This week we focus on the changing power stack with the growing renewables. Renewable generation across the US has been steadily rising over the years and shows no signs of slowing in 2021. This will have a definite impact on power burns and storage injection rates this coming summer. To get a better of what’s to come, we took close look at the EIA-860 report. The latest report was published in Jan 2021 and can be found here: https://www.eia.gov/electricity/data/eia860m/

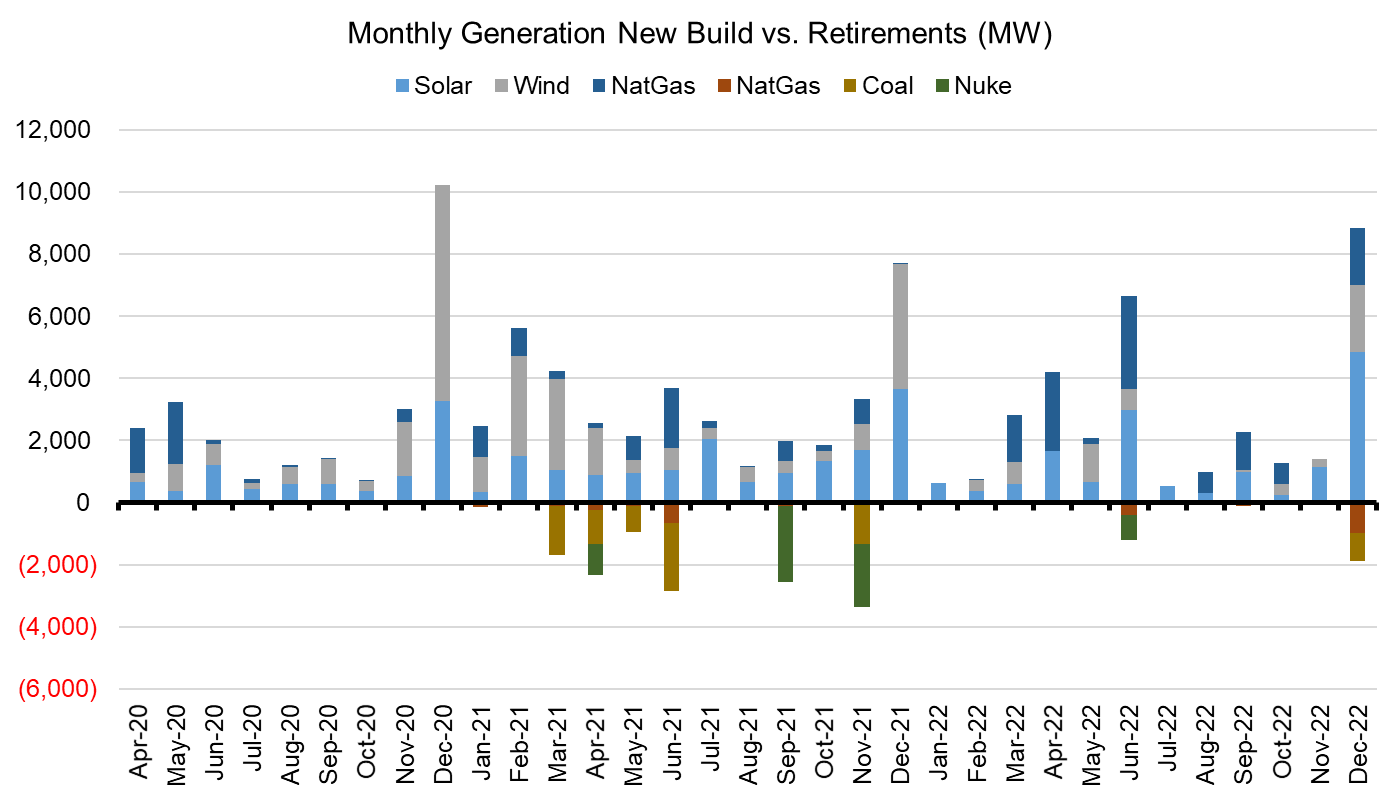

According to the latest EIA report, wind and solar additions totaled 25GW in 2020, and the trend looks to continue. The data shows a massive push in Dec 2020, with over 10GW added in that month alone. In 2021, the report shows another 16GW of wind, and 16GW of solar coming online. The image below shows the historical and forward-looking monthly build-out of solar, wind, and natural gas generation as well as the retirement of coal and nuke facilities.

