PDF attached

US

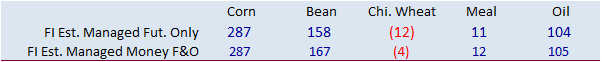

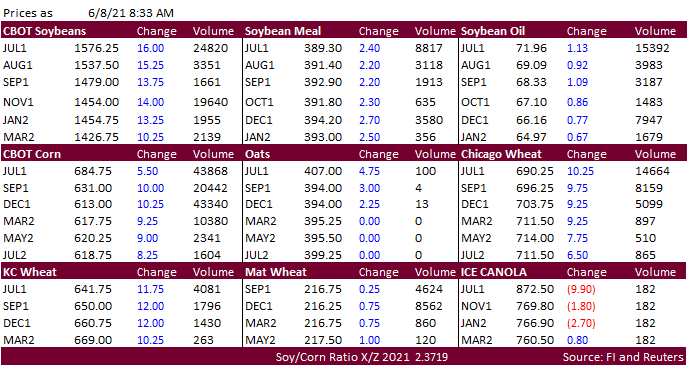

Census trade data attached. CBOT agriculture markets are higher from a more than expected drop in US corn, soybean and spring wheat crop ratings. Corn spreads continue to get hit. The weather outlook appears to be mostly unchanged with emphasis on net drying

across the WCB this workweek. Japan and Jordan are in for food wheat this week. Results are awaited on Algeria in for wheat. Egypt saw offers for vegetable oils.

WORLD

WEATHER HIGHLIGHTS FOR JUNE 8, 2021

-

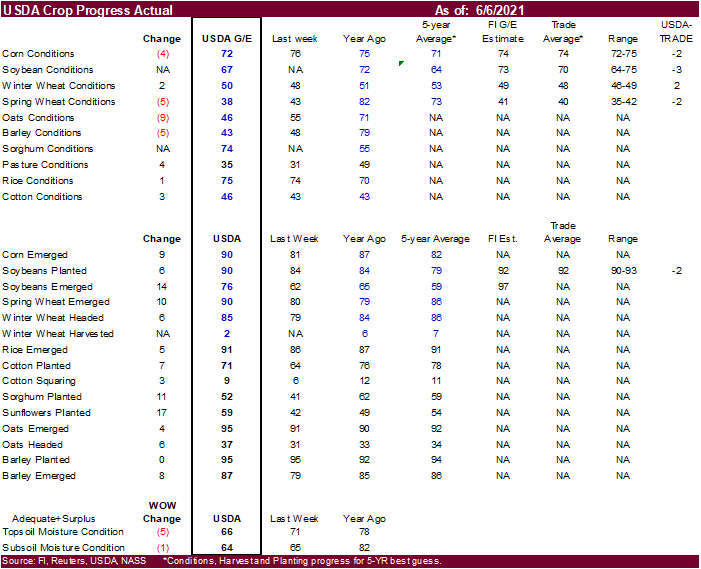

Rain

is still expected in Canada’s Prairies and to some degree across the northern U.S. Plains during the balance of this week and into the weekend.

-

Relief

from dryness is also expected in parts of east-central China, including the North China Plain, Yellow River Basin and neighboring areas.

-

Drying

and warmer weather in the Russian New Lands will be closely monitored over the next couple of weeks since a part of the region is already quite dry along with parts of Kazakhstan.

-

No

significant changes were noted in South America -

Northern

U.S. Midwest crop areas are not likely to see a good distribution of rain for a while which may lead to net drying over time.

-

West

Texas will experience a mini heatwave Wednesday into Friday with highs of 100 to 108 Fahrenheit -

Restricted

rainfall is expected as well -

U.S.

Delta and Tennessee River Basin will be abundantly wet for a while -

Timely

rain in southeastern U.S. will further ease the region from recent dryness -

U.S.

