Natural gas prices were wild, to say the least, this week, and adding to the volatility was the reported wild storage injection of +89 Bcf for the week ending September 11th. The fear of storage hit capacity sent Oct prices drastically lower, while the winter strip stayed somewhat intact. The VF spread closed the week at 1.24 – not in the normal range but makes sense with summer and winter fundamentals on completely different paths.

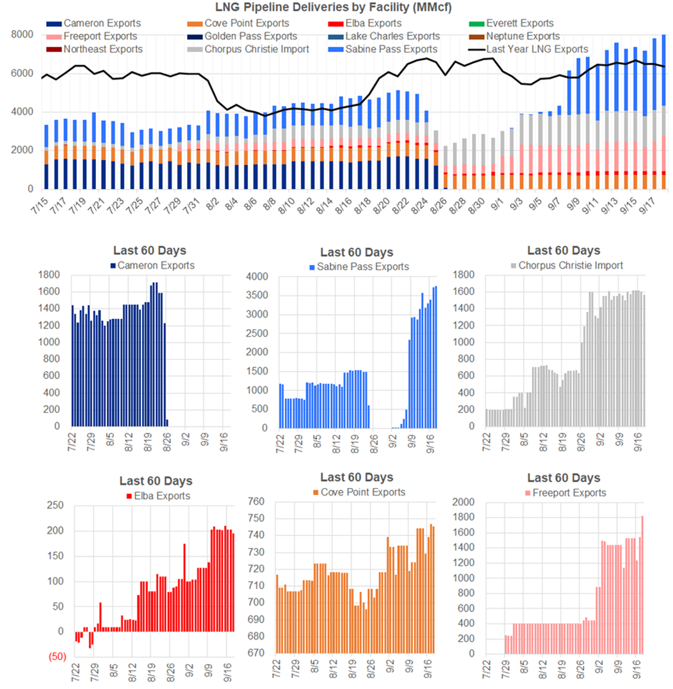

LNG is one of the key factors the markets relying on to keep the market from breaching storage limits, especially in a period where late-season storage ratchets limit daily injections.

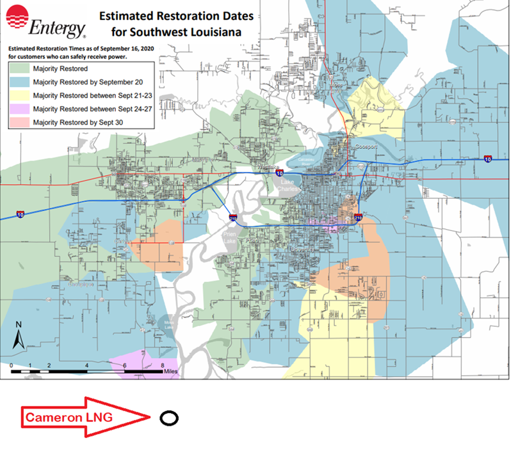

Cameron LNG is located on the northwestern edge of Calcasieu Lake. It is just south of Lake Charles, one of the hardest-hit areas from Hurricane Laura. The facility did not sustain any damage, but the start-up has been delayed due to the lack of waterway access to the facility using the Calcasieu channel and power supply issues.

We have seen LNG feedgas volumes rise this month despite Sempra’s Cameron facility not being available since its shut-down before Hurricane Laura. Freeport and Corpus Christie have picked up some of the slack, and Sabine Pass back online by Sept 8th with their onsite power generation. On Friday, LNG feedgas rose above 8.3 Bcf/d, but it is off this weekend as Freeport took in less feedgas.

The start-up of Cameron is on most traders’ minds, especially with storage level expected to jump well above 4 Tcf. Should Cameron LNG be offline for all of October, 1.0-1.4 Bcf/d of expected feedgas demand would be taken out of balances in October. This would be a bearish sign as storage within the region is elevated. There is no concrete timeline, but we expect to have Cameron on in the first week of October.

According to a note from ClipperData on Wednesday, “Five ballasting LNG vessels are still projected to load from Sempra’s Cameron LNG terminal… Four out of five vessels are currently in the Gulf of Mexico while one is bound for the region”.

