PDF Attached

Weather

World

Weather Inc.

-

Additional

rain fell from northern Cordoba through northern Entre Rios Wednesday and early today -

Local

rain totals over 4.00 inches were reported, although most amounts varied from 0.60 to 1.25 inches -

Lighter

rain fell briefly in interior southern Buenos Aires -

Temperatures

continued quite cool in central parts of the nation where heavy rain has occurred over the past two days -

Brazil

rainfall has become sporadic and light allowing much of the nation to dry out in favor of all kinds of fieldwork.

-

Late

season soybean harvesting should be advancing swiftly -

Argentina

will see additional bouts of rain in the central and north through the next ten days and southern areas should turn wetter again in the last days of March and early April -

Crop

improvements are occurring, although production recover is unlikely except in a few of the late soybeans and peanut crops -

Pakistan

and northern India will be impacted by rain over the next few days raising concern for winter wheat quality and perhaps a few other crops -

The

moisture will be welcome, though, for early cotton planting that occurs in April and May -

North

Africa is still advertised to be dry or mostly dry during the next ten days

-

Crop

moisture stress is high in the drier areas of Tunisia, interior northeastern and northwestern Algeria and in a few Morocco locations -

Production

cuts will be greatest in Tunisia this year relative to that of last year -

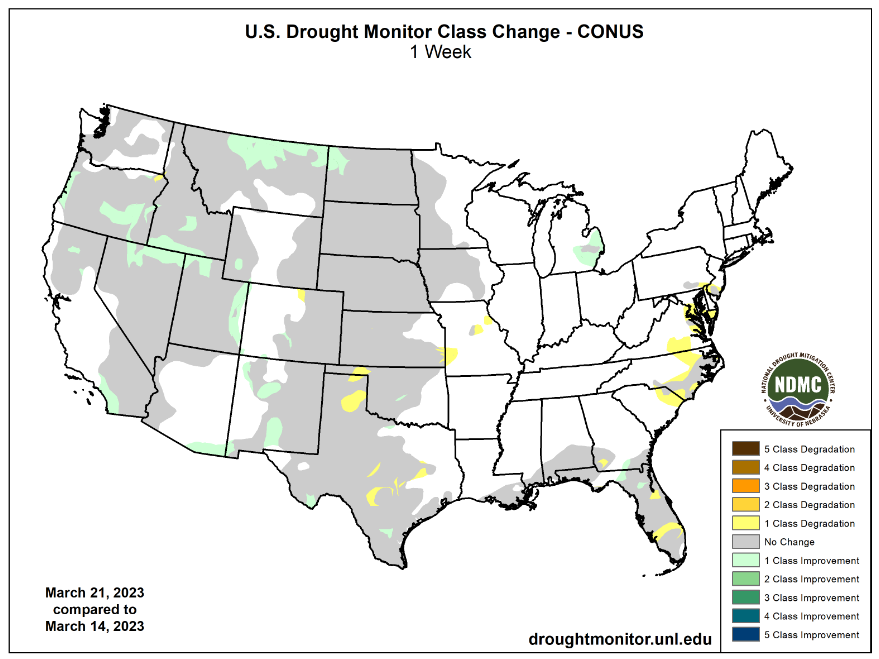

U.S.

lower Midwest, Delta and southeastern states will be wetter biased over the next ten days resulting in delays to spring planting and general fieldwork -

Flood

potentials remain high for the Red River Basin of the North and the upper Mississippi River basin in April when significant warming occurs to induce aggressive snowmelt

-

Planting

delays are possible in both of these areas this spring because of the anticipated flood water -

