File(s) attached

Good morning. Day 19. WTI crude oil was more than $6.00/barrel lower, USD down 13, US equities higher and Euro slightly higher.

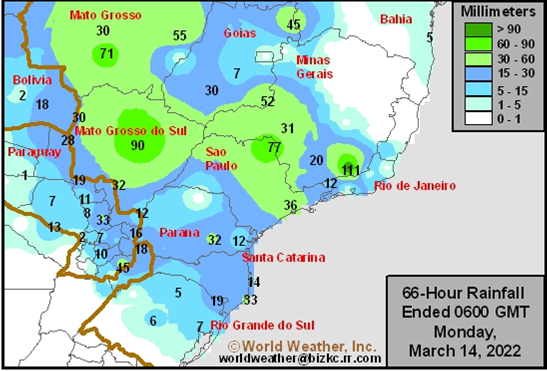

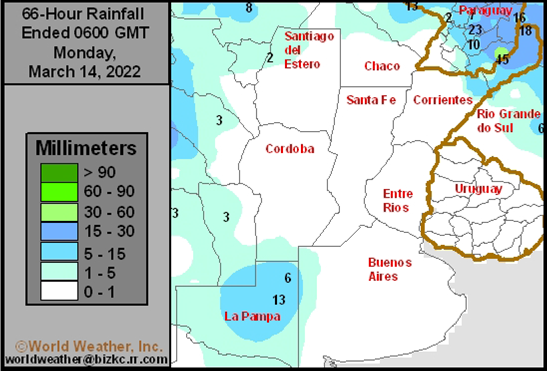

The soybean complex is mixed. Soybean meal hit a 7-year high overnight on expectations SA product demand will shift to the US. A sharply lower trade in WTI crude oil and dive in palm oil futures are weighing on soybean oil. China is releasing vegetable oils out of reserves. Soybeans are lower from weakness in outside related commodity markets and lower trade on corn & wheat. Argentina suspended new registrations for soybean meal and soybean oil for export. This might be a sign they intend to increase taxes. Speculation is that soybean meal and oil will increase from current 31 percent to 33 percent. Argentina harvests their soybeans during the April and May period. New-crop producer sales amount to 2.17 million tons through March 2. Argentina will see net drying over the next ten days. Brazil will see a mixed pattern over the next two weeks. Egypt on Saturday banned vegetable oil exports along with other food staples including corn, wheat, flour, past, lentils and fava beans, for three months to combat rising food prices. Russia will raise its export tax for sunflower oil to $313/ton for April, up from $260.10/ton in March. Palm oil futures traded sharply lower on Monday after China plans to release cooking oils out of stockpiles and demand destruction. China’s Sinograin plans to auction 4,066 tons of rapeseed oil produced in 2020 Thursday afternoon. They sold 10,778 tons of rapeseed oil, accounting for 10% of the volume it planned to sell, last Friday. India February palm oil imports fell to a 12-month low at 454,794 tons, down from 553,084 tons month earlier and compares to 391,158 tons for February 2021. India soybean oil imports during February were 376,594 tons, down from 391,158 tons in January. Port stocks as of end-February dipped to their lowest since May 2021. May Malaysian palm oil settled 346 ringgit lower to 6361 (-5.2%). Cash palm was down $142.50/ton to $1,605.00/ton (-8.2%). Today China planned to sell 295,596 tons of soybeans from reserves. China May soybeans were down 1.0%, meal down 0.5%, soybean oil down 2.5% and palm 5.0% lower.

CBOT corn traded two-sided overnight and is down hard early this morning on sharply lower WTI crude oil and speculation there might be a breakthrough with Ukraine/Russia peace talks. China plans to start releasing more than 3 million tons of fertilizer reserves in March. Brazil’s weather pattern will be mixed over the next two weeks and with abundant rain occurring over the past few weeks, the second corn crop should be fine when entering the dry season that starts around now. Egypt on Saturday banned corn and wheat exports along with commodities for three months to combat rising food prices. They have enough wheat to last through the end of the year after buying domestic supplies. Ukraine banned exports of fertilizers amid Russian/Ukraine situation. This adds to a growing list that already includes wheat, corn and sunflower oil. Ukraine has made several announcements they intend to ensure domestic food security. Spring plantings normally begin in late February and early March. Mid-March is a new target the AgMin projected. We are unsure what “safe” areas will look like for sowings, but it appears the far east and far west will see fieldwork progress. Ukraine’s agriculture producers’ union earned producers will likely reduce corn and oilseed area and plant more cereals such as buckwheat, oats and millet. Ukraine stockpiles of corn sit at 15 million tons and 6 million for wheat. Spain may soon approve emergency US and Argentina corn buying.

US wheat futures dropped on hopes talks between Russia and Ukraine could bring a ceasefire, allowing for grain exports to resume. Forecast for rainfall across the US HRW wheat country is also weighing on prices. U.S. hard red winter wheat areas will see rain Thursday in the central Plains with additional precipitation in the southern Plains during mid-week next week. Totals will vary from trace amounts to 0.6″ in the first event this week with another 0.20 to 0.75 inch elsewhere next week. The southwestern Plains may miss out on the event. China sold 525,869 tons of wheat out of auction on March 9 at an average price of 2,991 yuan per ton ($471.16/ton). Egypt will soon unload 189,000 tons of Black Sea wheat that was previously contracted, from Russia, Romania and Ukraine, according to a Rueters article. We are unsure if the wheat was already loaded onto vessels awaiting to leave the ports or if the wheat was recently loaded. On March 8 Egypt received a shipment of 63,000 tons of French wheat. They also received a similar amount of Romanian wheat on March 5. Egypt looks to produce more than 6 million tons of wheat this season that starts April. They produce on average a total 8.5 million tons a year. Algeria banned exporting sugar, vegetable oils, pasta, semolina and wheat derivatives.

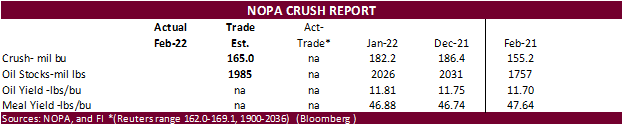

A Reuters NOPA survey calls for the February US crush to end up near 165.0 million bushels (162.0-169.1 million range), down from 182.2 million last month, but up 6.4% percent a year earlier of 155.2 million. The record for the month of February was 166.3 back in 2020. If the 165.0-million-bushel trade estimate for February 2022 is realized, that would put the daily crush 0.3% above January. End of February soybean oil stocks were estimated at 1.985 billion pounds, down from 2.026 billion at the end of January and well up from 1.757 billion year earlier. Trade range was from 1.900 to 2.036 billion pounds. End of January stocks slightly dipped from end of December.

Export Developments: Iraq’s trade ministry seeks 50,000 tons of optional origin hard wheat on March 17, open until the 22nd. Egypt’s GASC seeks a minimum 1000 tons of frozen whole chicken and minimum 500 tons of chicken thighs on March 17 for arrival during the April 1-15, 16-30, May 1-15, 16-31 periods.

Source: World Weather Inc.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.