Fundamentals for the week ending Nov 5:

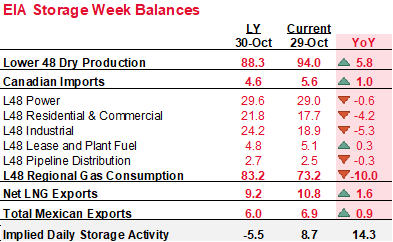

The EIA reported a +63 Bcf injection for week ending Oct 29, which was lower than the market consensus by ~3 Bcf. This is now the 7th week in a row where the injection exceeded both LY and the 5Yr average injection levels. The total storage injections benefited from strong production levels even as season heating demand kicked in. Last year, we had a net draw in storage for the same week but that was with a different S&D make up. The following table compares the last week of October from last year to this year. We can see that cooler temperatures last year resulted in heating demand levels well above this year, while production was also much lower. The net balances were ~14 Bcf/d looser this year.

For the week ending Oct 28, our early view is +9 Bcf. Our projected injection would take the L48 storage level to 3620 Bcf (-313 vs LY, -101 vs. 5Yr). There were a lot of moving pieces in the balances this week, with demand being the most notable.

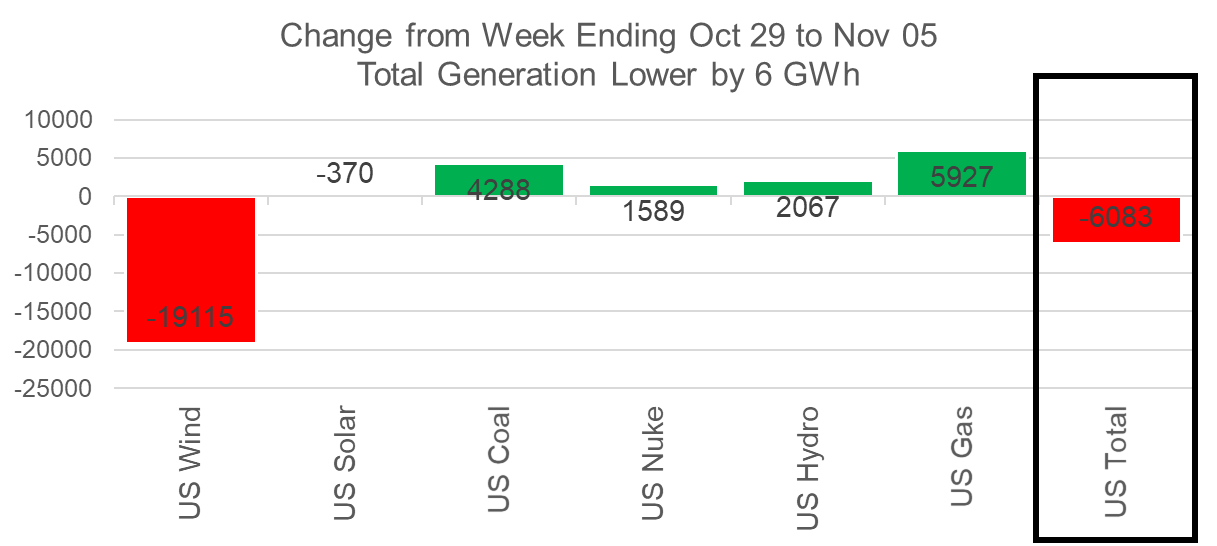

Typically, by this time of the year, power generation is not as important of a factor to track because this is typically the shoulder season. That has now changed with the immense growth and variability in wind. After 3 strong weeks of wind generation, this past week saw an almost 40% dip in wind output leading to other generation types picking up the slack; hence despite fewer CDDs WoW, we see natural gas generation slightly pick up.

