File(s) attached

Today is a hard open and shortened session. https://www.cmegroup.com/tools-information/holiday-calendar.html Due to the Federal holiday on Thursday, November 25, the weekly Commitments of Traders report will be released on Monday, November 29 at 3:30pm.

Soybeans 15-25 lower

Soybean meal $4-$7 lower

Soybean oil 75-125 points lower

Corn 6-10 lower

Wheat 10-20 cents lower bias Chicago to the downside

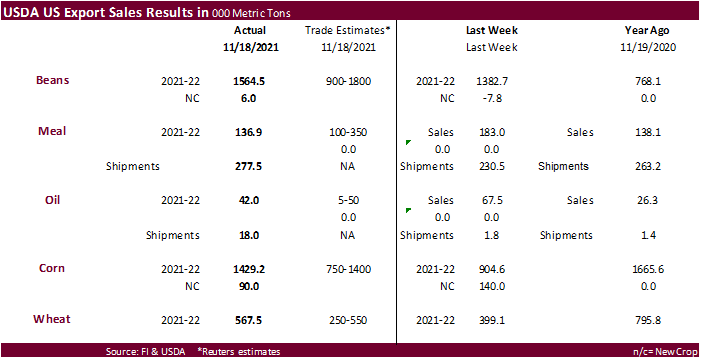

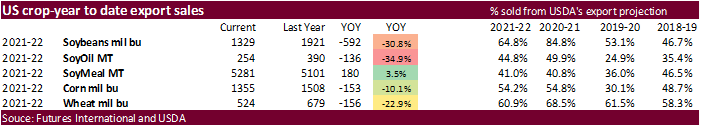

The US equity markets are rolling over in part to renewed concerns over a new South African Covid-19 variant. Major Asian stock indexes were down about 0.5-2.5%. FTSE was off 3.0%. WTI crude oil is down about $4.30 and USD is down 50 points. The outside markets are suggesting a sharply lower open for CBOT agriculture markets, although some money inflow from equities onto some commodity markets could limit losses. There is still concern over the quality of the Australian wheat crop. Over the last couple days we saw a few import tenders, notably Egypt buying SBO and Turkey buying nearly 400,000 tons of wheat. USDA export sales were good all around.

![]()

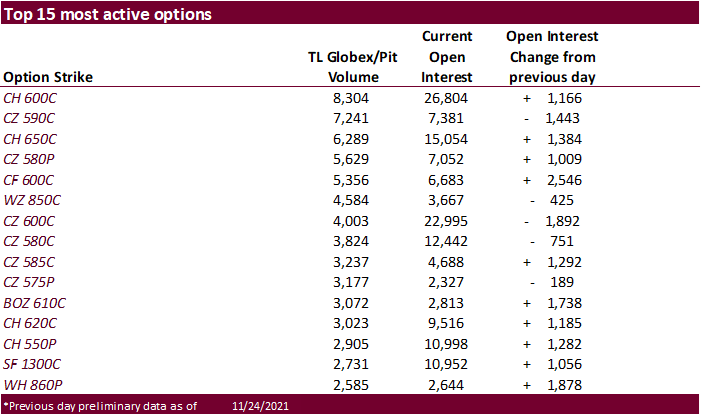

· December options expire today.

· South Africa’s CEC estimated the corn crop at 16.23 million tons for 2020-21, up from 16.21 million tons projected previous month and 6 percent higher previous year (15.3MMT). It includes 8.609 MMT white and 7.625 MMT yellow. USDA sees a 16.9 MMT crop.

· Agroconsult: Brazil corn crop production was estimated at 124 MMT. USDA is at 118 MMT, up from 86 MMT for 2020-21.

· Buenos Aires Grains Exchange: Argentina corn plantings at 30% of expected area.

· China’s AgMin reported the sow herd was up 6.6% year-on-year at the end of October at 43.48 million heads but the herd was down 2.5% from the previous month.

· French reported that as of November 22 the corn harvest was 97% complete, up from 91% a week earlier.

· Austria reported an outbreak of bird flu on a small chicken farm near Vienna.

· Germany reported an African swine fever case in wild boar in eastern German state of Mecklenburg-Vorpommern.

