PDF Attached

Happy

New Year!

A

sharply lower USD supported soybean prices. Soybean oil gain on meal and corn traded two-sided as wheat prices were lower.

Due

to the Federal holiday observed on Friday, December 31, the weekly Commitments of Traders report will be released on Monday, January 03 at 3:30pm.

WEATHER

EVENTS AND FEATURES TO WATCH

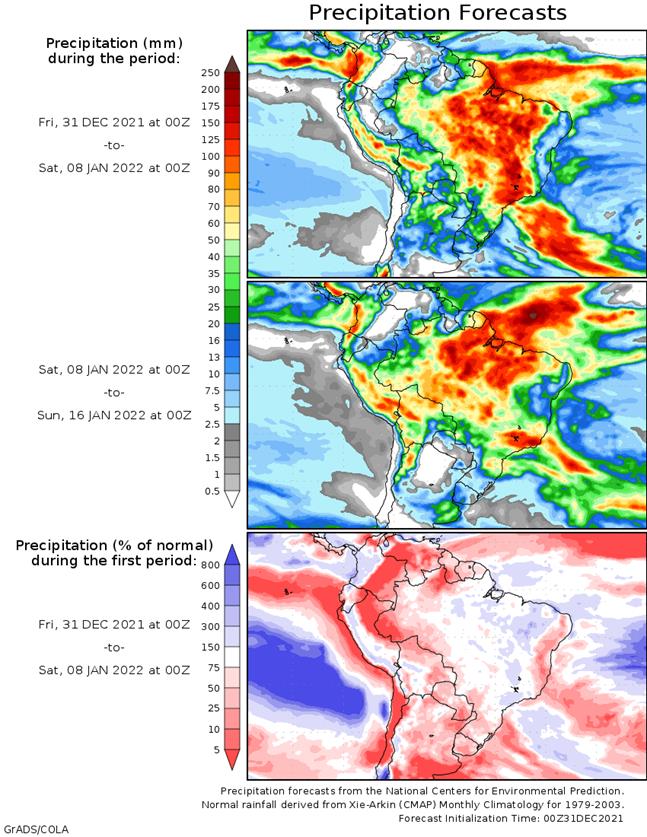

- The

ECMWF forecast model reduced some of the rainfall expected next week in southwestern Mato Grosso do Sul and Parana, but the change was needed and not that dramatic

- Too

much rain had been advertised previously - Both

areas that have been dry for an extended period of time will get some periodic rain in this coming week with next week wettest - The

precipitation will improve topsoil moisture and induce some better crop development for a while - Brazil’s

January weather outlook continues to promote below average precipitation in the far south and abundant to excessive rainfall in a part of the north (especially northeastern Mato Grosso to Bahia, Minas Gerais and northern Sao Paulo) - The

trend is classic La Nina and despite the changes expected in this coming week the trend of La Nina will prevail - The

key for southern Brazil crop development will be in the timeliness of rainfall in the next few weeks and not in the amount - Temperatures

in January will only be slightly warmer than usual for crop areas near the Paraguay and Argentina borders while near to slightly below average elsewhere in Brazil - Rio

Grande do Sul, Brazil will be caught up in the lighter than usual rainfall pattern of Argentina and Paraguay during the month of January and more threats to summer crop yield are expected - Brazil’s

is certainly being impacted by La Nina in a very traditional manner this year with dryness in the south and too much rain in the north - La

Nina is peaking now, but will be slow to abate and that will likely perpetuate some of these tendencies into late January - Dryness

in the south will not completely go away, but it will be eased in the first week of January - Below

average precipitation will continue during January, but there will be some timely rainfall continuing outside of Rio Grande do Sul, western Santa Catarina, southwestern Parana and southwestern Mato Grosso do Sul - The

wetter areas in January should be in parts of northern Sao Paulo, Minas Gerais, central and northern Goias, parts of Tocantins, southwestern Bahia and northeastern Mato Grosso - Some

delay to harvesting of soybeans is expected, but World Weather, Inc. expects the early soybean harvest to advance around the wettest conditions and planting of Safrinha crops will proceed as well - Field

progress will be slowed at times and there will be some crop quality issues in the wetter areas of the north - Safrinha

corn and cotton prospects in Brazil are still very good – at least from World Weather, Inc.’s perspective - Argentina’s

key summer crop areas are still dealing with good soil moisture and crop conditions, despite recent drying - The

next two weeks will be more challenging to crops from southern Cordoba to central Buenos Aires and in parts of San Luis, La Pampa and southern Santa Fe - Argentina’s

minor grain and oilseed areas in the north and east are too dry today, but showers expected late this week into next week will offer a short term bout of relief - Much

more rain will still be needed, though and a close watch on the rainfall and temperature outlook through January is warranted - World

