PDF attached

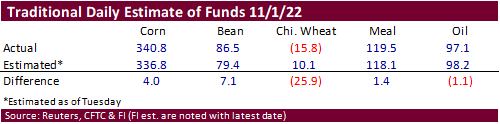

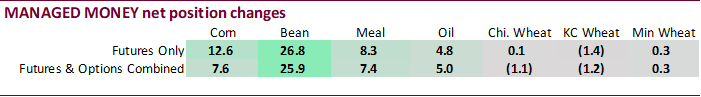

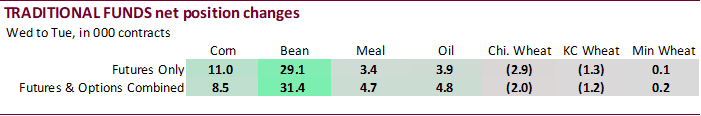

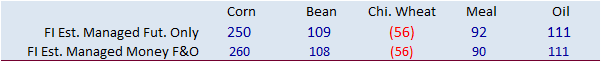

Traditional funds missed the net short position for Chicago wheat. Thinking it was net long 10,100 contracts, it was reported net short about 16,000 contracts. CFTC reported money managers added long positions for the third consecutive week.

Reuters table

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 196,686 11,982 358,695 -2,791 -502,977 -11,808

Soybeans 57,214 30,332 119,378 3,834 -147,249 -28,177

Soyoil 59,949 2,944 104,250 2,087 -178,009 -6,008

CBOT wheat -52,429 -1,822 105,375 2,831 -46,705 -1,018

KCBT wheat 4,788 -1,039 47,911 917 -51,681 301

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 271,960 7,586 221,802 3,172 -490,638 -14,286

Soybeans 101,329 25,918 75,856 1,919 -140,670 -27,316

Soymeal 93,417 7,388 79,479 -903 -221,230 -4,647

Soyoil 100,118 4,957 81,135 -3,836 -193,309 -1,962

CBOT wheat -37,149 -1,097 63,635 2,400 -38,241 -413

KCBT wheat 23,408 -1,218 28,618 1,115 -47,857 284

MGEX wheat 3,814 331 1,176 167 -5,739 -336

———- ———- ———- ———- ———- ———-

Total wheat -9,927 -1,984 93,429 3,682 -91,837 -465

Live cattle 66,048 326 53,153 269 -130,058 -333

Feeder cattle -6,494 -623 3,123 66 4,999 -53

Lean hogs 59,568 4,135 46,149 23 -85,678 -879

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 49,281 909 -52,405 2,618 1,916,119 53,532

Soybeans -7,171 5,468 -29,344 -5,989 669,123 -52,523

Soymeal 19,953 -2,697 28,381 861 435,093 8,412

Soyoil -1,753 -137 13,809 977 493,168 10,245

CBOT wheat 17,995 -899 -6,241 10 435,024 23,076

KCBT wheat -3,151 -3 -1,018 -178 179,185 4,203

MGEX wheat 2,246 -135 -1,496 -27 57,724 -473

———- ———- ———- ———- ———- ———-

Total wheat 17,090 -1,037 -8,755 -195 671,933 26,806

Live cattle 18,959 342 -8,103 -604 357,579 10,913

Feeder cattle -1,054 270 -574 339 57,443 -4,248

Lean hogs -6,494 -2,009 -13,546 -1,271 257,819 921

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.