by Terry Reilly | Mar 18, 2023

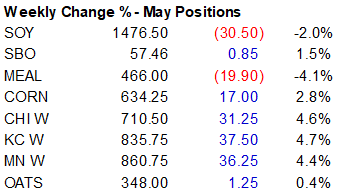

PDF Attached 11th hour Black Sea export deal may prompt a lower trade Sunday for grains, led by wheat. Lower close Friday for the CBOT soybean complex with soybean oil share recovering due to rumors Argentina soybean imports will yield higher than expected meal...

by Terry Reilly | Mar 16, 2023

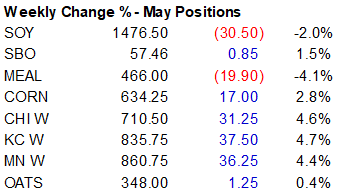

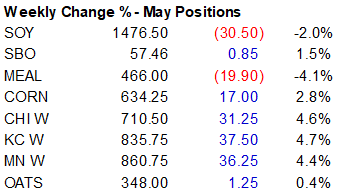

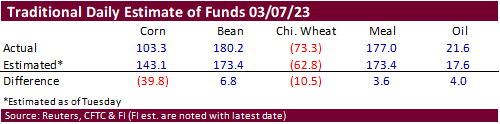

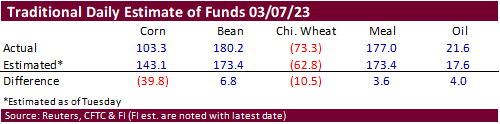

PDF attached CFTC Commitment of Traders as of March 7 Another week where the traditional (funds) net corn position was much less long than expected at 103,300 contracts (futures only). Unlike the previous week, open interest was actually up. Note the combined...

