PDF Attached

WASHINGTON,

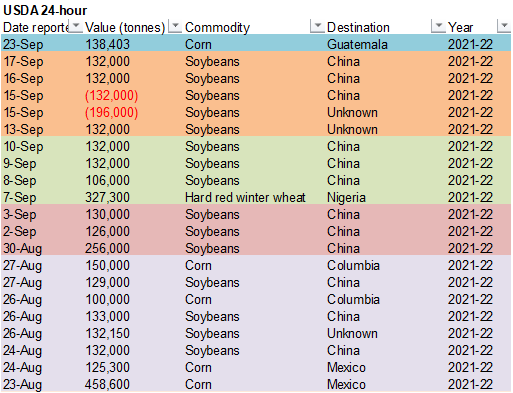

September 23, 2021–Private exporters reported to the U.S. Department of Agriculture export sales of 138,403 metric tons of corn for delivery to Guatemala during the 2021/2022 marketing year.

Higher

trade led by wheat on improving global import demand and sharply lower USD. That and crop concerns lifted corn higher. Soybeans were supported by soybean oil and higher wheat.

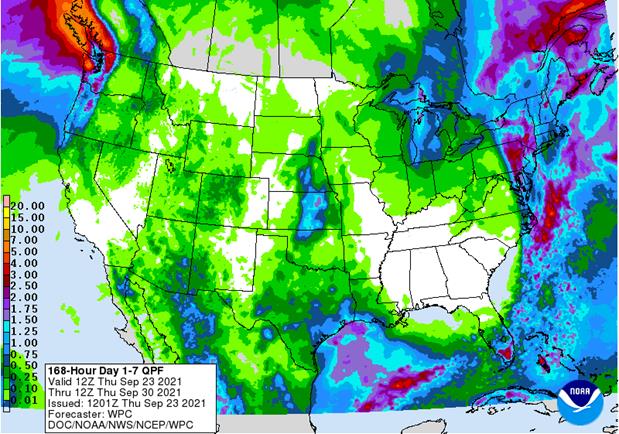

7-day

MOST

IMPORTANT WEATHER FOR THE COMING WEEK

- Russia’s

Volga River Basin is receiving needed moisture today and some of it will linger into Monday with 0.25 to 0.75 inch of rain resulting and a few amounts to 1.25 inches

o

The moisture is badly needed with top and subsoil moisture rated very short

o

The precipitation will offer a temporary reprieve from dryness, but will not be a fix all

- Improved

seed germination, emergence and establishment conditions should result

o

Drier biased weather resume and last for a full week thereafter

- Some

areas in Ukraine would benefit from greater rain as would Russia’s Southern Region, but these areas will not be completely dry during the next two weeks and winter crops will emerge and establishment regardless

- Russia

and Ukraine summer crop harvest progress will be slowed by this week’s rain - China’s

Yellow River Basin and North China Plain will experience a new round of frequent moderate to heavy rainfall during the coming week stalling winter crop planting and summer crop harvest progress

o

Some flooding will be possible, but damage to crops should be mostly low

o

A little replanting of wheat may be needed in the wettest areas, although the planting season has just begun and there is not likely much fieldwork that has already been completed

o

China’s minor cotton production areas in the Yellow River Basin will experience a decline in crop quality because of the coming week of rain

- Xinjiang

China weather will not be ideal during the next ten days

o

Rain will fall periodically in northeastern parts of the province causing a rise in cotton fiber quality concerns

o

Cold temperatures in the northeast should not be a problem since the crop is already being defoliated

o

Cotton in central and western production areas of Xinjiang will continue to mature more favorably with limited rain

- Cold

weather is expected at the end of next week and into the following weekend which may bring on a little frost - Other

areas in China will experience a mostly favorable weather pattern, although drying is needed in the northeastern provinces and across the interior southeast - India’s

monsoon should begin to withdraw from the far north next week and more definitively in the first week of October

o

The delayed withdrawal of seasonal rainfall will be good for rapeseed, millet, wheat and other winter crop planting

o

Some delay in summer crop maturation and harvest has occurred because of wet weather and a few crops may be suffering a quality decline because of too much moisture

- Cotton

fiber quality declines have likely impacted a part of the far north; including Punjab, Haryana and neighboring areas - Eastern

Australia’s forecast turned wetter today for the second week of the forecast. If the outlook is correct some badly needed rain may impact Queensland and New South Wales

o

The moisture will be good for reproducing winter crops in New South Wales and improve planting moisture for cotton and sorghum in Queensland

- Confidence

is high over rainfall in early October, but low on how much rain should be expected - Eastern

U.S. weather will improve starting today after too much rain in recent days

o

The past week has been quite wet in the Delta and the past several days have also been wet in the Tennessee River Basin, the Carolinas, Virginia, Georgia and the entire eastern Midwest