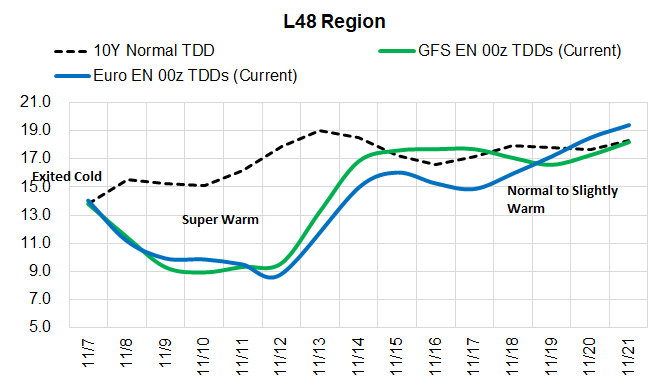

The other more predictable component of demand, rescomm & industrial, grew by a total of 8.5 Bcf/d WoW as HDDs increased by 4.2F WoW. We just exited a cooler than normal period but next week we have incoming warmth. There is risk in the 11-15 for cooler weather with many weather vendors suggesting that we could get much cooler mid-month. So this week we are expecting lower total consumption which could allow for one last storage injection week for the season.

The next 15 days are forecast to yield 231.7 GWHDDs, which is lower than normal but colder when compared to the 2nd ranked warm period observed last year (200.4 GWHDDs in 2020).

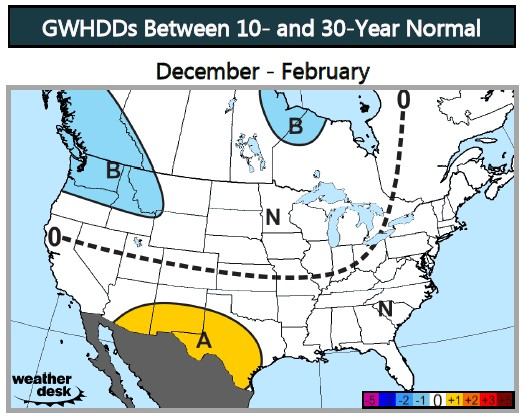

Here is Maxar’s longer-term outlook as presented on enelyst on Friday:

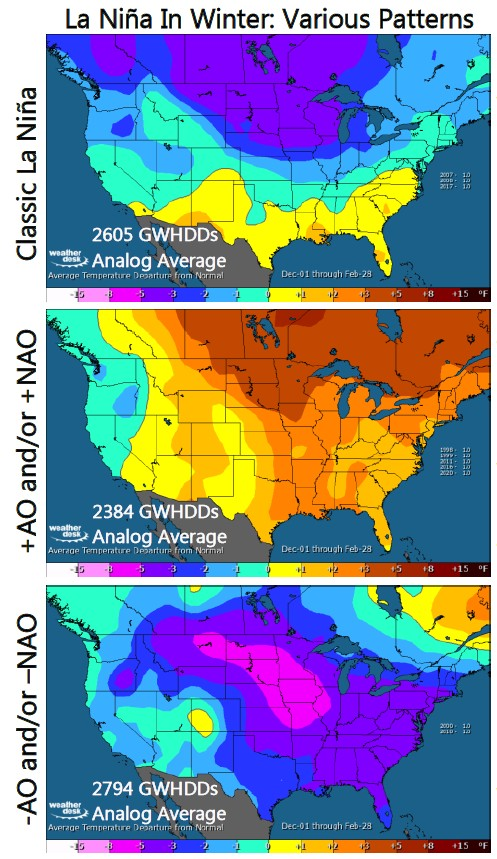

“The models and continued cooling of subsurface waters suggest that La Niña will be maintained for the upcoming winter. La Niña correlates with a colder and wetter winter along the Northern Tier, while a warmer and drier season is associated with the forcing in the South. However, there are a wide range of solutions associated with recent La Niña winters, and most cases can be separated into three categories:”

“The first is the ’classic La Niña’, which are those cases matching historical pattern correlations. The second are those cases with anti-Arctic blocking (i.e. +AO and/or +NAO), and these are the much warmer winters from the Rockies points eastward. The third are those cases with Arctic blocking (i.e. –AO and/or –NAO), and these are typically much colder winters from the Rockies to the East Coast. Simply put, the Arctic state will matter for how winter evolves for this winter.”

