PDF Attached

Volatile

week. After Wednesday’s close, we didn’t imagine soybeans, SBO, corn and Chicago wheat would end higher for the week.

Midday

GFS model turned drier for the 7-day for most of the heart of the US Midwest. US agriculture markets rallied by late morning, exception soybean meal which was on the defensive from product spreading. A rally in WTI crude oil added to the positive undertone

for soybean oil and corn. Global export developments were quiet. USDA Export Sales were good for soybean meal and new-crop wheat. China booked 265,000 tons of new-crop soybeans and cancelled 70,800 tons of current crop year corn. No surprises for the other

major commodities. Sorghum sales were 131,000 tons that included 128,000 tons for China.

Majority

of the US Midwest will dry down over the next seven days with temperatures above normal. The Midwest will not be totally dry. Any rain that develops will be bias far WCB and upper northeast. US Great Plains will continue to improve with precipitation over

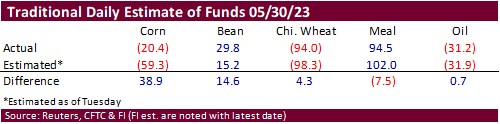

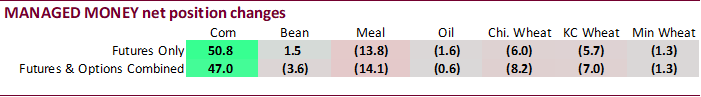

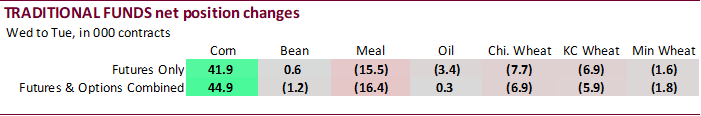

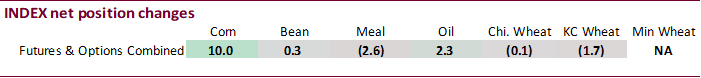

the next week. China’s largest producing state of Henan is forecast to receive additional rain. China’s southern areas are seeing very hot temperatures. Funds were active with short covering corn positions for the week ending May 30th, per CFTC

COT.

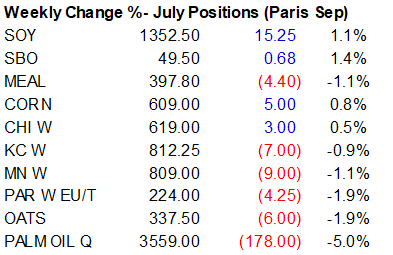

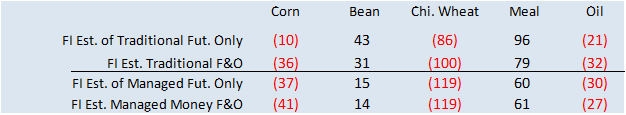

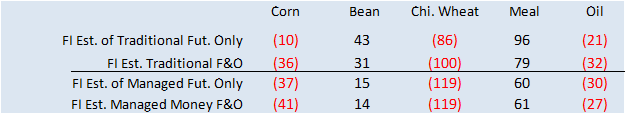

Fund

estimates as of June 2 (net in 000)

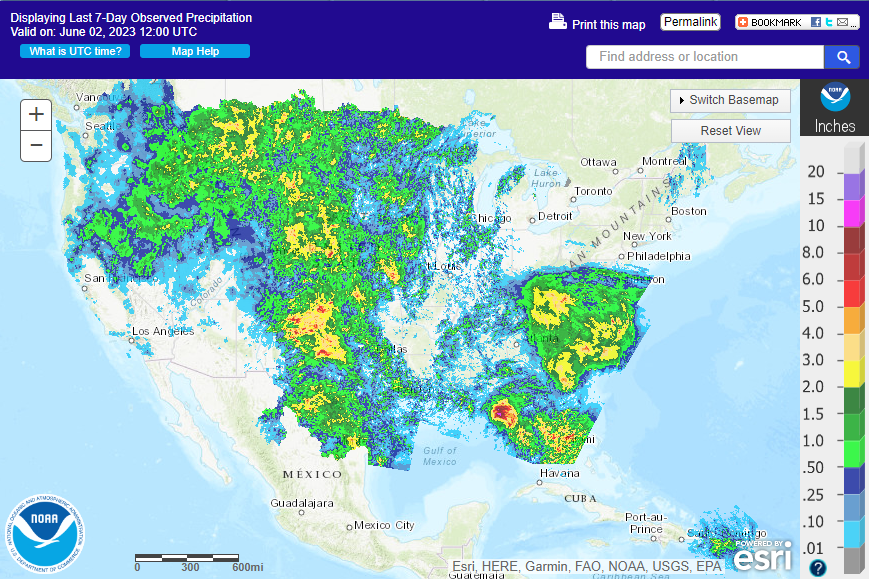

Weather

Past

7-days

WEATHER

TO WATCH

-

U.S.

