PDF attached

USD

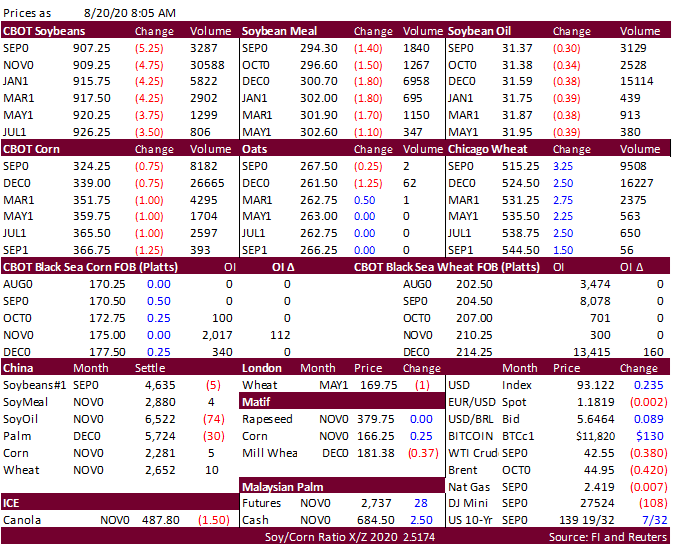

is higher by 19 points and WTI crude lower by 66 cents. No USDA 24-hour sales were posted. Pro Farmer crop tour early results are showing glowing corn yields and high pod counts for areas outside of storm ravaged Iowa. Weather models are showing a good warmup

for the US Midwest late this weekend into early next week, with precipitation limited over the next week. Malaysia is on holiday and China vegetable oil prices were lower. Offshore values are favoring CBOT soybean meal over soybean oil.

China

sold just over 4 million tons of corn from reserves at an average price of 1,959 yuan per ton. Japan bought 117,063 tons of food wheat. China sold another 4 million tons of corn out of reserves.