PDF attached

I will be in and out of the office today tending to a personal matter.

Hurricane

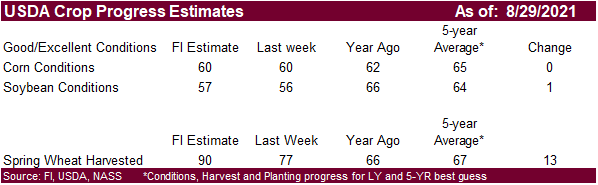

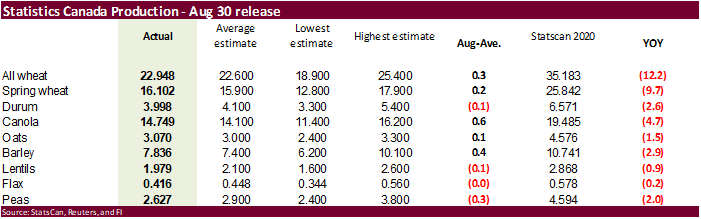

Ida is disrupting Gulf grain operations. Wheat import demand remains very strong. Some of the nearby futures spreads are collapsing. USDA export inspections were overall poor.

WASHINGTON,

August 30, 2021- Private exporters reported to the U.S. Department of Agriculture export sales of 256,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year.