Weather, Inc. anticipates lighter than usual rainfall and warm temperatures for much of the nation in January, but there will still be some timely showers - Today’s

Argentina forecast still offers some periodic shower and thunderstorm activity in the coming week that should help bring along a little stress relief after recent drying and Thursday’s very warm temperatures - Showers

do not begin significantly until late in the weekend with Sunday through Tuesday wettest

- After

that several days of dry and warm weather are expected again before the next bout of rain arrives - The

rain will not fully restore soil moisture to normal, but it will moisten the topsoil from time to time and offer some favorable crop development; however, much of the rain will not fix long term moisture deficits leaving the door open wide for more crop stress

later this summer - January

weather should bring a ridge of high pressure to the nation, but it will not be strong or very persistent - Nevertheless,

the ridge will bring back a period of very warm temperature and limited rainfall that could stress those crops that fail to get a good boost in soil moisture during this more unsettled period of weather in the coming week - Argentina

temperatures Thursday were quite warm to hot in the central and north with widespread upper 90- to lower 100-degree highs - Most

of the region reported highs of 96 to 104 with Santiago del Estero reaching 110 - Cooling

will accompany a boost in shower activity later this weekend and next week, but the next couple of days will be quite stressful for crops that have limited soil moisture

- Paraguay

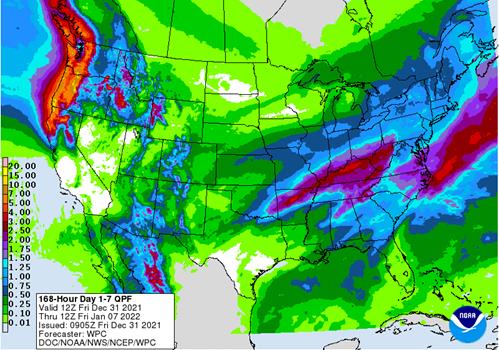

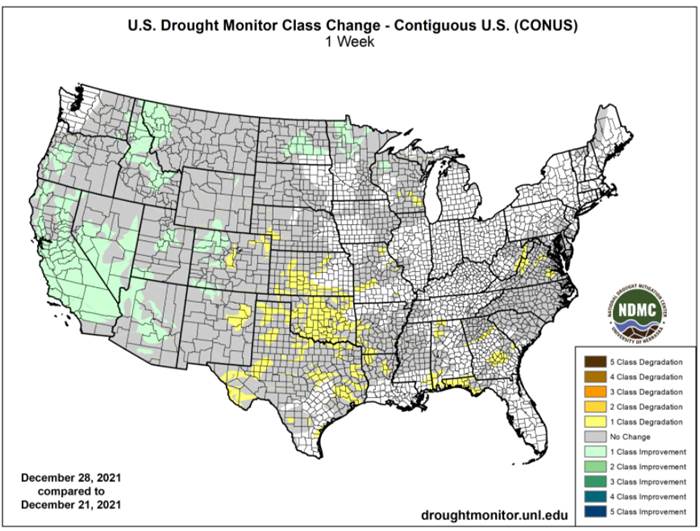

may end up suffering the greatest production cuts in 2021-22 because of poor rainfall and warm to hot temperatures - U.S.

hard red winter wheat areas will get some snow later today into Saturday to help protect winter wheat against a quick shot of bitter cold air expected Saturday and Sunday - Extreme

lows will fall to the negative and positive single digits Fahrenheit - There

is some concern that snowfall will be lighter than predicted for a few areas

- Drought

remains in the region and moisture availability will be low in the high Plains region - Snow

will still fall, but a close watch on its distribution is warranted to make sure there are no surprises - With

all of that said, World Weather, Inc. is not expecting a serious threat for wheat damage - Some

wheat damage may have occurred this week in South Dakota and Montana because of bitter cold and restricted snow cover in “some” areas, but any loss has been very light - The

snow event in the U.S. Midwest for this weekend has been consistently forecast in the past two days - Snow

accumulations of 3 to 9 inches will occur from a part of northern Kansas and southeastern Nebraska to southern parts of Lower Michigan and northern Ohio - A

few amounts greater than 10 inches will be possible - Rain

will fall significantly in the Ohio River Valley and especially in Kentucky where 1.00 to 3.00 inches and local totals to 4.00 inches will be possible - North

