PDF Attached

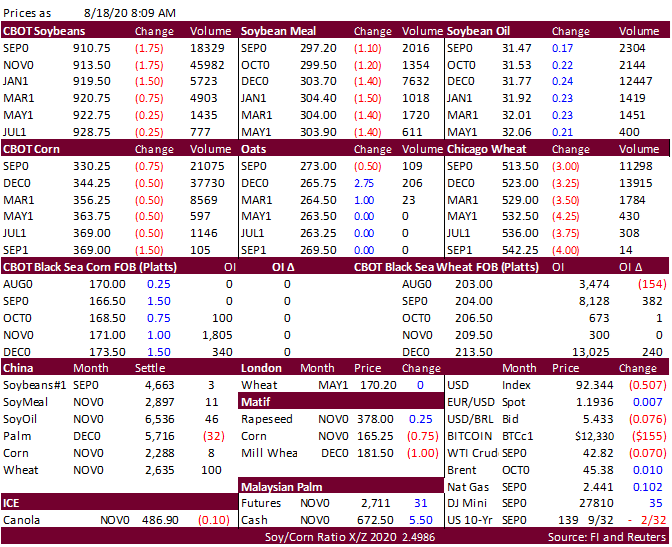

USD

was down 53 points earlier and WTI off 35 points.

USDA

24-hour: Private exporters sold 195,000 of corn to China for 2020-21 delivery and 130,000 tons of corn to unknown for 2020-21. Private exporters also sold 130,000 of soybeans to unknown for 2020-21 delivery.

Monday

ended a busy day with lower than expected decline in the national US corn condition. Then Pro Farmer reported very good pod counts and corn yield for Ohio and South Dakota. Traders await Egypt’s vegoil import tender-lowest offer was $789.50/ton for soybean

oil and 788.00/ton for sunflower. Offshore values this morning was leading CBOT soybean oil 11 higher and meal $2.30 lower. China vegetable oils were firmer overnight and palm futures rallied 32 MYR with cash appreciating $3.50/ton. Australia is appealing

China’s decision to slap prohibitive tariffs on Ausi barley imports. DBV farmer’s association estimated Germany’s 2020 grain harvest at 42.4 million tons, down from 44.3 million tons a year earlier, and about 5% below average. Winter wheat was projected

at 21.1 million tons, down from 22.8 million tons last year. DBV farmer’s association estimated Germany’s 2020 winter rapeseed crop at 3.3 million tons from 2.8 million tons in 2019. Japan is in for milling wheat.

The

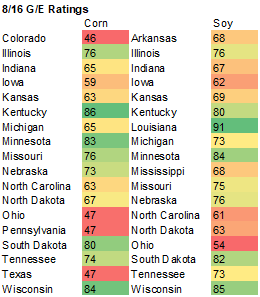

Pro Farmer crop tour:

- Ohio

– 167.69 vs. 154.35 for 2019 and 166.18 average - Ohio

– 1155.68 pods vs. 764.01 for 2019 and 1039.74 average - South

Dakota – 179.24 vs. 154.08 for 2019 and 160.02 average - South

Dakota – 1250.86 pods vs. 832.85 for 2019 and 919.04 average