1) Power Issues

Cameron is powered up by Entergy’s transmission and distribution system. The system had massive transmission line damage from a direct hit from Hurricane Laura.

Entergy anticipates that most customers in southwest Louisiana will receive service by Sept. 23 and the remaining customers who can safely accept power will be back on by Sept. 30. Although Cameron LNG is south of the region shown in this map, it indicates that Cameron should be powered up between Sept 24-27. Here is a link to the map.

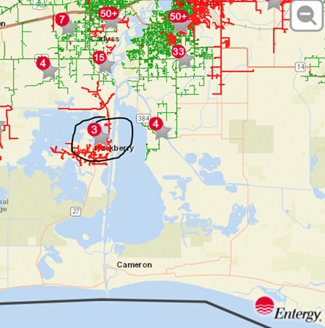

You can also see a live shot of the progress on Entergy’s website.

2) Waterways

Waterway access is currently limited to Cameron with debris and storm-related wreckages. To ensure the channels can handle large laden tankers, the recovery effort includes removal of debris and dredging are underway. Dredging is the removal of sediments and debris from the bottom of the water ways to ensure water depth can support marine traffic.

Here is the latest on the waterways from Moran Shipping.

The Calcasieu Waterway is open with restrictions as follows:

1) Vessels of less than 36-foot draft may transit the Calcasieu River from the “CC” buoy to Lake Charles

2) Monkey Island Loop surveys indicate significant debris. Vessels desiring to enter this waterway are advised to do so at their own discretion and to exercise due caution.

Dredging Plans for the Calcasieu:

Late Sept/Early October – Estimate complete dredging. Currently, Dredge Wheeler is working on the Outer Bar Channel

The typical laden LNG tanker draft is 40-feet. So there is the potential of a partially full tanker heading out of Cameron once power resumes.

3) CEO comments at DOE broadcast. This is probably the most bearish.

“We expect to have it in operation in the next six weeks,” Martin said during an energy summit sponsored by the US Department of Energy that was broadcast on the Internet.

Here is a link to the article.

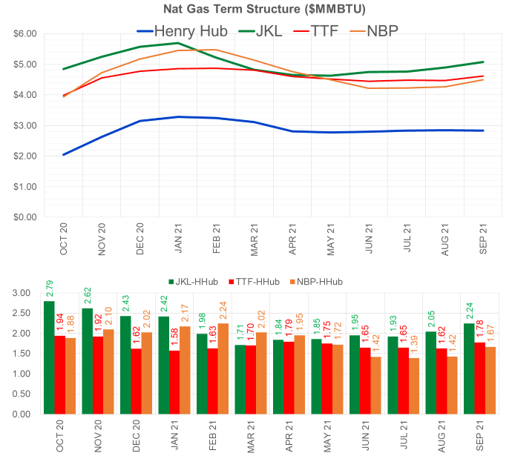

Lastly, here are the Global LNG Spreads. With Thursday’s drop, spread have opened significantly to move US LNG to major destinations.

Fundamentals for week ending Sept 18: Our early view for the upcoming storage report is a +79 Bcf injection for the lower 48. This would take storage levels to 3693 Bcf. The industry estimates for this report range between 63-89 according to The Desk.

US natural gas dry production was higher week on week with domestic production averaging 87.1 Bcf/d for the week. The decrease is a result of GoM production dropping due to Hurricane Sally knocking out production for a couple of days. Most of this lost production should return this weekend. Total natural gas demand was lower than the previous week. Power burns were lower by 1.9 Bcf/d week-on-week.

Canadian imports were once again lower last week averaging 3.8 Bcf/d. Mexican exports averaged of 6.2 Bcf/d.

Deliveries to LNG facilities averaged 7.3 Bcf/d, up 2.1 Bcf/d week on week. Total feedgas levels are now back to levels seen in late-April.

Expiration and rolls: UNG ETF roll starts on Oct 14th and ends on Oct 19th.

October futures expire on September 28th, and September options expire on September 25th

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.