PDF attached

CFTC Commitment of Traders

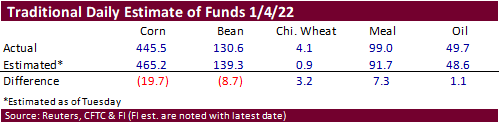

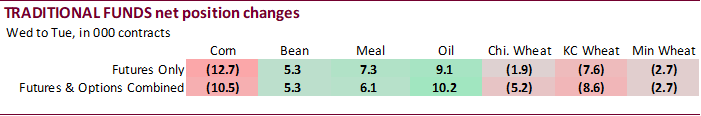

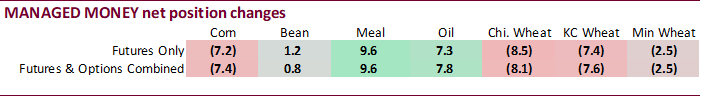

Largest discrepancy in the Commitment of Traders reports was that the funds net long position was not as long as expected, by 19,700 contracts. The funds were also not as long as expected for soybeans, by 8,700. Both position results may have little impact on prices. The net long traditional fund position for corn was down a small amount as of last Tuesday and for soybeans the net long position is highest since July 13, 2021. Chicago wheat is headed to near a flat position for funds futures only if prices continue to decline.

CFTC via Reuters

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 268,991 -13,799 438,828 4,594 -658,237 25,076

Soybeans 85,850 5,140 180,909 3,798 -227,666 -2,812

Soyoil 9,016 7,427 120,970 2,698 -137,078 -12,350

CBOT wheat -36,068 -5,570 124,628 3,214 -79,112 5,111

KCBT wheat 21,486 -8,166 59,571 -2,142 -84,508 8,229

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 365,905 -7,440 261,167 921 -648,855 25,468

Soybeans 98,919 839 140,056 5,299 -232,737 -4,504

Soymeal 70,768 9,606 87,067 51 -210,986 -7,660

Soyoil 53,188 7,794 91,223 -2,896 -141,957 -9,523

CBOT wheat -19,845 -8,071 77,397 3,892 -62,438 4,019

KCBT wheat 51,813 -7,593 24,792 -805 -72,213 7,369

MGEX wheat 9,481 -2,549 1,643 516 -20,667 3,505

———- ———- ———- ———- ———- ———-

Total wheat 41,449 -18,213 103,832 3,603 -155,318 14,893

Live cattle 72,346 2,743 80,277 -766 -155,806 -443

Feeder cattle 7,326 5,646 3,792 240 -1,997 -2,761

Lean hogs 55,674 -2,044 56,825 -394 -104,542 530

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 71,365 -3,077 -49,582 -15,872 1,865,691 22,589

Soybeans 32,855 4,491 -39,093 -6,126 789,340 21,901

Soymeal 25,888 -3,472 27,263 1,475 436,279 5,975

Soyoil -9,547 2,400 7,094 2,224 422,697 2,853

CBOT wheat 14,334 2,916 -9,448 -2,756 439,485 5,758

KCBT wheat -7,843 -1,049 3,451 2,078 247,064 2,544

MGEX wheat 6,860 -180 2,683 -1,292 77,161 -436

———- ———- ———- ———- ———- ———-

Total wheat 13,351 1,687 -3,314 -1,970 763,710 7,866

Live cattle 18,932 1,484 -15,750 -3,018 381,779 20,465

Feeder cattle 360 -76 -9,481 -3,050 49,318 3,076

Lean hogs 8,095 1,287 -16,053 621 264,825 1,877

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.