Natural gas markets opened higher with the Euro adding some HDDs later this week, and production continuing to remain lower. The Euro Ensemble added 11 GWHDD vs Friday’s 12z run.

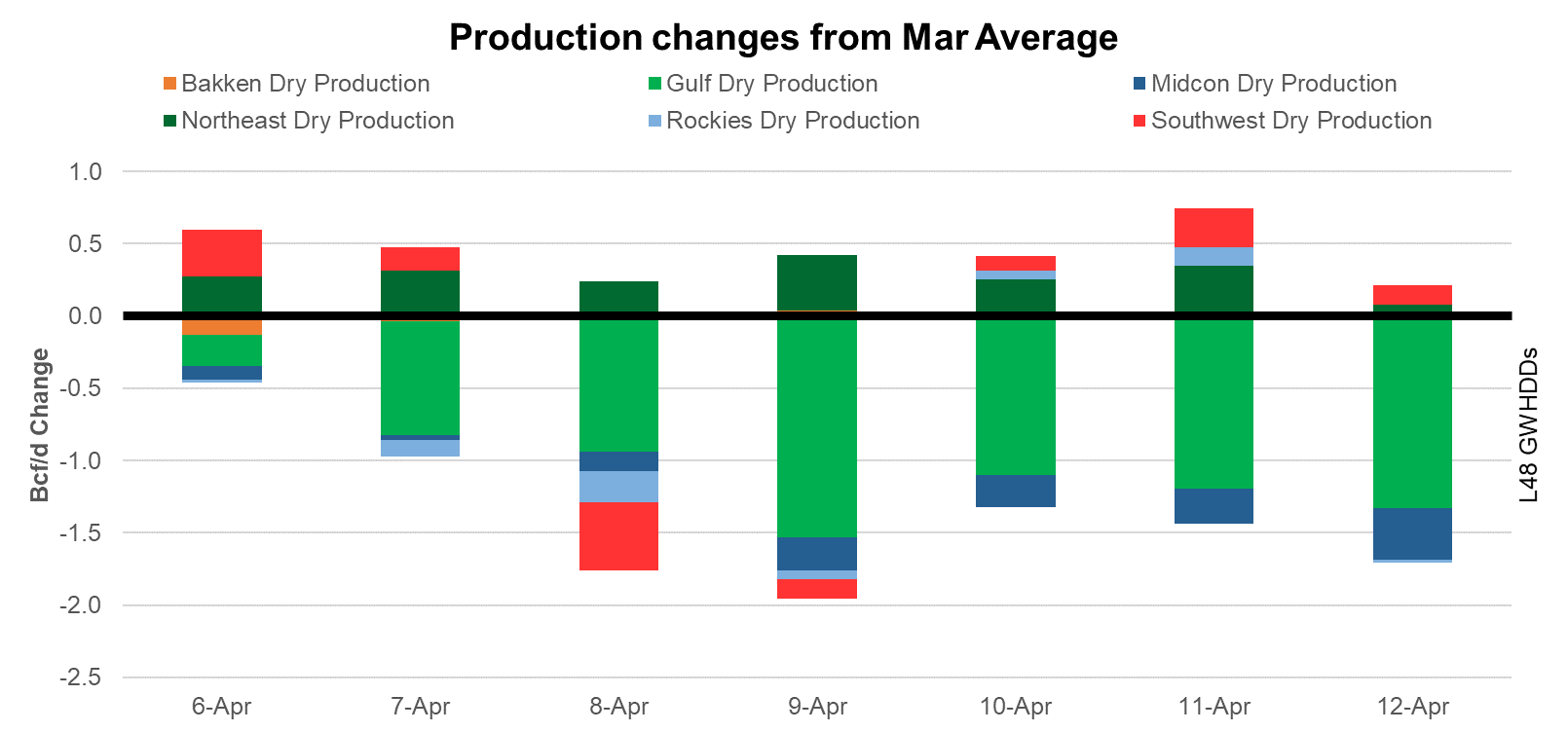

Production continues to printer about 1.5 Bcf/d lower than the March average. The drop primarily comes out of the TX and Midcon region. There is no clear story on what’s driving the lower levels, but the drop could be related to maintenance/repair of equipment after the cold Feb or the start up of some ethylene facilities that is reducing the amount of ethane being rejected in the South.

Today’s Fundamentals

Daily US natural gas production is estimated to be 90.5 Bcf/d this morning. Today’s estimated production is -0.81 Bcf/d to yesterday, and -0.85 Bcf/d to the 7D average.

Natural gas consumption is modelled to be 67.1 Bcf today, +1.52 Bcf/d to yesterday, and +2.9 Bcf/d to the 7D average. US power burns are expected to be 24.34 Bcf today, and US ResComm usage is expected to be 17.1 Bcf.

Net LNG deliveries are expected to be 11.6 Bcf today.

Mexican exports are expected to be 7 Bcf today, and net Canadian imports are expected to be 3.8 Bcf today.

The storage outlook for the upcoming report is +71 Bcf today.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.