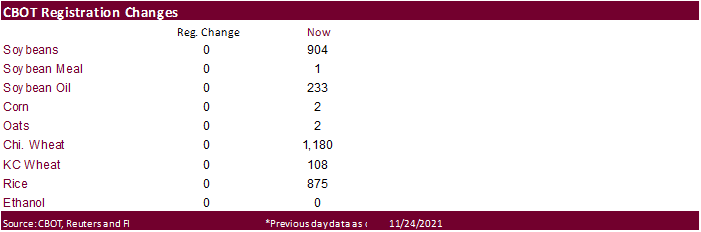

· There were no changes in CBOT ag registrations.

· Agroconsult: Brazil soybean crop production was estimated at 144.3 MMT. USDA is at 144 MMT vs. 138 MMT for 2020-21.

· Buenos Aires Grains Exchange: Argentina soybean plantings were up 10.7 points to 39.3% of expected area.

· Offshore values are leading soybean oil 65 points lower and meal $2.70 short ton higher.

· Over a two day period China soybean futures were up 0.5%, meal 1.1% lower, SBO up 0.8%, and palm up 0.2%.

· Rotterdam meal values were mixed over two-day period and vegetable oils mixed with SBO higher and rapeseed oil down about 20 eros.

· Malaysian February palm futures edged higher by 7 ringgit on Thursday. They fell on Friday by 76 ringgit. Over a two day period cash was off $17.50/ton to $1222.50/ton.

· Cargo surveyor SGS reported month to date November 25 Malaysian palm exports at 1,336,125 tons, 130,370 tons above the same period a month ago or up 10.8%, and 208,630 tons above the same period a year ago or up 18.5%. The Nov 1-25 amount was a record for other November comparable years. Other estimates vary. AmSpec reported 1.255 million tons of palm oil shipments, up 4.45 percent from October 1-25. ITS reported palm exports at 1.341 million tons, a 10.9 percent increase.

· China crush margins on our analysis was last $2.17/bu ($2.25 previous), compared to $2.30 at the end of last week and compares to $0.75 a year ago.

· Egypt’s GASC bought 30,000 tons of international soybean oil at $1,468/ton for January 15-31 arrival and passed on sunflower oil. It’s for payment at sight and/or 180-day letters of credit. They also bought 39,000 tons of domestic soybean oil for Jan 5-25 arrival.

· March Matif Paris wheat was 8.00 euros lower at 300.75 as of 6:55 am CT and over a two day period down about 7.50 euros. Matif March 260 puts traded 12,000x yesterday. Open interest dropped from 12,677 to 6,727. Renewed concerns over a new South African Covid-19 variant weighed on the contract. But there is still concern over the quality of the Australian wheat crop.

· The European Commission increased their estimate of soft wheat exports in 2021-22 to 32 million tons from 30 million tons last month. Stocks were lowered to 12.7 million tons from 13.9 million.

· French reported that as of November 22 the soft wheat crop was 97% complete, up from 93% the previous week.

· Buenos Aires Grains Exchange: Argentina wheat production estimated at 20.3 million tons from 19.8MMT previous, which would be a new record. In 2018-19, Argentina produced a record 19 million tons.

· Flooding across western Canada last week slowed or stopped rail service but the Canadian Pacific Railway will restart service on Tuesday and Canadian National Railway plans to reopen to limited traffic on Wednesday. (Reuters)

· AgriCensus noted France over the past couple months exported about 677,000 tons of wheat to China and 480,000 tons of barley to China.

· India extended its domestic aid wheat program from end of December to March 2022. Under the PMGKAY program, poor families will receive 5 kg of wheat and rice per month.

· Note Russia will increase its wheat export duty for the November 24-30 period to $78.30/ton from $77.10/ton. The duty on barley will fall to $65.3 from $66 per ton, while the corn duty fell to $53.6 from $62.9/ton.

· Turkey bought 385,000 tons of wheat for Jan 10-31 arrival at between $381.79 to $390.80/ton. The tender sought wheat with 12.5% and 13.5% protein content.

· Jordan passed on 120,000 tons of wheat for shipment between March 16-31, April 1-15, April 16-30 and May 1-15.

· Jordan seeks 120,000 tons of barley on December 1 for shipment between May 1-15, May 16-31, June 1-15 and June 16-30.

USDA export sales were good all around.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.