PDF attached

CFTC Commitment of Traders as of March 7

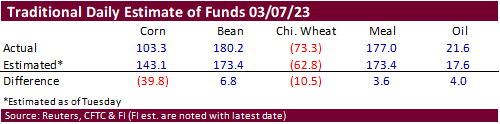

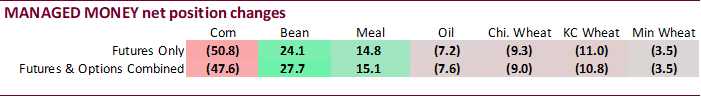

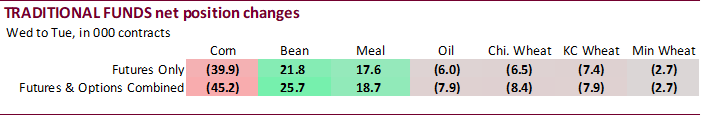

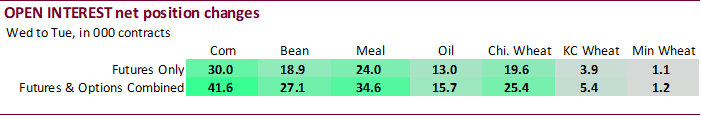

Another week where the traditional (funds) net corn position was much less long than expected at 103,300 contracts (futures only). Unlike the previous week, open interest was actually up. Note the combined five-day net fund estimates for corn were flat for the week ending 3/7, so the data is questionable after the traditional futures only position dropped a large 39,900 contracts. For traditional futures and options combined, funds were net long 74,400 contracts versus 119,600 previous week. Meanwhile, the money manager position for corn was also down sharply from the previous week and remains well below the net long traditional fund estimates (futures only). Money managers were only net long 15,600 corn contracts for futures only and net long 21,100 corn contracts for futures & options combined.

Reuters table

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn -19,613 -29,873 311,832 -17,695 -227,442 35,638

Soybeans 129,347 26,509 134,497 -4,264 -219,580 -25,190

Soyoil -5,194 -7,631 101,160 -603 -98,111 13,712

CBOT wheat -96,776 -6,240 87,284 -3,153 6,046 7,752

KCBT wheat -19,929 -5,702 43,462 -3,508 -21,752 8,147

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 21,058 -47,576 221,748 -3,310 -231,366 36,606

Soybeans 157,330 27,719 96,784 -5,689 -220,044 -22,914

Soymeal 155,063 15,093 80,013 -2,649 -274,619 -23,190

Soyoil 20,526 -7,567 102,266 1,823 -123,462 11,522

CBOT wheat -100,636 -8,995 64,264 -1,163 9,613 7,925

KCBT wheat -10,420 -10,757 36,302 -988 -23,572 7,831

MGEX wheat -3,029 -3,514 1,352 -1,005 -61 3,368

———- ———- ———- ———- ———- ———-

Total wheat -114,085 -23,266 101,918 -3,156 -14,020 19,124

Live cattle 112,605 156 47,773 1,393 -166,552 -3,290

Feeder cattle 10,284 3,616 1,657 -234 -1,162 -1,261

Lean hogs -2,079 -1,745 45,371 -73 -41,792 2,067

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 53,336 2,350 -64,777 11,930 1,564,601 41,643

Soybeans 10,193 -2,062 -44,264 2,945 816,692 27,082

Soymeal 19,837 3,564 19,707 7,182 496,776 34,590

Soyoil -1,475 -301 2,145 -5,477 479,009 15,719

CBOT wheat 23,315 593 3,446 1,641 432,751 25,423

KCBT wheat -528 2,851 -1,781 1,064 185,870 5,414

MGEX wheat 2,978 789 -1,240 362 55,131 1,229

———- ———- ———- ———- ———- ———-

Total wheat 25,765 4,233 425 3,067 673,752 32,066

Live cattle 20,680 1,920 -14,507 -179 437,250 -2,069

Feeder cattle 1,077 -791 -11,857 -1,329 70,818 6,210

Lean hogs -2,050 -2,057 549 1,808 289,063 5,884

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |