PDF Attached

Higher call seen for corn and soybeans, wheat to lose ground against those committees. Hard to call it, IMO, after a three-day US holiday weekend, but have a bias for a north open. LT, we see fund net long rebuilding across the ag space. CFTC COT corn position was well off expectations.

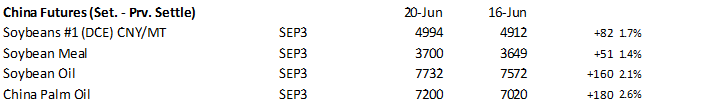

Soybeans 5-10 higher

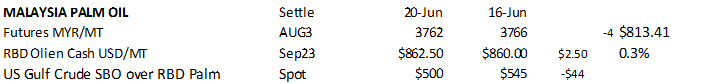

Meal $2.00-$5.00 higher (see offshore values)

Soybean oil 20-45 higher

Corn 3-6 higher

Wheat 1-5 higher

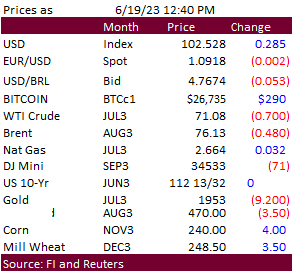

USD was up 29 points and WTI 70 cents lower as of 12:39 PM CT. Not much in the way of outside market influence for related products. However, Rotterdam meal was very strong following the rally in CBOT meal on Friday.

