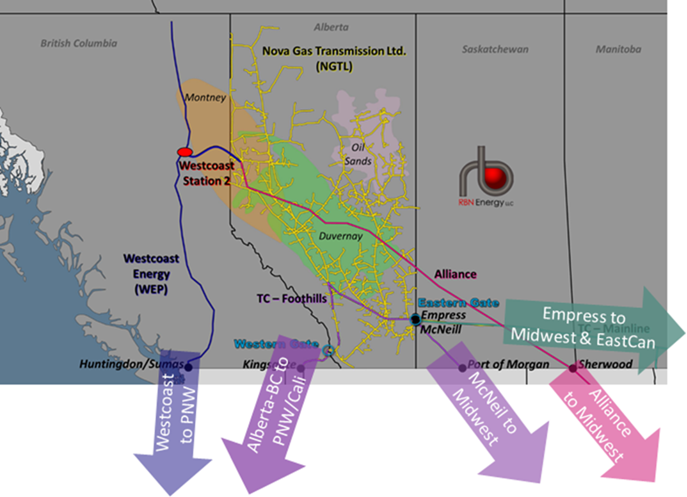

Western Canada has long been a critical natural gas producing region and supplier to the US. The rise of US shale and associated-gas from oil plays has put substantial pressure on Canadian production and pricing over the past decade. Despite increased competition and the resulting weak pricing environment, Western Canada’s gas production has continued to rise. This is because Alberta producers focused on two specific unconventional plays – the Montney and the Duvernay. Wells from these two adjacent plays have produced large quantities of light crude and NGLs — so much so that natural gas from these wells is considered a by-product.

2020 has been full of surprises for energy Alberta energy producers. The combination of the global oil price war and COVID demand destruction has hit the industry hard.

Let’s start with what’s happened this year so far.

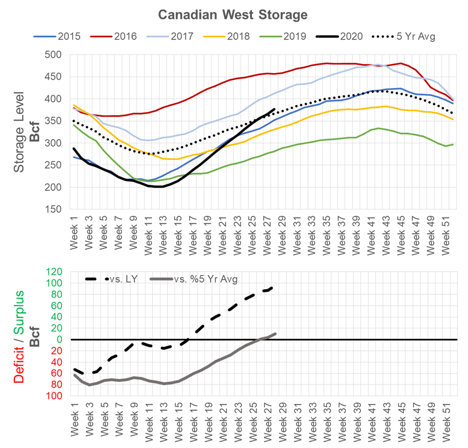

Two back-to-back cold winter’s left AECO Storage heavily depleted. This has been some sort of a blessing for anyone exposed to AECO prices (and Henry Hub). According to Enerdata, Western Canadian storage dropped to levels not seen since the polar vortex winter of 2013-14. During that winter, storage bottomed out with 99 Bcf in the tanks. This past winter exited with 202 Bcf in storage – not as bad but well below what is thought to be normal.

As seen in the chart, the injection rates this summer so far have been well beyond past years. The latest Enerdata shows 175 Bcf being injected into storage this summer so far. The typical injection over that same timeframe is 87 Bcf. This is the result of a weak demand & exports, and continued strong production.

The current West storage level is 376 Bcf or 77% full as of July 17th.

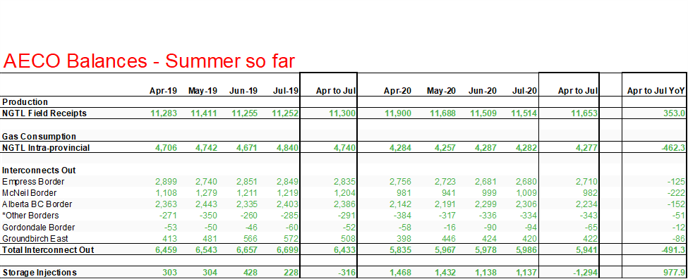

To better understand the steep rate of injections, we take a closer look at the balance this summer so far, and compare that to last year.