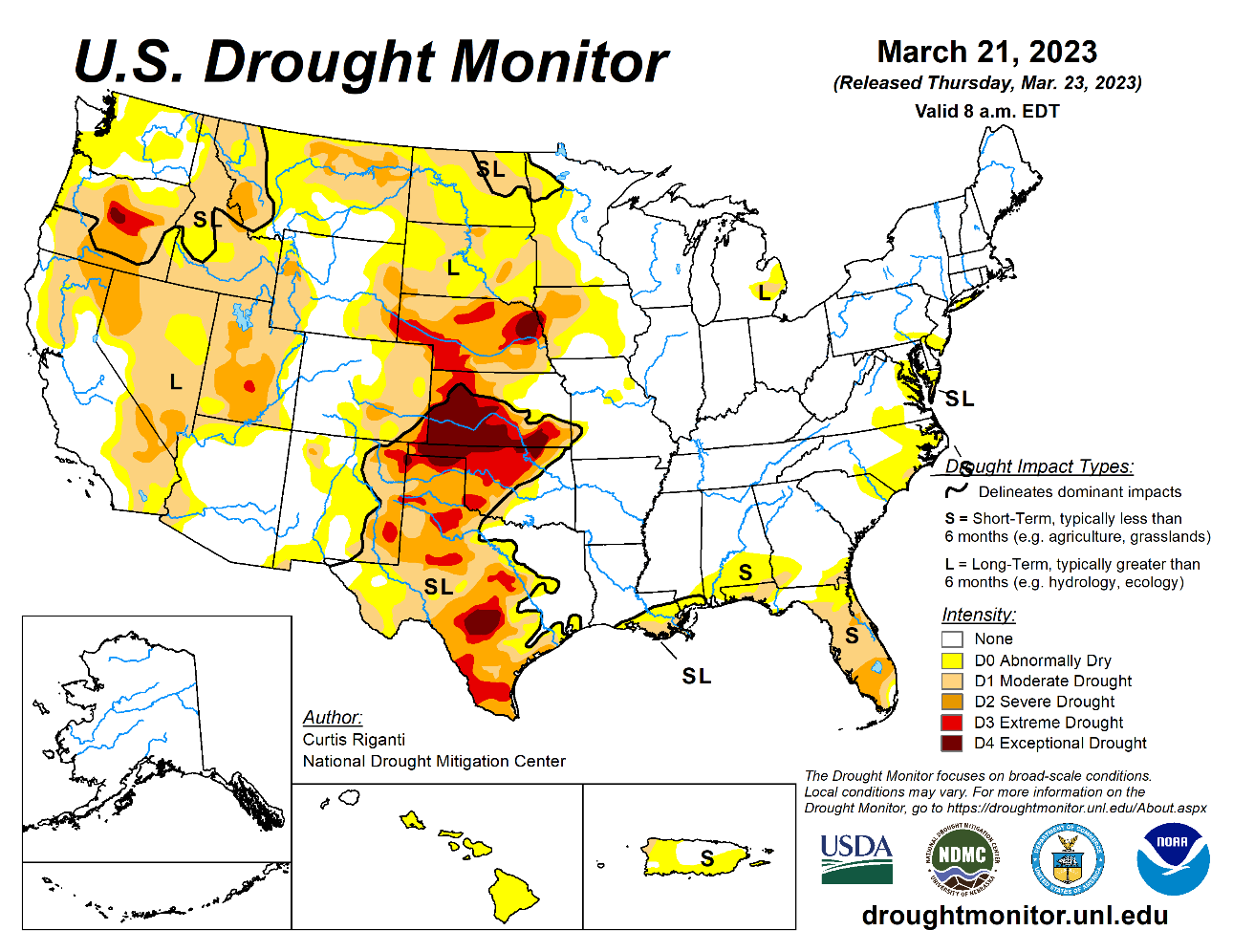

Southwestern

U.S. hard red winter wheat areas are unlikely to get much precipitation during the next ten days -

Central

portions of the Plains (i.e. Nebraska, northern Kansas and northeastern Colorado) will get some rain and snow into the weekend offering some short term benefits to topsoil moisture -

West

Texas precipitation potentials are very low for the next ten days -

South

Texas and the Texas Coastal Bend region may get some rain next week, but confidence is low -

World

Weather, Inc.’s Trend Model along with the CFS and GFS Ensemble models are all hinting at improved Texas and Oklahoma rainfall during April -

California’s

heavier precipitation events should be winding down, although light precipitation may continue to come and go periodically -

Flooding

in California later this spring could be significant in a few areas as water reservoirs reach full capacity warranting a spillage of water through dams as mountain snow melt reaches the storage facilities -

Much

less precipitation is expected in the Red River Basin of the North during the coming week while temperatures continue quite cold relative to normal -

The

drier conditions will be welcome, but until warmer weather arrives and the region’s deep snowpack melts there will not be much celebrating over the drier weather.

-

Canada’s

Prairies will continue drier than usual especially in the interior southwest where there is need for significant precipitation this spring in order to support planting and early crop development.

-

Northwestern

Russia continues to experience snowmelt and significant runoff -

Rain

is expected to develop during the weekend and last through most of next week resulting in some significant additional runoff that may worsen flooding that may already be under way -

China

rainfall over the next ten days will be greatest in the southern half of the Yangtze River Basin and southern coastal provinces benefiting rapeseed development and early season rice planting -

Additional

rain totals of 3.00 to 8.00 inches may occur near and south of the Yangtze River reaching into Guangdong, Fujian and Zhejiang -

Limited

precipitation in the lower Yellow River Basin and North China Plain will leave some wheat areas in need or greater precipitation especially in April -

Cool

temperatures are expected in eastern China over the next several days which may help to slow drying rates in winter wheat areas of the north and conserve soil moisture in the south -

Warming

is expected next week and into the following weekend -

Europe

will turn cooler next week and precipitation will increase in the north and west-central parts of the continent as well

-

Eastern

Spain will remain one of the driest areas in the continent for a while possibly threatening dryland winter crops and some of the planting of spring crops -

West-central

Africa precipitation will be erratically distributed over the next few days, but it may next week -

Recent

precipitation has been lighter than usual and temperatures warmer biased raising some concern over crop development -

Rain

later this week into next week will be very important for coffee, cocoa, rice and sugarcane -

Australia

rainfall resumed recently near and east of the Great Dividing Range and it will continue into next week

-

Temperatures

will continue warmer than usual this week and then trend a little cooler this weekend and next week – at least in eastern crop areas -

Mexico

is still dealing with a winter drought and there is need for precipitation to support corn, sorghum and cotton in unirrigated areas -

There

is also need for moisture in some citrus and sugarcane areas, although the situation for these two crops is not critical outside of the far northeast part of the nation -

Central

America rainfall will be greatest in Guatemala and from Costa Rica to Panama during the next ten days -

Net

drying is likely in Honduras and Nicaragua -

Drought

continues a concern in Canada’s southwestern Prairies -

Some

snow fell earlier this month in a part of the drought region, but snow water equivalents were not great enough to offer a tremendous improvement, although some benefit did occur as the snow melted -

Not

much precipitation of significance will occur in the dry areas over the next week, although some light precipitation will be possible infrequently -

Greater

precipitation may occur in the last days of March and early April -

South

Africa crop weather has been very good this year, although the nation is drying out now -

Early

season maturation and harvesting should go well -

Late

season crops will need some beneficial moisture later this season -

Rain

prospects on fair over the next ten days, but the precipitation should be erratic and often lighter than usual -

Southeastern

Canada’s corn, wheat and soybean production region is favorably moist and poised for a good start to spring, although fieldwork is still a few weeks away -

Turkey

will receive frequent bouts of rain over the next ten days bolstering soil moisture for wheat development and rice and cotton planting -

Portions

of the nation are already wet after weekend rain and mountain snow -

Other

spring planting will benefit from the coming moisture boost -

Other

areas in the Middle East will also experience a boost in precipitation -

Syria,

northern Iraq and much of Iran will receive significant rainfall as will some areas in Afghanistan and northern Pakistan -

Philippines

rainfall will be light to locally moderate most days through the coming week

-

Weather

conditions in the next ten days should be mostly good for the nation, although the south may eventually turn quite wet -

Indonesia

and Malaysia rainfall will occur abundantly during the next two weeks with all areas impacted and no area experiencing much net drying -

Mainland

areas of Southeast Asia will receive very little rain of significance through Sunday, but a notable boost in rain may occur in the last days of this month -

Eastern

Africa precipitation is expected to scatter from Tanzania to Ethiopia over the next ten days -

The

moisture will be good for ongoing crop development -

Today’s

Southern Oscillation Index was -0.34 and it was expected to move erratically over the coming week

Source:

World Weather, INC.

