PDF attached

CFTC Commitment of Traders report

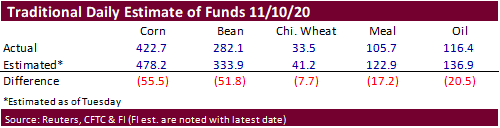

Trade estimates for the traditional corn fund position were well off for the third week in a row, missing the net long position by 55,500 contracts (423k actual vs. 478k estimate). The traditional funds also were more short than expected in soybeans by a large 51,800 contracts. Traders also overestimated the soybean oil and meal positions for the week ending 11/10.

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 299,382 -4,258 365,704 15,829 -626,638 -29,603

Soybeans 187,945 13,704 203,261 -3,395 -391,845 -17,578

Soyoil 69,898 -2,392 127,421 3,581 -217,130 -3,978

CBOT wheat 4,826 -14,700 137,071 -2,150 -126,652 14,358

KCBT wheat 23,044 -98 67,118 99 -91,009 -1,828

=================================================================================

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 280,835 -9,245 216,638 11,926 -594,179 -26,244

Soybeans 221,094 10,137 127,983 -9,700 -387,680 -16,852

Soymeal 83,798 -1,332 77,998 -5,656 -213,802 1,215

Soyoil 97,111 8,059 97,419 -1,806 -234,739 -2,096

CBOT wheat 32,633 -15,972 86,833 -2,044 -113,258 12,334

KCBT wheat 47,329 471 41,428 -3,317 -87,630 23

MGEX wheat 6,808 -360 2,944 295 -14,864 45

———- ———- ———- ———- ———- ———-

Total wheat 86,770 -15,861 131,205 -5,066 -215,752 12,402

Live cattle 27,987 11,920 68,958 -3,448 -108,871 -7,548

Feeder cattle -2,493 4,566 6,640 36 -2,263 -1,689

Lean hogs 33,935 -1,779 50,781 -1,395 -86,876 4,631

Source: CFTC, Reuters and FI

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.