PDF attached

CFTC Commitment of Traders

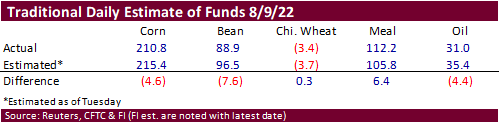

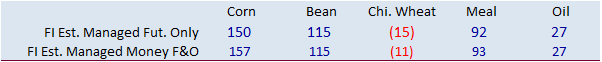

Not much in the way of actual vs. estimate deviations for the week ending Tuesday, August 9. Funds were still short Chicago wheat (and are going home Friday), something to watch as they can easily add long positions.

Reuters Table

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 54,670 19,425 372,220 -8,455 -377,473 -14,133

Soybeans 35,010 498 146,796 -117 -152,933 -2,452

Soyoil -3,915 -1,462 98,621 3,778 -100,661 -6,172

CBOT wheat -57,907 -3,432 118,604 -790 -55,356 537

KCBT wheat -13,622 -1,712 49,892 -386 -35,116 1,564

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 142,062 12,141 242,968 -7,606 -373,542 -11,476

Soybeans 101,509 2,039 89,029 -1,297 -151,179 -1,736

Soymeal 84,382 4,365 85,297 3,390 -213,939 -8,988

Soyoil 22,210 69 82,870 3,442 -114,087 -8,300

CBOT wheat -20,348 -5,378 69,041 1,613 -48,028 -167

KCBT wheat 8,023 -1,970 29,790 185 -31,253 1,095

MGEX wheat -1,015 -363 1,473 76 -518 407

Total wheat -13,340 -7,711 100,304 1,874 -79,799 1,335

Live cattle 49,072 11,067 59,953 -453 -121,615 -9,397

Feeder cattle 479 668 3,198 -184 3,485 -126

Lean hogs 65,153 8,402 50,574 -51 -109,656 -13,081

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 37,931 3,777 -49,418 3,164 1,803,434 -32,259

Soybeans -10,487 -1,077 -28,872 2,072 749,412 15,515

Soymeal 19,134 61 25,126 1,172 455,180 11,836

Soyoil 3,051 932 5,955 3,855 457,240 29,532

CBOT wheat 4,678 248 -5,341 3,684 429,529 6,722

KCBT wheat -5,403 154 -1,156 534 180,595 -5,427

MGEX wheat 2,536 -26 -2,477 -96 61,446 -985

Total wheat 1,811 376 -8,974 4,122 671,570 310

Live cattle 16,685 -235 -4,095 -981 311,042 -1,055

Feeder cattle 39 33 -7,200 -391 56,315 2,527

Lean hogs 3,902 3,309 -9,973 1,421 310,366 23,604

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.