Pacific Northwest will continue lacking rainfall leaving unirrigated winter crops stressed -

Western

Europe will be drying down for a while and Australia’s winter crops will get some sporadic rainfall periodically. -

India’s

monsoon depression late this week into next week will produce flooding rain from Odisha to Madhya Pradesh -

6.00

to 15.00 inches of rain and locally more may occur resulting in some notable flooding

-

Surrounding

areas will receive up to 6.00 inches -

A

second monsoon depression will evolve in the northern Bay of Bengal late next week possibly threatening India with additional heavy rain -

Australia

will experience a good mix of weather, but a boost in rainfall is still needed for many winter crop areas -

Well

timed rainfall is expected in west-central Africa -

East-central

Africa coffee and cocoa areas would benefit from greater rainfall -

Nicaragua

and Honduras will get some dryness easing rainfall in the coming week -

Mexico

rain will be greatest in the south leaving drought in western and northern crop areas -

Abundant

rain will continue west of the Ural Mountains in southwestern Russia, Ukraine and neighboring areas

Source:

World Weather, Inc.

Tuesday,

June 8:

- Australian

crop report - International

Grains Council Conference, day 1 - France

agriculture ministry’s monthly crop estimates

Wednesday,

June 9:

- EIA

weekly U.S. ethanol inventories, production - International

Grains Council Conference, day 2 - FranceAgriMer

releases monthly grains report

Thursday,

June 10:

- USDA’s

monthly World Agricultural Supply and Demand (WASDE) report, 12pm - USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - China’s

agriculture ministry (CASDE) releases monthly report on supply and demand for corn and soybeans - Malaysian

Palm Oil Board inventory, output and export data for May - Brazil’s

Conab releases output, yield and acreage data for corn and soybeans - Port

of Rouen data on French grain exports - Malaysia

June 1-10 palm oil export data

Friday,

June 11:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

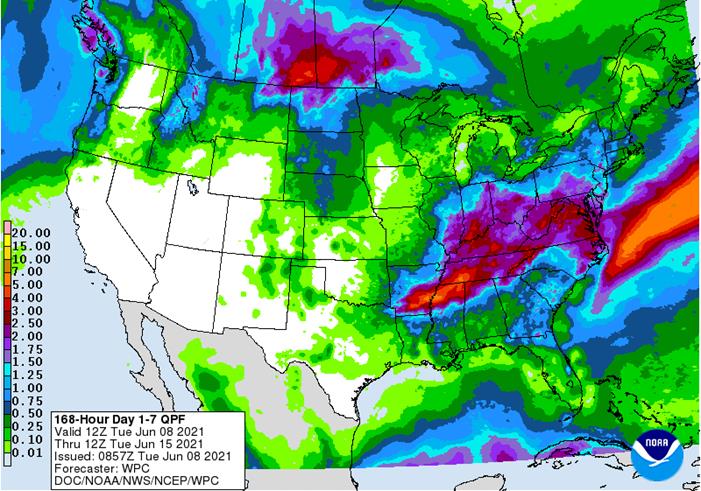

USDA

inspections versus Reuters trade range

Wheat

418,547 versus 230000-450000 range

Corn

1,413,073 versus 1400000-2200000 range

Soybeans

237,108 versus 100000-300000 range

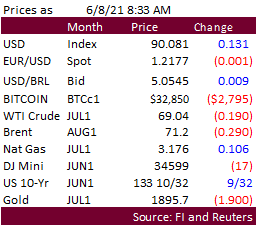

Macros

US

Trade Balance (USD) Apr: -68.9B (est -68.7B; prev -74.4B)

US

Crude Oil Exports Reached 3.24 Million B/D In April (Vs 2.61 Million B/D In March)

US

China April Trade Deficit USD25.83 Bln Vs March Deficit USD27.69 Bln

USDA

To Invest More Than USD4Bln To Boost Food Supply Chains

- US

corn futures are higher

on US weather concerns bias WCB and more than expected drop in US corn crop condition ratings. Several upper US states are in need of rain and we expect crop stress to increase next week if areas miss out on rain over the next 5 to 7 days. Corn import tenders

remain quiet and we think many importing countries are focused on new-crop supplies at the moment, and maybe waiting for a pullback before committing.

- Spreads

continue to get hit. Today is the second day of the Goldman Roll. - USD

was 13 higher as of 8:33 am CT. - The

weather outlook appears to be mostly unchanged with emphasis on net drying across the WCB this workweek.

-

US

corn conditions were reported 2 points below expectations at 72 percent, down 4 points from the previous week, below 75 year ago and above 71 percent average. 90 percent of the corn crop is emerged.

-

Yesterday

Argentina grain custom export workers launched a 7-hour strike over COVID-19 vaccinations.

