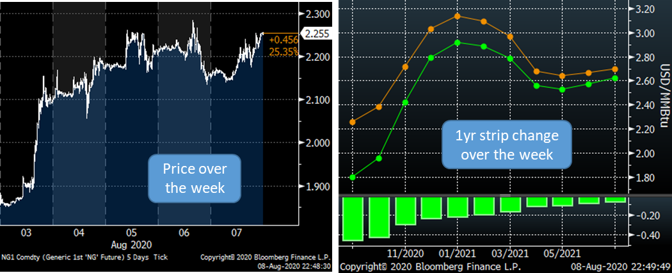

Last week on Monday, the Sept contract posted the largest single-day gain in the last year and a half. The gains continued throughout the week with a net gain of 0.456. The Sept contract closed out at 2.255.

Monday was the first trading day of August, and lots of moving fundamental pieces over the weekend ignited a rally, that seemed to continue as shorts ran for cover.

2) More hot weather past the first week of August.

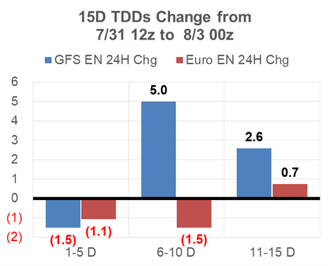

The GFS Ensemble came in with more heat past the first week of August. Below is the chart comparing the weather outlook on Monday morning (8/1 00z run) vs Friday afternoon runs (7/31 12z run). As can be seen, the GFS showed a big change pointing to above normal burns similar to July.

With that forecast, the heat continued to show above normal temps beyond – similar to every day in July. If it was not for TS Isiais, then we would even have the first week of August above the normal levels.

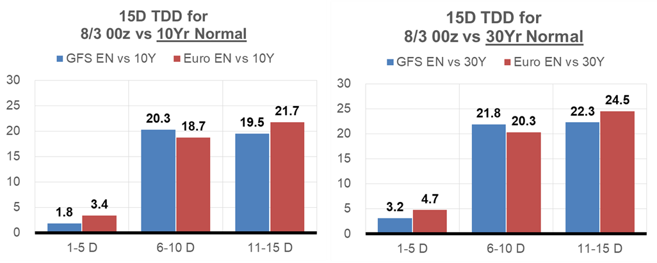

As of the 8/3 00z forecast, below are charts to show how extremely how the forecast looked in comparison to the 10Y and 30Y normal.

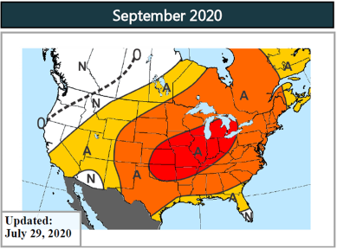

Here is how September as of July 29th. The outlook has not changed according to Maxar Weather on Friday. So still some heat that will lead to increased power burns.

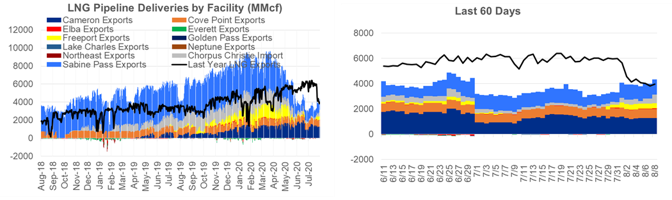

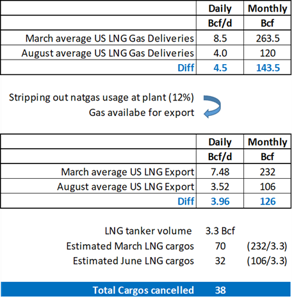

3) The last piece and probably the most important is the increase in natural gas deliveries to the US LNG facilities. The average LNG deliveries in July were 3.26 Bcf/d, which equates to less than one tanker leaving US shores each day after accounting for onsite gas usage. This showed severe underutilization of the capacity.

For August, the deliveries have averaged 4.0 Bcf/d so far. A step higher in the right direction to help ease the massive storage surplus.

Using our back of the envelop calculations, this level suggest 38 cargos being cancelled for August, or 6 more than July. This number is likely higher, because there have been LNG capacity additions since March that we are not accounting for.

Regardless of how prices moved, no one of the three factors above was exciting on its own. Its only when you combine the increased LNG, the potential increased burns due to heat and production drops that you make a dent to the end of season storage levels.

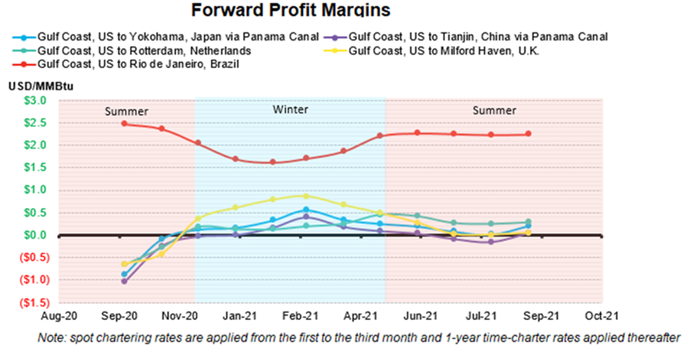

The last piece we will touch on is the forward outlook for LNG. We ran the BNEF LNG Shipping calculator to better understand when LNG could return to more normal levels. September still shows cargos out-of-the-money, but in October certain European ports (the ones that trade at a premium to TTF), and Asian ports become interesting.

Fundamentals for week ending Aug 7: Our early view for the upcoming storage report is a +58 Bcf injection for the lower 48. This would take storage levels to 3332 Bcf.

US natural gas dry production remained flat week on week with domestic production averaging 86.3 Bcf/d for the week. The Gulf regions was lower by 0.6 Bcf/d, but the Midcon and Bakken increased to offset that loss. Average weekly production is 0.6 Bcf/d lower than 4 weeks ago.

Total natural gas demand was lower than the previous week, with power burns coming off by 4.7 Bcf/d week-on-week.

Canadian imports were higher last week averaging 4.6 Bcf/d. Mexican exports averaged of 6.3 Bcf/d.

Deliveries to LNG facilities averaged 3.9 Bcf/d, up 0.7 Bcf/d week on week.

Expiration and rolls: UNG ETF roll starts on Aug 13th and ends on Aug 18th.

September futures expire on August 27th, and September options expire on August 26th

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.