PDF Attached

The

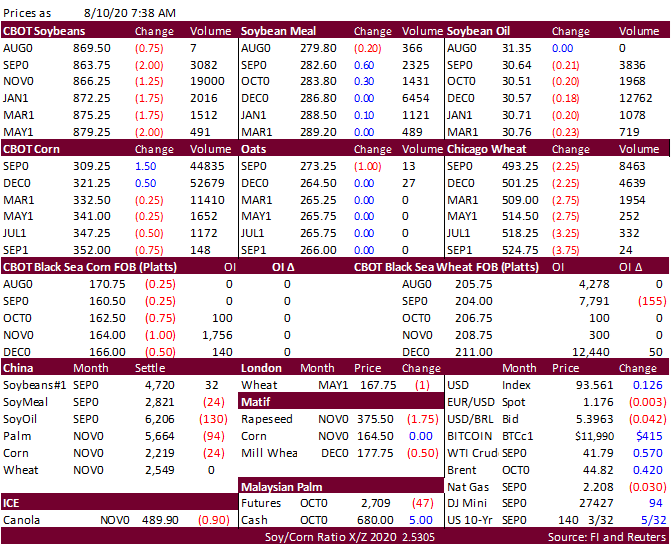

soybean complex is starting the week mostly lower, corn mixed on bull spreading, and wheat mostly lower (upward revisions to Black Sea grain crop). USD was 14 higher and WTI 53 cents higher and equities higher. MPOB reported larger than expected end of July

palm oil stocks, although they are at a 3-year low. AmSpec reported Malaysian palm exports for the Aug 1-10 period down 6.2 percent from last month to 429,937 tons. Egypt’s GASC bought 64,500 tons of local soybean oil for October 1-25 delivery. The third

month palm futures contract fell 49 points and cash was down $13.00/ton. China vegetable oil prices shed just over 2 percent, meal was lower and soybeans up 32 yuan or 0.7%. We look for a one-point increase in US corn, soybeans, and spring wheat conditions.

Russian 12.5% protein wheat export prices fell $2.00 from the previous week to $205/ton, according to IKAR. IKAR increased their outlook for the Russian 2020-21 grain crop by 1.5 million tons to 81MMT, in part to an upward revision to the wheat crop by 1.5MMT

to 81 million tons. APK-Inform increased their Ukraine grain production by 1.5 million tons to 73.0 million tons. Corn output was increased for Ukraine by 0.7MMT to 37.3MMT. APK sees Ukraine grain exports at 51.8MMT from 50.6MMT.