- Indiana,

Ohio eastern Michigan, Virginia and the Carolinas have reported the most excessive rainfall in recent days and drier weather expected in this coming week to ten days for parts of the region will be ideal for improving summer crop maturation and harvest conditions - U.S.

hard red winter wheat areas are still advertised to receive rain during mid-week next week with a follow up rain event during the following weekend

o

World Weather, Inc. still believes the wet weather advertised is overdone

o

Future model runs are likely to greatly reduce the early October rain event and should ease up on showers expected during mid-week next week as well

o

Totally dry weather is not expected, but a good distribution of rain is not likely especially in the high Plains region

- Canada’s

Prairies, the northern U.S. Plains, the northern Rocky Mountains region, California and the interior Pacific Northwest are not expecting to see much “significant” rainfall over the next ten days

o

Many of these areas will experience net drying

o

Concern over winter wheat planting, emergence and establishment will occur again this year in Canada and the northwestern Plains

- The

same is possible in the Pacific Northwest, although that region should have a little better potential for significant moisture over time.

- U.S.

Midwest crop weather will be favorably dry through early next week and then rain is expected in the second half of the week

o

Resulting amounts will be light and the duration of rain brief enough to limit the impact on harvest progress

- The

best harvest environment will continue in the western Corn Belt - U.S.

Delta and Southeastern States will experience the best drying conditions over the next week to ten days - Tropical

Depression 18 in the central tropical Atlantic Ocean will become tropical storm Sam later today and the storm is expected to become a hurricane this weekend and possibly a strong hurricane next week

o

The storm’s path is such that it should stay over open water in the Atlantic passing to the northeast of the northern Leeward Islands during the middle part of next week and then threatening Bermuda before turning to the northeast

in the early days of October.

- Tropical

Depression Peter dissipated and Rose will do the same in the next couple of days - Remnants

of Tropical Storm Odette will continue to wander through the open water of the north-central Atlantic Ocean and will not bring a threat to land - A

wave coming off the West Africa coast will be closely monitored for possible development into a tropical cyclone this weekend or next week

o

The system should pass to the northeast of northern Leeward Islands and poses no threat to North America through at least the latter part of next week

o

Further intensification is possible once it becomes a tropical cyclone

- Tropical

storm Dianmu was moving inland over Vietnam this morning and was located 82 miles southeast of Da Nang at 1434 GMT today.

o

The storm will produce heavy rain over a part of Vietnam’s Central Highlands as well as other central Vietnam and Laos locations today and in Thailand Friday

- Rainfall

will vary from 2.00 to more than 6.00 inches across many of these areas, although Thailand rainfall will likely be lighter and a few areas in northern Cambodia will also be impacted by significant rain from the storm - Tropical

Storm Mindulle was located near Guam today and was expected to intensify to typhoon intensity over the next few days as it moves northwesterly over open water. The storm will move toward Japan next week, but may turn to the northeast prior to making landfall

over Honshu

o

If this path verifies, Japan should be spared from the storm’s intense wind and torrential rainfall, but it will need to be closely monitored

- Ontario

and Quebec, Canada received heavy rainfall Wednesday and more is expected today

o

Rain totals of 1.00 to 2.50 inches have either occurred or soon will occur resulting in saturated field conditions and notable delays to summer crop harvesting and winter crop planting

o

A follow up system will bring more showers during the weekend before next week trends drier

- Argentina

reported rain in Buenos Aries Wednesday

o

Amounts reached 1.50 inches in central parts of the province while other areas received less than 0.25 inch of moisture

- Brazil

weather was dry Wednesday

o

Highest afternoon temperatures were in 95 to 108 Fahrenheit in center west and northeastern crop areas while more seasonable farther to the south

- Brazil

will continue very warm to hot in the center west and center south into the weekend

o

Showers will occur in the far south, but significant moisture will not be very great

o

Showers will develop in center west and center south this weekend and continue periodically next week

- Sufficient

rain will fall in “a few” areas to lift topsoil moisture for better early season soybean and early corn planting. Greater rainfall will still be needed before aggressive fieldwork can begin; however, any precipitation will be better than none.

- Rain

is advertised to increase in many areas during the final days in September and especially the first week in October - Argentina

is not likely to see much precipitation for a while, but showers will pop up from time to time next week offering some moisture for a part of the nation

o

Significant rain is needed in the north and west-central crop areas

- Europe

weather in the coming week is expected to be favorably mixed with a little rain and more sunshine. Southern parts of the continent will be wettest

o

Next week’s weather is expected to be wetter biased in France, the U.K., Germany and northern Italy

o

Eastern Europe will be drier than usual next week

o

Temperatures will be near normal this week and then cooler than usual in the west and warmer usual in the east