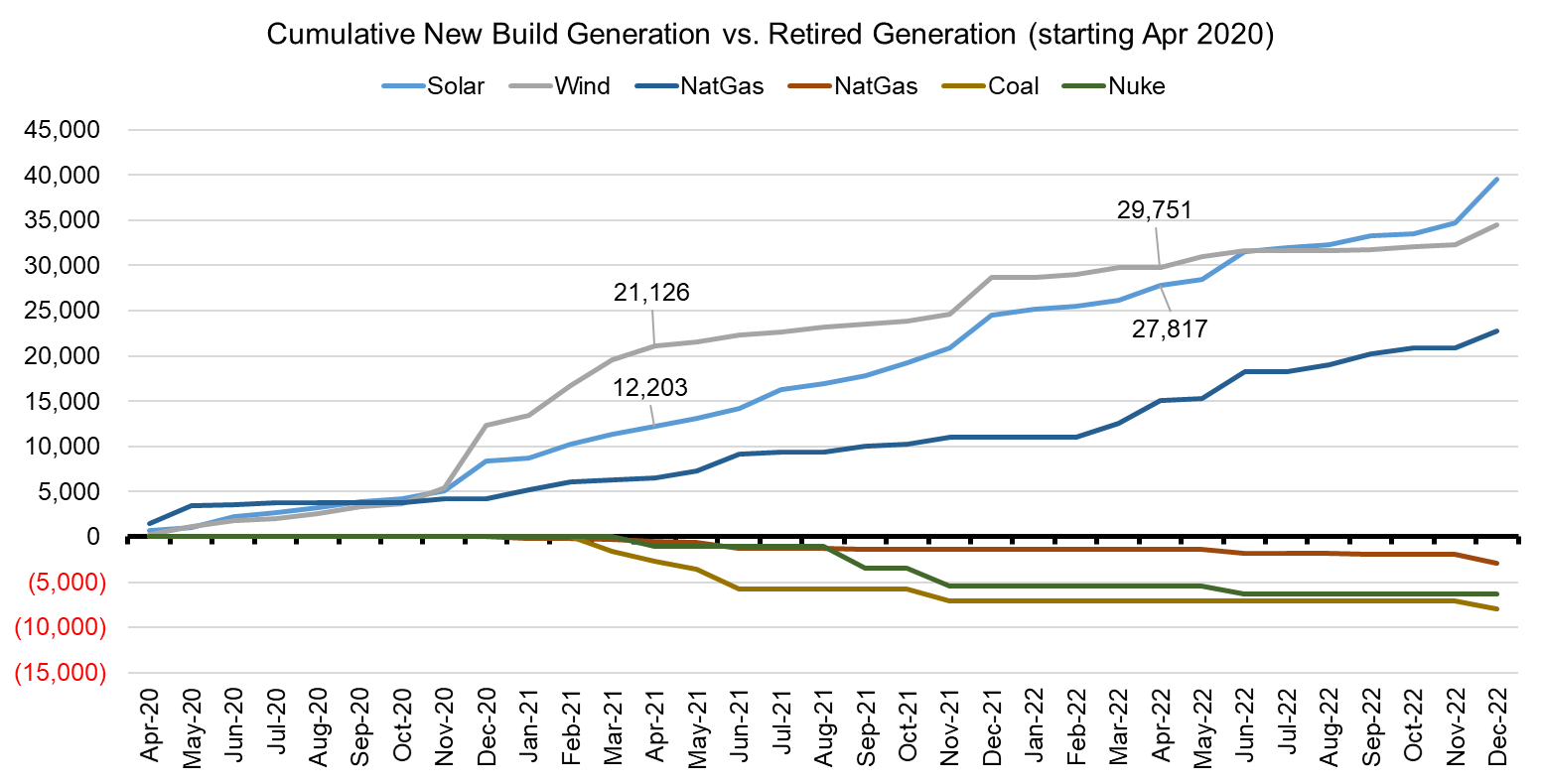

Looking at the same data in a cumulative MW format, we see large amount of capacity of solar and wind being added each month.