Midwest drying has left topsoil moisture rated short to very short and subsoil moisture marginally adequate to short -

Rain

is needed, but unlikely to occur for another ten days – at least significant rain -

Gulf

of Mexico moisture is still unavailable for to crops in the Midwest because of weather systems near the Gulf of Mexico coast that are preventing moisture inflows from the water to the land -

This

pattern will prevail for another ten days to possibly two weeks which is why the Midwest fails to get a good drink of water -

U.S.

Midwest temperatures will trend cooler after early next week and the milder conditions will prevail for a while helping to keep stress on summer crops as low as possible with the ground staying dry -

World

Weather, Inc. is expecting a return of the 62-day cool cycle in late June and that may perpetuate the cooler bias later this month -

A

short term bout of warming may occur prior to the arrival of the late month cooling -

U.S.

rain will fall frequently from western Texas to Montana for another ten days

-

Some

of the crop areas in this region are becoming too wet and flooding has already occurred in several localized areas -

Some

wheat quality declines are under way in the central and southwestern Plains where drier weather is needed most to protect the quality and overall production of this year’s crop which has already been reduced by drought -

Most

of the bigger rains will soon be ending, though and that will help greatly in improving conditions for many areas.

-

West

Texas cotton, corn and sorghum production areas (including those in the Texas Panhandle) are experiencing delays to planting because of frequent rain and wet field conditions -

These

delays will continue periodically, but the greatest rainfall will soon be diminishing

-

Improved

periods of drier weather should occur between rain events after this weekend -

Temperatures

will be cooler than usual over the next ten days resulting in slower drying rates than usual and fewer degree day accumulations than usual -

U.S.

Delta drying is expected through the next ten days and that will raise the need for rain by the end of this forecast period, but crops are mostly in good shape today -

U.S.

southeastern states are expecting a mix of rain and sunshine during the next ten days with more sun than rain -

Northern

Europe’s soil moisture continues in decline, but temperatures have not been excessively warm which has kept most crops still in favorable condition -

Rain

will continue to elude the region for ten more days and temperatures may rise slightly, but crops will likely stay in favorable condition for a while longer -

Near

to above normal temperatures in northern Europe will exacerbate the stress on crops in the drier areas of the North and Baltic Sea regions, although no extreme heat is expected -

Rainfall

has been lacking for two weeks in the North Sea region and for three weeks in the Baltic Plain

-

Another

ten days of dry weather is still coming -

Southern

Europe continues to experience frequent rain and thunderstorm activity maintaining wetter biased soil conditions -

There

is a risk of local flooding in many areas and some flooding has already occurred periodically in a few areas -

The

next ten days do not offer a serious change in the moisture situation -

Eastern

CIS New Lands soil conditions have dried out more notably in the past week with topsoil moisture now rated short to very short east of the Ural Mountains and into northern Kazakhstan

-

The

heat and dryness will last through Monday and then the opportunity for scattered showers and thunderstorms and gradual cooling is expected -

Relief

will evolve, but it is still questionable how significant that will be -

China’s

wheat harvest area is drying out after last weekend’s heavy rainfall -

The

production area was impacted by significant rain during the weekend of May 22 and this past weekend resulting in some wheat quality declines -

The

weather is expected to be much improved over the next ten days which should help to dry out the crop and limit grain quality losses -

Some

of east-central China’s summer crops may have to be replanted after the recent bout of extreme rainfall -

Eastern

and southern Alberta, Canada us still chronically dry and must get rain soon to keep crops alive in the driest areas -

Some

showers will evolve next week, but it is doubtful that the rain will be as great as needed to offer relief from recent weeks of dryness -

Saskatchewan,

Canada will receive frequent rain over the next week resulting in wetter biased field conditions -

The

exception will be in the far southeast of the province and in neighboring areas of southern Manitoba where it will remain dry -

Relief

from drought is expected, albeit temporarily and more rain will be needed.