- Belarus,

southwestern Russia and parts of Ukraine received some significant rain over the past week and lingering showers are expected through the weekend

o

The precipitation will be lighter than that which has been occurring, but still beneficial in ensuring much improved winter wheat, rye and barley establishment in areas that were considered too dry a week ago

- Data

from the southwestern Russia and its upper and middle Volga River Basin area has confirm 1.50 to more than 4.00 inches of rain over the past week - Much

lighter rain has occurred in farther to the east and north as well as in Ukraine, but rain will impact the Volga Basin through the weekend - Central

Africa rainfall will occur favorably over the next two weeks

o

Sufficient rain will fall to support normal coffee, cocoa, sugarcane, rice and other crop development from Ethiopia to northern Tanzania and from Ivory Coast to Cameroon and Nigeria

- South

Africa weather through early next week is not likely to have much precipitation in it

o

Showers will develop in the central and east next week

- Southeast

Asia rainfall is expected to be frequent and sufficient to support long term crop needs and boost runoff for winter water supply

o

This is true for the mainland areas as well as Philippines and a part of both Indonesia and Malaysia

o

Tropical Cyclone Dianmu will enhance rainfall in the mainland areas of Southeast Asia starting today and continuing through the weekend

- Mexico

precipitation will continue frequent this week, but it will turn drier next week

o

Most of this week’s rain will concentrate on western and southern parts of the nation while the northeast is dry biased.

o

Rain next week will be limited a few showers in the west and more generalized rain in the far south

- Today’s

Southern Oscillation Index was +9.79 and will likely move lower over the next few days - New

Zealand weather will include some periodic rainfall favoring western parts of South Island

o

Temperatures will be near to below average

Source:

World Weather Inc.

Thursday,

Sept. 23:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - Globoil

India – international vegetable oil conference, day 1 - The

UN Food Systems Summit - USDA

red meat production, 3pm - Port

of Rouen data on French grain exports - HOLIDAY:

Japan

Friday,

Sept. 24:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - Globoil

India – international vegetable oil conference, day 2 - FranceAgriMer

weekly update on crop conditions - U.S.

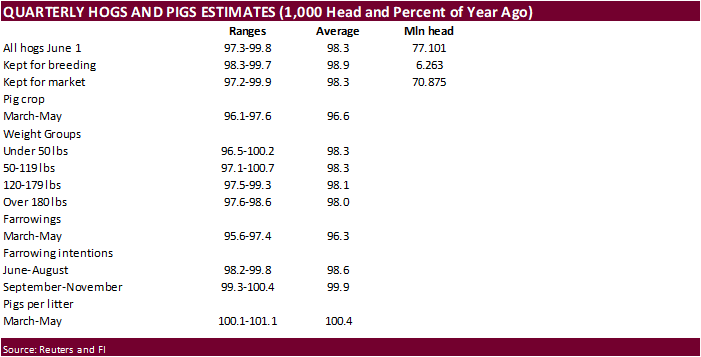

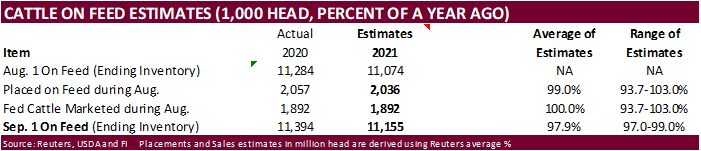

cattle on feed, hogs and pigs inventory, poultry slaughter, 3pm

Saturday,

Sept. 25:

- Globoil

India – international vegetable oil conference, day 3

Source:

Bloomberg and FI

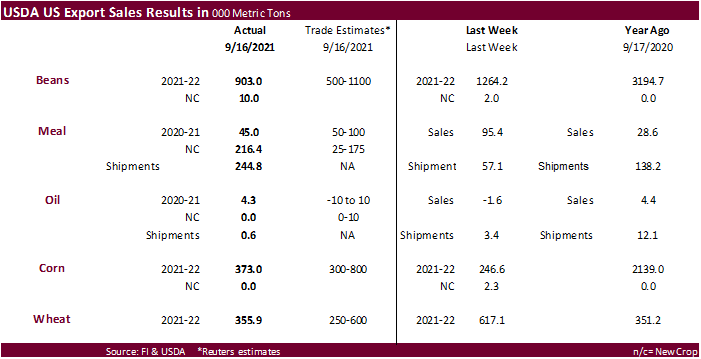

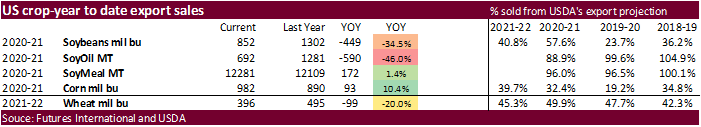

USDA

soybean export sales of 903,000 tons were within expectations and included China (624,200 MT, including decreases of 132,000 MT), Mexico (85,300 MT, including 47,500 MT switched from unknown destinations and decreases of 1,300 MT), and Egypt (58,000 MT).

