This week we review the Maxar Summer 2021 forecast (discussed on enelyst this past week).

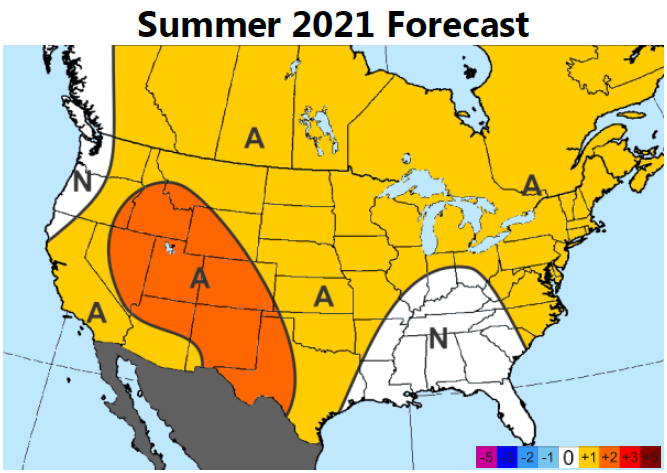

Despite the cooling trend for the end of April, they show broadly a hotter than normal summer season with drought-affected areas in the West. The forecast is ~10% hotter than the 1981-2010 30Y normal per national population-weighted CDD measures and ranks in the top-10 for hottest summers back to 1950.

“Many of the factors contributing to the hotter summers of late are still present this year, including the warm Atlantic (i.e. +AMO) as observed in each of the past 10 years and the anomalously warm tropical waters in the West Pacific as observed in eight of the past 10 years.”

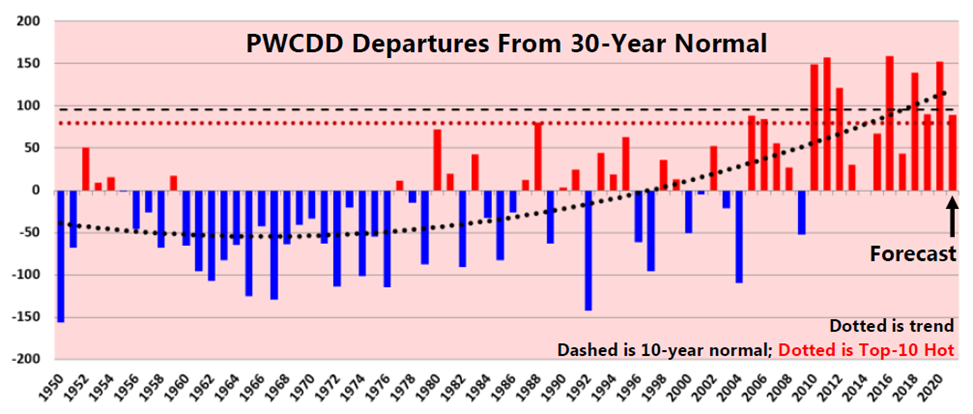

Despite the ranking, it is not surprising to forecast a top-10 hot summer at this lead time. Six of the top-7 hottest summers have all occurred in the past 10 years. Below shows the PWCDDs from June-August vs. the 30Y normal. It’s evident how we have trended warmer over the past decade. A 10Y normal would be the 7th hottest back to 1950 with ~11% higher PWCDDs versus the 30Y normal, and therefore we feel comfortable in using the 10Y normal in our demand modeling exercise.