-

Other

areas in the Prairies will experience some timely rainfall during the next ten days and the resulting precipitation will be welcome, although briefly disrupting to farming activity.

-

Portions

of southern Manitoba have been trending a little dry recently and greater rain is needed, despite the fact that some rain occurred earlier this week -

Ontario

and Quebec weather has improved with warmer temperatures and limited rainfall in recent days -

A

trend change back to cooler conditions and some periodic rain is needed and expected this weekend and especially next week that will maintain favorable crop and field conditions -

Tropical

Depression Two in the Gulf of Mexico will move to western Cuba this weekend where it will likely dissipate -

The

system may help bring some rain to Florida and will produce it in western Cuba as well, but no damaging wind or flooding rain is expected in either region -

U.S.

Pacific Northwest will continue to dry out with the Yakima Valley of Washington and neighboring areas of north-central Oregon in need of rain -

Irrigation

is used extensively in the region and will support many crops -

Temperatures

will rise above normal next week and that will accelerate the need for irrigation and raise crop stress for unirrigated areas -

Idaho

and Wyoming will experience frequent showers and thunderstorms during the coming week to ten days favoring dry bean, sugarbeets and some corn development -

Mexico’s

drought is not likely to improve for the next two weeks -

Rain

will occur periodically in eastern and far southern portions of the nation, but seasonal rains are expected to be delayed starting by at least two more weeks -

Seasonal

rains in India will also be delayed during the first half of June -

The

lack of rain will raise much worry over the general performance of the summer monsoon on India -

Northern

India and northern Pakistan will continue to receive infrequent showers and thunderstorms for a little while longer, but most of the greatest rainfall is winding down -

The

precipitation reported in the past week was greater than usual and an anomaly resulting from a more southward extent of the mid-latitude westerly winds aloft -

North

Africa will continue to receive periodic rain through the next week to ten days -

The

rain comes late in the growing season and may be threatening durum wheat quality in Morocco and northwestern Algeria while crop areas to the east may have benefited from recent rain.

-

China’s

excessive rain between the Yellow and Yangtze Rivers during the weekend ended earlier this week -

Drier

weather is expected for a while -

Fieldwork

was delayed, but the moisture should prove to be good for summer crop development in areas that were not flooded -

Wheat

areas need to dry down to protect grain quality -

Some

wheat quality has already declined with head sprouting confirmed in Henan -

Some

of the flooded areas likely had recently planted crops damaged and replanting is necessary -

Xinjiang,

China will continue cooler than usual -

Degree

day accumulations are well below normal and cotton, corn and other crops are not developing normally -

Warming

is needed -

The

next ten days will continue cooler than usual -

Thailand,

Cambodia and Laos rainfall in this coming week will be lighter than usual, although it is expected in all production areas -

Tropical

Storm Mawar will stay south of Japan’s main islands this weekend early next week as it move out of the region -

The

Ryukyu Islands will experience heavy rain and some windy conditions as the storm passes by -

Australia

weather during the next ten days should be unsettled enough to produce rain in some of the more important winter crop areas to help get winter crops better established -

Resulting

rainfall will be light, though, leaving need for much more away from the coast

-

Western

Australia received some needed rain overnight with moderate to heavy rain in southern production areas -

South

Africa rainfall in the coming week will not be very great, though winter crops will continue to germinate, emerge and establish on previous rainfall -

Some

summer crop harvest delays are likely and some interruption to late season winter crop planting is also expected -

The

moisture will help winter crops become better established -

Argentina

rainfall will be restricted in this next ten days, but last week’s rain has soil moisture looking very good for planting from Santa Fe and Entre Rios into central and eastern Buenos Aires -

Western

Buenos Aires and Cordoba still have a big need for rain and they may have to wait for a while -

Brazil

weather will be mild to warm and mostly dry for a while -

The

environment will be good for coffee, citrus and sugarcane harvesting as well as supportive of Safrinha corn and cotton development -

Some

of the early corn is beginning to mature with harvesting not too far away -

Brazil

sugarcane, citrus and coffee harvest delays are over and drier biased conditions will prove to be beneficial for crop maturation and harvest progress -

Central

America rainfall is expected frequently over the next ten days supporting improved soil moisture and some better runoff after a slow start to the rainy season -

Indonesia

and Malaysia rain frequency and intensity has been and is expected to continue better than advertised last week -