Soybean commitment are running 34.5% below the same period a year ago. Soybean meal old crop sales were 45,000 tons but new-crop was good at 216,400 tons. On top of that shipments of meal were 244,800 tons, supportive. Soybean oil sales were only 4,300

tons and shipments 600 tons. Corn export sales were 373,000 tons, low for this time of year (2.139MMT were sold a year earlier). Corn commitment this season are running 10.4% above this time last year. All-wheat sales slowed to 355,900 tons from 617,100

tons previous week but were within a range of expectations. Pork sales were 32,600 tons.

Macros

77

Counterparties Take $1352.483 Bln At Fed’s Fixed-Rate Reverse Repo (prev $1283.281 Bln, 77 Bidders)

US

Initial Jobless Claims Sep 18: 351K (est 320K; prevR 335k; prev 332K)

US

Continuing Claims Sep 11: 2845K (est 2600K; prevR 2714K; prev 2665K)

Canadian

Retail Sales (M/M) Jul: -0.6% (est -1.2%; prev 4.2%)

Canadian

Retail Sales Ex-Auto (M/M) Jul: -1.0% (est -1.5%; prev 4.7%)

US

Chicago Fed National Activity Index Aug: 0.29 (est 0.50; prevR 0.75; prev 0.53)

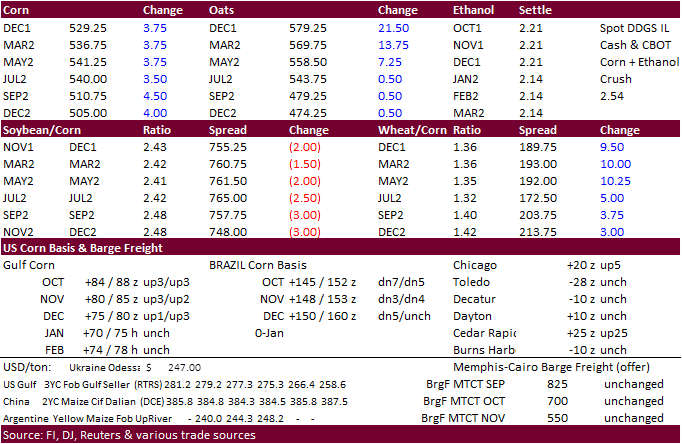

Corn

·

Corn was lower to start on soybean/corn spreading, talk of large US supplies, and lower crude oil, but a reversal in energies, a sharply lower USD, and talk of disease problems across the northern ECB sent prices higher. Wheat

and oats lent support. Brazil’s decision to drop its import tax on corn imports until December 31 make have underpinned prices. However, USDA corn export sales were 373,000 tons, low for this time of year, could have limited gains.

·

There was some talk corn yields across selected central IL were coming in 20 to 30 bushels per acre below expectations.

·

USDA announced export sales of 138,403 tons of corn to Guatemala. This is the first 24-hour corn sale announcement since August 27. Last time China showed up under the 24-hour system was May 20.

·

The oats market continued to rally bias nearby position (December up 22.25 cents), and this is seen supportive for feedgrains.

December

corn – December oats

·

China will see additional rain across its northern growing areas further delaying corn harvest progress.

·

The IGC raised its forecast for the 2021-22 global corn crop by 7 million tons to a record 1.209 billion tons.

·

Germany asked the European Commission to create a wild boar-free zone along the Polish border to deter African swine fever (ASF). They asked Poland for help.

Export

developments.

-

Under

the 24-hour USDA announcement system, private exporters reported export sales of 138,403 tons of corn for delivery to Guatemala during the 2021-22 marketing year. This is the first 24-hour corn sale announcement since August 27. Last time China showed up

under the 24-hour system was May 20.