Bloomberg

Ag calendar

Thursday,

March 23:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - Rabobank

Farm2Fork Summit, Sydney - Russian

Grain Union holds conference in Kazan - Brazil’s

Unica may release cane crush and sugar output data (tentative) - USDA

red meat production, 3pm - US

cold storage data for pork, poultry and beef, 3pm - HOLIDAY:

Indonesia

Friday,

March 24:

- Marine

Insurance London conference - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop conditions reports - US

poultry slaughter - HOLIDAY:

Argentina

Monday,

March 27:

- USDA

export inspections – corn, soybeans, wheat, 11am

Tuesday,

March 28:

- EU

weekly grain, oilseed import and export data

Wednesday,

March 29:

- EIA

weekly US ethanol inventories, production, 10:30am - Coffee,

rice and rubber exports from Vietnam

Thursday,

March 30:

- USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - USDA

hogs & pigs inventory, 3pm - HOLIDAY:

India

Friday,

March 31:

- US

prospective planting data for several crops, including corn, soybeans, wheat, cotton, barley and rice, noon - USDA’s

quarterly stockpiles data for corn, soybeans, wheat, barley and sorghum - ICE

Futures Europe weekly commitments of traders report - CFTC

commitments of traders weekly report on positions for various US futures and options, 3:30pm - FranceAgriMer’s

weekly crop condition report - Malaysia’s

March palm oil export data - US

agricultural prices paid and received, 3pm

Source:

Bloomberg and FI

USDA

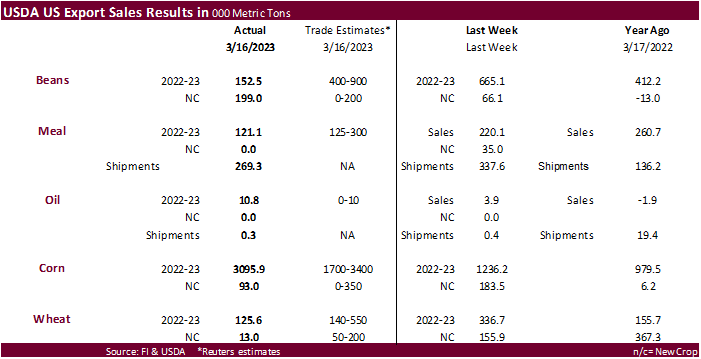

export sales

Macros

US

Initial Jobless Claims Mar 18: 191K (exp 198K; prev 192K)

Continuing

Claims Mar 11: 1694K (exp 1691K; prev 1684K)

US

Current Account Balance (USD) Q4: -206.8B (exp -213.3B; PREV -217.7.1B)

US

Chicago Fed National Activity Index Feb: -0.19 (exp 0.10; prev 0.23)

US

EIA Natural Gas Storage Change: -72 (exp-76; prev -58)

–

Salt Dome Cavern Stocks: -4 (prev +5)

99

Counterparties Take $2.234 Tln At Fed Reverse Repo Op. (prev $2.280 Tln, 104 Bids)

·

In a two-sided trade, corn futures ended 1.0-2.25 cents lower. A plunge in soybean futures outweighed bullish US corn export sales and USDA’s 24-hour sales announcement. Widespread selling by the investment funds also added to

the negative undertone.

·

Funds sold an estimated 3,000 corn contracts.

·

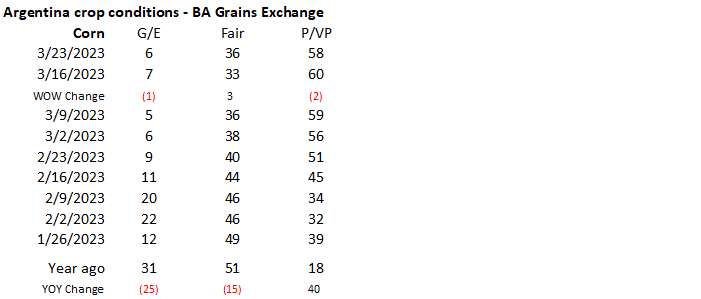

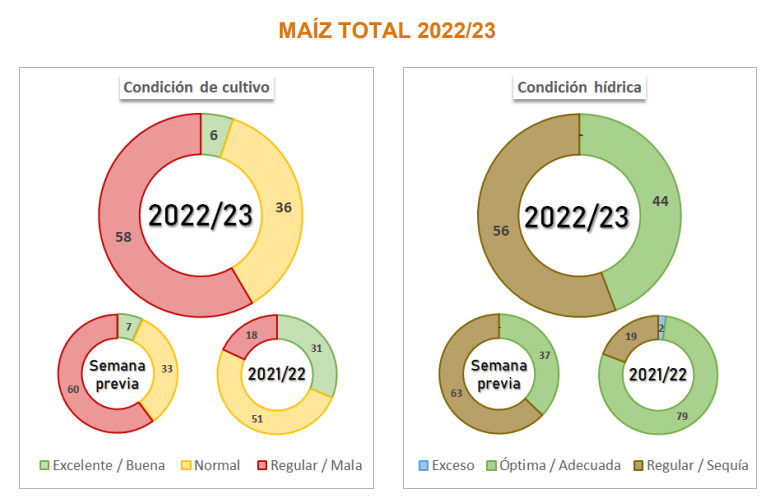

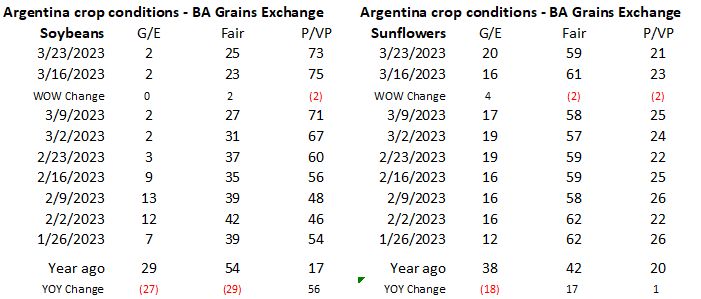

The BA Grains Exchange left their Argentina corn production estimate unchanged at 36 million tons.

·

China will resume importing Brazil beef aged under 30 months. This comes after mad cow disease was discovered on February 23.

