PDF Attached

11th

hour Black Sea export deal may prompt a lower trade Sunday for grains, led by wheat. Lower close Friday for the CBOT soybean complex with soybean oil share recovering due to rumors Argentina soybean imports will yield higher than expected meal exports. Ukraine

announced a 120-day grain deal expansion on Saturday, after grain prices rose Friday from uncertainty. US is not out of the woods for small bank closures, so economic uncertainty is expected to spill over for the short term. Two weeks from today USDA will

release the 2023 initial US planting survey and March 1 grain stocks. Look for positioning ahead of this report to gradually increase.

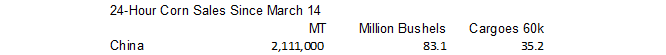

Private

exporters reported sales of 191,000 metric tons of corn for delivery to China during the 2022/2023 marketing year.

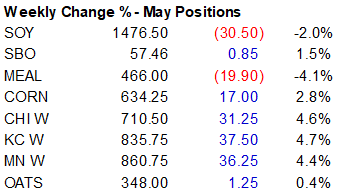

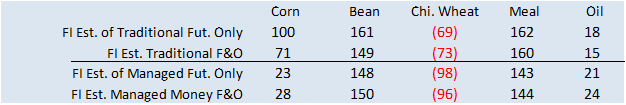

CFTC:

March 17, 2023: The cyber-related incident at ION prevented the submission of timely and accurate data to the CFTC last month. As a result, the weekly CFTC Commitments of Traders (CoT) report has been delayed. Today, staff will not issue the Commitments of

Traders report as data for this week will need to be reviewed and validated.

Our

fund/managed money estimates as of March 17.

Weather

Source:

World Weather, INC.

MORNING

WEATHER UPDATE

WORLD

DROUGHT AREAS

-

Mexico

is still dealing with a winter drought and there is need for precipitation to support corn, sorghum and cotton in unirrigated areas -

There

is also need for moisture in some citrus and sugarcane areas, although the situation for these two crops is not critical outside of the far northeast part of the nation -

Drought

remains in eastern Spain and in the lower Danube River Basin in southeastern Europe -

Dryness

is also a problem in Norway -

Drought

continues in portions of northern Africa with some areas hurting for moisture more than other areas -

Interior

parts of Tunisia are experiencing the biggest decline in crop conditions relative to those of last year -

Southwestern

Morocco has seen improved rainfall this winter, although it was too dry to plant most of the irrigated wheat and barley in the region this year so production will still be down -

Crop

conditions in Algeria seem to be similar to slightly poorer than last year at this time -

Rain

prospects are poor for at least another week -

India’s

winter rainfall was poor this year hurting some of the dryland winter crop production

-

Temperatures

were warmer than usual in February which added to the crop moisture stress -

March

started off warmer than usual and quite dry, but the coming two weeks will be cooler than usual and there is a good chance for showers this weekend through early next week -

Most

of the rain comes too late to improve yield potentials, but some late developing winter crops will see an improvement in crop quality -

Argentina

remains the world’s most seriously drought impacted country -

Recent

rain has improved topsoil moisture in central and southern Buenos Aires and in portions of western and southern Cordoba, San Luis and a few La Pampa locations, although much more rain is needed -

Central

portions of Argentina have been most seriously impacted by dry and hot weather during the most recent 30-days

-

Rain

is expected Monday into Wednesday across central Argentina offering some relief to persistent dryness, but the drought will not end because of the rain -

The

moisture comes too late in the season to benefit more than a few crops, but some improvement will be possible -

Rain

totals will vary from, 0.75 to 2.50 inches from Cordoba to Entre Rios and northern Uruguay

-

Southern

Rio Grande do Sul, Brazil will also benefit from the early week rain event next week -

Other

areas in Argentina will get some rain in the coming ten days, but the moisture will be sporadic and light -

Warm

temperatures will keep evaporation rates high -

Drought-like

conditions have been evolving in northeastern Brazil in the past few weeks, although the impact on agriculture has been low so far -

This

area will be impacted by more dryness late this year and into early 2024 if El Nino evolves as expected -

Dryness

in Rio Grande do Sul, Brazil has been an extension of drought from Argentina and it has had some negative impact on rice and corn production this year -

Soybeans

have been impacted to a smaller degree of seriousness -

Some

timely rainfall is possible in the state next week, but more rain will be needed to end long term dryness -

Eastern

Australia has been struggling with some dryness in recent weeks, but rain a week ago in central through southeastern Queensland offered some welcome relieve for late season summer crops -

New

South Wales was not as seriously relieved from dryness as Queensland, although northeastern parts of the state did get some significant moisture -

Eastern

Australia summer crop areas have resumed a drier bias and will continue to experience limited rain for the next ten days -