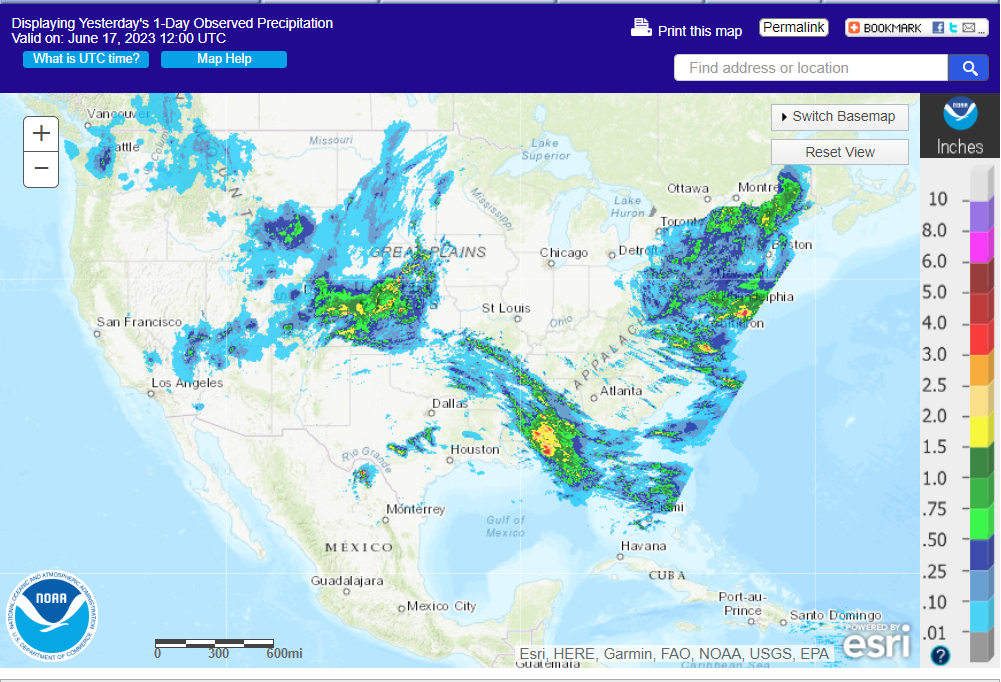

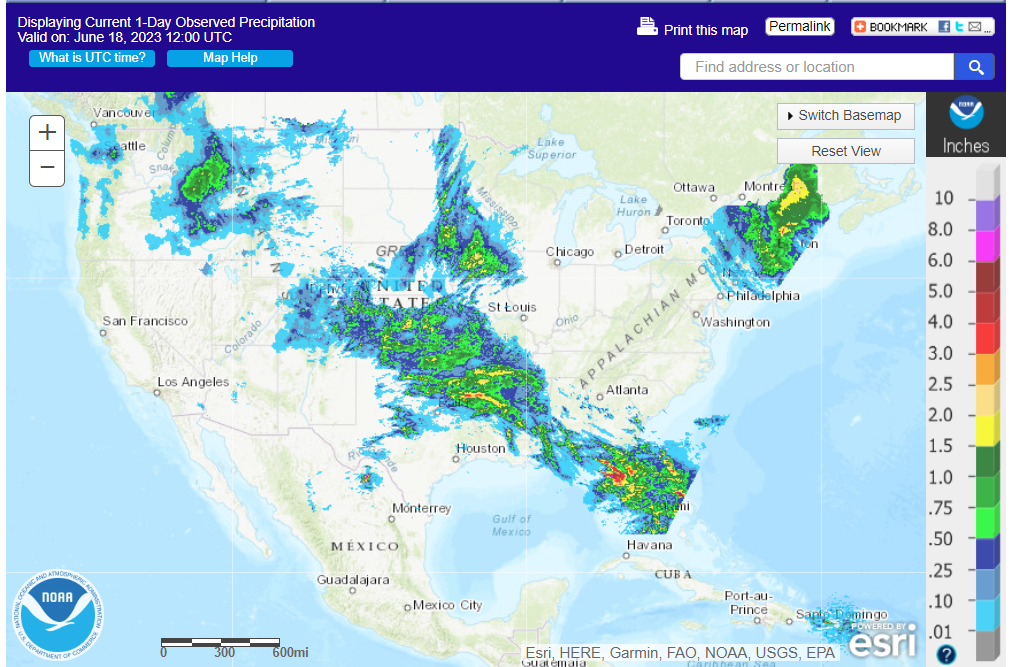

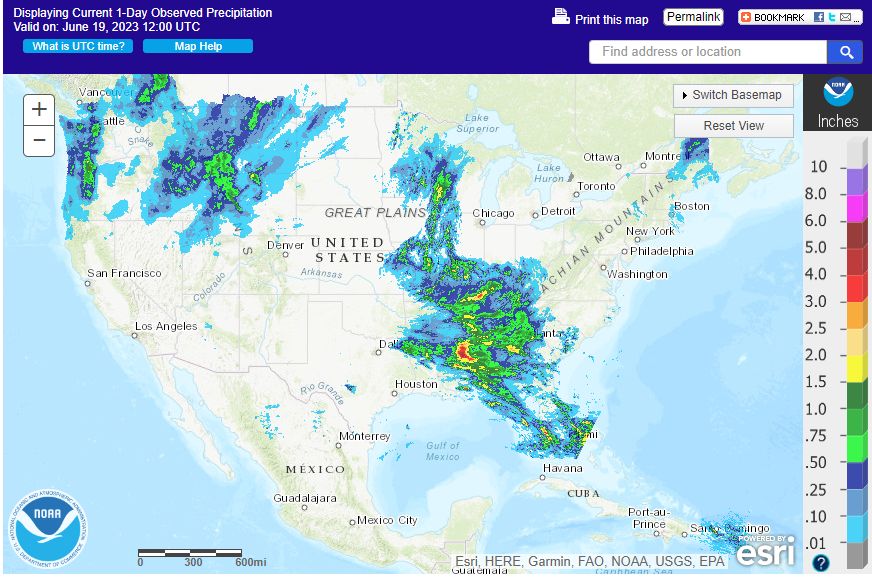

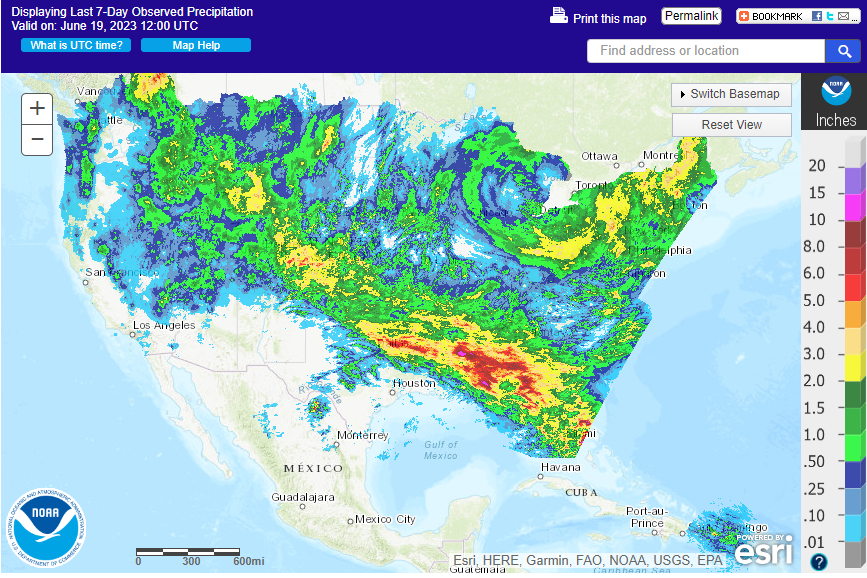

US net drying seen for the upcoming week. Here in Chicago, it was dry over the weekend. Elsewhere for the Midwest, scattered rains occurred. The trade needs a more definitive outlook on conditions post summer emergence but our observation for the upcoming USDA 7-day crop progress report is for crop ratings to decline for corn and soybeans after a lackluster rain event(s) for the “I” states over the weekend. The US WCB finally saw rain, but amounts are not close to end drought conditions. NA weather improved for the Plains and Canadian Prairies, and concerns emerged for parts of the southern Delta. Rice may benefit from the heavy rains across the Delta, but other summer crops should be monitored for that area. 7-day past US weather suggests winter wheat harvest pressure but prices for Chicago wheat should be heavily influenced by corn and soybean price action. Black Sea grain deal looks dead after Russia again said they may not extend it.