America Weather pattern not showing much signs of change - U.S.

hard red winter wheat production areas and most of the northwestern Plains will continue to receive less than usual precipitation through the first half of January - West

Texas cotton, corn and sorghum areas are quite dry and need rain, but not much moisture is expected for quite a while - Some

brief showers will occur this weekend without a lasting boost in soil moisture - Waves

of cold air will keep parts of Canada’s Prairies, the northern U.S. Plains and some areas in the western United States cold biased through the next two weeks - Cooling

will occur a little more significantly in the Plains and Midwest during the second week of January raising the potential for stronger heating fuel demand in the in those areas and more stormy weather in the eastern U.S.

- The

air may moderate in the second half of January once again, but a cold finish to winter is still possible for the eastern U.S. - Canada

Prairie’s cold weather bias will continue through mid-January, despite warming this weekend and early next week - Soil

moisture remains critically low in a large part of western and central Saskatchewan and southern and east-central Alberta, Canada, although at this time of year that really does not matter much - California’s

snow water equivalency is now above average throughout the Sierra Nevada for this time of year

- Northern

areas are reporting 145% of normal snow water equivalency - Central

areas are reporting 162% of normal snow water equivalency - Southern

areas are reporting 167% of normal snow water equivalency - Relative

to the April 1st average peak of the snow season snow water equivalents are 50-56% of what they should be by that time - U.S.

Pacific Northwest snow water equivalency is 84-116% of normal with the exceptions of western and southern Oregon and south-central Idaho where it is 120 to 154% of normal - Nevada

snowpack is above average, too - Most

of the central and northern Rocky Mountains are also reporting near normal snowpack

- Dryness

remains in northeastern and north-central Wyoming, central Montana and in southeastern Colorado - The

greatest snow drought remains in some of the mountains of New Mexico - Eastern

U.S. weather may trend stormy in second week of January - A

subtropical cyclone is expected to evolve in the next couple of days off the eastern Queensland, Australia coast

- The

storm produced heavy rain in the Cape York Peninsula earlier this week, but the system is moving far enough from land to begin reducing its influence

- The

storm will actually help suppress rainfall in eastern Australia during the coming week as it move southeast well off the east coast - Australia’s

weather will be unusually dry and warm to hot over the next week - Rapid

drying is expected and the need for rain will be steadily rising in livestock and summer crop areas of the east - The

hottest weather is expected in the west and it will persist longest in that region as well - Crop

moisture stress is already rising in western summer crop areas of both Queensland and New South Wales - Excellent

late season barley and wheat harvest conditions are expected in the south - East-central

Australia will get some needed rain next week, although it will be somewhat limited

- The

moisture will be welcome, but not widespread enough to benefit all of the dry areas - India’s

weather will trend dry or mostly dry through early next week and then another bout of rainfall is possible - Rain

that fell earlier this week was great for pre-reproductive winter crops - Rain

coming during the middle to latter part of next week will help further improve crop conditions and raise production potentials, but yields will be largely determined by February weather - La

Nina should favor a better than average production year for many crops - Harvesting

in southern India will continue to advance without much precipitation - North

Africa precipitation will continue restricted for the coming week - A

boost in precipitation is needed most in southwestern Morocco and northwestern Algeria, but precipitation would be welcome in all areas - The

second week of the outlook may bode better for rain in the drier areas - Southeast

Asia precipitation will continue to occur routinely in Indonesia, Philippines and Malaysia during the next two weeks, although precipitation intensity should decrease in Indonesia and Malaysia for a little while - Southern

Philippines rainfall will be heaviest in this first week of the outlook - Some

heavy rain already occurred Tuesday - Central

Vietnam coastal areas will experience frequent rain Thursday into early next week with some heavy precipitation in a few areas that might result in some flooding - China’s

weather will continue typical of this time of year with relatively dry and cool conditions in the north, some periodic snow in the far northeast while waves of rain and some snow fall in the Yangtze River Basin and areas southward - Russia’s

widespread snow cover will and frequent precipitation pattern in the next two weeks will leave winter crops adequately protected against any harsh weather that evolves and the same is true of Ukraine, Belarus and the Baltic States - Europe

weather will be relatively active during the next two weeks maintaining good field moisture for crop use in the spring - Temperatures

will be warmer than usual in most of the continent - There

is need for greater rain in parts of Spain, although some areas in the nation will get needed moisture in this coming week - South