·

U of I: A Solid Year for Ethanol Production Profits in 2022

Irwin,

S. “A Solid Year for Ethanol Production Profits in 2022.” farmdoc daily (13):52, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, March 22, 2023.

https://farmdocdaily.illinois.edu/2023/03/a-solid-year-for-ethanol-production-profits-in-2022.html

·

The USDA Attaché estimated Mexico corn production at 27.4 million tons for 2023-24, unchanged from their 2022-23 estimate.

https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Grain%20and%20Feed%20Annual_Mexico%20City_Mexico_MX2023-0011

·

Sweden reported an outbreak of H5N1 bird flu on a farm in the south of the country, killing 1,137 birds and another culling of 23,598-strong flock.

Export

developments.

-

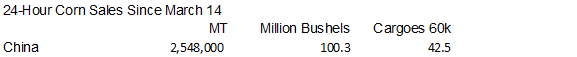

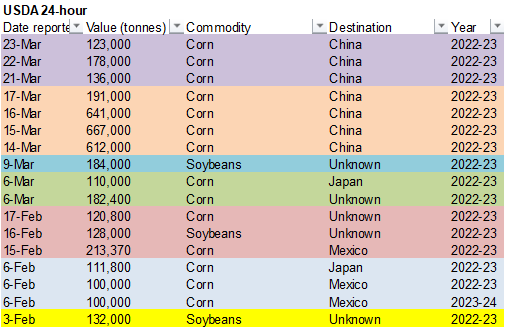

USDA

under the 24-hour reporting system announced private exporters reported sales of 123,000 tons of corn for delivery to China during the 2022/2023 marketing year.

Prices

attached (modified close)

