PDF Attached

Early calls:

Soybeans steady

Meal steady to $0.50 lower

Soybean oil steady 30 points higher (depends on energy open)

Corn steady to 2 lower

Wheat steady to 5 lower

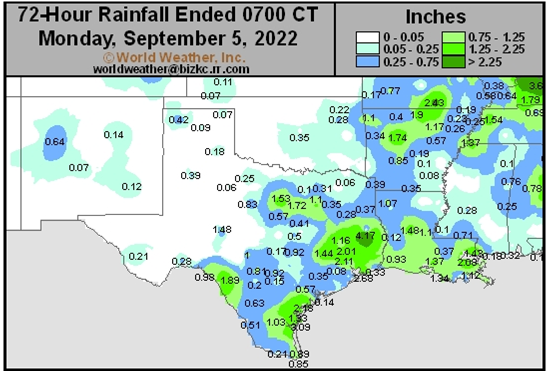

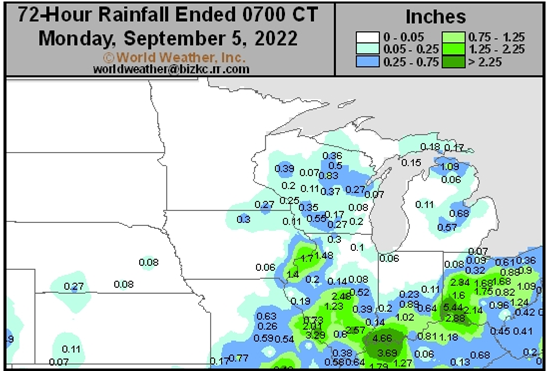

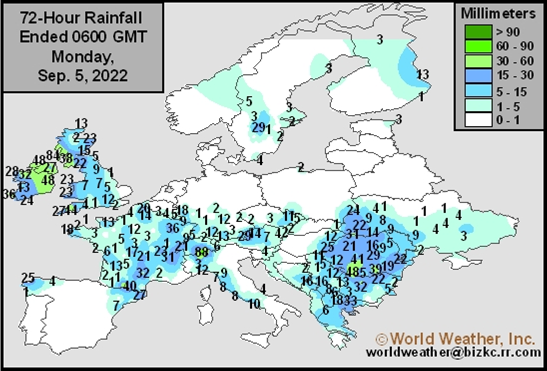

The US Great Plains bias HRW wheat country saw better than expected rains over the weekend. Western NE parts of western KS and eastern Colorado finally saw some relief. The Central Plains turned a little drier than that of Friday. Look for light precipitation, if any, to develop across the northern Great Plains and some of the west central areas through Saturday. US Midwest weekend rainfall was about expected bias ECB. This week rains are forecast drier in the northwest. SD, NE into KS. IA will see rain. Precipitation will also fall across other parts of the northern Corn Belt. The US southeast areas will see rain, slowing harvest progress and drying rates for corn. Europe saw good rain over the weekend and will see additional rain this week bias western growing areas, Poland and Romania.

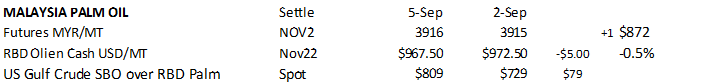

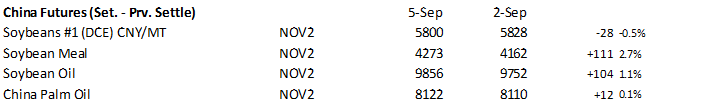

A surge in Argentina producer soybean sales over the coming days could be negative for CBOT soybean futures, but we will have to see how producers react to the “soybean dollar” in coming days. Rains across US HRW wheat country is beneficial for the upcoming US winter wheat planting season. December Matif wheat finished 2.25 euros higher at 321.75, in part to a lower euro (near a 20-year low). Matif November corn was up 0.25 to 316.25. Malaysian palm oil was up 1 ringgit and cash was down $5.00 per ton. ITS reported Sep 1-5 Malaysian palm shipments at 249,102 tons, up 17.8% from month earlier. A Bloomberg survey calls for end of August Malaysia palm oil stocks to end up near 2.05 million tons, highest in more than 2 years, and up nearly 16 percent from July. China soybean meal was up sharply by 2.7%, soybeans down 0.5%, SBO up 1.1%, and palm oil up 0.1%. China corn was up 0.1%.

Monday changes

Offshore values were leading SBO 194 points lower on Monday and meal $2.30 short ton higher.

Argentina’s central bank plans to increase its interest rate early this week, according to a Reuters article. This comes after the government announced a new exchange rate for soybean producers. The “soy dollar” allows soybean producers to convert their earnings to local currency at 200 pesos per dollar, above the official rate of 140 pesos, and may require the government to come up with more pesos to purchase dollars if liquidity immediately increases. Interest rates are at 69.5% with inflation running around 70% on an annual basis. They may increase the interest rate to 75%. AgRural reported 9 percent of the first Brazil corn crop had been planted, down slightly from 10 percent last season. But on a volume basis, plantings are running slightly above, as AgRural looks for 2022-23 1st corn production to end up near 28.2 million tons, up from 24.8 million last season. Russia’s wheat harvest reached 75 percent for 82.2 million tons expected, according to the AgMin, compared with 66.4 million tons last year.

Egypt’s GASC seeks vegetable oils on Tuesday for Oct. 20-Nov. 10 and/or Nov. 11-30 arrival. They are also in for local vegetable oils for Oct. 5-30 and/or Nov. 1-25 delivery.

Taiwan Flour Millers’ Association seeks 55,375 tons of US grade 1 milling wheat on Sept. 8 for shipment Nov. 2 and Nov. 16. Types sought include dark northern spring, hard red winter and white wheat.

Iraq bought 100,000 tons of US hard red wheat at $494.00 per ton C&F.

Bangladesh will buy 200,000 tons of rice from Myanmar in a government-to-government deal at $645.50/ton CIF for delivery within 2 months.

Source: World Weather INC

Source: World Weather INC

Source: World Weather INC

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.