Africa weather will be mostly well mixed over the next two weeks, although the western parts of summer crop country will be a little drier biased for a while - Temperatures

will be seasonable - West-central

Africa precipitation will be limited to coastal areas and temperatures will be a little warmer than usual - Middle

East precipitation is expected to be a little better distributed over the next couple of weeks with western Iran getting the most significant rain along with parts of western Turkey - Other

areas will get mostly light and sporadic rainfall – all of which will be welcome, but more will be needed for better crop establishment - Portions

of the region are drier than usual - Northwestern

Mexico will get some welcome rain in northwestern parts of the nation in the late this week and into the weekend - The

precipitation will be welcome to some winter crops and for water supply, although much more will be needed over the winter to ensure the best winter crop performance - Central

America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica - East-central

Africa rainfall is expected to be light to moderate with western Ethiopia, Uganda, southwestern Kenya and western Tanzania getting rain most often. - Some

western Ethiopia areas will be wettest relative to normal as will be some southern Uganda and southwestern Kenya locations - Western

Colombia and western Venezuela precipitation is expected to occur periodically in coffee, corn, rice and sugarcane production areas during the next ten days, but no excessive rain is expected - Today’s

Southern Oscillation Index was +13.07 and it was expected to stay strongly positive this weekend - New

Zealand rainfall will be lighter than usual during the coming week while temperatures are near to above normal - A

boost in rainfall is possible next week

Monday,

Jan. 3:

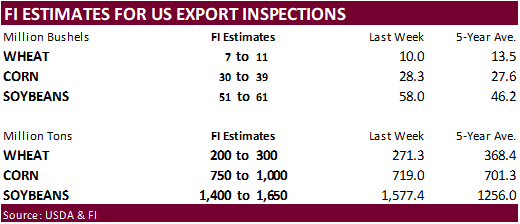

- USDA

export inspections – corn, soybeans, wheat, 11am - CFTC

and ICE commitments of traders reports (delayed from Dec. 31) - Honduras

and Costa Rica coffee exports - Global

cotton balance report from the International Cotton Advisory Committee - USDA

soybean crush, DDGS production, corn for ethanol, 3pm - Ivory

Coast cocoa arrivals - HOLIDAY:

U.K, New Zealand, Thailand, Russia, Japan, China, Canada, Australia

Tuesday,

Jan. 4:

- EU

weekly grain, oilseed import and export data - Australia

Commodity Index - Purdue

Agriculture Sentiment - HOLIDAY:

New Zealand, Russia

Wednesday,

Jan. 5:

- EIA

weekly U.S. ethanol inventories, production - Malaysia’s

Jan. 1-5 palm oil exports - HOLIDAY:

Russia

Thursday,

Jan. 6:

- FAO

World Food Price Index - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - HOLIDAY:

Russia

Friday,

Jan. 7:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - HOLIDAY:

Russia

Source:

Bloomberg and FI

·

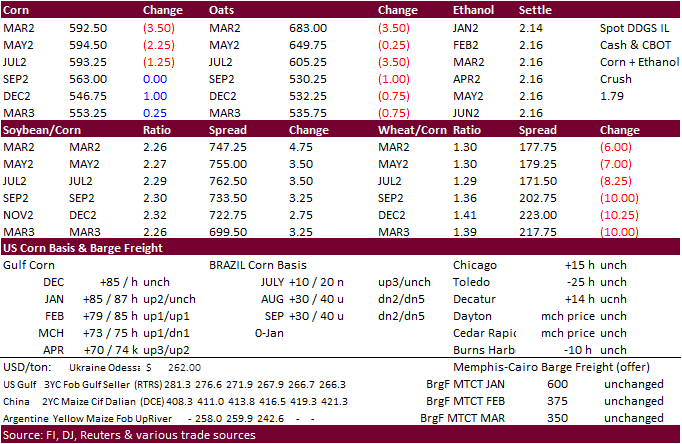

CBOT corn ended lower in the front four months on improving SA weather and lower wheat. News was light. WTI crude oil sold off, with February down $1.71 by 1:45 pm CT.

·

China’s reported its sow herd at the end of November was 4.7% higher than the previous year at 42.96 million head, and down 1.2% from the previous month. Abattoirs with annual production capacity at 20,000 heads and above slaughtered

235.89 million pigs in the first 11 months of the year, up 66.1% from a year ago, according to data reported by Reuters. The net profit of raising pigs on large farms was at 293 yuan ($45.97) per head in November, down 187.3% from the previous month. The value

was also down 69% from a year ago, according to the data. (Reuters)

Export

developments.