Updated

03/21/23

May

corn $5.85-$6.75

July

corn $5.75-$7.00

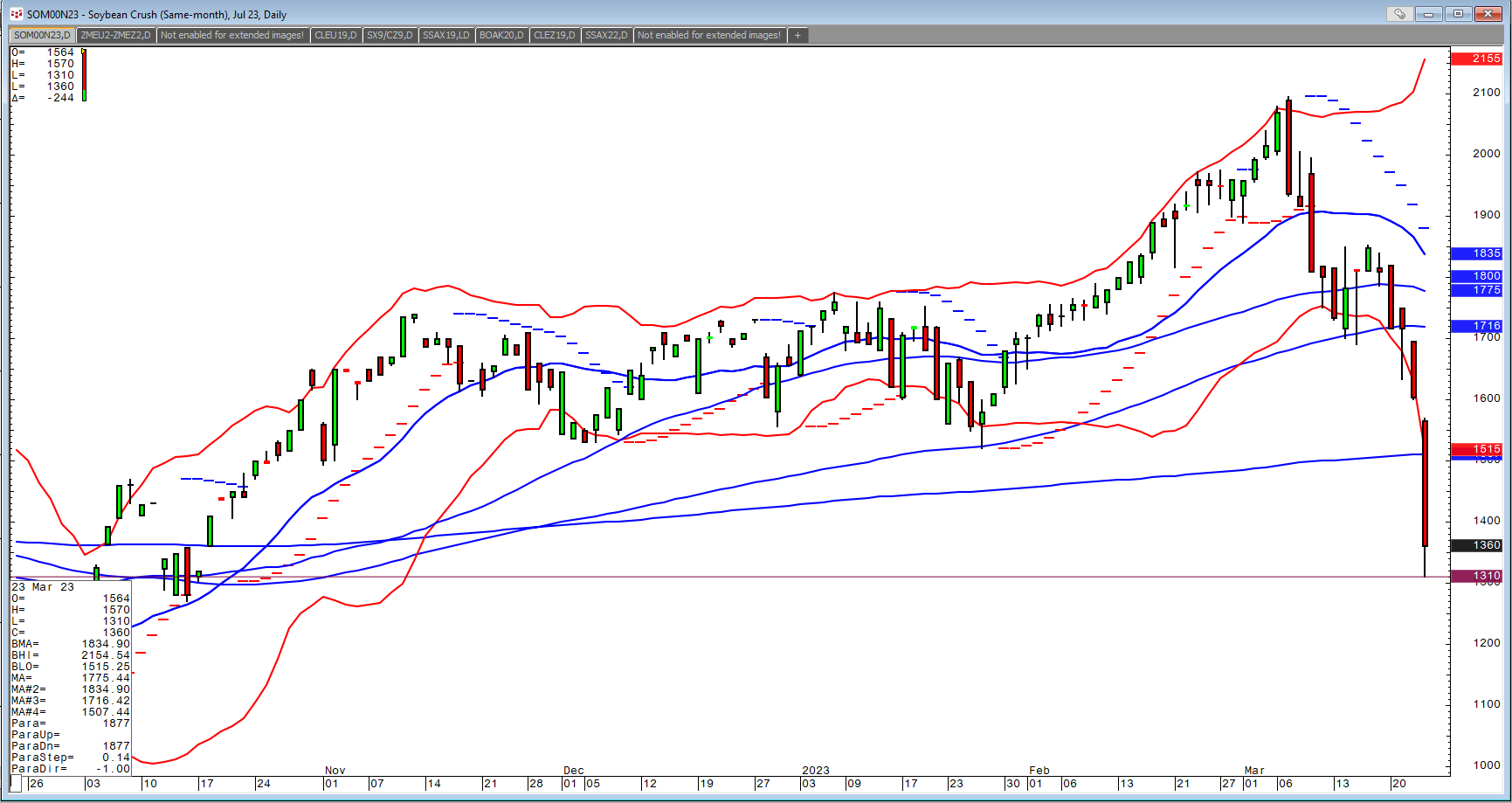

·

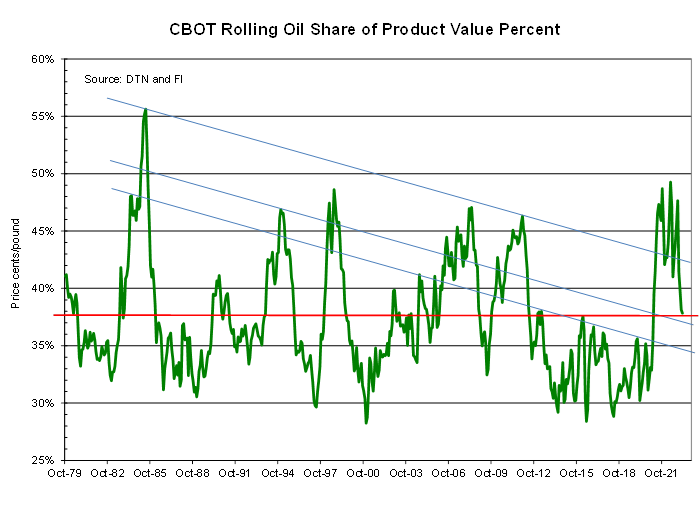

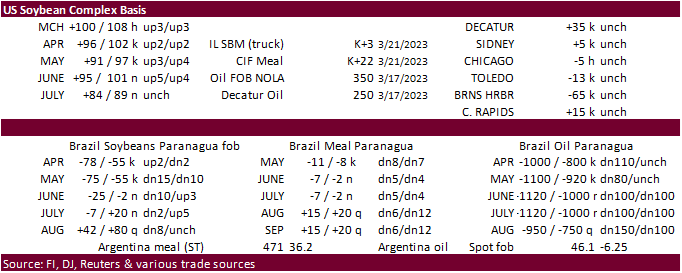

Heavy investment fund selling sent soybeans sharply lower, by 13.25-29.00 cents. Nearby spreads were on the defensive (we attached a spread run after the text). There are rumors many banks/funds are exiting agriculture commodity

markets and moving money into bonds and other sectors. May soybean futures hit its lowest level during the session since October 31, 2022. CBOT soybean products lost more ground to soybeans today, weakening crush margins.

·

Charts look bearish for soybeans and the products.

·

Funds sold an estimated net 16,000 soybeans, 6,000 soybean meal and 12,000 soybean oil.

·

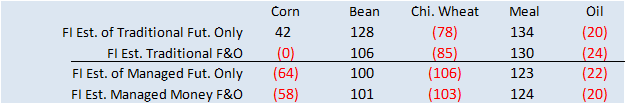

Note the investment funds have already chopped their net long position in corn over the past month, unlike soybeans where traditional and money managers still hold a large net long position.

·

November soybeans fell 13 consecutive sessions, longest streak for new-crop November soybeans in decades (Reuters).

·

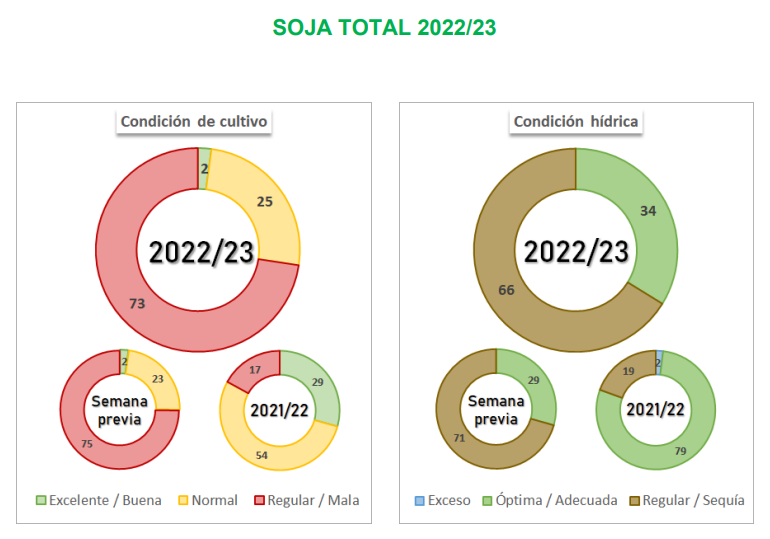

USDA export sales were poor for the soybean complex.

·

Soybean meal ended sharply lower. US cash soybean meal premiums were weaker today on slowing domestic and export demand.

·

CBOT soybean oil was sharply lower but did close well off session lows on investment fund selling, lower outside related vegetable oil markets and recent weakness in WTI crude oil.

·

Palm oil futures fell to more than 6-month low. A combination of lower outside related vegetable oil markets, lower mineral oil, and uptrend in palm yield trends, have been weighing on palm oil futures.

·

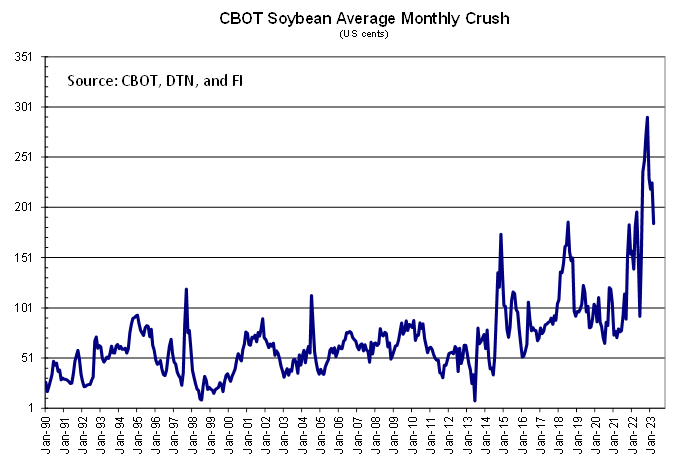

There was heavy CBOT crush selling today. July crush was down 24.50 to $1.3600. On March 7th traded at intraday high of 2.0950. Daily July crush below.

·

The BA Grains Exchange left their Argentina soybean production estimate unchanged at 25 million tons.

·

The Rosario Grains Exchange looks for Argentina soybean imports to increase 139% to 7.9 million tons this year, most coming from Brazil and Paraguay. A flood of imports should boost crush that will provide exportable meal and

oil this year.

·

Malaysia kept its CPO export duty unchanged at 8 percent for the month of April. The reference price was set at 4,031.45 ringgit ($913.64) per ton.

·

Abiove estimated Brazil soybean production and exports at 153.6 million tons and 92.3 million tons, respectively, up 1 million and 300,000 tons from previous. Brazil harvest progress is running above 50 percent. Crush was pegged

at 52.5 million tons, 1.6 million above 2022.

