PDF attached

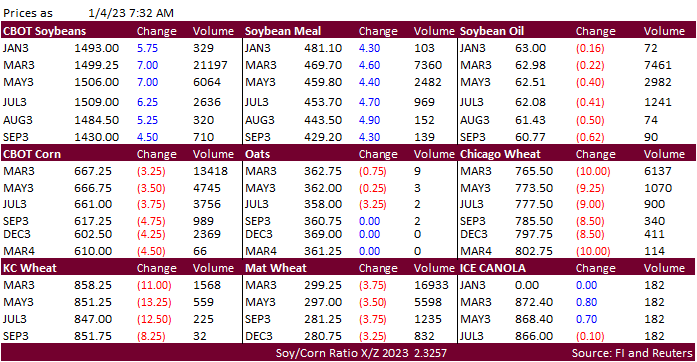

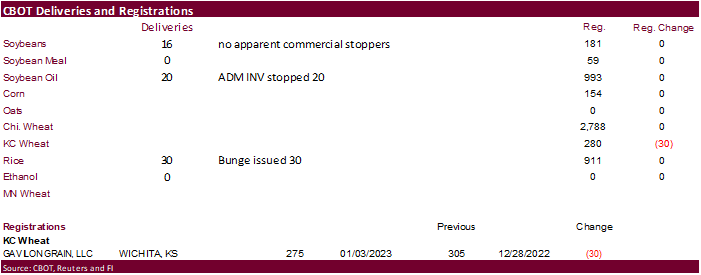

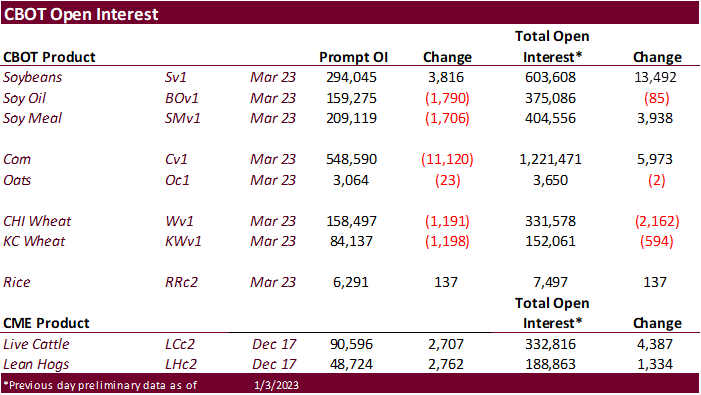

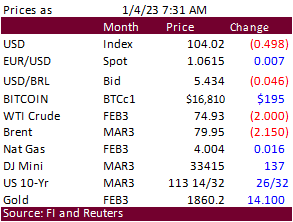

WTI crude was down more than $1.80 earlier, USD lower and US equities higher. CBOT soybeans and soybean meal are rebounding this morning. The lower trade in WTI crude oil and weakness in palm oil futures are pressuring soybean oil. Offshore values were leading SBO higher by about 67 points earlier this morning and meal $3.50 short ton higher. CBOT corn futures are lower, but a lower USD is limiting losses. US wheat futures extended losses from ongoing Russia competition and strong December Western Australia wheat exports. Three import tenders were announced overnight. Selected US states reported winter wheat crop conditions. Kansas, Nebraska, Montana, and South Dakota declined from late November, while Oklahoma and Colorado improved.