US

corn inspections were on the lower end of trade expectations. USDA US corn export inspections as of June 03, 2021 were 1,413,073 tons, within a range of trade expectations, below 2,104,363 tons previous week and compares to 1,220,985 tons year ago. Major

countries included China for 542,565 tons, Mexico for 313,845 tons, and Japan for 310,891 tons.

U

of I: International Benchmarks for Corn Production

Langemeier,

M. “International Benchmarks for Corn Production.” farmdoc daily (11):89, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, June 4, 2021.

https://farmdocdaily.illinois.edu/2021/06/international-benchmarks-for-corn-production-5.html

Export

developments.

-

The

soybean complex is higher on lower than expected US initial soybean crop ratings and a mostly unchanged US weather forecast. The ECB appears to be in good shape but the WCB and upper Midwest is in need of rain. Spreading should be back in focus today. They

are for corn. -

Offshore

values are leading soybean oil 7 points higher and meal $1.60 higher. -

US

initial soybean conditions were reported 3 points below expectations at 67 percent, below 72 year ago and above 64 percent average. 90 percent of the soybean crop had been planted.

-

Rotterdam

rapeseed and soybean oil prices were mixed and meal 5-11 euros lower. -

Indonesia

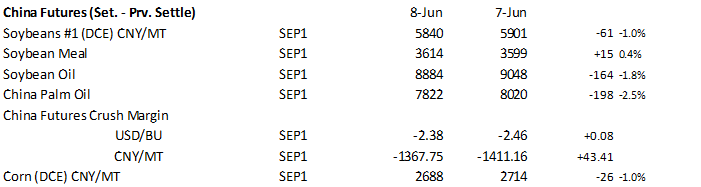

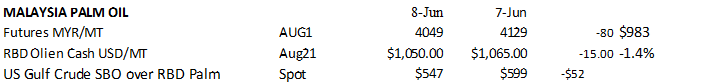

will see heavy rain affecting palm oil production this week. - China:

- Malaysian

palm oil: back

from one day holiday

-

USDA

US soybean export inspections as of June 03, 2021 were 237,108 tons, within a range of trade expectations, above 194,131 tons previous week and compares to 274,052 tons year ago. Major countries included Indonesia for 71,573 tons, Mexico for 62,716 tons, and

Malaysia for 28,235 tons.

- Egypt’s

GASC saw offers for vegoils for August 1-20 arrival. Payment with 180-day letter of credit was requested. Lowest offer for at least 30,000 tons of soyoil was $1,299 a ton c&f, and $1,369.96 a ton c&f for sunflower oil.

- USDA

seeks 1,180 tons of packaged vegetable oil for export donation on June 15 for July 16-Aug 15 shipment.

- US

wheat is higher on a more than expected drop in US spring wheat rating that is supporting all three US markets. Japan and Jordan joined Algeria this week in announcing new import tenders. We are already awaiting results for Algeria in for wheat.

- September

Paris wheat market basis September was up 0.25 euros at 216.75 at the time this was written. - France’s

AgMin: Projected winter barley 7.74 million tons, up 19.3% from last year but 6.4% below 5-year average.

- US

winter wheat conditions were up 2 points to 50 percent and were 2 points above an average trade estimate. US spring wheat conditions declined a large 5 points last week to 38 percent, 2 points below a trade average.

- We

are using 1.842 billion for US wheat production, below 1.872 billion USDA May. Spring wheat was lowered to 480 million from 497 million and durum to 51 million to 55 million. Our total other spring and durum combined wheat production estimate is 531 million,

down from 552 million previous, and 58 million below USDA. Our winter wheat production estimate for July is higher than USDA May (FI estimates already set for June S&D).

- USDA

US all-wheat export inspections as of June 03, 2021 were 418,547 tons, within a range of trade expectations, above 260,288 tons previous week and compares to 510,262 tons year ago. Major countries included Philippines for 165,627 tons, Mexico for 74,246 tons,

and China for 64,065 tons.

- Results

awaited: Algeria seeks 50,000 tons of milling wheat on June 8 for July and/or August shipment.

- Japan

seeks 181,355 tons of food wheat later this week from United States, Canada and Australia.

- Jordan

seeks 120,000 tons of wheat on June 22 for December shipment. - Jordan

seeks 120,000 tons of feed barley on June 9 for Lat Oct/Nov shipment. - Jordan

seeks 20,000 tons of wheat bran on June 15 for July/August shipment.

Rice/Other

·

None reported

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.