Summer

crop advancement is getting to the point that dryness is not likely to have a big impact on unirrigated crops in the future, but moisture is needed to improve field conditions for the planting of winter crops beginning in late April -

Drought

continues a concern in Canada’s southwestern Prairies -

Some

snow fell earlier this month in a part of the drought region, but snow water equivalents were not great enough to offer a tremendous improvement, although some benefit did occur as the snow melted -

Not

much precipitation of significance will occur in the dry areas over the next couple of weeks -

Drought

in the U.S. western Plains is the most serious out of all dryness in North America,

but it could also be fixed faster than some other areas because “normal” rainfall is not all that great -

Dryness

is most serious from West Texas cotton and wheat areas north into western Kansas and eastern Colorado, although a part of the region from western Nebraska to Montana is also considered to be too dry -

Relief

from dryness is unlikely in the next ten days and probably longer -

U.S.

southeastern states had been drying out in recent weeks, but the region has not been seriously impacted except in Florida where drought is a concern for long term crop development -

Relief

is expected in the interior southeastern parts of the United States in the coming ten days to two weeks with rain likely in many areas -

Florida

will get “some” rain, but probably not enough to break drought status -

South

Texas and the Texas Coastal Bend planting of corn, sorghum and some cotton is underway, but dryland production areas (especially in the south) need significant rain -

Some

precipitation is expected over the next ten days, but more will be needed to bolster soil moisture for long term crop development especially in unirrigated areas -

West

Texas precipitation will continue restricted over the next two weeks, although totally dry weather may not occur -

Some

parts of the dryland production region need a tremendous amount of rain to restore soil moisture and water supply

WETTER

AREAS OF THE WORLD

-

Portions

of the U.S. Midwest, Delta and Tennessee River Basin are quite wet and need drier weather to improve planting conditions in the next few weeks -

The

U.S. Red River Basin of the North and portions of the upper Mississippi River Basin have tremendous amounts of snow on the ground and could experience some flooding if the snow melts too fast while significant rain falls in the region -

No

such forecast has been made for the coming two weeks, but cool temperatures will leave much of the snow in place raising the potential that when it does warm up the snow may melt fast resulting a sudden turn toward flooding -

California

and western parts of both Washington and Oregon are very wet and there is potential for flooding this spring as the deep snowpack in the mountains melts -

A

large part of northern Europe has become saturated with moisture in the past week, but dryness down deep in the soil should absorb much of the moisture in time limiting the potential for flooding -

Many

rivers and streams are still flowing at below normal levels following last summer’s drought and a poor winter season of precipitation -

The

low water levels will prevent major flooding from occurring event if Europe goes into a more active weather pattern this spring which is possible -

Western

Russia continues saturated with moisture and significant snowmelt is under way now and will continue into early April -

Some

flooding is suspected, although not confirmed -

Any

abundance of rain that evolves in the next few weeks could raise the severity of flooding across the region -

Portions

of Belarus and the Baltic States are quite wet as well -

Many

areas in Indonesia and Malaysia have seen waves of significant rain in recent months leaving the ground saturated and inducing periodic flooding -

This

pattern may continue for a while, but as La Nina’s lingering affects diminish so will the rainfall

REST

OF WORLD

-

South

Africa crop weather has been very good this year, although the nation is drying out now -

Early

season maturation and harvesting should go well -

Late

season crops will need some beneficial moisture later this season -

Most

of Australia’s irrigated crops have performed well this summer and will likely finish out well -

China’s

weather has been nearly ideal in recent weeks and months -

Winter

crops should develop well, although some timely rain will be needed in the Yellow River Basin and North China Plain soon -

Rain

in the Yangtze River Basin and areas to the south in the next ten days will improve soil moisture for aggressive rapeseed development and good rice planting and early development potential -

Much

of the Russia’s Southern Region and Ukraine weather has been good since planting occurred last autumn and early spring crop development potential looks good -

Europe

weather outside of the drier and wetter areas noted above will remain favorable for a while -

Southeastern

Canada’s corn, wheat and soybean production region is favorably moist and poised for a good start to spring, although fieldwork is still a few weeks away -

West-central

Africa rainfall is expected to increase through Friday of next week bolstering soil moisture and improving conditions for flowering coffee and cocoa -

Turkey

will receive frequent bouts of rain over the next ten days bolstering soil moisture for wheat development and rice and cotton planting -

Other

spring planting will benefit from the coming moisture boost -

Other

areas in the Middle East will also experience a boost in precipitation -

Syria,

northern Iraq and much of Iran will receive significant rainfall as will some areas in Afghanistan and northern Pakistan -

Philippines

rainfall will be light to locally moderate most days through the coming week

-

Weather

conditions in the next ten days should be mostly good for the nation -

Indonesia

and Malaysia rainfall will occur abundantly during the next two weeks with all areas impacted and no area experiencing much net drying -