The

pattern will perpetuate favorable crop conditions from rice and sugarcane to oil palm, coconut and rubber development -

Philippines

rainfall will remain well mixed with sunshine over the next ten days -

West-central

Africa will continue to receive periodic rainfall over the next two weeks and that will prove favorable for main season coffee, cocoa and sugarcane -

Some

cotton areas would benefit from greater rain, though the precipitation that has occurred has been welcome -

East-central

Africa rainfall has been favorable for coffee, cocoa and other crops in recent weeks with little change likely -

Central

Asia cotton and other crop weather has been relatively good this year with adequate irrigation water and some timely rainfall reported -

The

favorable environment will continue -

Today’s

Southern Oscillation Index was -17.41 and it should continue moving lower for a while

Source:

World Weather, INC.

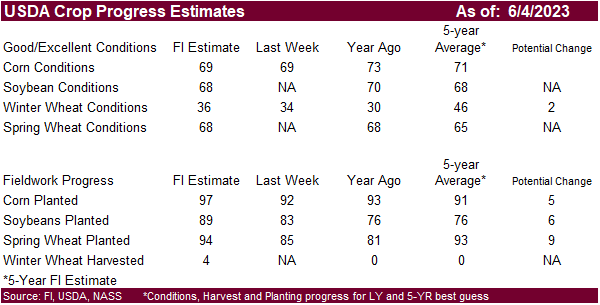

Monday,

June 5:

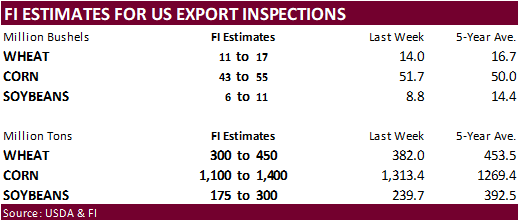

- USDA

export inspections – corn, soybeans, wheat, 11am - US

cotton, corn, spring wheat and winter wheat condition, 4pm - US

planting data for corn, cotton, spring wheat and soybeans, 4pm - HOLIDAY:

Malaysia, New Zealand, Thailand

Tuesday,

June 6:

- Russia

grain union conference in Gelendzhik, day 1 - EU

weekly grain, oilseed import and export data - New

Zealand global dairy trade auction - New

Zealand commodity prices - Malaysia’s

June 1-5 palm oil export data - US

Purdue Agriculture Sentiment

Wednesday,

June 7:

- China’s

1st batch of May trade data, including soybean, edible oil, rubber and meat & offal imports - EIA

weekly US ethanol inventories, production, 10:30am - Russia

grain union conference in Gelendzhik, day 2

Thursday,

June 8:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - Russia

grain union conference in Gelendzhik, day 3 - HOLIDAY:

Brazil

Friday,

June 9:

- USDA’s

World Agricultural Supply & Demand Estimates (WASDE), 12pm - China’s

agriculture ministry (CASDE) releases monthly supply and demand report - Sustainable

World Resources conference in Singapore - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - Russia

grain union conference in Gelendzhik, day 4

Source:

Bloomberg and FI

USDA

Export Sales

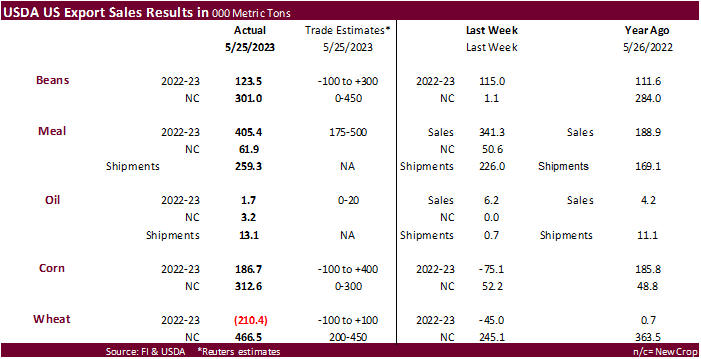

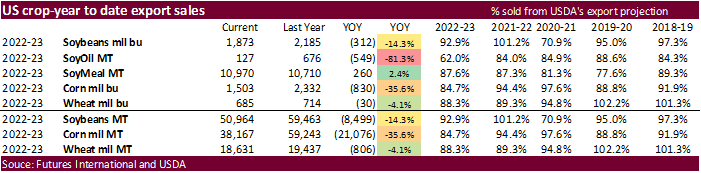

All

within. Most notable was good soybean meal sales of 405,400 tons, up from 341,300 tons previous week. The Philippines booked 235,900 tons of soybean meal. Old crop soybean sales were within expectations and new crop improved to 301,000 tons that included 265,000

tons booked by China. Soybean oil sales were as expected. Corn export sales were 186,700 tons. Major countries included Mexico and Columbia. China canceled 70,800 tons of 2022-23 corn. 312,600 tons of new crop corn were mainly for Mexico, Japan and unknown.