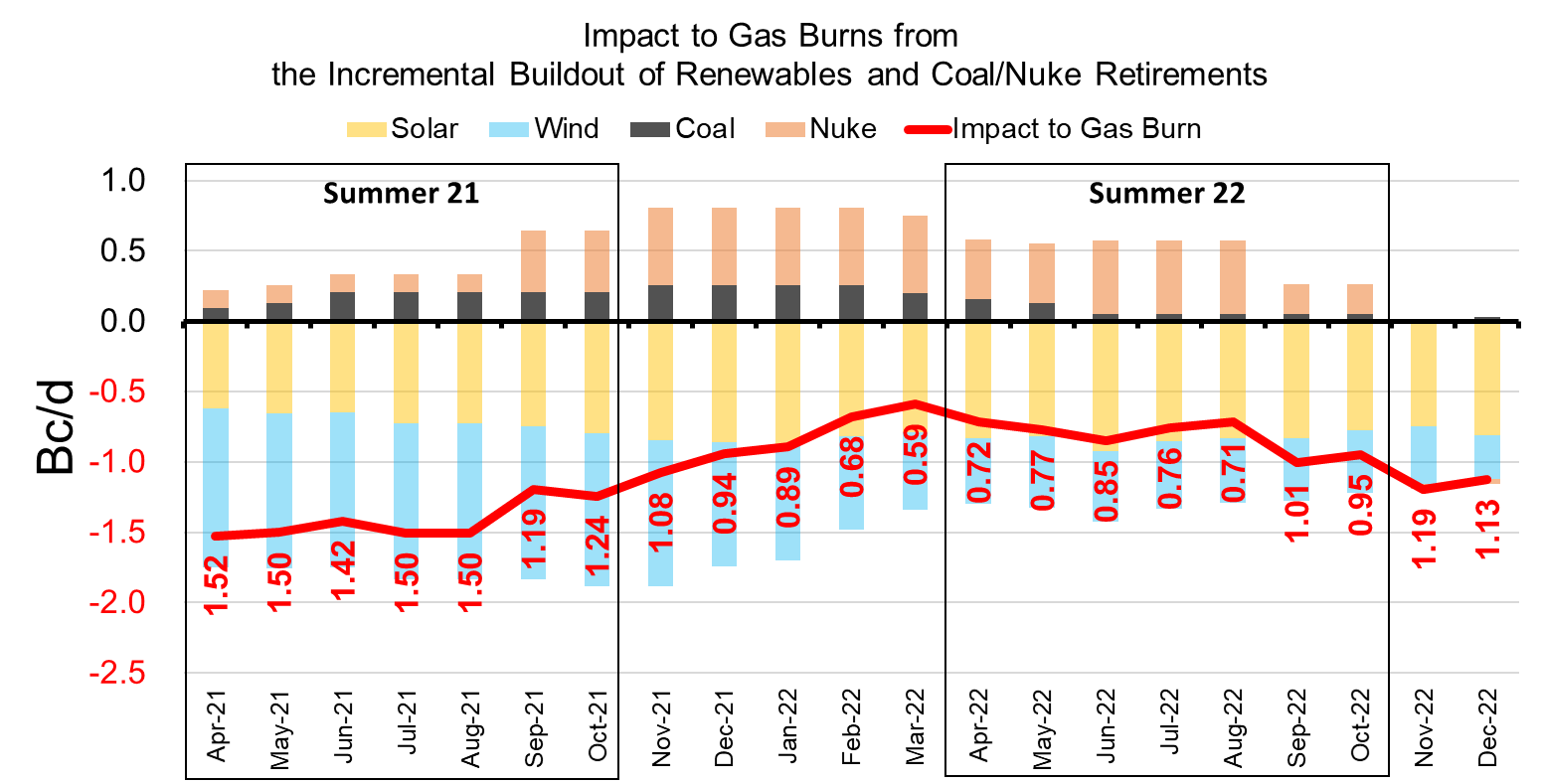

For this report, we want to focus on the year-on-year change in the stack as summer starts. The addition of wind and solar is bearish for nat gas usage, while the retirement of coal and nukes is bullish. As expected, the new renewable builds far out way the retirements.

We estimated the impact of the YoY change in the power stack at the national level. This a very rough estimate, but should serve as a good estimate on the change to power burns purely from the change in the power generation mix.

For this exercise, we estimated the new wind and solar capacity is utilized 30%, the retiring coal capacity was utilized at 20%, and the retiring nuclear capacity was utilized at 80%. For the retiring units, we assume it is replaced with a 7.5 heat rate nat gas unit.

Using these assumptions, we estimate the gas burns will be on average 1.4 Bcf/d lower this summer from the net generation change. The impact to this coming winter will be an average of 0.8 Bcf/d lower.

Here is the monthly breakdown, assuming that the units come on as planned.

Fundamentals for the week ending April 09: This past week the EIA reported a -20 Bcf storage draw for week ending April 2nd. This past week’s storage report came within the expected range and in line with both our S/D model and scrape model.

For the week ending April 9th, our early view is +67 Bcf. This will be the third injection of the season already. The 5Yr average is a 68 Bcf injection. This injection would take the L48 storage level to 1851 Bcf (-236 vs LY, +17 vs. 5Yr)

We see production lower week-on-week. The drops came out of the Gulf Regions, particular looks to be from the Permian region. We are not certain but the drop could be related to maintenance/repair of equipment after the cold Feb or the start up of some ethylene facilities that is reducing the amount of ethane being rejected. The drop from those regions was modestly offset by an increase in the Northeast, which is now producing 33 Bcf/d. For the Northeast, this is roughly 2.5 Bcf/d higher than last April.

We recorded L48 HDDs dropped off by an average of 2.1 degrees to 8.9 HDDs, while CDDs started to increase by 0.9. The overall weather led to an average drop in ResComm consumption of -4.8 Bcf/d, and a drop in Power consumption by -1.4 Bcf/d.

Deliveries to LNG facilities averaged 11.5 Bcf/d, which was -0.2 Bcf/d lower than the previous week. The small drop was associated with Cheniere’s Corpus Christi LNG having a planned 8 hour shut down of the Sinton Compressor Station on Thursday.

Net the balance is looser by 6.9 Bcf/d week-on-week.

Expiration and rolls: UNG ETF roll starts on Apr 14th and ends on Apr 19th.

May futures expire on Apr 28th, and May options expire on Apr 27th.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.