Export

Developments

·

None reported

Prices

attached (modified close)

Updated

03/23/23

Soybeans

– May $13.75-$15.00

Soybean

meal – May $400-$475

Soybean

oil – May 49.50-55.55

·

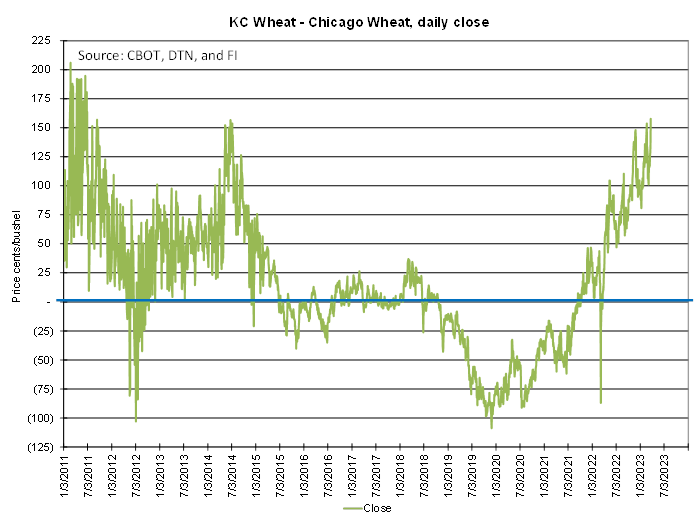

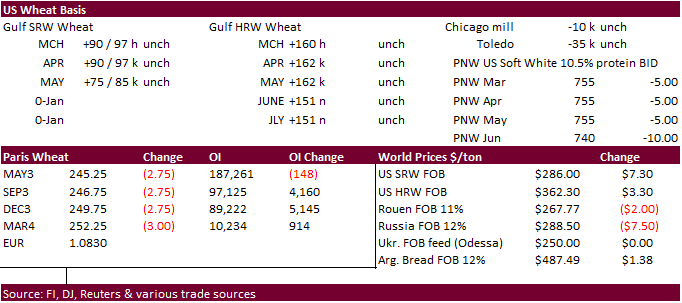

US Chicago wheat futures were mixed (bear spreading), and higher for KC & MN. Bottom picking was cited for back month Chicago and higher protein wheat. Drought across US HRW wheat country supported KC wheat. India’s wheat crop

was damaged by a storm earlier this week across their largest producing region. The USD was slightly higher at the end of the day. Paris wheat hit an 18-month low.

·

Funds sold an estimated net 1,000 Chicago wheat contracts. Note most investment funds prefer to utilize the Chicago wheat contract, one reason nearby Chicago was under pressure.

·

USDA export sales were poor.

·

Nearby KC wheat traded at its highest premium over Chicago wheat in years, ending at $1.5775, KC May premium over May Chicago.

·

The recent unfavorable weather in India affected 10 percent of Punjab’s wheat crop. That state is the largest Indian state producer of wheat.

·

Russia’s wheat crop in 2023 could amount to 85.3 million tons, down from 104.2 million tons in 2022, according to SovEcon.

·

Paris May wheat was down 2.75 euros at 245.00 per ton.

·

Jordan seeks 120,000 tons of wheat on March 28 for Sep-Oct shipment.

·

China plans to auction off 140,000 tons of wheat from state reserves on March 29.

Rice/Other

·

Results awaited: South Korea seeks 121,800 tons of rice, most of it from China.

Prices

attached (modified close)

Updated

03/21/23

KC

– May $7.60-$8.75

MN

– May

$8.00-$9.50

This summary is based on reports from exporters for the period March 10-16, 2023.

Wheat:

Net sales of 125,600 metric tons (MT) for 2022/2023 were down 63 percent from the previous week and 59 percent from the prior 4-week average. Increases primarily for Mexico (74,900 MT, including decreases of 600 MT), China (73,600 MT, including 65,000 MT switched

from unknown destinations), Ecuador (37,900 MT, including 34,700 MT switched from unknown destinations), Algeria (33,000 MT), and the Philippines (26,600 MT, including 23,000 MT switched from unknown destinations), were offset by reductions for unknown destinations

(142,700 MT), Nigeria (25,000 MT), and Panama (100 MT). Net sales of 13,000 MT for 2023/2024 were reported for Trinidad and Tobago (8,900 MT), Ecuador (4,000 MT), and Panama (100 MT). Exports of 361,600 MT were up 44 percent from the previous week, but down

8 percent from the prior 4-week average. The destinations were primarily to China (68,300 MT), Mexico (52,600 MT), the Philippines (48,600 MT), Taiwan (47,500 MT), and Ecuador (37,900 MT).

Corn: Net sales of 3,095,900 MT for 2022/2023–a marketing-year

high–were up noticeably from the previous week and from the prior 4-week average. Increases primarily for China (2,245,200 MT, including 123,000 MT switched from unknown destinations), Japan (683,000 MT, including 94,400 MT switched from unknown destinations

and decreases of 122,100 MT), Mexico (224,900 MT, including decreases of 3,600 MT), Colombia (54,100 MT, including decreases of 42,200 MT), and the Dominican Republic (51,200 MT), were offset by reductions for unknown destinations (261,400 MT), Italy (35,000

MT), Guatemala (7,100 MT), and Costa Rica (3,500 MT). Net sales of 93,000 MT for 2023/2024 were reported for Mexico (80,000 MT), Japan (10,000 MT), and unknown destinations (3,000 MT). Exports of 1,381,300 MT–a marketing-year high–were up 23 percent from

the previous week and 57 percent from the prior 4-week average. The destinations were primarily to Mexico (395,600 MT), Japan (304,700 MT), China (201,900 MT), Colombia (116,900 MT), and South Korea (67,600 MT).

Optional Origin Sales:

For 2022/2023, the current outstanding balance of 140,000 MT were for South Korea (100,000 MT) and Egypt (40,000 MT).

Export Adjustments:

Accumulated exports of corn to Colombia were adjusted down 41,145 MT for week ending March 9th. This shipment was reported in error.

Barley: No net sales or exports were reported for

the week.

Sorghum:

Total net sales reductions of 3,600 MT for 2022/2023–a marketing-year low–were down noticeably from the previous week and from the prior 4-week average. Decreases were for China. Exports of 49,400 MT were down 32 percent from the previous week and 34 percent

from the prior 4-week average. The destination was to China.