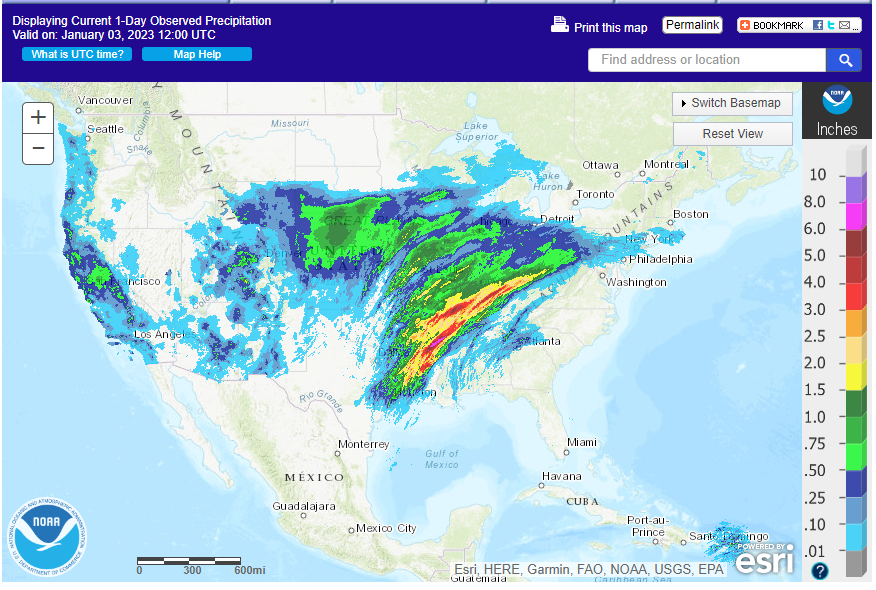

Weather

Argentina’s weather forecast turned slightly negative than that of Tuesday. Mostly dry weather is seen through Saturday. Brazil’s Santa Catarina and RGDS will see limited rain this week while the rest of the country is in good shape, with exception across parts of Mato Grosso where rain may delay harvesting progress. The Great Plains and WCB will trend drier through Friday. Eastern and central TX will see rain this weekend.

Past day

WORLD WEATHER HIGHLIGHTS FOR JANUARY 4, 2023

- Argentina weather will be drier than usual for the next ten days and temperatures will slowly rise above normal

- Excessive heat is expected in Argentina, Uruguay and a part of Rio Grande do Sul late this week, through the weekend and into early next week with highs in the middle and upper 90s to 106 with possible extremes 110 degrees Fahrenheit in Santiago del Estero causing stress to crops and livestock

- Brazil weather will continue favorably mixed in most of the nation, although Rio Grande do Sul will be dry and very warm through early next week

- Frontal system expected to move through Argentina and far southern Brazil during mid-week next week will bring cooler temperatures and “some” limited rain

- Another short term bout of heat and dryness will occur in Argentina late next week before another cool front arrives shortly after mid-month

- Central U.S. snowstorm has ended with 6-18 inches of accumulation common and local totals to 27 inches

- Nebraska and southern South Dakota were hit hardest

- Snowstorm is now in the upper Midwest where another 2 to 8 inches of accumulation is expected sending totals over 14 inches in a part of Minnesota and northern Wisconsin

- Amazingly heavy, frequent, rain will impact northern California over the next ten days with impressive mountain snowfall expected as well

- The pattern will bring relief to years of drought and water supply may improve if the forecast verifies as it should

- Central and southwestern U.S. Plains will continue drought stricken for the next ten days with no relief expected

- Europe will stay warm for the next ten days

- Western CIS crop areas will be cold over the next several days with new snow falling in snow free areas to adequately protect wheat and rye from any potential damage

- India needs rain in its winter crop areas

- Interior eastern Australia needs rain – especially in interior southeastern and south-central Queensland

- South Africa weather will remain favorably mixed for a while

Source: World Weather INC

- No major event scheduled

Thursday, Jan. 5:

- Census Trade Balance

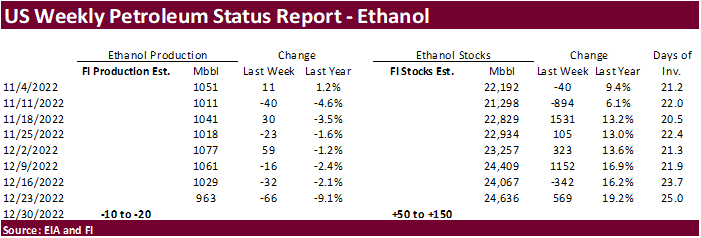

- EIA weekly US ethanol inventories, production

- Port of Rouen data on French grain exports

- Malaysia’s Jan. 1-5 palm oil exports

Friday, Jan. 6:

- FAO Food Price Index

- Net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- ICE Futures Europe weekly commitments of traders report

- CFTC commitments of traders weekly report on positions for various US futures and options

USDA inspections versus Reuters trade range

Wheat 85,672 versus 250000-450000 range

Corn 667,010 versus 650000-900000 range

Soybeans 1,462,882 versus 1500000-1865000 range

Macros

US MBA Mortgage Applications Dec 30: -10.3% (prev -0.9%)

US MBA 30YR Mortgage Rate Dec 30: 6.58% (prev 6.34%)

· CBOT corn futures are lower, but a lower USD and higher soybeans are limiting losses. The upper Midwest will see precipitation (snow) through Thursday.