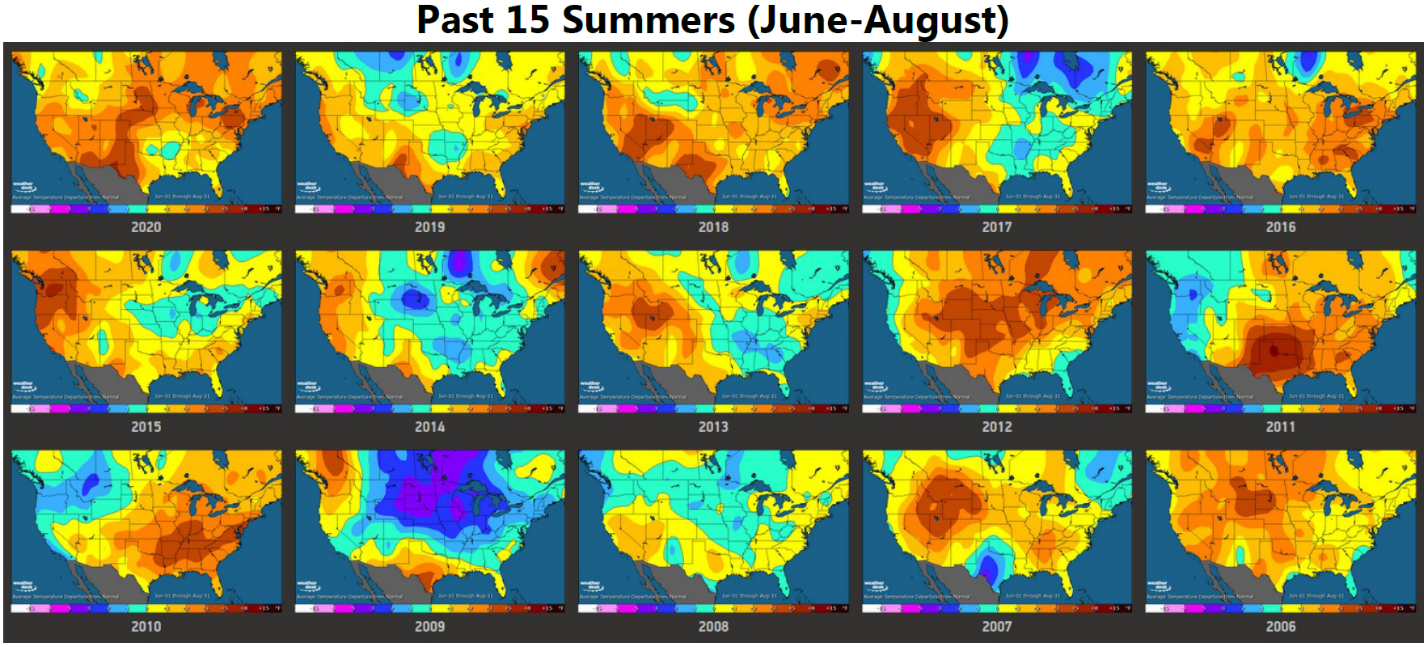

Below are the outcomes of the past 15 summers from Maxar. Of these, 11 are in the top-20 for hottest summers back to 1950 including eight in the top-10. Also notable is that zero seasons among this list ranked in the top-20 for coolest back to 1950.

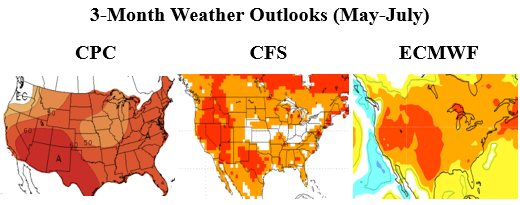

As a comparison, here are the May-July views from all the other major models.

