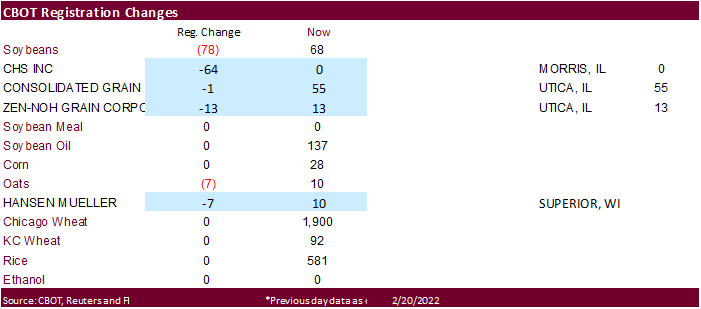

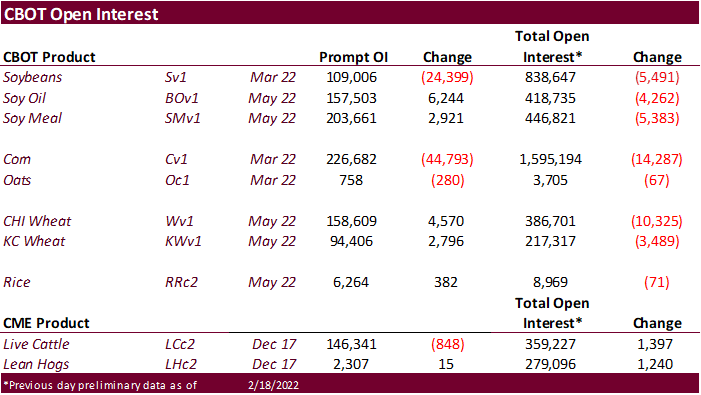

Deliveries (below) and OI attached.

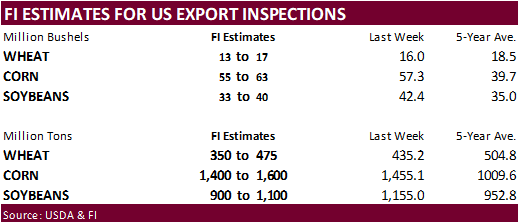

USDA inspection estimates below

Very hard to speculate market reaction per recent Ukraine/Russia developments but based on EU & Asian markets:

Calls-

Corn 4-7 higher

Wheat 7-12 higher

Soy 11-16 higher

Meal $3-$4 higher

soybean oil 50-80 higher

Feb 20 (Reuters) – Exports of Malaysian palm oil products for February 1 – 20 rose 24.9 percent to 825,193 tons from 660,866 tons shipped during January 1 – 20, cargo surveyor Intertek Testing Services said on Sunday.

(Reuters) – Exports of Malaysian palm oil products for February 1 – 20 rose 29.2 percent to 818,293 tons from 633,531 tons shipped during January 1 – 20, independent inspection company AmSpec Agri Malaysia said on Sunday.

(Reuters) – China sold 508,089 tons of wheat or 96.64% of the total offer at an auction of state reserves held Feb. 16, the National Grain Trade Center said on its website on Monday. The average price of the wheat sold was 2,689 yuan ($425.13) per ton.

(Reuters) – Brazil’s farmers had harvested 33% of the country’s soybean area as of Thursday, against 24% a week earlier and 15% by the same time last year, but still faced widespread weather-related issues, agribusiness consultancy AgRural said on Monday. The top grain-producing state of Mato Grosso has been hit by excessive rain, hurting soybean quality, while Brazil’s southernmost states have been affected by hot, dry weather recently. AgRural forecasts Brazil’s 2021/22 soybean crop at 128.5 million tons, down 17 million tons from its initial forecast, but a new revision is expected in the coming days. On corn, the consultancy said the planting of Brazil’s second crop reached 53% of the area in the Center-South, well ahead of the 24% a year ago. However, fieldwork was also affected by excessive showers in Mato Grosso and by drought in the southern state of Parana.

Feb 21 (Reuters) – Argentina’s grains inspectors began a 24-hour strike on Monday demanding bonus payments, but port activity and shipments of farm products were not affected in the South American country, the top global exporter of processed soybeans. Juan Carlos Peralta, press secretary of the URGARA union, said there was strong compliance with the strike action and that on Monday afternoon the union would hold another assembly to decide whether to extend the strike. “We will continue with the measure if we do not have an answer,” Peralta said.

HAMBURG, Feb 21 (Reuters) – European wheat prices rose on Monday as continued tension between Russia and Ukraine brought more uncertainty over grain exports from the Black Sea region. May wheat BL2K2, the most active contract on the Paris-based Euronext exchange, unofficially closed up 3.00 euros or 1.0% at 278.75 euros ($316.16) a ton.

Feb 21 (Reuters) – Argentina’s 2021/22 soybean and corn crops could see yields continue to decline in the weeks ahead with abundant rains only expected to arrive in mid-March to relieve a lengthy period of dry weather, the Buenos Aires grains exchange said on Monday. Argentina is the world’s top exporter of soybean oil and meal, and the second largest for corn, but has seen harvest forecasts slashed after drought since late last year, impacted by the La Nina climate phenomenon for a second straight year. “Given the double episode of ‘La Nina’ we’re going through, the return of the rains could be delayed until mid-March, causing significant yield losses,” the exchange said in a monthly weather report.

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.