Mainland

areas of Southeast Asia will receive very little rain of significance in this coming week, but a notable boost in rain may occur in the last week of this month -

Eastern

Africa precipitation is expected to scatter from Tanzania to Ethiopia over the next ten days -

The

moisture will be good for ongoing crop development -

Eastern

Mexico and portions of Central America will receive rain during the next ten days -

The

precipitation will be most organized in Central America with Costa Rica and Panama wettest, but some areas in western Honduras, northwestern Nicaragua and Guatemala this weekend into next week

-

Moisture

totals may be enough to stimulate premature coffee flowering and that potential event should be closely monitored -

Most

likely the advertised rain is overdone and will be reduced in future forecast model runs.

-

Mexico

rainfall will continue erratic and light as it has been -

Today’s

Southern Oscillation Index was +1.07 and it was expected to move lower over the coming week

Source:

World Weather, INC.

Bloomberg

Ag calendar

Monday,

March 20:

- China’s

trade data, including country breakdowns for various commodities - MARS

monthly report on EU crop conditions - USDA

export inspections – corn, soybeans, wheat, 11am - Malaysia’s

March 1-20 palm oil export data - USDA

total milk production

Tuesday,

March 21:

- New

Zealand global dairy trade auction - EU

weekly grain, oilseed import and export data - HOLIDAY:

Japan

Wednesday,

March 22:

- EIA

weekly US ethanol inventories, production, 10:30am - EARNINGS:

Syngenta - HOLIDAY:

Indonesia

Thursday,

March 23:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - Rabobank

Farm2Fork Summit, Sydney - Russian

Grain Union holds conference in Kazan - Brazil’s

Unica may release cane crush and sugar output data (tentative) - USDA

red meat production, 3pm - US

cold storage data for pork, poultry and beef, 3pm - HOLIDAY:

Indonesia

Friday,

March 24:

- Marine

Insurance London conference - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop conditions reports - US

poultry slaughter - HOLIDAY:

Argentina

Source:

Bloomberg and FI

Dozens

Of Banks May Have Risks Similar To Silicon Valley Bank, Economists Find – WSJ

Charles

Schwab Clients Pull $8.8 Billion From Prime Funds In Three Days

Canadian

Industrial Production Price (M/M) Feb: -0.8% (exp 0.2%; prev 0.4%)

Canadian

Raw Materials Price Index (M/M) Feb: -0.4% (exp -0.1%; prev -0.1%)

Canadian

International Securities (CAD) Transactions Jan: 4.21B (prevR 21.22B)

US

Industrial Production (M/M) Feb: 0.0% (exp 0.2%; prev 0.0%)

US

Capacity Utilisation Feb: 78.0% (exp 78.4%; prev 78.3%)

US

Manufacturing (SIC) Production Feb: 0.1% (exp -0.3%; prev 1.0%)

·

Corn was higher from follow through buying amid strength in wheat and US corn sales to China. We

think China is done buying for the short term. CBOT front

month contracts gained on back months, but the spreads settled down during the mid-session day trade. US corn remains competitive over Brazil through early June, but don’t discount additional Chinese second Brazil corn crop forward buying over the next few

months. Brazil second corn crop sales by producers stand at 14 million tons.

·

Soaking in the 2+ million tons of US corn sales to China, worth a note China imported 3.09 million tons last month.

·

US producers might be at least 20 percent locked in for new-crop corn and soybean sales.

·

There is no reason at these prices producers should be planting to the edge of the roads. We look for inflated March panting intentions to find the planted area lower by August.

·

China is still dealing with African swine fever disease as multiple cases were reported across various parts of the country over the winter. Something to monitor.

·

China announced more subsidies to incentivize producers to plant more soybeans to reduce import dependency. This may reduce the amount of China’s grain planted area.

·

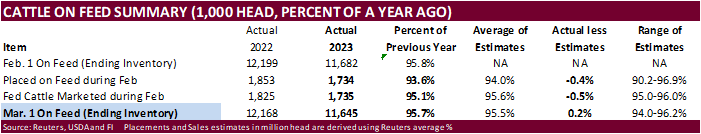

USDA US cattle on feed was slightly higher than expected. While inventories are historically low, we see no major price movements from the monthly report.

U

of I: Will Brazil Emerges as the Number One Corn Exporting Nation?

Colussi,

J., G. Schnitkey and N. Paulson. “Will Brazil Emerges as the Number One Corn Exporting Nation?”

farmdoc daily (13):48, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 16, 2023.

Export

developments.