Updated

9/14/21

December

corn is seen in a $4.75-$5.75 range

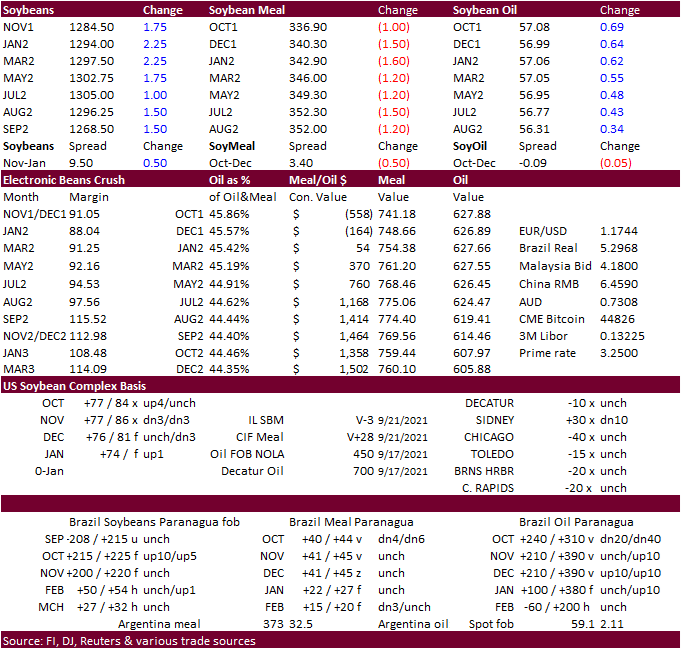

Soybeans

·

Soybeans ended 1.50-2.25 higher led by another rally in soybean oil (up 55-71 points led by October SBO to upside). Meal was down $1.30 to $1.70/short ton. The USD was down 43 points at 1:15 pm CT. US biofuel blending proposals

might be released sometime by the end of the week.

·

Rapeseed futures traded at an all-time high. November reached 617 euros and settled at 615.

·

Malaysian palm futures were up nearly 3 percent on follow through buying from a report calling for September palm production may fall short of expectations. December futures were up 117 ringgit to 4,447, a new contract high.

Cash palm increased $30/ton or 2.7%.

·

USDA export sales of 903,000 tons included 624,200 tons for China, but crop year to date commitments is running 34.5 percent below this time last year. 41% of USDA’s export projection had been sold. Soybean meal sales were good

and soybean oil poor.

·

The Buenos Aires Grain Exchange estimated the Argentina new-crop soybean area at 16.5 million hectares, a 2.4 percent decrease from 2021 and lowest in 15 years. Corn is the preferable crop to plant this year, in part to the export

tax program and overall returns (opposite of Brazil).

·

Argentina said they will appeal the US ruling in biodiesel import duties. They have 60 days to file.

·

China palm futures were up 2.5%China soybeans were up 0.4%, meal up slightly, and soybean oil climbed 1.6%.

·

G.G. Patel & Nikhil Research Company: India’s palm oil imports in 2021/22 are likely to drop 9% from a year earlier to 7.6 million tons from 8.35MMT year ago on a rise in domestic supplies, as farmers expand the area planted with

oilseeds.

·

Edible oil imports seen at 13.3 mln T vs 13.7 mln T yr ago

·

Edible oil supply seen at 8.5 mln T vs 8.05 mln T yr ago

·

Edible oil demand seen at 21.8 mln T vs 21.36 mln T yr ago (Reuters)

Export

Developments

None

reported

Updated

9/14/21

Soybeans

– November $11.75-$13.75 range, short term $12.70-$13.30.

Soybean

meal – December $310-$385

Soybean

oil – December 53-62 cent range

·

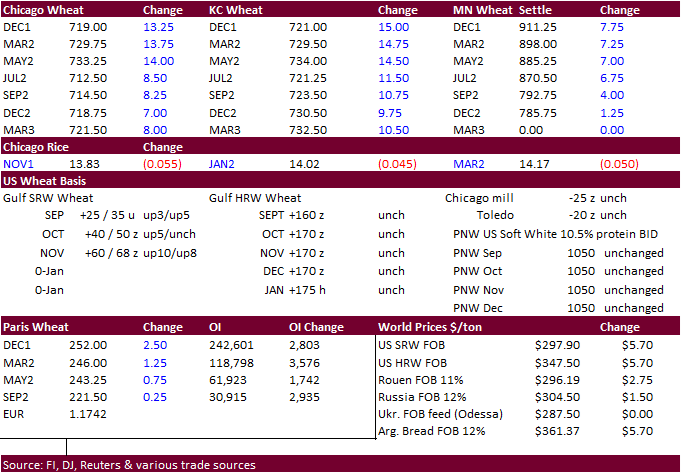

Wheat futures were higher on follow through buying, strong Black Sea prices, and renewed global demand. The USD was sharply lower. There was up to 1.7 million tons of combined wheat sales reported over last 12 hours between

Algeria, Pakistan and Taiwan. Paris wheat is at a 5-week high.

·

December Paris wheat was up 2.50 at 252.00 euros.

·

The USD was 43 points lower as of 1:15 pm CT.

·

Some people also noted the rally in the oat market as supportive for wheat, as US oats are grown in areas where spring wheat is produced.

·

USDA export sales for all wheat of 355,900 tons are down from 617,100 tons previous week.

·

The IGC lowered its world wheat production for 2021-22 by one million tons to 781 million.

Export

Developments.

·

Pakistan bought 575,000 tons of wheat at $383.50 c&f for shipment between Nov. 11 and Dec. 30.

·

Algeria bought 300,000 to 500,000 tons of durum wheat at between $620 and $640/ton c&f. Another trader said Mexican durum was bought at $630 to $640/ton c&f and Canadian at $650/ton c&f, for November shipment. (Reuters)

·

Taiwan Flour Millers’ Association bought 49,580 tons of milling wheat from the United States.