Rice: Net sales of 14,900 MT for 2022/2023 were down

42 percent from the previous week and 73 percent from the prior 4-week average. Increases were primarily for Guatemala (6,200 MT), El Salvador (4,000 MT), Canada (2,400 MT, including decreases of 200 MT), Saudi Arabia (800 MT, including decreases of 700 MT),

and Mexico (500 MT). Exports of 14,300 MT were up 37 percent from the previous week, but down 76 percent from the prior 4-week average. The destinations were primarily to Guatemala (6,200 MT), Mexico (3,800 MT), Canada (2,300 MT), Saudi Arabia (800 MT), and

Jordan (500 MT).

Soybeans:

Net sales of 152,500 MT for 2022/2023 were down 77 percent from the previous week and 55 percent from the prior 4-week average. Increases primarily for China (137,700 MT, including 126,000 MT switched from unknown destinations and decreases of 6,500 MT), Mexico

(76,700 MT, including decreases of 700 MT), the Netherlands (65,000 MT, including 62,000 MT switched from unknown destinations), Japan (52,800 MT, including decreases of 18,000 MT), and Algeria (42,500 MT, including 45,000 MT switched from unknown destinations

and decreases of 2,500 MT), were offset by reductions primarily for unknown destinations (222,000 MT). Net sales of 199,000 MT for 2023/2024 were reported for unknown destinations (132,000 MT) and China (67,000 MT). Exports of 704,300 MT were down 8 percent

from the previous week and 26 percent from the prior 4-week average. The destinations were primarily to China (420,900 MT), the Netherlands (65,000 MT), Egypt (50,300 MT), Algeria (42,500 MT), and Mexico (42,500 MT).

Optional Origin Sales:

For 2022/2023, the current outstanding balance of 300 MT, all South Korea.

Export for Own Account:

For 2022/2023, the current exports for own account outstanding balance of 1,600 MT are for Canada (1,500 MT) and Taiwan (100 MT).

Export Adjustments:

Accumulated exports of soybeans to Colombia were adjusted down 9,624 MT for week ending March 9th. This shipment was reported in error.

Soybean Cake and Meal:

Net sales of 121,100 MT for 2022/2023 were down 45 percent from the previous week and 38 percent from the prior 4-week average. Increases primarily for Canada (33,400 MT, including decreases of 1,800 MT), the Philippines (19,700 MT, including decreases of

300 MT), Venezuela (12,500 MT), Costa Rica (12,000 MT), and Panama (6,900 MT), were offset by reductions for Japan (1,600 MT). Exports of 269,300 MT were down 20 percent from the previous week, but up 3 percent from the prior 4-week average. The destinations

were primarily to Chile (49,300 MT), Colombia (49,000 MT), Poland (47,700 MT), Ecuador (31,900 MT), and Mexico (29,700 MT).

Late Reporting:

For 2022/2023, net sales totaling 2,000 MT of soybean cake and meal were reported late for Malaysia. Exports of 1,600 MT were late to Malaysia.

Soybean Oil:

Net sales of 10,800 MT for 2022/2023–a marketing-year high–were up noticeably from the previous week and from the prior 4-week average. Increases were reported for Mexico (10,700 MT) and Canada (100 MT, including decreases of 100 MT). Exports of 300 MT were

down 7 percent from the previous week and 80 percent from the prior 4-week average. The destination was to Canada.

Cotton:

Net sales of 310,200 RB for 2022/2023 were up 38 percent from the previous week and 33 percent from the prior 4-week average. Increases primarily for Vietnam (115,300 RB, including 2,600 RB switched from South Korea, 800 RB switched from China, 300 RB switched

from Japan, and decreases of 100 RB), China (95,900 RB, including 900 RB switched from Pakistan), Bangladesh (30,000 RB), Turkey (25,100 RB), and Pakistan (15,700 RB, including decreases of 4,700 RB), were offset by reductions for Guatemala (14,000 RB). Net

sales of 21,300 RB for 2023/2024 were reported for Guatemala (9,600 RB), Japan (5,300 RB), Pakistan (4,400 RB), Vietnam (1,300 RB), and Peru (700 RB). Exports of 272,500 RB were unchanged from the previous week, but up 13 percent from the prior 4-week average.

The destinations were primarily to Vietnam (92,300 RB), Pakistan (42,100 RB), Turkey (38,400 RB), China (30,100 RB), and Mexico (15,400 RB). Net sales of Pima totaling 16,900 RB for 2022/2023–a marketing-year high–were up noticeably from the previous week

and from the prior 4-week average. Increases were primarily for India (11,200 RB), China (3,200 RB), Pakistan (1,000 RB), Thailand (700 RB), and Guatemala (400 RB). Total net sales of 400 RB for 2023/2024 were for Japan. Exports of 7,100 RB were up noticeably

from the previous week and from the prior 4-week average. The destinations were primarily to China (1,500 RB), India (1,500 RB), Peru (900 RB), Turkey (900 RB), and Vietnam (900 RB).

Optional Origin Sales:

For 2022/2023, the current outstanding balance of 7,300 RB, all Malaysia.

Export for Own Account:

For 2022/2023, new exports for own account totaling 17,300 RB were to China (15,100 RB) and Vietnam (2,200 RB).

Exports for own account totaling 2,500 RB to China were applied to new or outstanding sales. The current exports for own account outstanding balance of 115,700 RB are for China (86,900 RB), Vietnam (16,200 RB), Pakistan (5,000 RB), Turkey (3,700 RB), South

Korea (2,400 RB), and India (1,500 RB).

Hides and Skins:

Net sales of 328,100 pieces for 2023 were down 3 percent from the previous week and 6 percent from the prior 4-week average. Increases primarily for China (196,700 whole cattle hides, including decreases of 20,800 pieces), Mexico (74,900 whole cattle hides,

including decreases of 2,300 pieces), South Korea (43,800 whole cattle hides, including decreases of 1,700 pieces), Turkey (7,100 whole cattle hides), and Thailand (3,900 whole cattle hides, including decreases of 400 pieces), were offset by reductions primarily

for Italy (1,500 pieces), Brazil (400 pieces), and Taiwan (400 pieces). In addition, total net sales reductions of 400 kip skins were for Canada. Exports of 393,800 pieces were down 13 percent from the previous week and 12 percent from the prior 4-week average.

Whole cattle hides exports were primarily to China (226,500 pieces), South Korea (65,700 pieces), Mexico (44,700 pieces), Brazil (20,600 pieces), and Italy (10,800 pieces). Exports of 2,600 kip skins were to Canada.