· The Czech Republic reported a bird flu outbreak on a poultry farm west of Prague, resulting in the culling of 750,000 hens, largest outbreak recorded for that country.

· USDA US corn export inspections as of December 29, 2022, were 667,010 tons, low end of a range of trade expectations, below 922,142 tons previous week and compares to 759,563 tons year ago. Major countries included China for 348,414 tons, Mexico for 145,444 tons, and Japan for 69,530 tons.

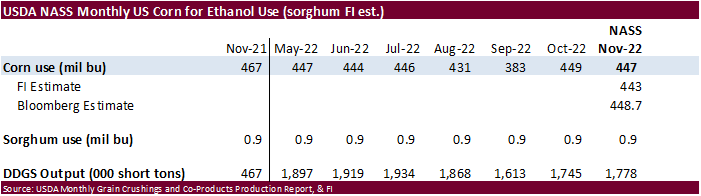

· The USDA NASS November US corn for ethanol use was near trade expectations.

Export developments.

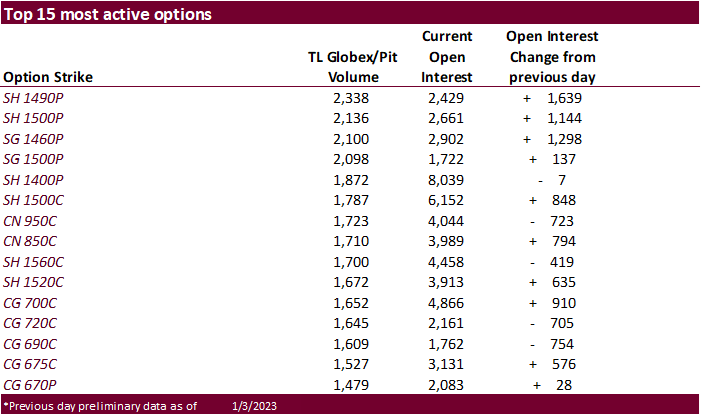

· CBOT soybeans and soybean meal are rebounding this morning over Argentina weather concerns. The lower trade in WTI crude oil and weakness in palm oil futures are pressuring soybean oil.

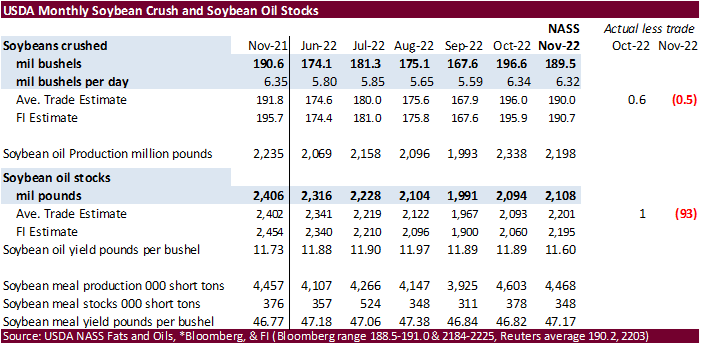

· The NASS crush was viewed slightly constructive for US soybean products and neutral for soybeans.

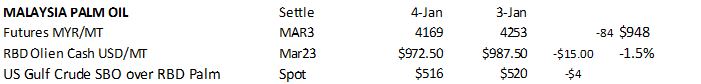

· March palm oil futures in Malaysian were down 84 ringgit to 4,169 and cash down $15.00/ton at $972.50.

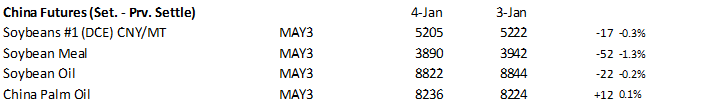

· China soybean futures were down 0.3%, meal 1.3% lower, soybean oil off 0.2% and palm up 0.1%.

· Rotterdam vegetable oils were unchanged to 10 euros lower from early yesterday morning. Rotterdam meal was mixed.

· Offshore values were leading SBO higher by about 67 points earlier this morning and meal $3.50 short ton higher.

· USDA US soybean export inspections as of December 29, 2022, were 1,462,882 tons, below a range of trade expectations, below 1,774,899 tons previous week and compares to 1,616,018 tons year ago. Major countries included China for 908,152 tons, Mexico for 132,942 tons, and Korea Rep for 60,588 tons.

· European Union soybean imports so far for the 2022-23 season that started in July reached 5.52 million tons by Jan. 1, against 6.55 million by the same week of the previous season. EU rapeseed imports reached 3.73 million tons, compared with 2.71 million tons a year earlier.

