File(s) attached

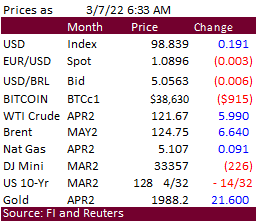

Another eye-opening overnight session as many commodity markets make an impressive move higher, led by energy and wheat markets. To add fuel onto the fire, China’s AgMin warned their winter wheat conditions could end up “worst in history,” in a note published by Reuters. A survey was conducted, and some China winter wheat plots are yielding 20 percent below average. China aims to expand policies to ensure they have a bumper summer grain crop, so one can’t jump to conclusion that they will immediately be seeking feedgrains for animal feed use.

CBOT corn futures are higher following wheat futures. News is light for corn. China aims to expand summer grain plantings to ensure food security. If successful, we look for grain imports to decline from 2021. China looks to buy 38,000 tons of frozen pork for state reserves on March 10. They bought pork last week, making the Thursday tender second for the crop year. CBOT soybeans, soybean meal and soybean oil are higher following strength in wheat, energy prices, and concerns global grain supplies are shrinking. This morning we did not see offers for Argentina soybean meal, but Brazil meal offers were sharply higher. Rapeseed oil and soybean oil cash prices for Rotterdam were up from Friday. Palm oil rallied after a sharply lower trade Friday. May Malaysian palm oil settled 350 ringgit higher to 6,626 ringgit. Cash palm was up $45/ton to $1,685/ton. China May soybeans were down 0.4%, meal up 2.7%, soybean oil down 0.5% and palm 1.1% lower. Offshore values are leading SBO 341 points higher and meal $6.30 short ton higher. 14-year highs were established in wheat. Several countries announced they have enough grain reserves for domestic consumption. US wheat interest is picking up with Taiwan seeking PNW wheat. China last week, on March 2, sold 526,254 tons of wheat from state reserves at an average price of 3,054 yuan per ton ($483.32/ton), well above 2,753 average price recoded February 23. Tunisia seeks 125,000 tons of soft wheat and 100,000 tons of barley, optional origin, on Tuesday. Shipment is for March through May. Taiwan seeks 50,000 tons of US PNW milling wheat on March 11 for April 23-May 7 shipment. Algeria seeks 50,000 tons of soft milling wheat, optional origin, on March 8, opening until the 9th, for May shipment.

85 cent Chicago and KC wheat limit for Monday https://www.cmegroup.com/trading/price-limits.html

- China’s 1st batch of Jan.-Feb. trade data, incl. soybean, edible oil, rubber and meat & offal imports

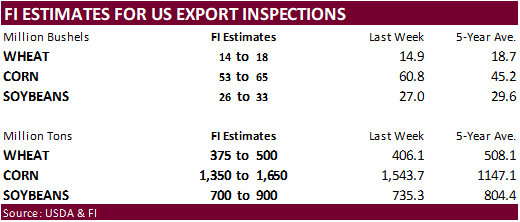

- USDA export inspections – corn, soybeans, wheat, 11am

- Bursa Malaysia Palm Oil Conference, day 1

- Vietnam’s customs to publish Feb. coffee, rice and rubber export data

- Ivory Coast cocoa arrivals

- HOLIDAY: Russia

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.