PDF attached

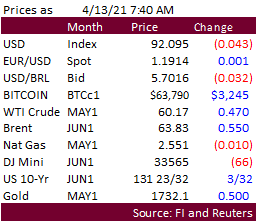

USD

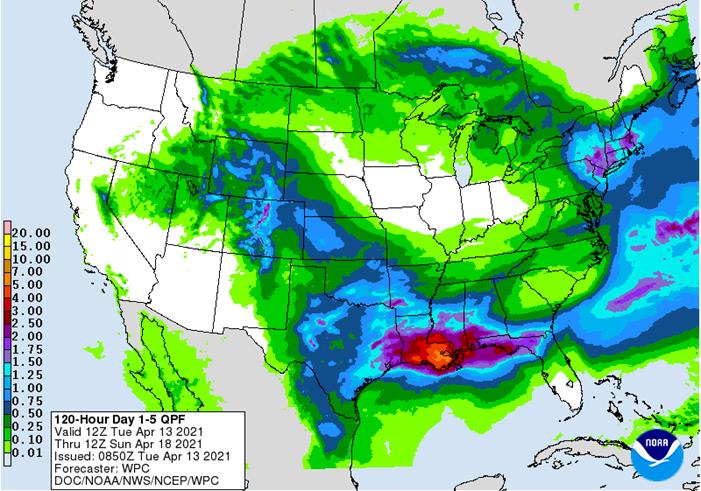

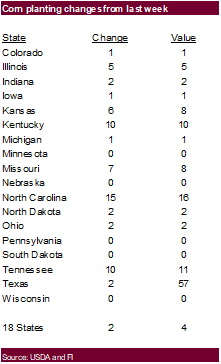

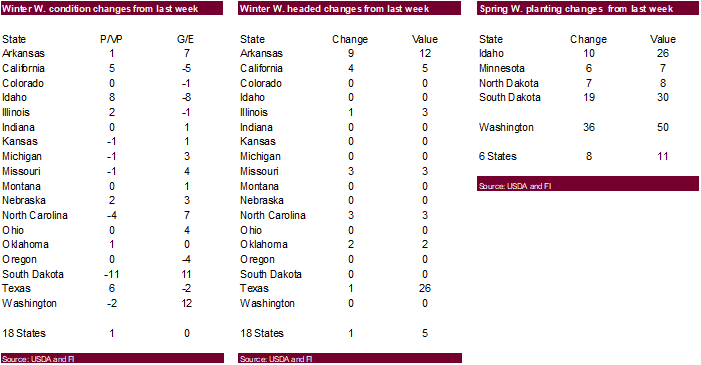

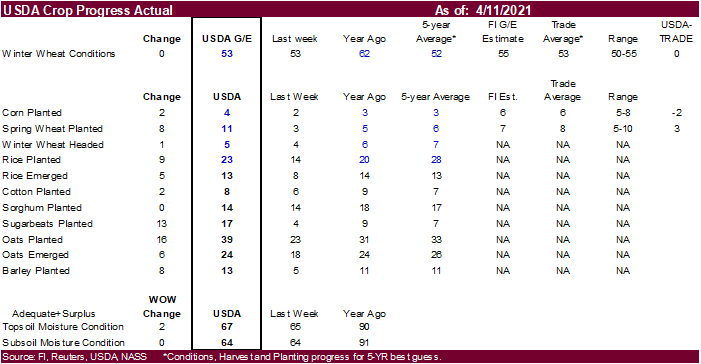

was 4 points lower (reversal) and WTI up 57 cents as of 7:41 am CT. US stocks are on the defensive in part to vaccine rollout concerns. US and SA weather forecast is mostly unchanged. Slower than expected start to the US corn planting season is not expected

to have that much impact on prices but drier weather ahead for the western Corn Belt and colder than normal temperatures will be talked about this week. US corn seedings advanced nicely across the Delta and lower Midwest last week. The lower Midwest will

see additional rain this week, delaying fieldwork activity. US winter wheat ratings came in at expectations. SK bought a cargo oof optional origin corn. Jordan passed on barley and SK bought feed wheat. Japan is back in for food wheat. China March soybean

arrivals were up 82 percent form a year ago.

Tuesday,

April 13:

- China

customs to publish trade data, including imports of soy, edible oils, meat and rubber - France’s

agriculture ministry updates on 2021 crop plantings - Malaysian

Cocoa Board releases 1Q 2021 cocoa grinding numbers - HOLIDAY:

Thailand

Wednesday,

April 14:

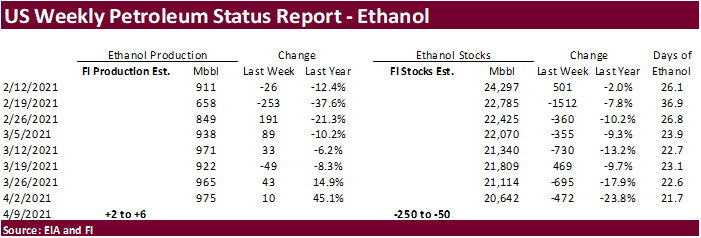

- EIA

weekly U.S. ethanol inventories, production - Unica’s

data on cane crush and sugar production in Brazil’s center-south region (tentative) - FranceAgriMer

monthly grains report - European

Cocoa Association’s quarterly grind data (tentative) - HOLIDAY:

India, Bangladesh, Thailand

Thursday,

April 15:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Malaysia’s

April 1-15 palm oil export data - The

U.S. National Confectionery Association releases first quarter cocoa grinding data for North America - USDA

updates monthly North American sugar and sweeteners outlook - White

sugar May contract expires - New

Zealand food prices - HOLIDAY:

Thailand

Friday,

April 16:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Cocoa

Association of Asia releases 1Q 2021 cocoa grinding data - FranceAgriMer

weekly update on crop conditions

Source:

Bloomberg and FI

USDA

inspections versus Reuters trade range

Wheat

458,432 versus 300000-550000 range

Corn

1,584,761 versus 1200000-2100000 range

Soybeans

327,799 versus 100000-400000 range

Macro

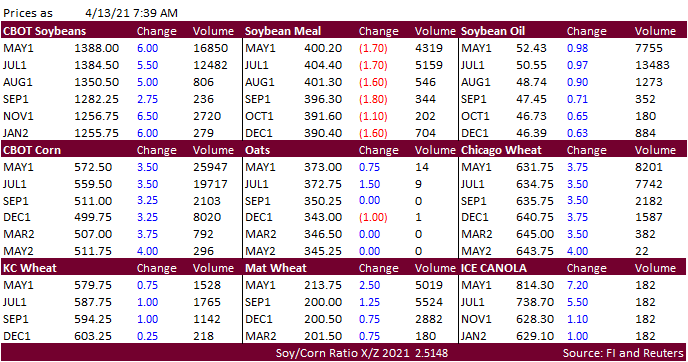

- CBOT

corn

was higher led by the back months in a light trade. US corn seeding progress came in less than expected and that is supporting back month corn futures. Ongoing concerns over the Brazil corn crop may prompt major importers to book US corn.

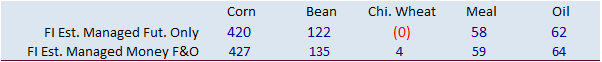

- Funds

on Monday sold an estimated net 11,000 corn contracts. - Rains

will occur across Brazil’s northern Mato Grosso this week. Central Parana and western RGDS will see light rain.

- Today

is day four of the “Goldman Roll.”

Export

developments.

-

South

Korea’s FLC bought 65,000 tons of optional origin corn at $296.79/ton c&f for arrival in SK in July.

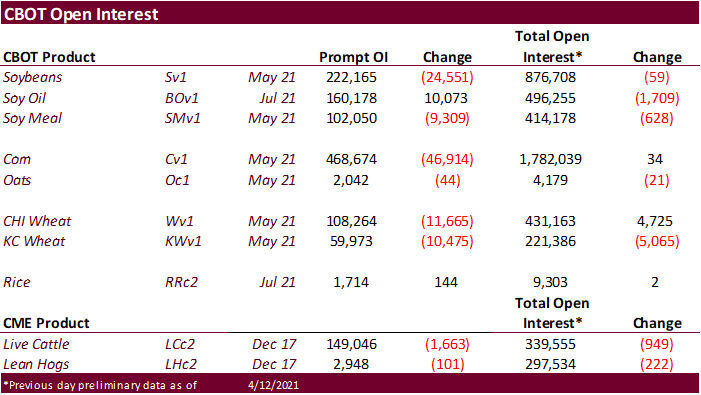

- CBOT

soybeans and soybean oil are higher led by strength in palm oil, technical buying and heavy March China soybean arrivals.

