*The RESEND includes a correction to my storage outlook for tomorrow.

“For week ending May 27th, our S/D storage model is pointing to a +84 Bcf injection while our flow model is higher with a +87 Bcf”

Today’s Fundamentals

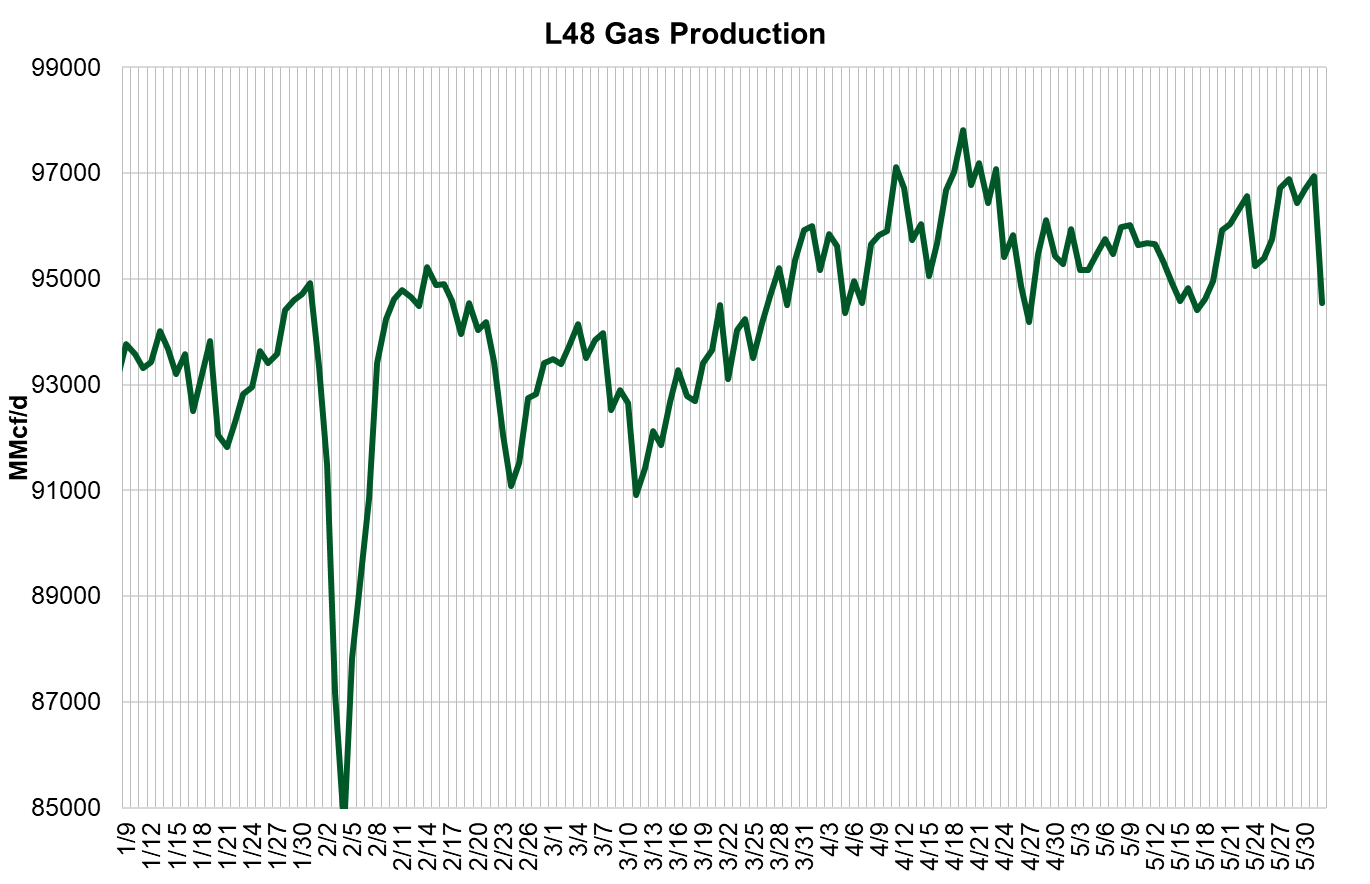

Daily US natural gas production is estimated to be 95.1 Bcf/d this morning. Today’s estimated production is -1.81 Bcf/d to yesterday, and -1.27 Bcf/d to the 7D average. Today’s nomination data shows production retreating in the SC and Northeast. This could related to the 1st of the month nomination noise. We expect today’s numbers to be revised higher as we work through the week.

Natural gas consumption is modelled to be 69.9 Bcf today, -1.88 Bcf/d to yesterday, and +2.73 Bcf/d to the 7D average. US power burns are expected to be 32.2 Bcf today, and US ResComm usage is expected to be 8.7 Bcf.

Net LNG deliveries are expected to be 12.7 Bcf today. Sabine Pass levels did bounce back up today after being lower for just one day.

Mexican exports are expected to be 7.2 Bcf today, and net Canadian imports are expected to be 4.8 Bcf today. Pipe flows to Mexico continue to rise as the heat picks up, and LNG is a less economic option.

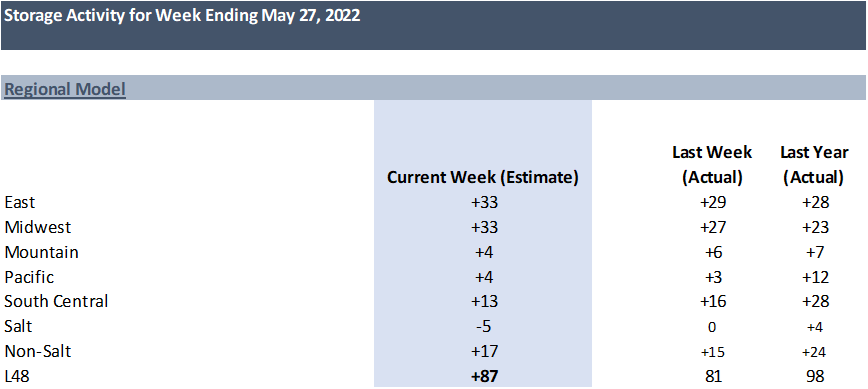

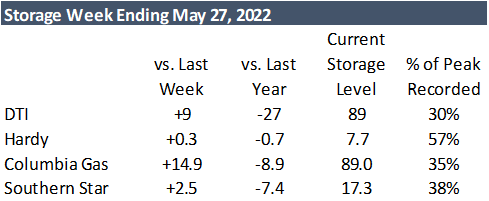

For week ending May 27th, our S/D storage model is pointing to a +84 Bcf injection while our flow model is higher with a +87 Bcf. Below is the regional break down of the flow based model + the week storage activity at the 4 facilities that report on a weekly basis. This is likely to be the highest injection for the first half of the year. The Northeast showed a big injection, which was driven returning production and shoulder season demand. The East storage region as a whole is 56 Bcf behind LY, which is concerning. We anticipate production picking up in the region to fill the gap this summer.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.