· South Korea’s state-backed Agro-Fisheries & Food Trade Corp. bought about 6,000 tons (25,000 sought) of GMO-free food-quality soybeans, optional origin for arrival between December 2023 and June 2024.

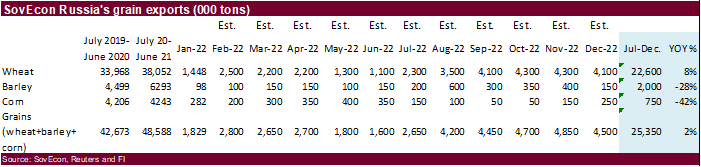

· US wheat futures extended losses from ongoing Russia competition and strong December Western Australia wheat exports. CBH Group shipped 2.18 million tons of grain during December, up from previous record of 1.89 million tons for that month. SovEcon predicted Russia will export 21.3 million tons during the first half of 2023, a record. They see January shipments for wheat at least at 3.6 million tons. US wheat inspections were poor last week.

· Selected US states reported winter wheat crop conditions. Kansas, Nebraska, Montana, and South Dakota declined from late November, while Oklahoma and Colorado improved.

· The US Great Plains was mostly dry from late yesterday. Snowfall coverage for the central GP did improve over the last three days.

· Bloomberg noted some ship insurers have altered their insurance policies for 2023 to exclude claims due to the war in Ukraine.

· SovEcon reported Russian wheat with 12.5% protein content from Black Sea ports were unchanged last week at $307-$311 per ton.

· Paris March wheat was 4.00 euros lower earlier at 299.00 euros a ton.

· EU soft wheat exports so far for the 2022-23 season that started in July reached 16.71 million tons by Jan. 1, compared with 15.79 million tons by the same week in 2021-22.

· USDA US all-wheat export inspections as of December 29, 2022, were 85,672 tons, well below a range of trade expectations, below 313,707 tons previous week and compares to 230,361 tons year ago. Major countries included Mexico for 66,773 tons, and Italy for 18,899 tons.

· Tunisia seeks 100,000 tons of soft milling wheat and 75,000 tons of barley on January 5, all optional origin. The wheat is sought for shipment between Jan. 10 and March 5, 2023, and barley between Jan. 10 and Feb. 28, 2023.

· The Philippines seek 110,000 tons of feed wheat on January 5 for Feb-Mar shipment. They are also in for barley.

· Thailand seeks up to 75,200 tons of feed wheat today for April 1-20 shipment.

Rice/Other

· Results awaited: South Korea’s state-backed Agro-Fisheries & Food Trade Corp. seeks 113,460 tons of rice on December 29 from the United States for arrival in South Korea in 2023 between Feb. 1 and June 30.

Bloomberg table on selected state winter wheat crop conditions.

Kansas: | V Poor | Poor | Fair | Good | Excel. | Excel.

Jan. 1 | 23| 26| 32| 17| 2| 19

Dec. 4 | 18 | 24| 36| 20| 2| 22

Difference | 5| 2| -4| -3| 0| -3

Oklahoma: | V Poor | Poor | Fair | Good | Excel. | Excel.

Jan. 1 | 4| 23| 35| 37| 1| 38

Nov. 27 | 12| 12| 45| 30| 1| 31

Difference | -8 | 11| -10| 7| 0| 7

Colorado: | V Poor | Poor | Fair | Good | Excel. | Good/Exc.

Jan. 1 | 5| 10| 35| 50| 0| 50

Nov. 27 | 17| 21| 32| 29| 1| 30

Difference | -12| -11| 3| 21| -1| 20

Montana: | V Poor | Poor | Fair | Good | Excel. | Good/Exc.

Jan. 1 | 1| 10| 67| 16| 6| 22

Nov. 27 | 0| 11| 45| 31| 13| 44

Difference | 1| -1| 22| -15| -7| -22

Nebraska: | V Poor | Poor | Fair | Good | Excel. | Good/Exc.

Jan. 1 | 10| 26| 46| 16| 2| 18

Nov. 27 | 16| 23| 41| 19| 1| 20

Difference | -6| 3| 5| -3| 1| -2

South Dakota: | V Poor | Poor | Fair | Good | Excel. | Good/Exc.

Jan. 1 | 5| 16| 63| 16| 0| 16

Nov. 27 | 5| 24| 44| 25| 2| 27

Difference | 0 | -8 | 19| -9| -2| -11

Source: Bloomberg

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.