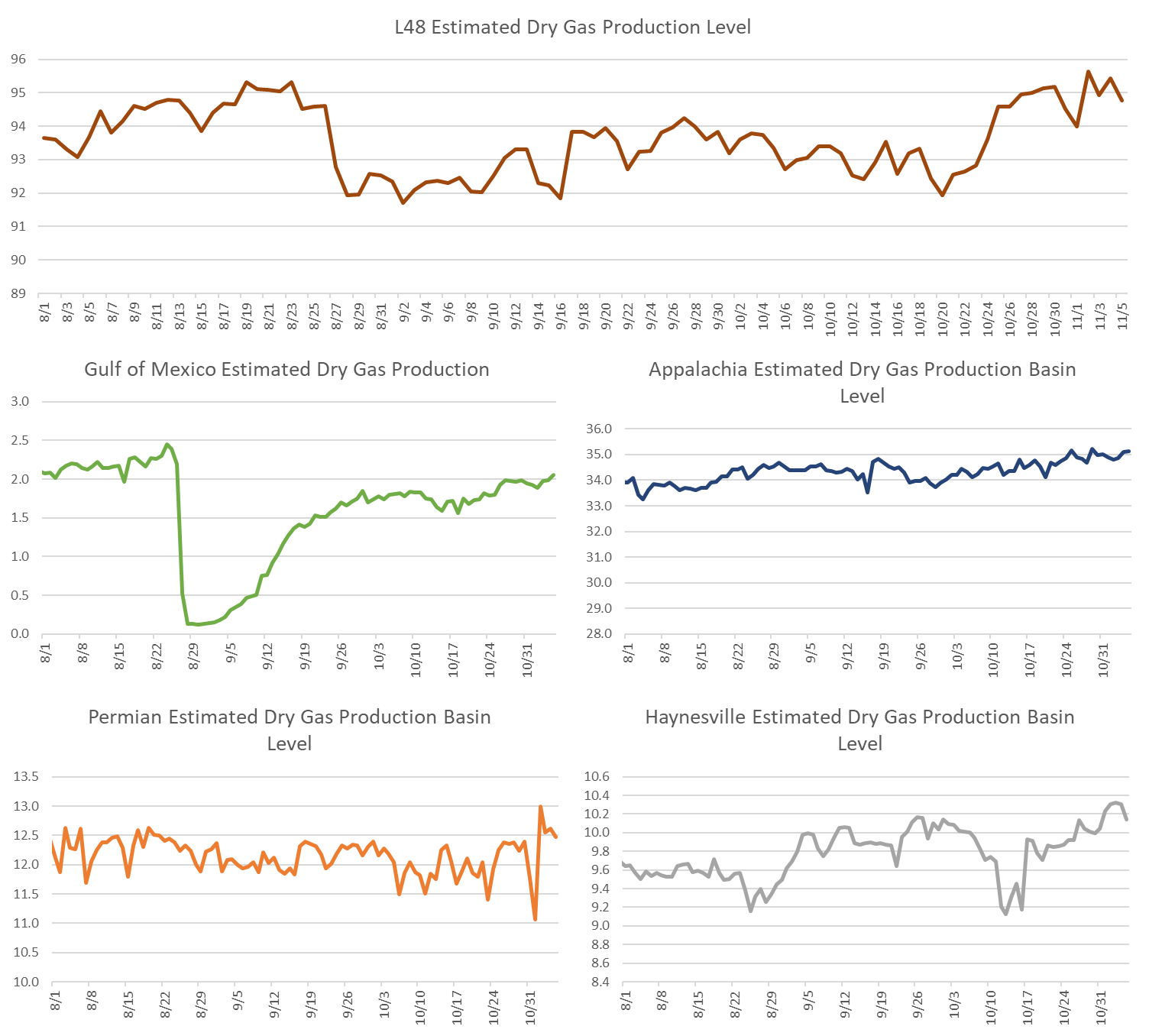

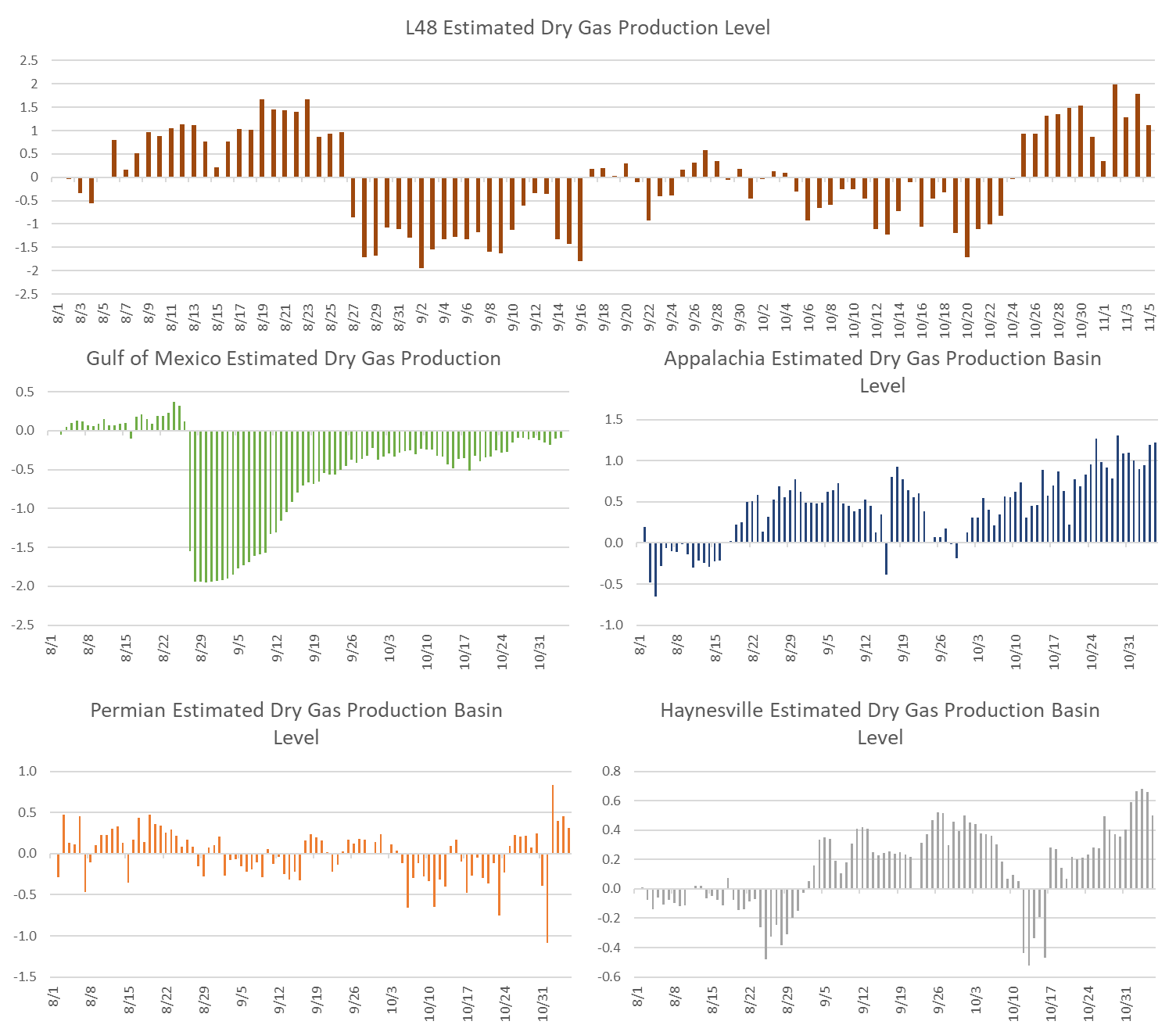

Domestic dry gas production made a significant move higher once again this week. For last week, we observed production grow by 0.9 Bcf/d week-on-week to 95 Bcf/d. All the weekly growth came from the South Central. Typically, we see unusual pipeline nominations at the beginning of the month; hence we were unsure if the move higher level was a result of that. As the week went on there was no significant revision, and production levels remained robust. We saw levels that we last saw in late-August before peak hurricane season shut-in GoM prod rigs and onshore processing capacity.