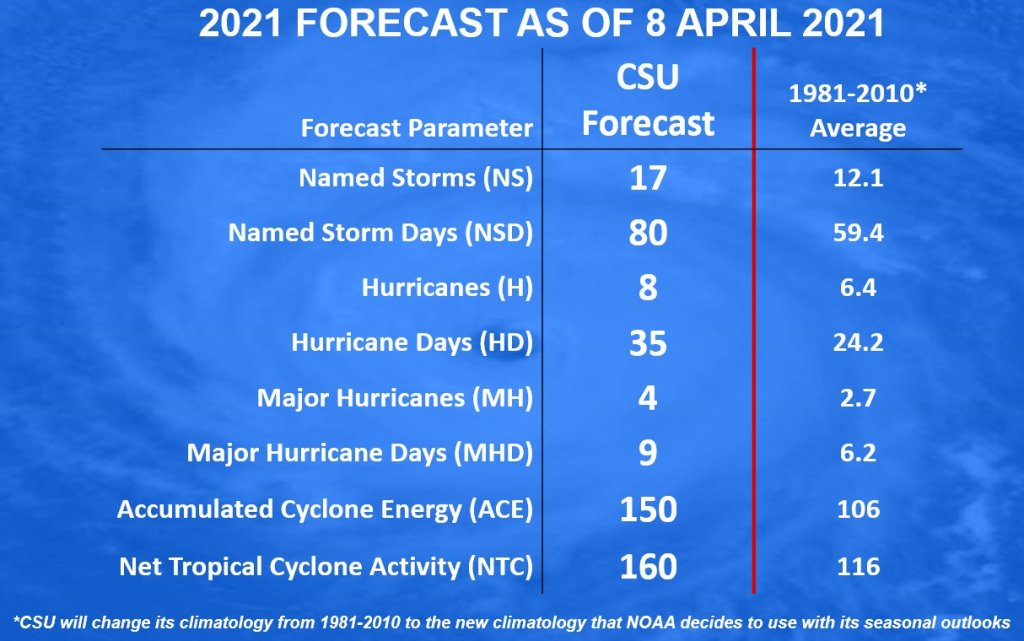

Hurricane forecast issued on April 8th

Colorado State University researchers are predicting an above-average 2021 Atlantic Hurricane Season, with 17 named storms and eight hurricanes.

Fundamentals for the week ending April 16: This past week the EIA reported a +61 Bcf storage injection for week ending April 9nd. This past week’s storage report came out lower than our S/D model but was within the range of the scrape model.

For the week ending April 16th, our early view is +55 Bcf (with some low side risk). The 5Yr average is a +37 Bcf injection. Our projected injection would take the L48 storage level to 1900 Bcf (-234 vs LY, +29 vs. 5Yr)

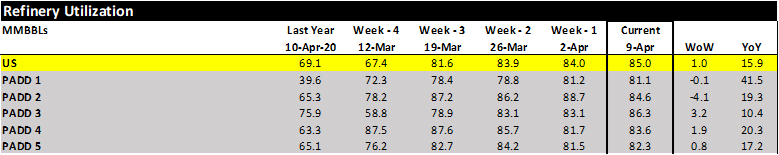

Domestic production continues to shift lower week-on-week. The drops once again is coming from the Gulf Regions (-0.8 Bcf/d WoW). As we mentioned last week, the drop looks to be related to the start up of some industrial facilities, particularly ethylene facilities that is reducing the amount of ethane being rejected into the gas stream. Additionally we see oil refinery utilization bump up to 85% (PADD3 at 86.3%) which potentially means gas demand straight off the intrastates; hence less making it to interstates which we scrape to sample TX production. All other producing regions showed flat levels week-on-week.

We recorded L48 TDDs modestly dropping off by an average of 0.6 degrees to 10.1 TDDs. The overall weather led to modest drop in ResComm consumption, but an increase in Power consumption by 1.2 Bcf/d. The change in the wind will likely impact power burns throughout the summer months.

Deliveries to LNG facilities averaged 11.4 Bcf/d, which was -0.1 Bcf/d lower than the previous week. Meanwhile, Mexican exports increased by 1.1 Bcf/d this week out of South Texas. This could be a preview to the strong export levels to Mexico as more pipe infrastructure come online to full connect the system.

Net the balance is looser by 0.6 Bcf/d week-on-week.

Expiration and rolls: UNG ETF roll starts on May 12th and ends on May 17th.

May futures expire on Apr 28th, and May options expire on Apr 27th.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.