report - EARNINGS:

CF, Mosaic - HOLIDAY:

Canada

Tuesday,

Aug. 2:

- New

Zealand global dairy trade auction - EU

weekly grain, oilseed import and export data - Australia

commodity index - US

Purdue Agriculture Sentiment, 9:30am - EARNINGS:

FMC, Green Plains, Andersons

Wednesday,

Aug. 3:

- EIA

weekly U.S. ethanol inventories, production, 10:30am - Malaysia’s

July 1-20 palm oil export data - New

Zealand Commodity Price

Thursday,

Aug. 4:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - EARNINGS:

Corteva

Friday,

Aug. 5:

- FAO

World Food Price Index - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Malaysia’s

Aug. 1-5 palm oil export data

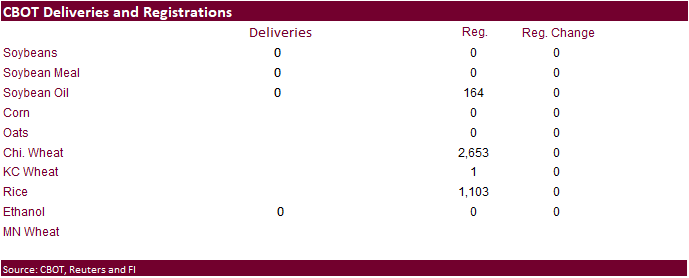

First

Notice Day was Friday – registrations were unchanged, no deliveries

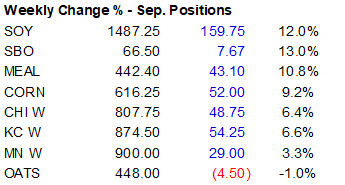

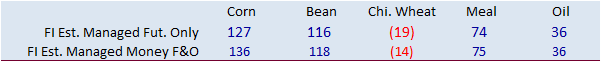

CFTC

Commitment of Traders report

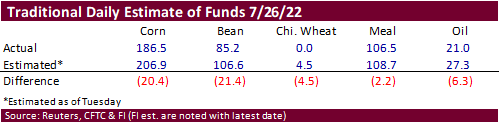

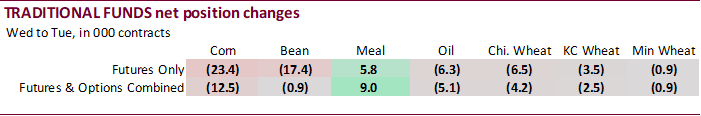

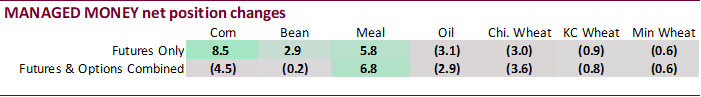

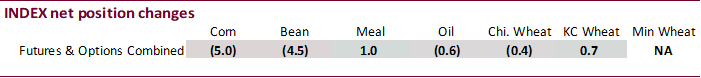

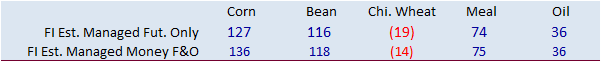

As

of last Tuesday, investment funds were busy selling corn, but not so much for managed money. Index funds continued to unwind long positions. This was likely not the case this week, however. Key takeaway is there is a lot of room for funds to rebuild long positions

in this weather market.

![]()

Reuters

table

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

26,089 -9,860 376,731 -4,961 -357,372 17,203

Soybeans

28,092 1,641 142,157 -4,525 -140,062 530

Soyoil

-6,953 -4,472 89,492 -631 -86,210 5,622

CBOT

wheat -51,339 -4,106 118,341 -391 -59,894 2,842

KCBT

wheat -12,104 -2,429 50,280 716 -36,414 294

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

120,788 -4,513 253,684 -2,931 -358,075 17,862

Soybeans

87,676 -156 90,986 -4,125 -140,488 2,641

Soymeal

73,380 6,792 79,926 -1,717 -199,141 -7,721

Soyoil

14,908 -2,936 78,611 659 -98,912 4,972

CBOT

wheat -10,391 -3,575 65,987 2,182 -50,521 338

KCBT

wheat 11,041 -826 29,175 2,232 -31,912 -1,100

MGEX

wheat 358 -624 1,215 -21 -2,541 1,613

———- ———- ———- ———- ———- ———-

Total

wheat 1,008 -5,025 96,377 4,393 -84,974 851

Live

cattle 37,505 17,841 59,829 33 -110,709 -14,738

Feeder

cattle -1,294 1,250 3,473 -13 3,631 -784

Lean

hogs 51,075 5,730 48,161 757 -88,017 -6,843

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

29,050 -8,035 -45,449 -2,382 1,812,824 -65,397

Soybeans

-7,986 -711 -30,188 2,352 724,199 -58,520

Soymeal

23,578 2,223 22,257 421 438,045 -5,999

Soyoil

1,721 -2,177 3,670 -520 414,842 -21,510

CBOT

wheat 2,033 -599 -7,108 1,654 404,440 -7,004

KCBT

wheat -6,543 -1,724 -1,761 1,418 181,353 2,362

MGEX

wheat 1,745 -271 -777 -696 63,008 238

———- ———- ———- ———- ———- ———-

Total

wheat -2,765 -2,594 -9,646 2,376 648,801 -4,404

Live

cattle 17,801 -1,624 -4,427 -1,511 314,918 -11,293

Feeder

cattle 305 127 -6,115 -580 51,377 1,624

Lean

hogs -334 709 -10,883 -352 270,459 12,608

Macros

US

Personal Income (M/M) Jun: 0.6% (est 0.5%; prev R 0.6%)

–

Personal Spending (M/M): 1.1% (est 1.0%; prev R 0.3%)

–

Real Personal Spending (M/M): 0.1% (est 0.0%; prev R -0.3%)

US

PCE Deflator (M/M) Jun: 1.0% (est 0.9%; prev 0.6%)

–

PCE Deflator (Y/Y): 6.8% (est 6.8%; prev 6.3%)

–

PCE Core Deflator (M/M): 0.6% (est 0.5%; prev 0.3%)

–

PCE Core Deflator (Y/Y): 4.8% (est 4.7%; prev 4.7%)

US

Employment Cost Index Q2: 1.3% (est 1.2%; prev 1.4%)

Canadian

GDP (M/M) May: 0.0% (est -0.2%; prev 0.3%)

–

GDP (Y/Y): 5.6% (est 5.4%; prev R 5.1%)