We took the same date and pinned the daily fluctuation to the level set on Aug 1st. In this series of charts, we can more clearly see that GoM production has returned, while all the growth has come from the Haynesville and the App basin.

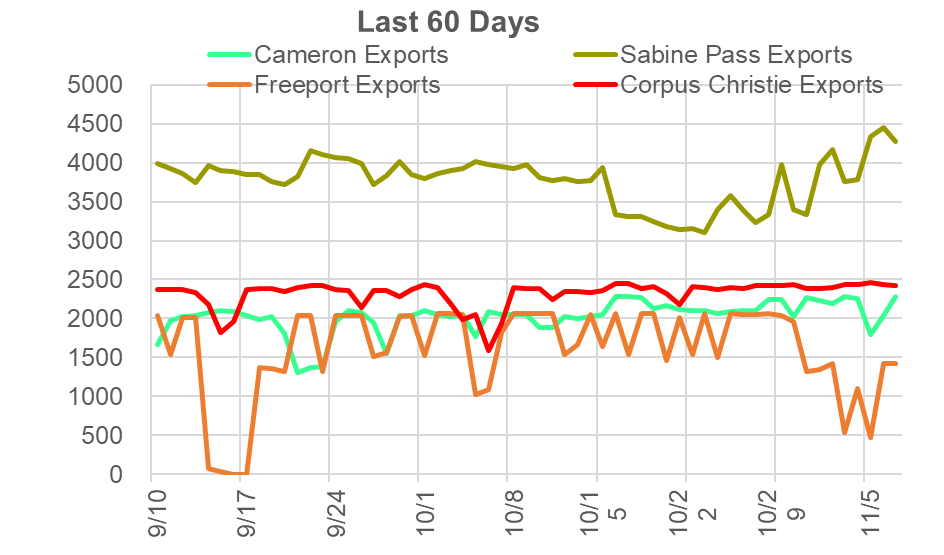

Deliveries to LNG facilities averaged 10.9 Bcf/d, which was slightly higher than last week. Freeport having an unplanned maintenance event. According to Criterion Research, “the facility was forced to take down their pretreatment train after an incident Sunday”, and they expect that unit to be offline until today. Sabine has been ramping up the last few days to make up for some of the lost feedgas volumes to Freeport. Yesterday’s total volumes hit 4.45 Bcf/d to Sabine which is near its record levels.

