For this weekend’s report, we take a look at the latest monthly supply and demand figures from the EIA. This data is most interesting because it covers the cold period during February and we can now see how each line item of the natural gas balance was impacted by the severe cold episode in that month.

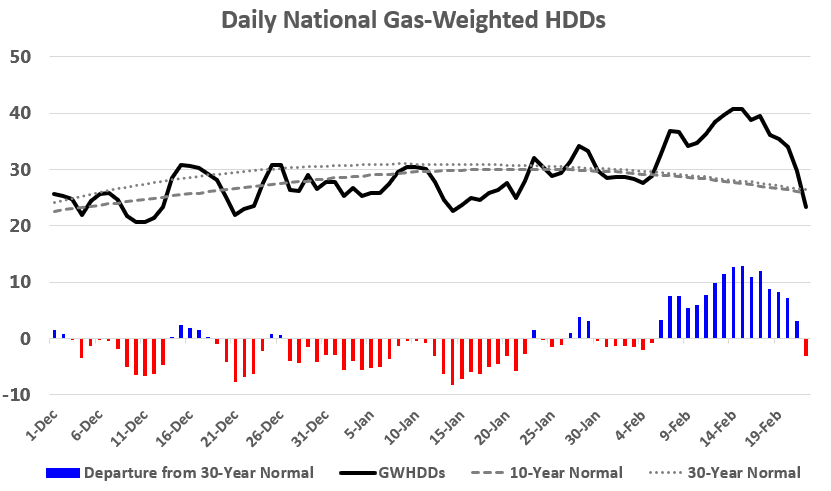

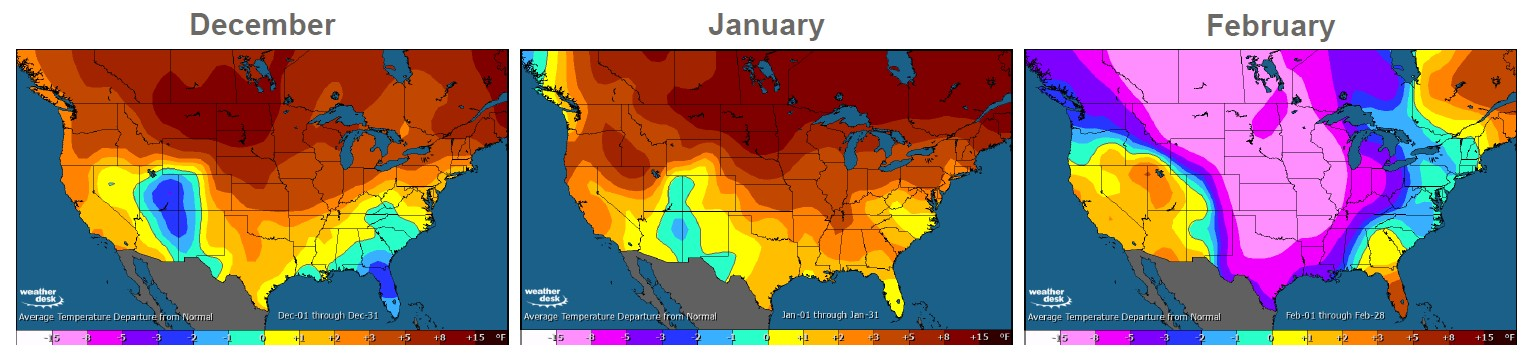

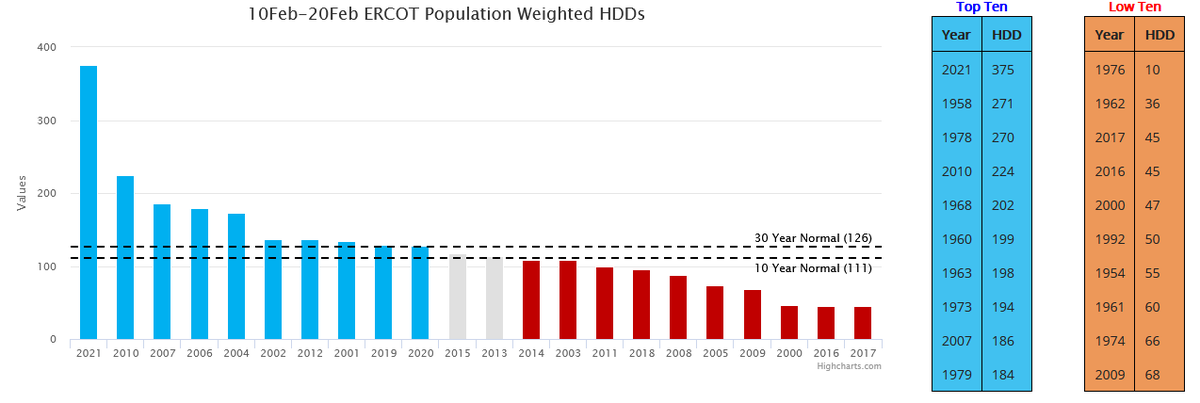

As a recap on the weather intensity, we saw in mid-Feb, here is a graphic from Maxar showing the extreme level of HDDs from Feb 10th to the 20th.

The graphic below shows just how the Feb 10-20 window was by far the coldest on record for mid-Feb. 2010 was the only other recent year that was comparable, but even that comparison is a stretch.

We did not anticipate the major impacts to the natural gas system and regional cash prices, as a result of severe cold weather. In the future, we can expect more major impacts besides production freeze-offs, such as:

1) a power shortage crisis (due to restricted gas pipeline flows, frozen infrastructure at gas and coal power stations, failure of wind generation due to lack of de-icing capabilities)