·

None reported

Updated

12/9/21

March

corn is seen in a $5.50 to $6.20 range

·

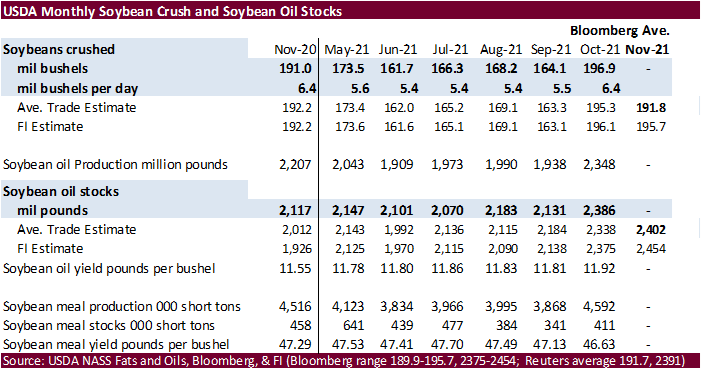

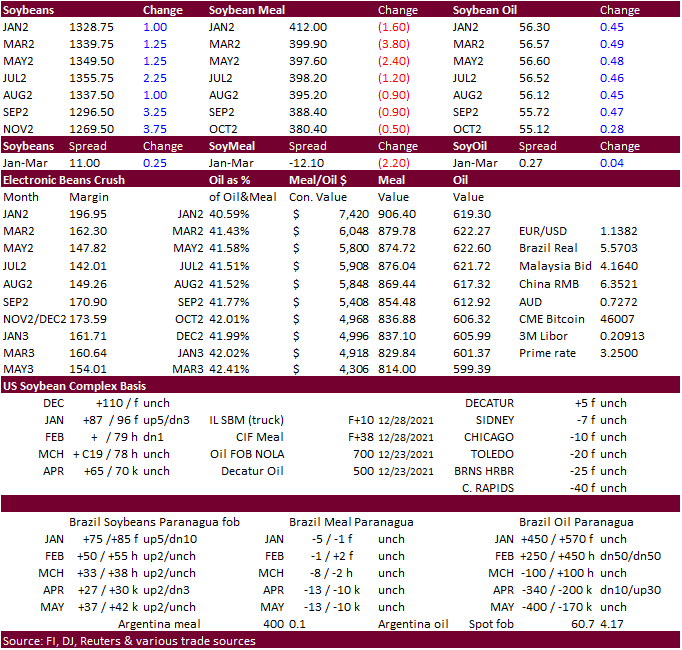

Higher trade in US soybeans despite lower outside markets and improving SA weather. Soybean saw its best monthly gain of the year. SBO gained on meal in part to better than expected SBO for biofuel feedstock production for the

month of October. Soybean meal fell on product spreading.

·

January soybean crush traded at a session high of $2.0650, highest for that position, ending at $2.03. March crush went out at $1.62.

·

The USD traded sharply lower, hitting its lowest level since November 30.

·

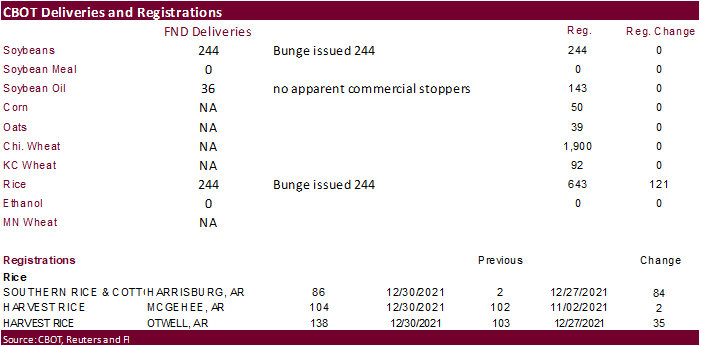

Deliveries in beans were a little heavier than expected at 234 contracts by Bunge and being stopped by the street. Oil deliveries were lighter than expects at only 36 contracts, mostly all local holdings.

·

Cargo surveyor AmSpec reported Malaysian Dec 1-31 palm exports at 1.492 million tons, 5.1% below the same period a month ago of 1.572MMT.

·

Cargo surveyor ITS reported Malaysian palm exports at 1.581MMT, 5.3 percent below 1.669MMT from the same period a month ago.