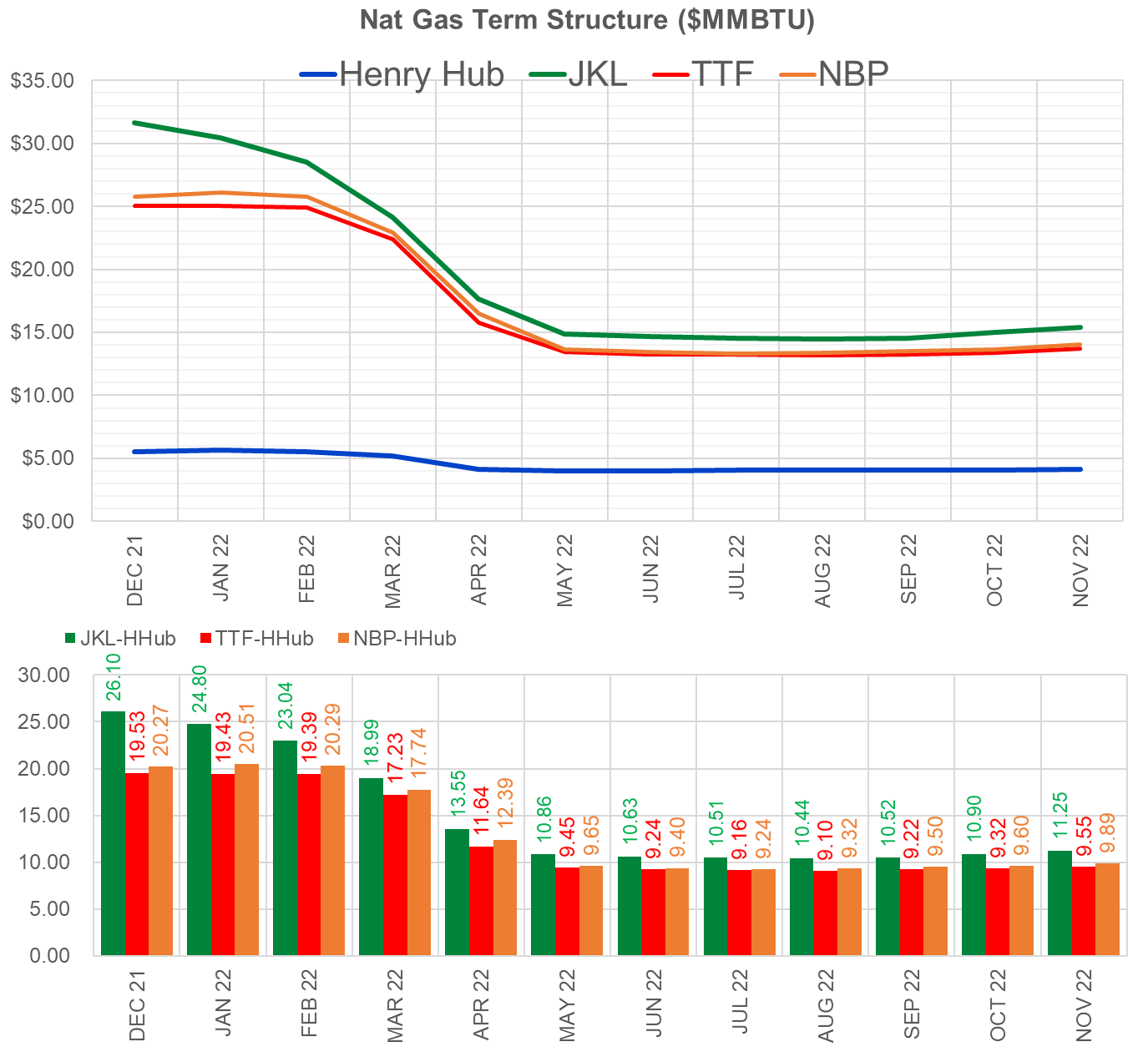

We anticipate all LNG facilities to operate at high levels throughout the winter with global spreads remaining very wide.

