File(s) attached

Day 9 of the invasion.

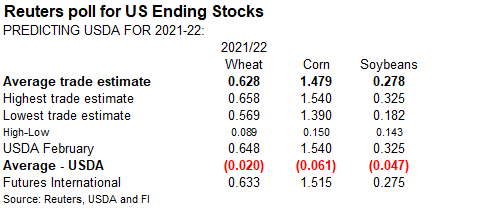

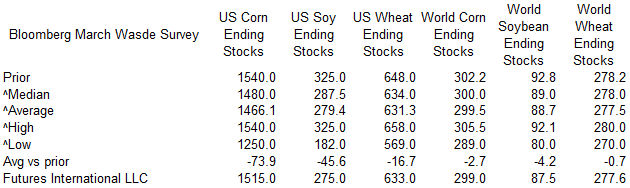

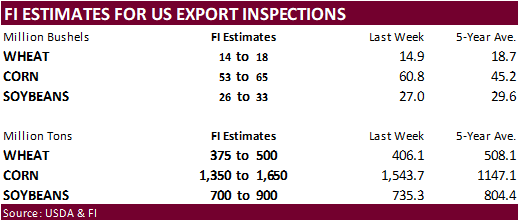

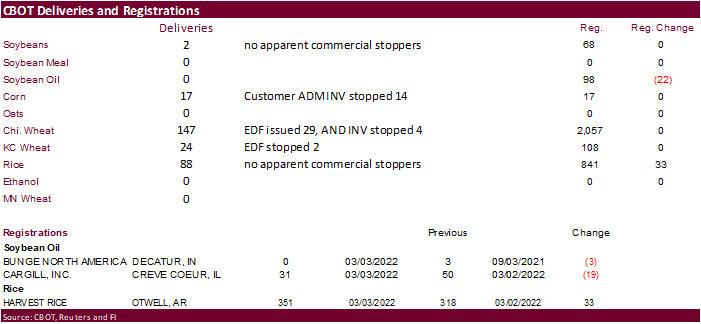

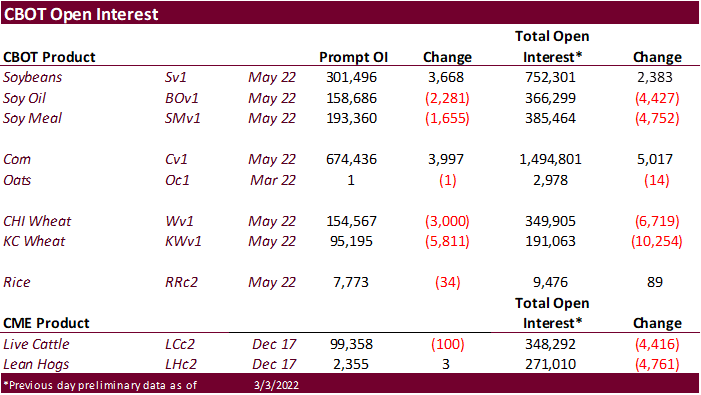

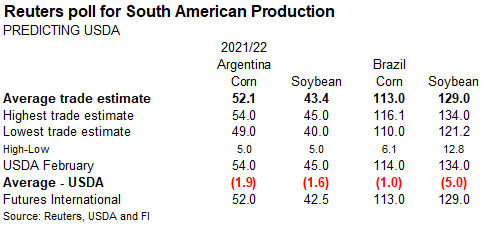

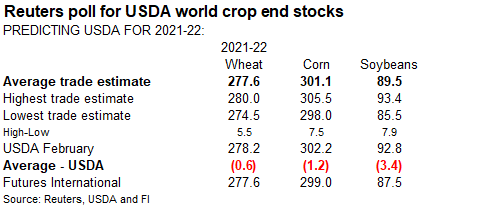

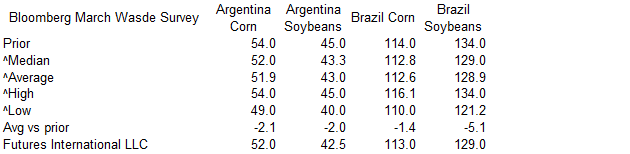

Demand for EU wheat is very strong with Black Sea ports closed and this is sending EU and US futures sharply higher. All three US wheat markets are up limit for the May, July & September contracts. Yesterday there was chatter the EU may limit wheat exports and set aside land for crop use. If true, this could be a blow to Algeria, Egypt and other countries looking for alternative suppliers. May Paris wheat futures were up 27.75 euros at 394.00 euros at the time this was written. China May wheat futures increased to nearly 3,600 yuan per ton on Friday and settled at new contract high. Iraq seeks two million tons of wheat to provide a strategic reserve. Iraq will accept offers from international companies for wheat from Sunday. Corn is about 20 cents higher. Soybeans are higher led by strength in soybean meal. Soybean oil is selling off from product spreading and lower palm. Malaysian palm oil futures rolled over on profit taking Friday. May Malaysian palm oil settled down 532 ringgit to 6,276 ringgit, down 7.8%. Cash palm was down $130.00/ton to $1,640/ton. China May soybeans were down 0.9%, meal up 0.5%, soybean oil down 2.1% and palm 3.7% lower. Offshore values are leading SBO 84 points lower (161 higher for the week to date) and meal $0.60 short ton higher ($8.70 higher for the week). USDA S&D estimates below.

CBOT limits – https://www.cmegroup.com/trading/price-limits.html

![]()

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.