By June 21, the EPA will roll out final decisions for US mandates (RFS) for 2023, 2024 and 2025. Perception is for higher advanced fuels partially offset by lower conventional fuel versus December proposal.

Iran passed on corn and soybean meal. Algeria started buying wheat. Japan passed on wheat and barley. Mauritius bought 6,000 tons of rice. Saudi Arabia snapped up 350,000 tons of wheat from overseas farms.

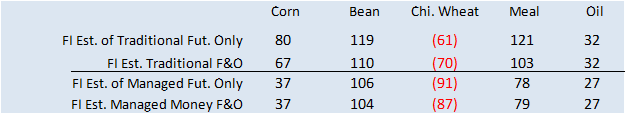

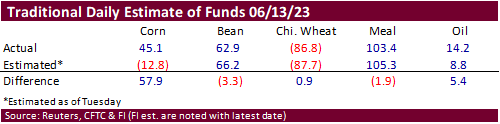

Fund estimates as of June 16 (net in 000)

June 17

June 18

June 19

7-day

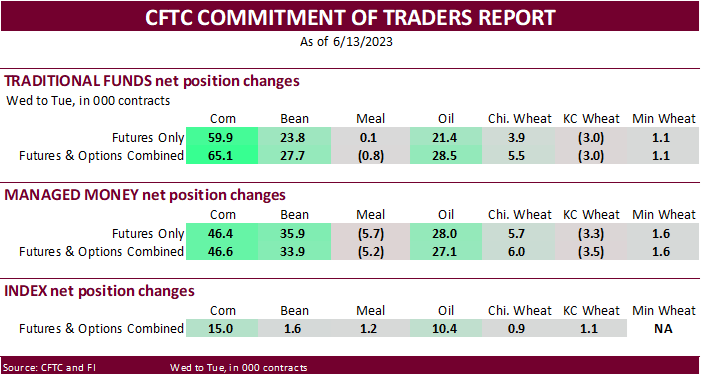

CFCT Commitment of Traders

The trade really missed it with the estimated net long position for the traditional and managed money net long position for corn.

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |