PDF attached

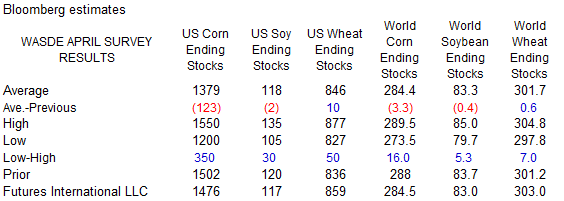

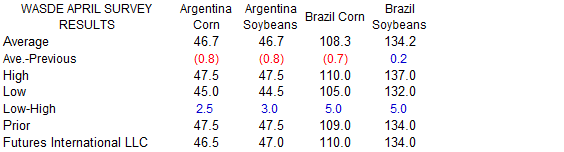

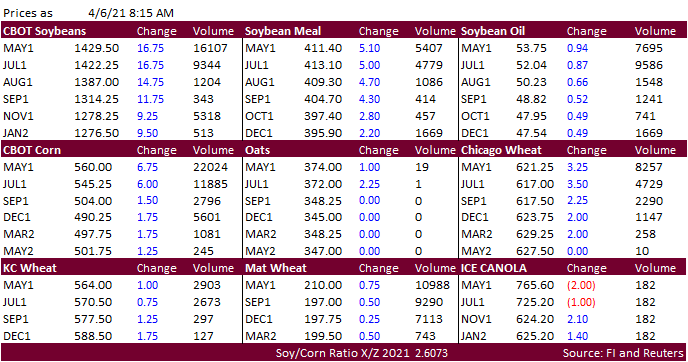

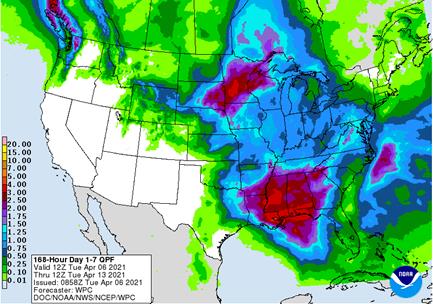

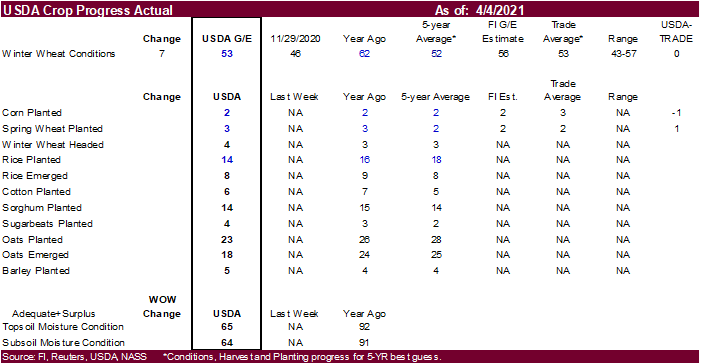

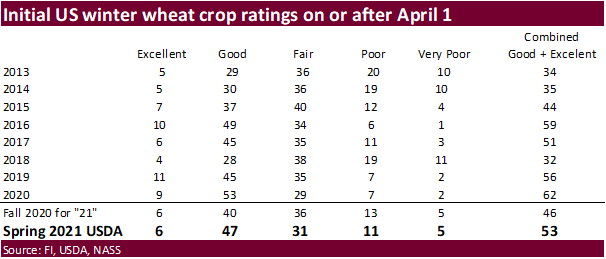

Higher trade in US agriculture futures as energies rebound and a fresh wave of import tenders hits the wheat market. China is still on holiday. Europe and Latin America are back. Malaysian palm nearby futures were up 53 to 63 MYR and cash Rotterdam SBO and rapeseed oil were unchanged to 20 euros higher from late Thursday. Bloomberg trade estimates were released after the close yesterday and consensus is traders look for tighter US soybean (-2) and corn stocks (-123) in the upcoming Friday report. Estimates are below. Meanwhile talk of spot global soybean supplies due to Brazil’s delay in harvesting of soybeans is also underpinning the market. Brazil is 78% complete on collecting soybeans, down from 83% year ago. May soybeans are back above their 20-day MA. May corn is finding support from technical buying and higher wheat. Traders are awaiting results of the Egypt wheat import tender (lowest price $234.00/ton for Russian). Thailand is in for 504,000 tons of feed wheat, Taiwan in for 96,485 tons of US wheat, Jordan postponed buying 120,000 tons of barley, and Ethiopia seeks 30,000 tons of wheat. South Korea bought 30,000 tons of non-GMO soybeans. 53% of the US wheat crop was rated G/E, near expectations. The “Goldman” roll starts Thursday. US weather is mostly unchanged. Mainland Asia is a little wetter. The northern Plains and Delta rain will increase by the end of the week.