·

Malaysian palm oil futures were up nearly 31 percent in 2021.

·

Malaysian palm futures were down 12 ringgit to 4683 and cash was unchanged at $1,177.50/ton.

·

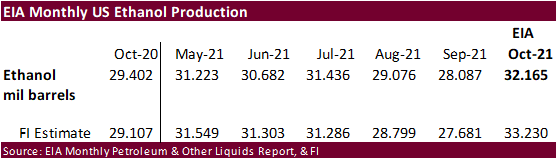

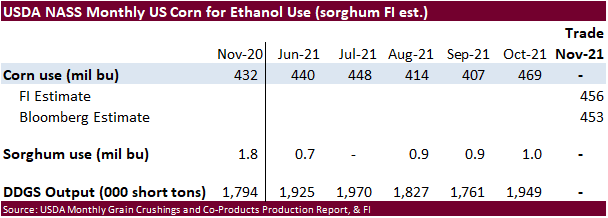

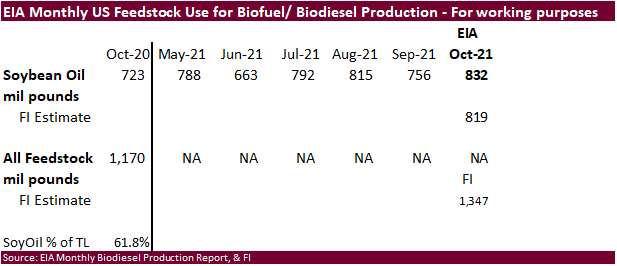

EIA’s October biofuel feedstock report showed soybean oil use better than expected at 832 million pounds, above 756 million previous month and above 723 million for October 2020. We are standing at 11 billion pounds for biofuel

feedstock use, up from our working 8.639 billion for 2020/21 (USDA currently 8.850). We look for USDA to make a revision to 2020-21 biofuel feedstock use.

Export

Developments

·

The CCC seeks 12,000 tons of soybean oil on Jan 5 for Feb 5-15 delivery for the Dominican Republic.

Updated

12/30/21

Soybeans

– March $12.00-$13.75

Soybean

meal – March $345-$415

Soybean

oil – March 51.00-59.00

·

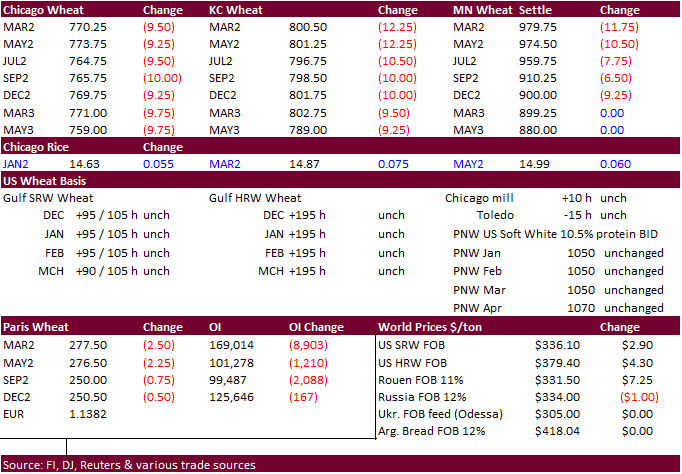

EU wheat basis the March position closed 0.9% lower at 277.50 euros ($314.30) a ton. For the year EU wheat was up 30 percent.

·

Ukraine exported 32.2 million tons of grain in the first half of the 2021-22 July-June season, up 23.5% from a year ago. That included 15.8 million tons of wheat, 5.2 million tons of barley and 10.8 million tons of corn.

·

China plans to sell 50,000 tons of wheat from state reserves on January 5 to flour millers. The sold an estimated 891,938 tons of wheat from reserves in October.

·

Jordan’s state grain buyer seeks 120,000 tons of milling wheat, optional origins, on Jan. 5, for shipment in 2022 between July 1-15, July 16-31, Aug. 1-15 and Aug. 16-31.

·

Iraq seeks 50,000 tons of wheat on January 3 from the US, Canada and Australia.

Rice/Other

·

Results awaited: Bangladesh

seeks 50,000 tons of non-basmati parboiled rice for delivery 50 days from contract award and letter of credit opening.

Updated

12/9/21

Chicago

March $7.40 to $8.60 range

KC

March $7.55 to $9.00 range

MN

March $9.50‐$11.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.