PDF attached

Hurricane

Ida left more than 1 million customers without power. It will take some time to get an idea on damage. Some facilities could be without power for weeks. We understand a few grain facilities are impaired. End of August/early September is traditionally a

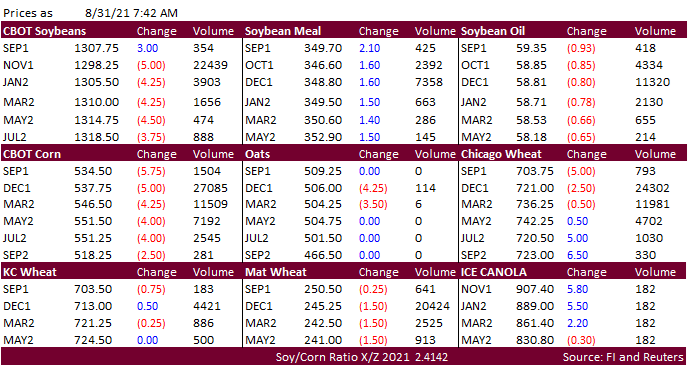

slow week for US exports, and a slow week for trading ahead of the long holiday weekend. Soybeans are mostly with November breaking around 7 am CT. USD is 21 points lower. Soybean meal is higher on product spreading. Soybean oil is under pressure from lower

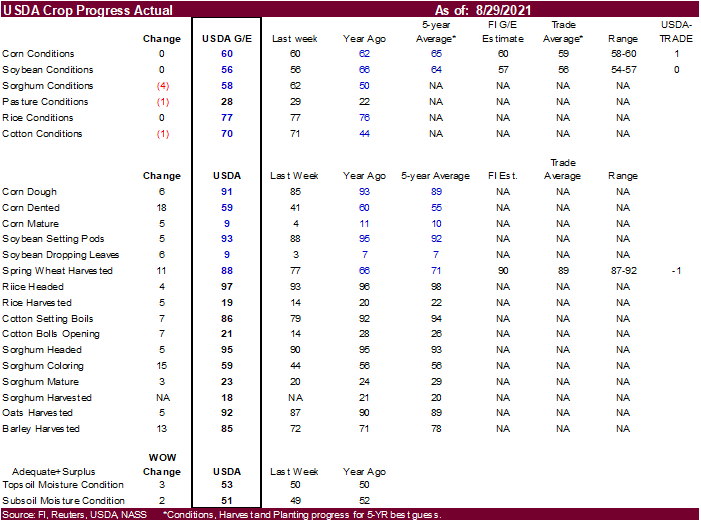

WTI crude oil. Corn is lower after USDA left US crop conditions unchanged. Wheat is mixed. FND deliveries were heavy for Chicago and Minneapolis wheat.