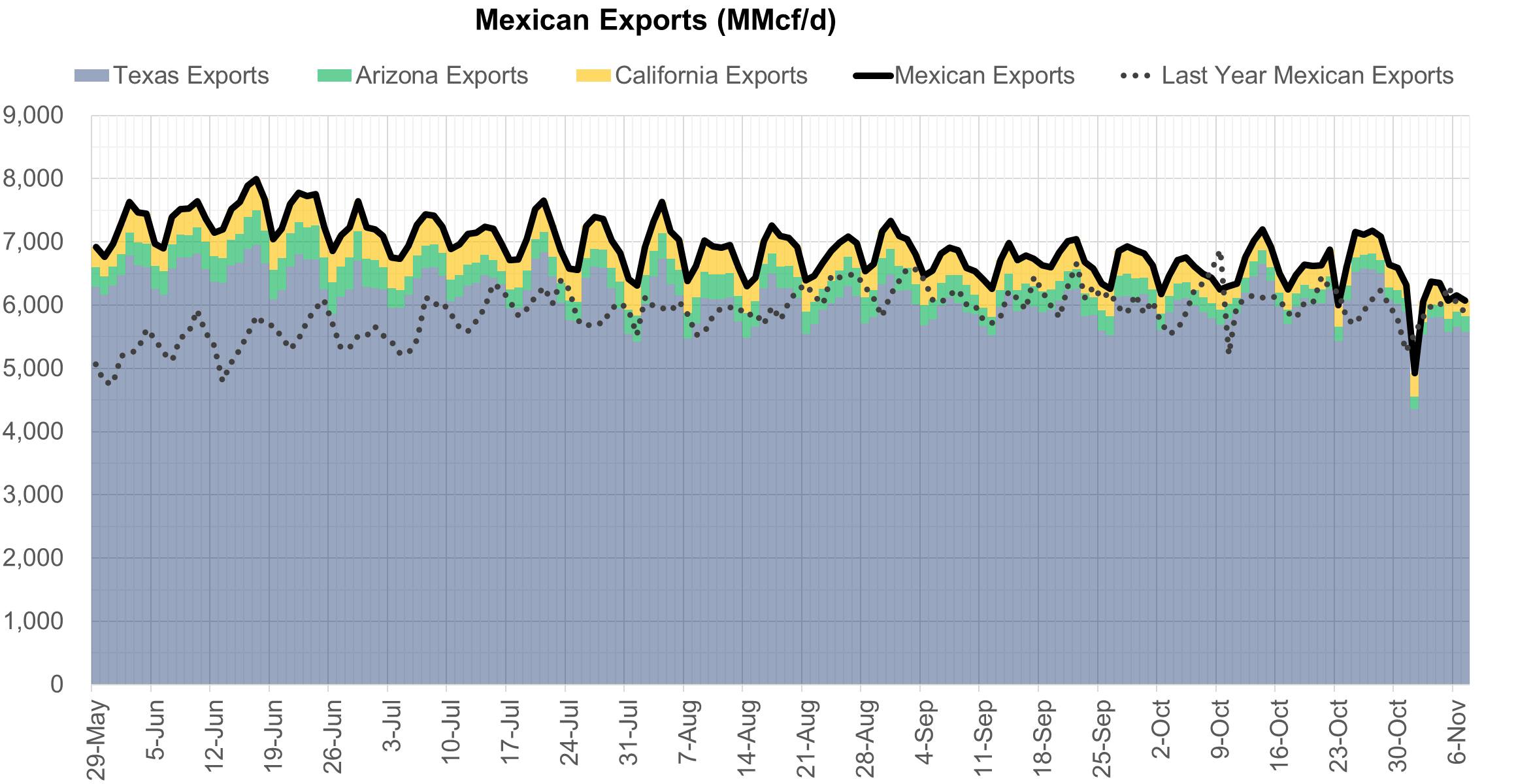

Deliveries to Mexico were also notable this week as we saw the seasonal drop begin. Mexico’s natural gas demand is all related to industrial and power generation, with no requirements for heating. Total pipeline deliveries averaged 6.2 Bcf, or 0.7 Bcf/d lower than the previous week. Mexico currently has very limited underground storage and hence daily flows can be volatile to match daily demand. One more thing to note about Mexican exports is that we could see stronger pipeline flows this winter with Mexico opting to use the existing pipeline capacity over the more expensive imports into the Altamira facility.

The net balance was 3.7 Bcf tighter week-on-week.

Expiration and rolls: UNG ETF roll starts on Nov 11th and ends on Nov 16th.

Dec futures expire on Nov 28th, and Nov options expire on Nov 24th.

One more item to note this week:

- The California Public Utilities Commission voted unanimously to increase the storage capacity of the underground Aliso Canyon field to 41 billion cubic feet (1.1 billion cubic meters) of natural gas from the current capacity of 34 billion cubic feet (962 million cubic meters).

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.