It was for

PNW Nov. 6 and Nov. 20 shipment that included 27,780 tons of U.S. dark northern spring wheat of 14.5% protein content at $403.53 a ton FOB, and 16,690 tons of hard red winter wheat of 12.5% protein bought at $356.41 a ton FOB, 5,110 tons of soft white wheat

of 11% protein at $392.69 a ton FOB.

·

Jordan passed on 120,000 tons of feed barley for Dec. 16-31, Jan. 1-15, Jan. 16-31, and Feb. 1-14.

·

Jordan seeks 120,000 tons of wheat on September 29.

·

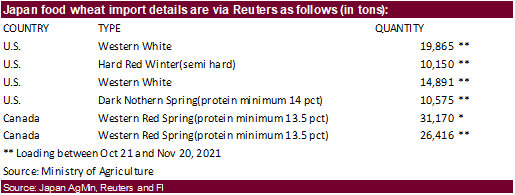

Japan seeks 113,067 tons of food wheat from the US and Canada, this week for October 21-November 20 loading.

·

Pakistan seeks 640,000 tons of wheat on Sep. 29

for

shipment between January and February 2022.

·

Results awaited: Mauritius seeks 47,000 tons of wheat flour, optional origin, on Sept. 21 for various 2022 shipment.

Rice/Other

·

Results awaited: Lowest offer $428.94/ton CIF. Bangladesh seeks 50,000 tons of rice on September 23.

Bangladesh

seeks 50,000 tons of rice on October 4.

Updated

9/9/21

December

Chicago wheat is seen in a $6.50‐$7.80 range

December

KC wheat is seen in a $6.40‐$8.00

December

MN wheat is seen in a $8.45‐$9.50

U.S. EXPORT SALES FOR WEEK ENDING 09/16/21

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR |

CURRENT YEAR |

YEAR |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

34.7 |

1,572.5 |

1,637.0 |

204.8 |

2,537.6 |

3,372.1 |

0.0 |

0.0 |

|

SRW |

25.1 |

749.9 |

419.2 |

37.9 |

945.7 |

705.5 |

0.0 |

0.0 |

|

HRS |

124.5 |

980.9 |

1,732.6 |

138.0 |

1,945.1 |

2,215.5 |

0.0 |

0.0 |

|

WHITE |

115.4 |

575.5 |

1,296.5 |

109.1 |

1,350.7 |

1,570.8 |

0.0 |

0.0 |

|

DURUM |

56.2 |

65.5 |

256.8 |

18.1 |

61.4 |

277.9 |

0.0 |

0.0 |

|

TOTAL |

355.9 |

3,944.3 |

5,342.1 |

507.9 |

6,840.4 |

8,141.8 |

0.0 |

0.0 |

|

BARLEY |

0.0 |

20.5 |

33.6 |

0.0 |

4.7 |

8.5 |

0.0 |

0.0 |

|

CORN |

373.0 |

24,100.0 |

20,602.2 |

485.8 |

845.7 |

1,992.9 |

0.0 |

333.2 |

|

SORGHUM |

123.0 |

2,269.4 |

2,587.0 |

1.3 |

3.1 |

176.9 |

0.0 |

0.0 |

|

SOYBEANS |

902.9 |

22,659.7 |

31,996.2 |

274.4 |

532.7 |

3,425.9 |

10.0 |

12.0 |

|

SOY MEAL |

45.0 |

1,090.6 |

642.4 |

244.8 |

11,190.3 |

11,466.2 |

216.4 |

2,365.2 |

|

SOY OIL |

4.3 |

17.0 |

93.4 |

0.6 |

674.6 |

1,188.0 |

0.0 |

7.6 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

0.2 |

175.8 |

267.6 |

3.5 |

173.2 |

53.0 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

8.0 |

27.4 |

0.1 |

1.2 |

1.5 |

0.0 |

0.0 |

|

L G BRN |

2.1 |

4.7 |

14.4 |

0.5 |

12.8 |

4.8 |

0.0 |

0.0 |

|

M&S BR |

20.1 |

42.4 |

15.0 |

0.1 |

13.8 |

18.1 |

0.0 |

0.0 |

|

L G MLD |

4.9 |

178.8 |

59.2 |

2.5 |

87.2 |

57.0 |

0.0 |

0.0 |

|

M S MLD |

1.5 |

30.3 |

47.3 |

13.2 |

60.6 |

58.9 |

0.0 |

0.0 |

|

TOTAL |

28.8 |

440.0 |

431.0 |

19.8 |

349.0 |

193.4 |

0.0 |

0.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

345.4 |

5,300.8 |

5,770.3 |

176.8 |

1,351.6 |

1,951.9 |

0.0 |

686.8 |

|

PIMA |

23.5 |

155.3 |

212.6 |

3.8 |

42.9 |

76.6 |

0.0 |

0.0 |

This

summary is based on reports from exporters for the period September 10-16, 2021.

