PDF attached

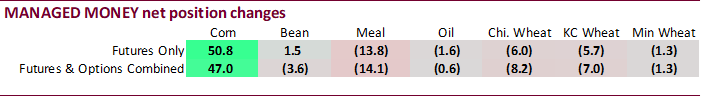

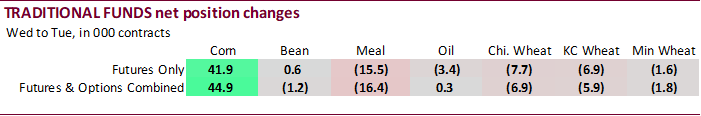

Funds were active with short covering corn positions for the week ending May 30th.

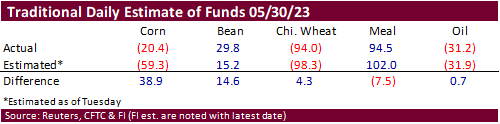

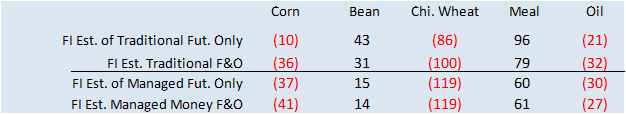

Fund estimates as of June 2 (net in 000)

Reuters table

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn -112,046 37,591 291,443 9,975 -127,167 -49,317

Soybeans -10,960 -6,271 109,874 315 -70,458 3,886

Soyoil -53,896 114 96,788 2,281 -41,949 -1,095

CBOT wheat -110,215 -7,059 68,177 -50 35,573 7,827

KCBT wheat -6,999 -3,625 40,139 -1,691 -26,716 6,271

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn -51,065 46,962 246,292 -951 -147,843 -45,697

Soybeans 529 -3,616 84,601 -6,326 -73,825 5,448

Soymeal 59,676 -14,113 96,867 2,937 -190,427 10,460

Soyoil -37,449 -573 113,424 1,467 -70,931 -470

CBOT wheat -126,998 -8,210 67,635 -328 33,388 7,912

KCBT wheat 9,628 -6,993 31,873 1,046 -29,461 5,784

MGEX wheat -7,703 -1,301 1,557 316 3,360 1,061

———- ———- ———- ———- ———- ———-

Total wheat -125,073 -16,504 101,065 1,034 7,287 14,757

Live cattle 107,835 5,845 50,319 216 -169,230 -6,186

Feeder cattle 17,432 661 950 3 -5,766 -1,823

Lean hogs -31,110 -6,981 50,387 -249 -25,505 4,740

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 4,848 -2,066 -52,230 1,752 1,761,882 -12,577

Soybeans 17,152 2,425 -28,458 2,070 847,867 5,425

Soymeal 18,676 -2,319 15,209 3,034 538,779 -373

Soyoil -4,100 875 -943 -1,300 613,532 2,880

CBOT wheat 19,510 1,344 6,464 -717 475,870 -1,890

KCBT wheat -5,617 1,118 -6,424 -955 204,606 -5,769

MGEX wheat 2,351 -520 435 444 61,646 -3,006

———- ———- ———- ———- ———- ———-

Total wheat 16,244 1,942 475 -1,228 742,122 -10,665

Live cattle 28,525 -821 -17,449 948 411,741 5,564

Feeder cattle 610 871 -13,226 290 79,717 -3,567

Lean hogs 1,945 2,958 4,282 -466 339,064 8,587

FUTURES ONLY Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn -46,846 50,803 244,826 -343 -172,616 -43,279

Soybeans 2,238 1,528 80,957 -6,042 -85,119 4,284

Soymeal 59,329

| Terry Reilly Senior Commodity Analyst – Grain and Oilseeds |

| Futures International One Lincoln Center 18W140 Butterfield Rd. Suite 1450 Oakbrook terrace, Il. 60181 |

| Work: 312.604.1366 ICE IM: treilly1 Skype IM: fi.treilly |

| treilly@futures-int.com

|

| DISCLAIMER: The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content. Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results. |