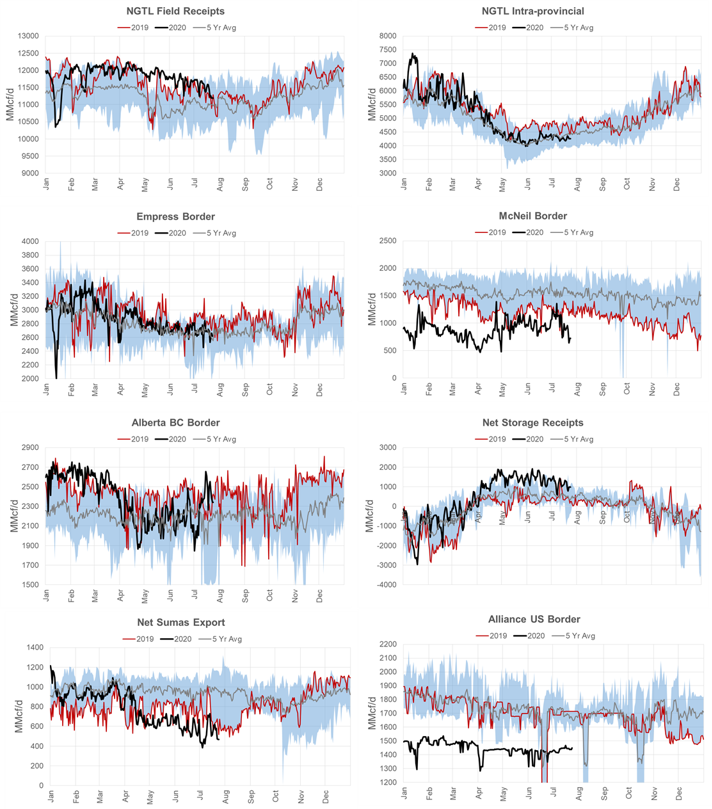

Production: NGTL production has averaged 11.6 Bcf/d (+0.35 Bcf/d YoY) this summer so far. This high production level coming in spite of oil and gas rig counts falling throughout Q2 2020. For week ending June 26th, the total Alberta rig count was only 5. The same time last year, the rig count stood at 69.

Gas Consumption: Gas consumption has dropped by 10% with the combination of local demand destruction due to COVID-19 and oil sands production being shut-in due to low global oil prices. Oil sands mining projects use natural gas to generate steam to inject into underground formations to thin the heavy, sticky bitumen crude and allow it to be pumped to surface. At the peak of shut-ins, producers shut-in nearly 1 mmbbls/d or 25% in response to low Western Canadian Select (WCS) crude prices in Q2. With the recovery of prices, many producers have reversed their shut-ins. As of June, more than 200 kbbls/d has returned.

Interconnects Out: The elevated storage levels in the L48 along with decreased demand due to COVID has resulted less natgas exported from Canada. Exports out of the NGTL system averaged 5.94 Bcf/d or 0.49 Bcf/d lower than last year.

Along with exports from the NGTL, the Alliance pipeline and Westcoast system delivered less gas as well. The Alliance pipeline is being filled downstream in the Bakken by cheap associated gas – hence not as much gas is required from Canada.

Storage: The result of all these moving pieces is more gas being injected into Western Canadian storage. So far this summer, injection have exceeded last year’s levels by nearly 1 Bcf/d.

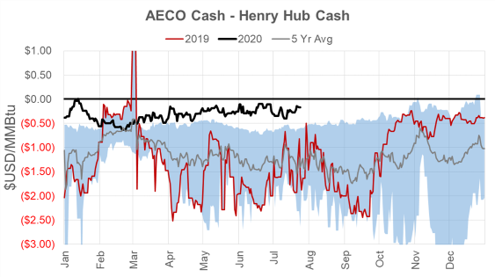

Price: Last we touch on AECO prices which have fared quite well starting Q4 last year. The strength can be attributed to both a cold winter, but also TransCanada’s Temporary Service Protocol (TSP) that was enacted in late September 2019. The TSP makes storage deliveries available to all shippers on the NGTL system, no longer giving priority to producers with firm transport only. In the past, this contributed to daily imbalances on the NGTL system and led to price volatility, particularly during periods of maintenance or system outages.

The TSP was in place from September 13th to October 31st last year, and now again from April 2020to October 2020, i.e. injection season. In Q2 2021, there are expansions planned on the NGTL system which should increase efficiencies on the pipe network making the TSP unnecessary.

In our view, Western Canadian storage is headed on a crash course to capacity – similar to the situation in Europe. Unlike Europe though, there are couple of simple levers to pull to correct the problem.

1) Lower outright production levels which could be already happening with record low rig counts.

2) Oil sands projects resume and natural gas demand picks up.

3) AECO prices weaken further incenting exports to US markets. In the end that would push the problem down south, similar how Europe is dealing with their storage problem with LNG cargo cancellations.

Fundamentals for week ending July 24: Our early view for the upcoming storage report is a +23 Bcf injection for the lower 48. This would take storage levels to 3238 Bcf.

US natural gas dry production remained flat week on week with domestic production averaging 86.2

Bcf/d for the week. Average weekly production is 0.9 Bcf/d lower than 4 weeks ago.

Natural gas demand continues to rise with late-July showing extreme heat in many parts of the country. According the Bloomberg, we hit a record power burn on July 20th with 48.9 Bcf/d. This led the week averaging at a record level.

Residential and commercial sector consumption had no real change week-on-week, while power consumption increased by 2.7 Bcf/d to average at 45.6 Bcf/d.

Canadian imports were lower last week averaging 4.4 Bcf/d.

Mexican exports averaged of 6.3 Bcf/d. A new peak of 6.6 Bcf/d was set this past week.

Deliveries to LNG facilities averaged 3.6 Bcf/d.

Expiration and rolls: UNG ETF roll starts on Aug 13th and ends on Aug 18th.

August futures expire on July 29th, and July options expire on July 28th

Other WestCan Charts

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.