World Weather Inc.

MARKET WEATHER MENTALITY FOR CORN AND SOYBEANS:

Weather conditions in South America are still looking mostly good, although there will be some concern over interior southern Brazil’s ongoing drying trend. Mato Grosso gets some timely rainfall over the next ten days and Argentina’s late season crops should continue to develop favorably. Today’s GFS model run offers some greater rain potential after April 15 in interior southern Brazil.

U.S. weather is looking relatively good for early season planting with rain this week and next week to help ensure good soil moisture for aggressive planting later this month. Field progress will not advance very well during the next ten days in some of the wetter areas, but some progress is expected.

Western Europe warmed up during the weekend and will be warm and dry early this week followed by some precipitation late this week and cooling into next week. Not much coarse grain planting is expected right away, but some fieldwork should begin later this month. Warming in the western CIS will slowly bring rapeseed in Ukraine out of dormancy, but that will be a slow process.

India’s winter crops are maturing and will be harvested swiftly in the next few weeks. China’s winter crops need to warm up, but soil moisture is favorable for aggressive development once it does warm appropriately. China’s spring planting will also advance well once warming kicks in.

South Africa summer crops have yielded well and should mature and be harvested in a favorable environment.

Overall, weather today may support a mixed influence on market mentality with a slight bearish bias.

MARKET WEATHER MENTALITY FOR WHEAT: Concern may rise in the west-central and southwestern U.S. Plains this week because of missed rainfall and warm temperatures. Portions of the northern Plains and Canada’s Prairies will get some needed moisture, but much of it will concentrate on South Dakota and Minnesota limiting the moisture boost for some of the drier areas in North Dakota, Montana and Canada’s Prairies. Soft wheat conditions in the U.S. Midwest remain mostly good, despite weekend freezes. Soft wheat damage in the Carolinas and Tennessee from weekend freezes should have been quite limited outside of the burning of vegetative growth.

Small grain planting conditions in Europe are improving with warmer temperatures and firming soil. Winter crops in Europe are rated favorably with those in the west coming out of dormancy. Most of the CIS winter crops are just beginning to green up in Ukraine and Russia’s Southern Region while still dormant elsewhere.

India’s winter crops are maturing and expected to be harvested swiftly in the next few weeks. China’s winter crops are greening up in the north and in the vegetative stage of development in the south with huge production potentials this year.

Australia will need rain later this month and next to support autumn planting and the prospects for that moisture are looking good.

North Africa will get some rain this week, but more will be needed to induce the best possible crop development and production potential.

Overall, weather today will likely produce a mixed influence on market mentality.

Source: World Weather inc.

Bloomberg Ag Calendar

Tuesday, April 6:

- Purdue Agriculture Sentiment

- New Zealand global dairy trade auction

- HOLIDAY: Hong Kong, Thailand

Wednesday, April 7:

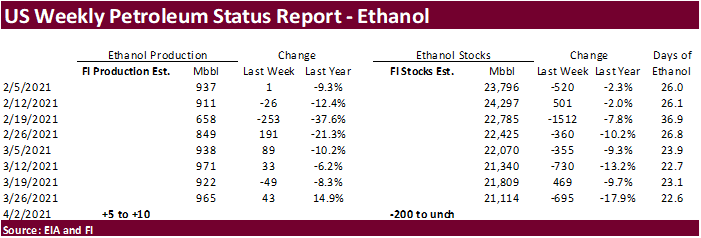

- EIA weekly U.S. ethanol inventories, production

- ANZ Commodity Price

Thursday, April 8:

- FAO World Food Price Index

- USDA weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am

- China’s CNGOIC to publish soybean and corn reports

- Conab’s data on yield, area and output of corn and soybeans in Brazil

- Port of Rouen data on French grain exports

Friday, April 9:

- USDA’s monthly World Agricultural Supply and Demand (WASDE) report, noon

- ICE Futures Europe weekly commitments of traders report (6:30pm London)