2) industrial facility outages

3) changes to LNG flows due to lack of supplies and changing economics

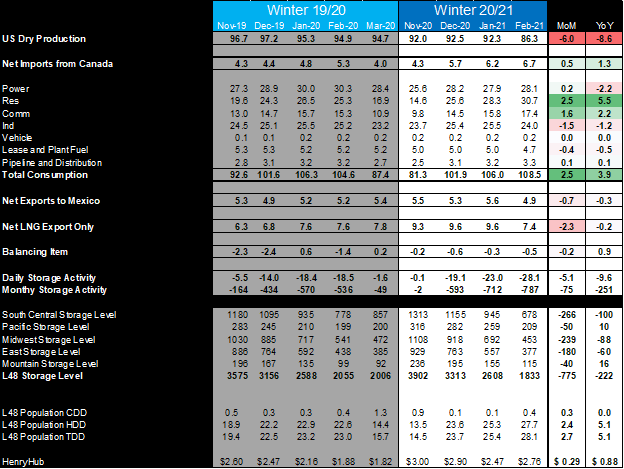

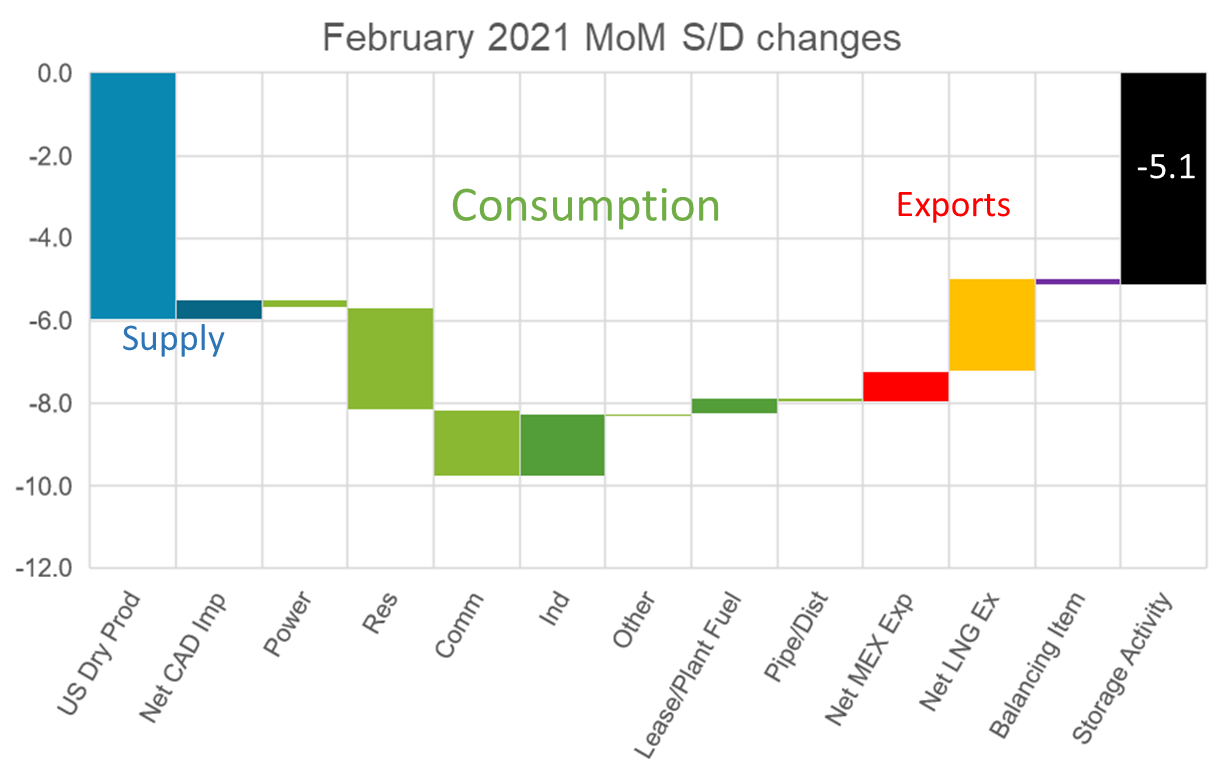

Below are the supply and demand balances for the month. Let’s keep in mind that the first 1/3 of the month was normal and that all the impact was related to the 10 days in the middle of the month plus some lingering effects past that.

Tightening Factors: lower domestic production, increased power, and RC usage

Offsetting (Loosening) Factors: lower industrial usage, and lower net exports to LNG and Mexico

Overall balances were -5.1 Bcf/d tighter month-on-month, and -9.6 tighter year-on-year. The cold temp resulted in a 787 Bcf draw leading to a year-on-year deficit in storage (after carrying a surplus throughout 2020).

The total draw in previous Feb’s were:

2021 was 787 Bcf [28.1 Bcf/d]

2020 was 536 Bcf [19.1 Bcf/d] (29 days)

2019 was 586 Bcf [20.9 Bcf/d]

2018 was 477 Bcf [17.0 Bcf/d]

2017 was 291 Bcf [10.4 Bcf/d]

Fundamentals for the week ending May 7: This past week the EIA reported a +60 Bcf storage injection for the week ending April 30th. This past week’s injection was mainly in line with the market consensus and our S/D model. This report once again supports the fact the natural gas balances are 6-7 Bcf/d tighter YoY (wx adj).

For the week ending May 6th, our early view is +79 Bcf. The 5Yr average is a +82 Bcf injection. Our projected injection would take the L48 storage level to 2037 Bcf (-370 vs LY, -64 vs. 5Yr).

Domestic production was off last week – led by the Northeast dropping due to pipeline maintenance along Transco’s Leidy Line. It appears these flow restrictions will continue into the next storage week.

The biggest moving factor this week was consumption, which was lower by an average of -3.6 Bcf/d over the storage week. We recorded L48 HDDs dropping by 2.2 degrees from the previous week, while CDDs crept up only slightly. The dropping HDDs resulted in the majority of the drop coming from ResComm consumption decreasing by -3.1 Bcf/d WoW.

Deliveries to LNG facilities averaged 11.3 Bcf/d, which was -0.1 Bcf/d lower than the previous week. The drop is primarily a result of Cameron tripping on Sunday for a day. Mexican exports were flat at 6.7 Bcf/d this past week.

Net the balance is looser by 2.8 Bcf/d week-on-week.

Expiration and rolls: UNG ETF roll starts on May 12th and ends on May 17th.

June futures expire on May 26th, and May options expire on May 25th.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.