Wheat: Net

sales of 355,900 metric tons (MT) for 2021/2022 were down 42 percent from the previous week, but up 1 percent from the prior 4-week average. Increases primarily for the Philippines (126,600 MT, including decreases of 600 MT), Mexico (71,400 MT, including

decreases of 400 MT), Japan (60,600 MT, including decreases of 500 MT), Nigeria (45,000 MT), and unknown destinations (36,000 MT), were offset by reductions for Canada (8,800 MT). Exports of 507,900 MT were down 1 percent from the previous week, but up 2

percent from the prior 4-week average. The destinations were primarily to Mexico (91,400 MT), the Philippines (86,600 MT), Japan (86,400 MT), China (67,800 MT), and South Korea (53,300 MT).

Late

Reporting:

For 2021/2022, net sales and exports totaling 16,000 MT of durum wheat were reported late for Italy.

Corn:

Net sales of 373,000 MT for 2021/2022 primarily for Canada (135,800 MT, including decreases of 1,400 MT), Mexico (134,500 MT, including decreases of 64,800 MT), Japan (72,200 MT, including 1,400 MT switched from unknown destinations), unknown destinations

(28,800 MT), and China (4,200 MT), were offset by reductions for Jamaica (4,700 MT). Exports of 485,800 MT were to Mexico (254,500 MT), China (140,200 MT), Japan (32,300 MT), Jamaica (19,900 MT), and Guatemala (17,100 MT).

Optional

Origin Sales:

For 2021/2022, the current outstanding balance of 170,000 MT is for unknown destinations

Barley:

No net sales or exports were reported for the week.

Sorghum:

Total net sales for 2021/2022 of 123,000 MT were for China. Exports of 1,300 MT were to Mexico.

Rice:

Net

sales of 28,800 MT for 2021/2022 were down 9 percent from the previous week and 41 percent from the prior 4-week average. Increases were primarily for South Korea (20,000 MT), Canada (4,700 MT), Saudi Arabia (1,600 MT), Costa Rica (1,200 MT), and Mexico (400

MT). Exports of 19,800 MT were down 76 percent from the previous week and 66 percent from the prior 4-week average. The destinations were primarily to Japan (12,000 MT), Mexico (4,500 MT), Canada (2,400 MT), Saudi Arabia (400 MT), and Jordan (200 MT).

Soybeans:

Net sales of 902,900 MT for 2021/2022 primarily for China (624,200 MT, including decreases of 132,000 MT), Mexico (85,300 MT, including 47,500 MT switched from unknown destinations and decreases of 1,300 MT), Egypt (58,000 MT), Japan (43,700 MT, including

40,600 MT switched from unknown destinations and decreases of 1,000 MT), and the Netherlands (30,800 MT, including 28,000 MT switched from unknown destinations), were offset by reductions for unknown destinations (800 MT). Net sales for 2022/2023 of 10,000

MT resulting in increases for unknown destinations (12,000 MT), were offset by reductions for Indonesia (2,000 MT). Exports of 274,400 MT were primarily to Mexico (83,800 MT), Japan (73,300 MT), China (66,200 MT), the Netherlands (30,800 MT), and Malaysia

(6,200 MT).

Export

for Own Account:

For 2021/2022, the current exports for own account outstanding balance is 5,800 MT, all Canada.

Soybean

Cake and Meal:

Net sales of 45,000 MT for 2020/2021 were down 53 percent from the previous week and 24 percent from the prior 4-week average. Increases primarily for Canada (12,900 MT, including decreases of 400 MT), the Philippines (10,800 MT), Guatemala (6,800 MT), Mexico

(5,300 MT), and Malaysia (4,000 MT), were offset by reductions primarily for the Dominican Republic (2,900 MT) and Panama (1,000 MT).

For 2021/2022, net sales of 216,400 MT were primarily for Mexico (47,400 MT), France (45,000 MT), Germany (45,000 MT), the Dominican Republic (38,000 MT), and unknown destinations (15,000 MT).

Exports of 244,800 MT were up noticeably from the previous week and up 85 percent from the prior 4-week average. The destinations were primarily to the Philippines (69,400 MT), the Dominican Republic (58,100 MT), Mexico (34,500 MT), Canada (27,900 MT),

and Guatemala (20,900 MT).

Soybean

Oil:

Net sales of 4,300 MT for 2020/2021 resulting in increases for Jamaica (4,000 MT) and Mexico (600 MT), were offset by reductions for Canada (300 MT). Exports of 600 MT were down 83 percent from the previous week and 72 percent from the prior 4-week average.

The destination was primarily to Canada (300 MT).