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- FranceAgriMer weekly update on crop conditions

Source: Bloomberg and FI

USDA inspections versus Reuters trade range

Wheat 594,032 versus 300000-555000 range

Corn 1,912,211 versus 1100000-2100000 range

Soybeans 298,252 versus 150000-500000 range

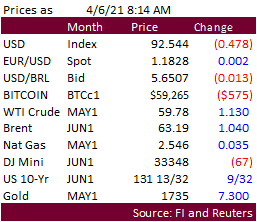

Macro

IMF Raises World GDP Growth Forecast To 6% Vs. 5.5% In January Forecast

-Sees World GDP Up Most In 4 Decades

-Raises 2021 US GDP Forecasts To +6.4% Y/Y (Jan Est: +5.1%)

-Raises 2021 China GDP Estimate To +8.4% Y/Y (Jan Est: +8.1%)

- CBOT corn is higher on renewed fund buying, rebound in US energies, and higher soybeans. Bloomberg trade estimates were released after the close yesterday and consensus is traders look for much tighter US corn stocks (-123) in the upcoming Friday report. There are several factors to watch over the next month most notably Brazilian weather with late planted corn, Brazil soybean shipments pushing back Brazil’s export campaign (driving business to the US), and US weather for upcoming paintings. We think USDA is 3.5 million acres too low for their 15 major crop area plantings, and in the June report US corn acreage will increase. Spreads are expected to remain active this week. The “Goldman” roll starts Thursday.

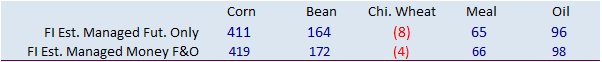

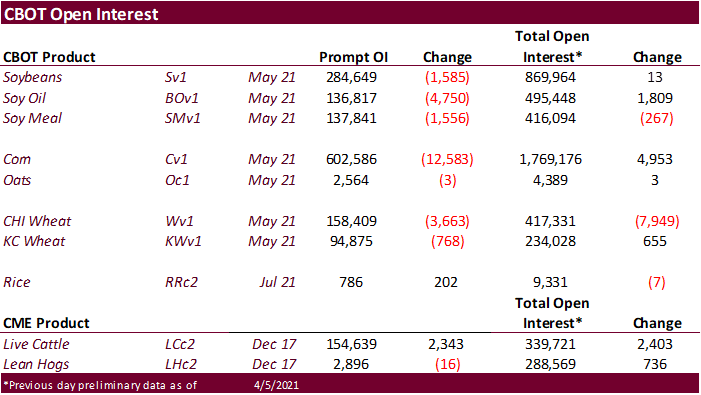

- Funds on Monday sold an estimated net 8,000 corn contracts.

- USDA US corn export inspections as of April 01, 2021 were 1,912,211 tons, within a range of trade expectations, above 1,720,251 tons previous week and compares to 1,279,364 tons year ago. Major countries included China for 503,190 tons, Mexico for 447,764 tons, and Japan for 368,130 tons.

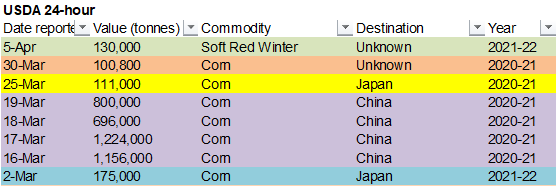

Export developments.

- None reported

- The soybean complex is higher as money managers begin to add long positions. US energies are rebounding. The USD turning lower just before the electronic pause. China is still on holiday. Europe and Latin America are back. Malaysian palm nearby futures were up 53 to 63 MYR and cash Rotterdam SBO and rapeseed oil were unchanged to 20 euros higher from late Thursday. Meanwhile talk of spot global soybean supplies due to Brazil’s delay in harvesting of soybeans is also underpinning the market. Brazil is 78% complete on collecting soybeans, down from 83% year ago. May soybeans are back above their 20-day MA. South Korea bought 30,000 tons of non-GMO soybeans. Weather is mostly unchanged for the US.

- Strategie Grains lowered its forecast for the 2021 EU rapeseed harvest to 16.8 million tons from 17.05 million forecast last month and is now 3.4% above 2020.

- Funds on Monday bought an estimated net 5,000 soybean contracts, sold 2,000 soybean meal and bought an estimated 4,000 soybean oil.