Net sales of 145,100 wet blues for 2023 were up 68 percent from the previous week and 22 percent from the prior 4-week

average. Increases primarily for Vietnam (48,300 unsplit), Brazil (42,900 grain splits, 100 unsplit, and decreases of 100 grain splits), China (29,200 unsplit), Taiwan (19,500 unsplit), and Mexico (3,400 unsplit, including decreases of 100 unsplit), were offset

by reductions for Hong Kong (100 unsplit). Exports of 117,300 wet blues were down 26 percent from the previous week and 23 percent from the prior 4-week average. The destinations were primarily to Italy (37,600 unsplit), China (25,400 unsplit), Vietnam (17,600

unsplit), Thailand (14,800 unsplit), and Brazil (6,300 unsplit and 2,000 grain splits). Total net sales of 224,100 splits were for Vietnam. No exports of splits were reported for the week.

Beef: Net sales of 18,600 MT for 2023 were up 5 percent

from the previous week and 59 percent from the prior 4-week average. Increases primarily for South Korea (10,800 MT, including decreases of 1,700 MT), Japan (3,600 MT, including decreases of 900 MT), China (1,500 MT, including decreases of 300 MT), Taiwan

(800 MT, including decreases of 300 MT), and Hong Kong (800 MT, including decreases of 100 MT), were offset by reductions for the United Kingdom (100 MT). Exports of 13,500 MT were down 15 percent from the previous week and 13 percent from the prior 4-week

average. The destinations were primarily to Japan (3,500 MT), South Korea (3,200 MT), China (2,300 MT), Mexico (1,300 MT), and Taiwan (900 MT).

Pork:

Net sales of 38,000 MT for 2023 were up 7 percent from the previous week and 8 percent from the prior 4-week average. Increases were primarily for Mexico (18,400 MT, including decreases of 600 MT), Canada (4,800 MT, including decreases of 500 MT), Japan (4,400

MT, including decreases of 200 MT), South Korea (3,400 MT, including decreases of 300 MT), and Australia (1,800 MT). Exports of 30,500 MT were up 3 percent from the previous week and 2 percent from the prior 4-week average. The destinations were primarily

to Mexico (13,200 MT), China (4,400 MT), Japan (3,900 MT), South Korea (2,600 MT), and Canada (1,500 MT).

U.S. EXPORT SALES FOR WEEK ENDING 3/16/2023

|

|

CURRENT MARKETING YEAR |

NEXT MARKETING YEAR |

||||||

|

COMMODITY |

NET SALES |

OUTSTANDING SALES |

WEEKLY EXPORTS |

ACCUMULATED EXPORTS |

NET SALES |

OUTSTANDING SALES |

||

|

CURRENT YEAR |

YEAR AGO |

CURRENT YEAR |

YEAR AGO |

|||||

|

|

THOUSAND METRIC TONS |

|||||||

|

WHEAT |

|

|

|

|

|

|

|

|

|

HRW |

48.8 |

696.7 |

1,586.8 |

43.6 |

4,161.9 |

5,873.3 |

0.1 |

112.4 |

|

SRW |

24.0 |

491.4 |

567.6 |

57.3 |

2,244.2 |

2,188.3 |

7.5 |

381.8 |

|

HRS |

6.4 |

924.8 |

1,067.2 |

111.8 |

4,486.8 |

4,112.0 |

5.4 |

94.9 |

|

WHITE |

13.3 |

772.4 |

503.8 |

148.9 |

3,717.5 |

2,803.4 |

0.0 |

43.2 |

|

DURUM |

33.0 |

77.8 |

18.8 |

0.0 |

290.5 |

169.7 |

0.0 |

36.9 |

|

TOTAL |

125.6 |

2,963.0 |

3,744.1 |

361.6 |

14,900.7 |

15,146.7 |

13.0 |

669.2 |

|

BARLEY |

0.0 |

3.9 |

13.9 |

0.0 |

8.0 |

14.7 |

0.0 |

6.0 |

|

CORN |

3,095.9 |

16,354.1 |

22,719.4 |

1,381.3 |

18,586.9 |

30,297.9 |

93.0 |

1,952.4 |

|

SORGHUM |

-3.6 |

855.0 |

3,274.7 |

49.4 |

642.7 |

3,501.7 |

0.0 |

63.0 |

|

SOYBEANS |

152.5 |

5,944.1 |

11,161.5 |

704.3 |

43,533.7 |

42,874.7 |

199.0 |

1,745.2 |

|

SOY MEAL |

121.1 |

2,666.0 |

3,223.1 |

269.3 |

5,720.5 |

5,829.4 |

0.0 |

264.0 |

|

SOY OIL |

10.8 |

41.3 |

167.2 |

0.3 |

32.8 |

435.2 |

0.0 |

0.6 |

|

RICE |

|

|

|

|

|

|

|

|

|

L G RGH |

10.2 |

158.4 |

234.2 |

9.0 |

426.2 |

922.9 |

0.0 |

0.0 |

|

M S RGH |

0.0 |

31.3 |

3.5 |

0.8 |

20.6 |

10.7 |

0.0 |

5.0 |

|

L G BRN |

1.3 |

5.1 |

16.5 |

0.4 |

15.0 |

33.2 |

0.0 |

0.0 |

|

M&S BR |

0.0 |

35.8 |

43.9 |

0.1 |

8.8 |

42.3 |

0.0 |

0.0 |

|

L G MLD |

1.5 |

104.6 |

73.9 |

2.4 |

442.3 |

569.2 |

0.0 |

0.0 |

|

M S MLD |

1.8 |

141.4 |

240.4 |

1.7 |

179.1 |

257.5 |

0.0 |

13.0 |

|

TOTAL |

14.9 |

476.5 |

612.5 |

14.3 |

1,091.9 |

1,835.9 |

0.0 |

18.0 |

|

COTTON |

|

THOUSAND RUNNING BALES |

||||||

|

UPLAND |

310.2 |

4,958.3 |

7,670.9 |

272.5 |

6,220.8 |

6,292.4 |

21.3 |

1,360.0 |

|

PIMA |

16.9 |

56.1 |

160.7 |

7.1 |

108.4 |

270.5 |

0.4 |

3.9 |

#non-promo