Cotton:

Net sales of 345,400 RB for 2021/2022 were up 21 percent from the previous week and 27 percent from the prior 4-week average. Increases were primarily for China (219,800 RB), Turkey (52,700 RB), Pakistan (36,200 RB), Vietnam (9,700 RB, including 3,700 RB

switched from China, 500 RB switched from Japan, and decreases of 500 RB), and Peru (5,500 RB, including decreases of 100 RB). Exports of 176,800 RB were down 26 percent from the previous week and 7 percent from the prior 4-week average. The destinations

were primarily to

Turkey

(36,000 RB), China (32,700 RB), Vietnam (25,700 RB), Mexico (22,700 RB), and Pakistan (19,700 RB). Net sales of Pima totaling 23,500 RB were up noticeably from the previous week and up 86 percent from the prior 4-week average. Increases were primarily for

India (16,000 RB), Peru (2,400 RB), Turkey (1,500 RB), China (1,300 RB), and Greece (900 RB). Exports of 3,800 RB were up 23 percent from the previous week, but down 45 percent from the prior 4-week average. The destinations were to India (2,800 RB), China

(500 RB), Peru (300 RB), and Pakistan (200 RB).

Optional

Origin Sales:

For 2021/2022, the current outstanding balance of 8,800 RB is for Pakistan.

Exports

for Own Account:

For 2021/2022, the current exports for own account outstanding balance of 4,800 RB is for China (4,700 RB) and Vietnam (100 RB).

Hides

and Skins:

Net sales of 366,700 pieces for 2021 were up 32 percent from the previous week and 19 percent from the prior 4-week average. Increases primarily for China (214,700 whole cattle hides, including decreases of 62,400 pieces), South Korea (96,400 whole cattle

hides, including deceases of 800 pieces), Brazil (16,900 whole cattle hides, including decreases of 100 pieces), Thailand (15,600 whole cattle hides, including decreases of 800 pieces), and Mexico (12,500 whole cattle hides, including decreases of 6,400 pieces),

were offset by reductions for Turkey (100 pieces) and Japan (100 pieces). Exports of 342,000 pieces were down 19 percent from the previous week and 22 percent from the prior 4-week average. Whole cattle hides exports were primarily to China (243,800 pieces),

South Korea (42,100 pieces), Mexico (16,100 pieces), Thailand (10,500 pieces), and Taiwan (9,900 pieces).

Net

sales of 142,900 wet blues for 2021 were down 28 percent from the previous week, but up 8 percent from the prior 4-week average. Increases primarily for China (93,800 unsplit), Vietnam (43,600 unsplit, including decreases of 100 unsplit), and Mexico (11,900

grain splits, including decreases of 5,600 unsplit), were offset by reductions for Italy (500 unsplit) and Thailand (100 unsplit).

Total

net sales for 2022 of 5,000 wet blues were for Mexico.

Exports of 145,400 wet blues were down

34 percent from the previous week and 6 percent from the prior 4-week average. The destinations were primarily to Italy (49,100 unsplit and 6,400 grain splits), Vietnam (31,300 unsplit), China (28,700 unsplit), Thailand (12,100 unsplit), and Mexico (6,100

grain splits and 1,700 unsplit). Net sales of 1,201,600 splits were reported for Vietnam (1,200,000 pounds) and Taiwan (1,600 pounds). Exports of 249,600 pounds were to Taiwan (169,600 pounds) and Vietnam (80,000 pounds).

Beef:

Net

sales of 15,800 MT for 2021 were up 3 percent from the previous week and 17 percent from the prior 4-week average. Increases were primarily for Japan (5,100 MT, including decreases of 1,000 MT), South Korea (3,200 MT, including decreases 400 MT), China (3,000

MT, including decreases of 100 MT), Taiwan (900 MT, including decreases of 100 MT), and Canada (800 MT, including decreases of 100 MT). Net sales of 1,600 MT for 2022 primarily for Mexico (1,100 MT), were offset by reductions for South Korea (100 MT). Exports

of 18,200 MT were up 8 percent from the previous week and 1 percent from the prior 4-week average. The destinations were primarily to Japan (5,000 MT), South Korea (4,700 MT), China (3,500 MT), Taiwan (1,400 MT), and Mexico (1,200 MT).

Pork:

Net

sales of 32,600 MT for 2021 were up 29 percent from the previous week and 12 percent from the prior 4-week average. Increases were primarily for Mexico (16,300 MT, including decreases of 500 MT), Japan (6,800 MT, including decreases of 100 MT), Canada (2,000

MT, including decreases of 500 MT), South Korea (1,900 MT, including decreases of 800 MT), and Colombia (1,600 MT). Exports of 36,100 MT were up 40 percent from the previous week and 28 percent from the prior 4-week average. The destinations were primarily

to Mexico (19,000 MT), Japan (4,800 MT), China (4,700 MT), Canada (1,900 MT), and South Korea (1,800 MT).

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.