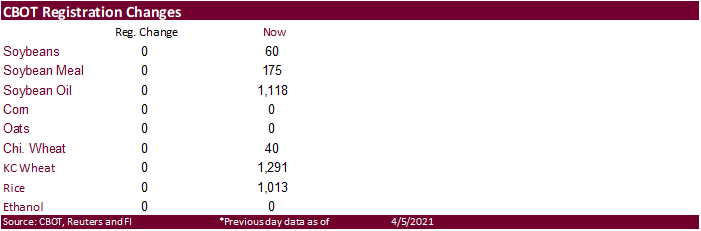

- There were no changes to CBOT registrations.

- AgRural reported Brazilian producers harvested 78% of their soybean crop as of last Thursday, down from 83% year ago. Brazils second corn crop was complete.

- Offshore values were leading CBOT SBO 41 points higher and meal $1.50 short ton lower.

- China cash crush margins on our analysis were 156 vs. 144 cents late last week and compares to 214 cents year earlier.

- China is on holiday.

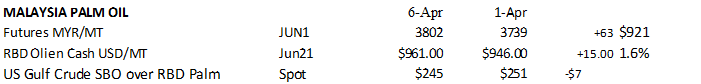

Malaysian palm oil: (uses settle price)

- USDA US soybean export inspections as of April 01, 2021 were 298,252 tons, within a range of trade expectations, below 439,930 tons previous week and compares to 301,111 tons year ago. Major countries included Mexico for 94,294 tons, Egypt for 68,751 tons, and China for 28,088 tons.

Export Developments

- South Korea’s bought around 12,000 tons of non-GMO soybeans on April 2, at $724 a ton c&f and $733.60 a ton for arrival in South Korea between June 15 and Sept. 20.

- Today the USDA seeks 540 tons refined veg oil, under the McGovern-Dole Food for Education export program (470 tons in 4-liter cans and 70 tons in 4-liter plastic bottles/cans) for May 1-31 (May 16 – Jun 15 for plants at ports) shipment.

- Chicago wheat is higher on fund buying from a fresh wave of import tenders. Traders are awaiting results of the Egypt wheat import tender (lowest price $234.00/ton for Russian, a price slightly higher than previous cash indications). Thailand, Taiwan, and Ethiopia are in for wheat. Algeria seeks wheat on Wednesday. Paris wheat was up 0.50 euro.

- 53% of the US wheat crop was rated G/E, near expectations.

- Weather is mostly unchanged. The northern Plains and Delta rain will increase by the end of the week. The western Canadian Prairies are dry and need rain and will see only scattered showers this week.

- China sold 1.6 million tons of wheat out of auction from 4.022 million tons offered, bringing 2021 sales to 26 million tons (out of 48MMT offered).

- Funds on Monday bought an estimated net 5,000 CBOT SRW wheat contracts.

- USDA US all-wheat export inspections as of April 01, 2021 were 594,032 tons, above a range of trade expectations, above 306,579 tons previous week and compares to 350,190 tons year ago. Major countries included China for 200,297 tons, Mexico for 143,305 tons, and Korea Rep for 100,648 tons.

- Lowest offer $234.00/ton 55k Russian wheat: Egypt seeks wheat for August 1-10 shipment on Tuesday, April 6, with offers valid for 24 hours.

- Thailand’s TFMA group seeks up to 504,000 tons of animal feed wheat on April 7 for shipment between May and December.

- Taiwan seeks 96,485 tons of US wheat on April 8.

- Ethiopia seeks 30,000 tons of wheat on April 16.

- Jordan postponed their 120,000 ton import tender of animal feed barley on April 6 to April 13.

- Algeria’s OAIC seeks optional-origin milling wheat on Wednesday.

- Ethiopia seeks 400,000 tons of optional origin milling wheat, on April 20, valid for 30 days. In January Ethiopia cancelled 600,000 tons of wheat from a November import tender because of contractual disagreements.

Rice/Other

· Thailand lowest price @ $569.50/ton: Iraq seeks 30,000 tons of rice on April 5, valid until April 8.

· Mauritius seeks 4,000 tons of optional origin long grain white rice on April 16 for delivery between June 1 and July 31.

· Syria seeks 39,400 tons of white rice on April 19. Origin and type might be White Chinese rice or Egyptian short grain rice.

· Ethiopia seeks 170,000 tons of parboiled rice on April 20.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.