by Terry Reilly | Mar 16, 2023

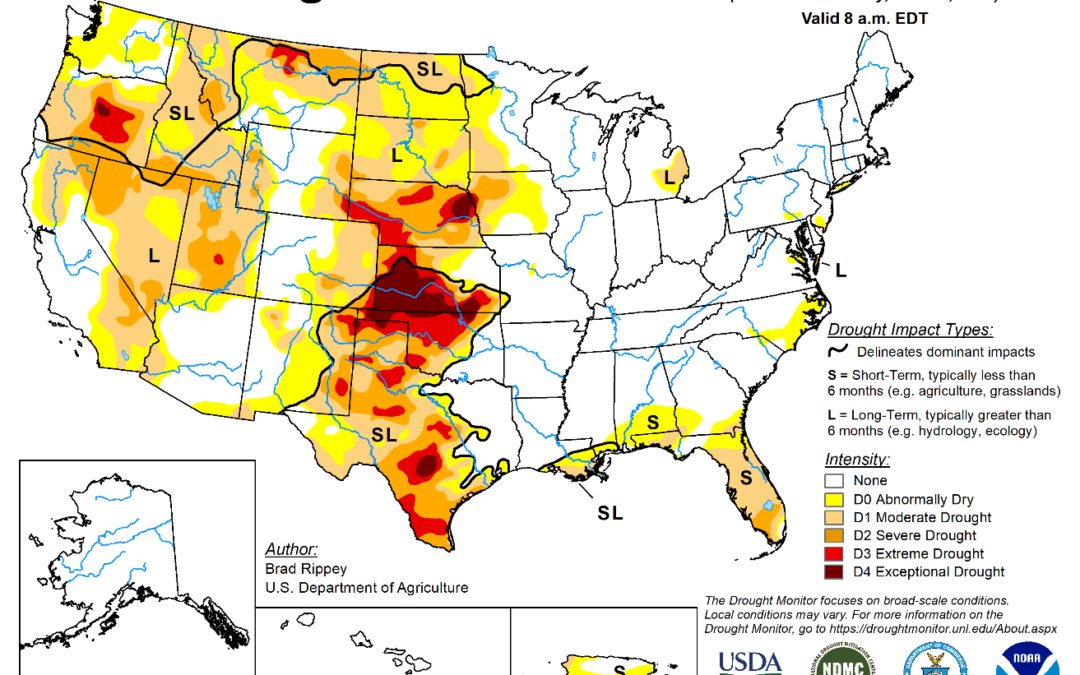

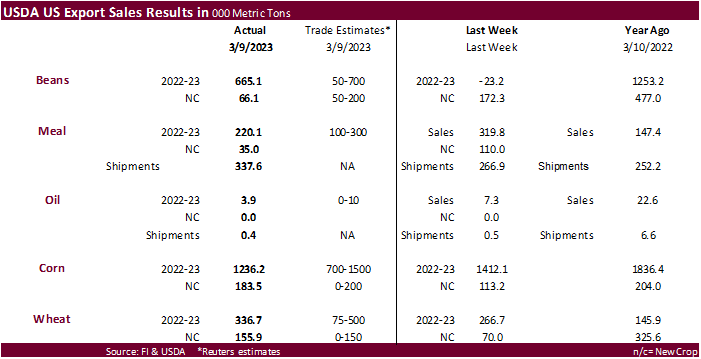

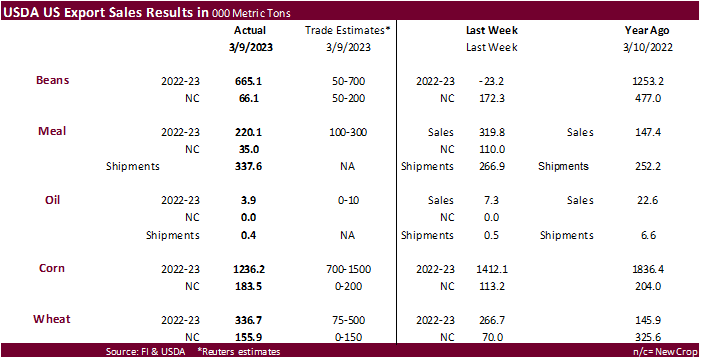

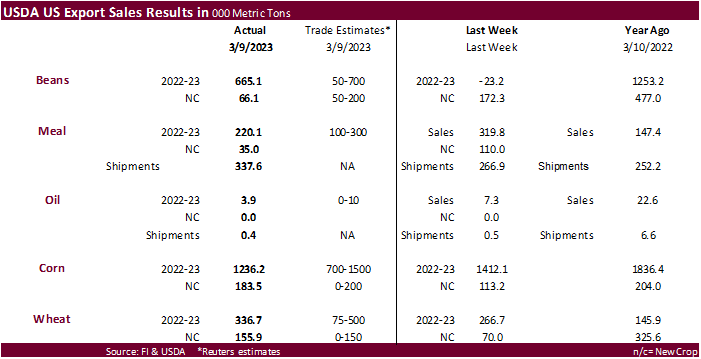

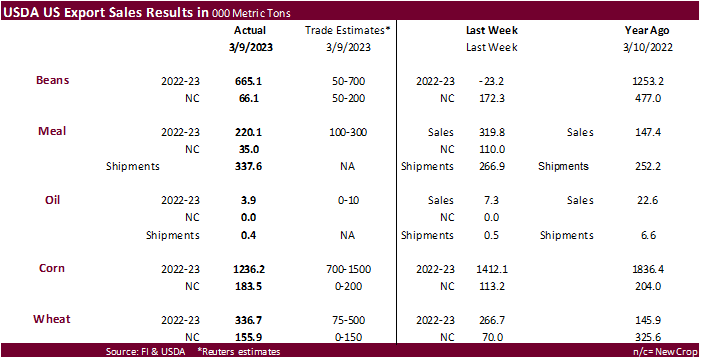

PDF Attached USDA export sales for the complex, corn and wheat were within expectations. Sorghum sales were a marketing year high. WTI crude oil rebounded, USD was lower and US equities turned higher. Soybeans ended mixed (bull spreading), meal lower and...

by Terry Reilly | Mar 16, 2023

PDF attached Good morning. European meal prices are unavailable. Foreign prices are therefore not included. USDA export sales for the complex, corn and wheat were within expectations. Sorghum sales were a marketing year high. WTI is...

by Terry Reilly | Mar 16, 2023

PDF attached Sales were within expectations Export Sales Highlights This summary is based on reports from exporters for the period March 3-9, 2023. Wheat: Net sales of 336,700 metric tons (MT) for 2022/2023 were...