All-wheat sales for the current marketing year were net reduction of 210,400 tons, typical for this time of year. New-crop all-wheat sales were 466,500 tons, slightly above a range of expectations (HRS and White categories top bookings). Sorghum sales were

131,000 tons that included 128,000 tons for China.

Funds

were active with short covering corn positions for the week ending May 30th.

Fund

estimates as of June 2 (net in 000)

Reuters

table

SUPPLEMENTAL

Non-Comm Indexes Comm

Net

Chg Net Chg Net Chg

Corn

-112,046 37,591 291,443 9,975 -127,167 -49,317

Soybeans

-10,960 -6,271 109,874 315 -70,458 3,886

Soyoil

-53,896 114 96,788 2,281 -41,949 -1,095

CBOT

wheat -110,215 -7,059 68,177 -50 35,573 7,827

KCBT

wheat -6,999 -3,625 40,139 -1,691 -26,716 6,271

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

-51,065 46,962 246,292 -951 -147,843 -45,697

Soybeans

529 -3,616 84,601 -6,326 -73,825 5,448

Soymeal

59,676 -14,113 96,867 2,937 -190,427 10,460

Soyoil

-37,449 -573 113,424 1,467 -70,931 -470

CBOT

wheat -126,998 -8,210 67,635 -328 33,388 7,912

KCBT

wheat 9,628 -6,993 31,873 1,046 -29,461 5,784

MGEX

wheat -7,703 -1,301 1,557 316 3,360 1,061

———- ———- ———- ———- ———- ———-

Total

wheat -125,073 -16,504 101,065 1,034 7,287 14,757

Live

cattle 107,835 5,845 50,319 216 -169,230 -6,186

Feeder

cattle 17,432 661 950 3 -5,766 -1,823

Lean

hogs -31,110 -6,981 50,387 -249 -25,505 4,740

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

4,848 -2,066 -52,230 1,752 1,761,882 -12,577

Soybeans

17,152 2,425 -28,458 2,070 847,867 5,425

Soymeal

18,676 -2,319 15,209 3,034 538,779 -373

Soyoil

-4,100 875 -943 -1,300 613,532 2,880

CBOT

wheat 19,510 1,344 6,464 -717 475,870 -1,890

KCBT

wheat -5,617 1,118 -6,424 -955 204,606 -5,769

MGEX

wheat 2,351 -520 435 444 61,646 -3,006

———- ———- ———- ———- ———- ———-

Total

wheat 16,244 1,942 475 -1,228 742,122 -10,665

Live

cattle 28,525 -821 -17,449 948 411,741 5,564

Feeder

cattle 610 871 -13,226 290 79,717 -3,567

Lean

hogs 1,945 2,958 4,282 -466 339,064 8,587

FUTURES

ONLY Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

-46,846 50,803 244,826 -343 -172,616 -43,279

Soybeans

2,238 1,528 80,957 -6,042 -85,119 4,284

Soymeal

59,329

Macros

US

Change In Nonfarm Payrolls May: 339K (exp 195K; prevR 294K)

Unemployment

Rate May: 3.7% (exp 3.5%; prev 3.4%)

Average

Hourly Earnings (M/M) May: 0.3% (exp 0.3%; prevR 0.4%)

Average

Hourly Earnings (Y/Y) May: 4.3% (exp 4.4%; prev 4.4%)

US

Change In Manufacturing Payrolls May: -2K (exp 5K; prevR 10K)

Change

In Private Payrolls May: 283K (exp 165K; prevR 253K)

Underemployment

Rate May: 6.7% (prev 6.6%)

Labor

Force Participation Rate Feb: 62.6% (exp 62.6%; prev 62.6%)

US

Short-Term Interest-Rate Futures Add Slightly To Losses After Jobs Report, Traders Still Betting On Fed’s June Hold

104

Counterparties Take $2.142 Tln At Fed Reverse Repo Op.