File(s) attached

Calls:

Soybeans 12-20 lower

Soybean meal $3-5 lower

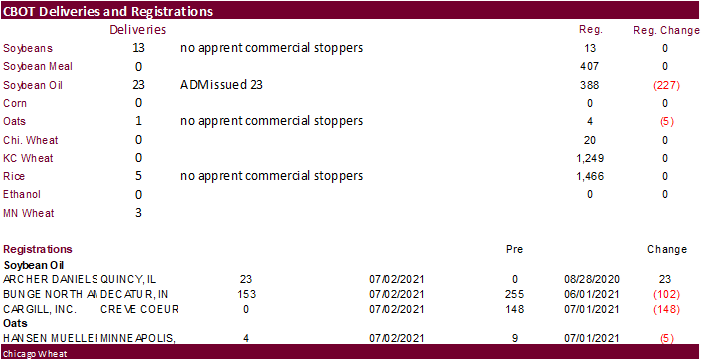

Soybean oil 50-100 lower (could be supported post open amid large drop in registrations)

Corn 6-11 lower

Wheat 12-20 lower bias MN to downside

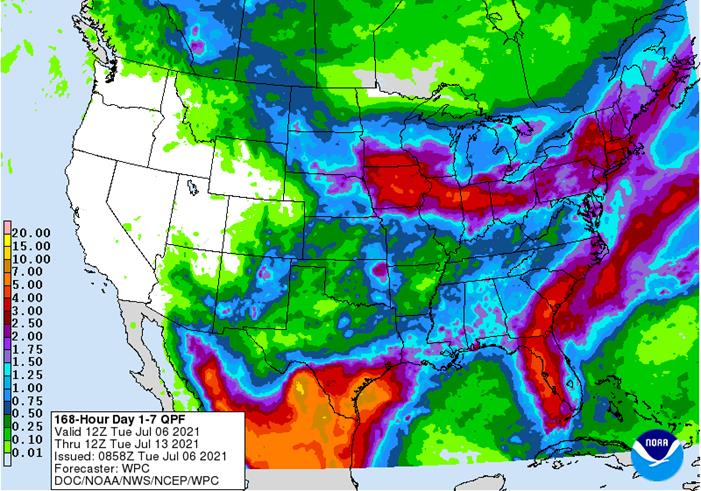

Calls are predicated on sharply lower Canadian canola and weaker values in Europe. Weather is the primary driver. Weekend rains for the US were as expected. Some of the models are suggesting an unchanged forecast while others are shifting rains into the dry areas of the US and southern Canadian Prairies. See 1-7 day below. Outside markets are supportive. OPEC cancelled their meeting, driving mineral oil higher. USD was up 15 points and WTI 72 cents higher. Gold was up $26. Canola and rapeseed prices are down sharply, about 40 & 35, respectively.

World Weather Inc.: Weak high pressure ridge over the western part of North America this week will also allow for some rain to fall in other parts of the southern Canada Prairies, the northern Plains, Minnesota and Iowa resulting in relief to those dry areas, as well. Rainfall this week will range from 0.50 to 1.50 inches with local totals of 2.00 to more than 3.00 inches possible. Iowa and southeastern South Dakota should be among the wettest areas while totals in North Dakota and southern Saskatchewan will vary from 0.40 to 1.50 inches and locally more.

Over a two day period, palm oil futures increased 62 points and cash was up $35/ton. China soybean oil over a two day period was up 52 yuan, soybeans up 138 or 2.4% and meal down 39 or 1.1%. China corn demand was lowered by two agencies over the past few days (Attaché and think tank), a bearish indication for corn.

Brazil corn crop seen at 85.3MMT – AgRural (bullish)

Several import tenders were announced over the weekend.

(Reuters) – Turkey’s state grain board TMO has issued an international tender to purchase around 440,000 tonnes of animal feed barley, European traders said on Tuesday.

(Reuters) – South Korea’s state-backed Agro-Fisheries & Food Trade Corp. has bought around 15,600 tonnes of soybeans free of genetically-modified organisms (GMOs) for food use in an international tender for the same volume, European traders said on Tuesday.

(Reuters) – A group of importers in Thailand has issued an international tender to purchase up to 230,700 tonnes of animal feed wheat, European traders said on Tuesday.

(Reuters) – Egypt’s state grains buyer, the General Authority for Supply Commodities (GASC,) said on Monday it had bought 240,000 tonnes of wheat in an international purchasing tender for shipment Sept. 1-15.

(Reuters) – Iranian state-owned animal feed importer SLAL has purchased an unknown volume of animal feed corn, feed barley and soymeal in an international tender which closed last week, European traders said on Tuesday.

(Reuters) – Iranian state agency the Government Trading Corporation (GTC) purchased an unknown volume of milling wheat in an international seeking about 60,000 tonnes of milling wheat which closed last week, European traders said on Monday.

(Reuters) – China will auction more than 130,000 tonnes of imported corn from the United States and Ukraine at an auction on July 9, according to the country’s grain stockpiler Sinograin on Tuesday.

(Reuters) – Japan’s Ministry of Agriculture sought 108,175 tonnes of food-quality wheat from the United States, Canada and Australia in a regular tender.

(Reuters) – Three trading companies are believed to be taking part in the international tender from Jordan’s state grains buyer to purchase 120,000 tonnes of wheat which closed on Tuesday, traders said.

(Reuters) – South Korea’s Feed Leaders Committee (FLC) purchased about 65,000 tonnes of corn expected to be sourced from the Black Sea region in a private deal on Friday without an international tender being issued, European traders said on Monday.

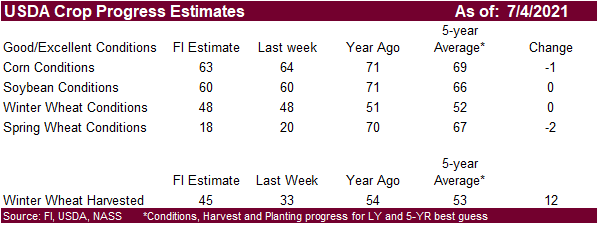

Crop Conditions

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.