Updated

03/7/23

May

corn $5.80-$6.80

July

corn $5.75-$7.00

·

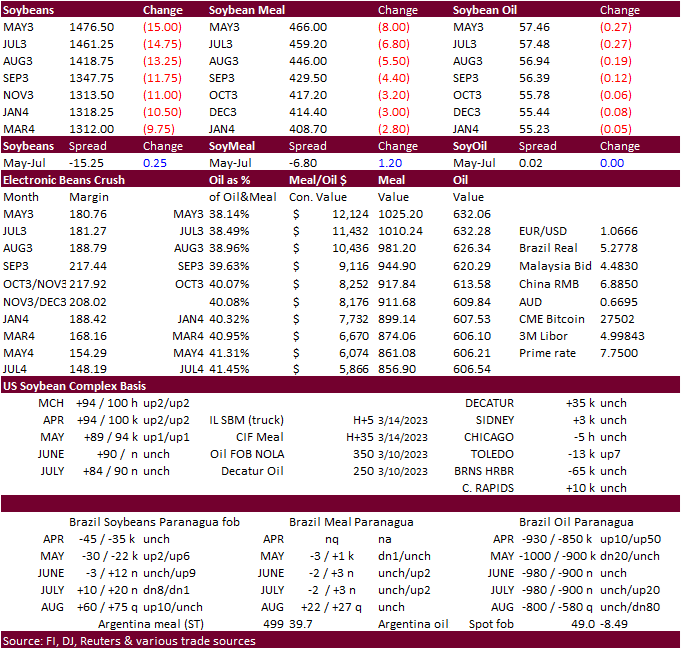

Soybeans opened lower on technical selling and lower soybean meal, and ended lower from technical selling led by soybean meal on rumors Argentina’s crush will exceed expectations from record soybean imports for the crush industry.

Soybean oil dropped from lower WTI crude oil. Palm oil futures were lower Friday and closed the week down 4.2%. Argentina may import 8 million tons of soybeans, a 4x fold from average. Argentina’s crush rates, percentage wise, are currently near at all-time

low per capacity.

·

However, with US and Argentina soybean oil export limitations for the rest of 2023, Brazil soybean oil exports could balloon LH 2023 and early 2024. Trade flows are at most difficult to predict.

·

Soybean meal might be backing up across the US with good crush rates and lack of export developments over the past week.

·

Brazil will increase their biodiesel blend requirement to 12 percent in April from current 10 percent, then increase it to 13 percent in 2024 and 14 percent in 2025. The gradual increase over the long term is conservative, but

near term the 2 point increase was as expected. No price reaction is expected from this announcement as the change in government powers already indicated a change. They can change long term blend rates anytime. 65 percent of Brazil’s biodiesel was made from

soybean oil.

·

Brazil is 63 percent harvested versus 72 percent year ago for soybeans. A good pace since production will be record this year.

Export

Developments

·

None reported

Updated

03/10/23

Soybeans

– May $14.50-$16.00

Soybean

meal – May $430-$520

Soybean

oil – May 55-61

·

US wheat futures were higher Friday on black Sea uncertainty (that changed Saturday) and reached a two-week high basis the nearby Chicago contract. Ukraine on Saturday said the Black Sea grain export deal was extended to 120

days. Don’t expect the backup in inspections to ease.

·

11th hour deal – Look for a softer CBOT $ open on Sunday (evening).

·

Egypt bought 120,000 tons of Ukraine wheat for April 15-25 shipment.

·

French soft wheat crop ratings as of March 13 were 95% good/excellent, same as the previous two weeks and compare with 92% year earlier. Winter barley was 92%, also unchanged, and durum wheat 92%, up from 91% previous week. Spring

barley plantings are complete.

·

Long-term, the US weather service called for above normal temperatures and below normal precipitation for the southwestern US HRW wheat country. Short-term, the US HRW wheat areas will see restricted rain over the next week.

·

(Interfax) – The export duty on Russian wheat will decline 0.1% to 5,327.9 rubles per ton as of March 22 from 5,344 rubles per ton the previous seven-day period, and this will be the second consecutive week that the duty has decreased,

first time since January 25 this year, the Agriculture Ministry said in a statement. The duty on barley will rise to 3,298.2 rubles per ton from 3,016.6 rubles per ton, and the duty on corn will increase to 2,646.9 rubles per ton from 2,615.3 rubles per ton.

·

Thailand passed on 21,000 tons of feed barley for July shipment.

·

Jordan seeks 120,000 tons of feed barley on March 22.

·

Jordan seeks 120,000 tons of milling wheat on March 21 for Sep-Oct shipment.

·

China plans to auction off 140,000 tons of wheat from state reserves on March 22.

Rice/Other

·

South Korea seeks 121,800 tons of rice, most of it from China, on March 21.

Updated

03/03/23

KC

– May $7.50-$9.25

MN

– May

$8.00-$9.75

#non-promo