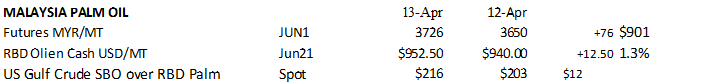

News

was light overnight. Offshore values are leading soybean oil higher and meal lower. Malaysian palm oil rebounded on thoughts end users will start to stockpile after the recent setback in prices. June palm oil settled 76 higher and cash was up $12.50 to $952.50.

- At

7:25 am CT, 500 BOK/BON traded from +190 down to +175. - China

soybean imports for the month of March came in at a large 7.77 million tons, up 82 percent form a year ago, in part to slow January and February arrivals because of the delay in the Brazilian soybean harvest. 5 million tons of U.S. soybeans were loaded in

January and some of that arrived in March, Reuters noted. Q1 China soybean imports stand at 21.2 million tons, 19 percent higher than a year ago. China also imported 1.02 million tons of meat during March, up 11.4 percent from a year ago, and highest since

January 2020. October through December China soybean imports were 25.8 million tons, up from 23.93 million a year earlier. China soybean imports are on track to 100-102 million tons for 2020-21.

- Offshore

values were leading CBOT SBO 142 points higher and meal $3.30 short ton lower.

- Rotterdam

vegetable oil values were unchanged to up 2 euros this time previous session and Rotterdam meal mostly higher.

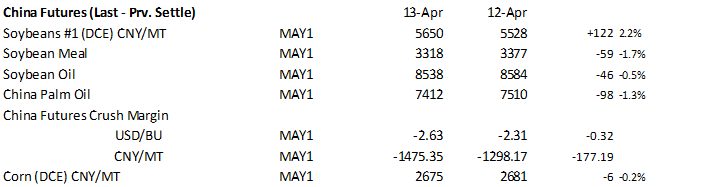

- China

cash crush margins on our analysis were 158 (178 previous) vs. 179 cents late last week and compares to 197 cents year earlier.

- China:

- Funds

on Monday sold an estimated net 12,000 soybean contracts, bought 1,000 soybean meal and sold an estimated 7,000 soybean oil.

-

USDA

seeks 35,000 tons of soybean meal for the Food for Progress export program on April 14, of which 11,000 tons for Ivory Coast and 24,000 tons for Ghana.

-

Egypt’s

GASC seeks 30,000 tons of soyoil and 10,000 tons of sunflower oil on April 15 for arrival June 1-20. Payment is for at sight and 180-day letter of credit.

- US

wheat was mostly higher as adverse US weather is seen slowing development of winter wheat and delaying spring wheat seedings. However, US spring wheat seedings reported by USDA at 11 percent complete as of Sunday were better than expected.

- September Paris wheat was

up 1.25 euros to 200.00 euros. - France’s soft wheat spring

crop area as of April 1 was estimated by the AgMin at 4.9 million hectares, up 15% from 2020 and in line with the five-year average. Rapeseed plantings were estimated at 990,000 hectares, down 11% from 2020, and 27% below the five-year average. - Black Sea region crop areas

of Belarus, Ukraine, southwest Central Region, and southwest North Caucasus should see rain this week.

- Japan seeks 90,169 tons

of food wheat this week from US and Canada. - South Korea’s MFG bought

66,000 tons of feed wheat at $269.30/ton c&f for arrival around October 25.

- Jordan passed on 120,000

tons of animal feed barley.

- Algeria’s OAIC seeks 50,000

tons of durum wheat on Wednesday, April 14, valid until Thursday, April 15, for shipment between May 1-15 and May 15-31. - Japan in its weekly SGS import tender seeks 80,000 tons of feed

wheat and 100,000 tons of barley for arrival by September 30.

- Ethiopia seeks 30,000 tons of wheat on April 16.

- Ethiopia seeks 400,000 tons of optional origin milling wheat, on

April 20, valid for 30 days. In January Ethiopia cancelled 600,000 tons of wheat from a November import tender because of contractual disagreements.

Rice/Other

·

Mauritius seeks 4,000 tons of optional origin long grain white rice on April 16 for delivery between June 1 and July 31.

·

Bangladesh seeks 50,000 tons of rice on April 18.

·

Syria seeks 39,400 tons of white rice on April 19. Origin and type might be White Chinese rice or Egyptian short grain rice.

·

Ethiopia seeks 170,000 tons of parboiled rice on April 20.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.