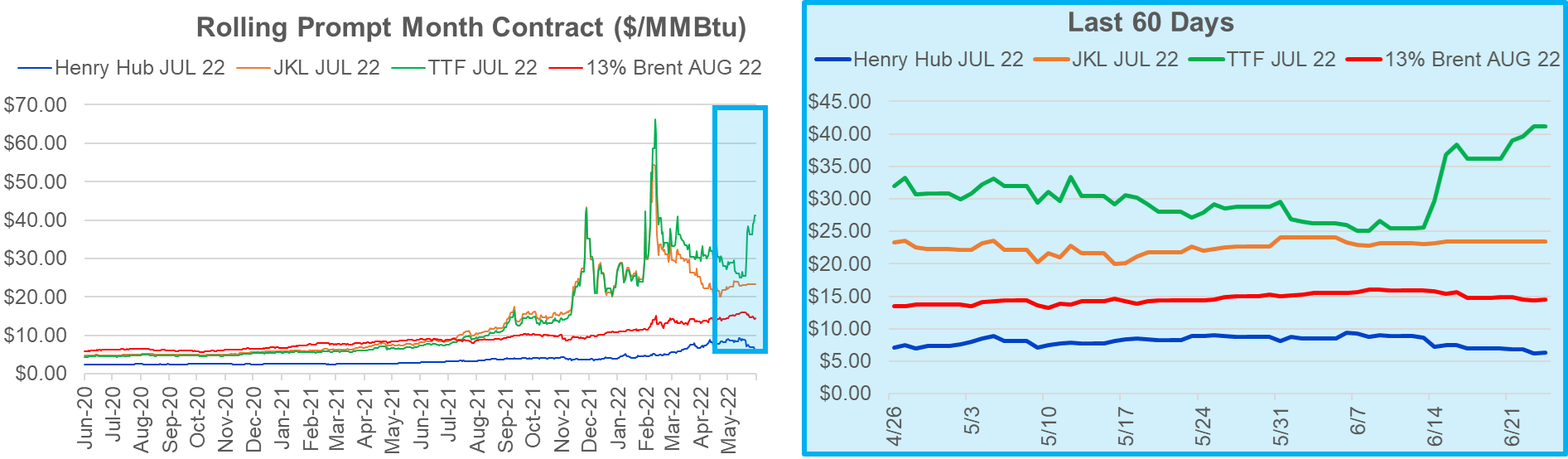

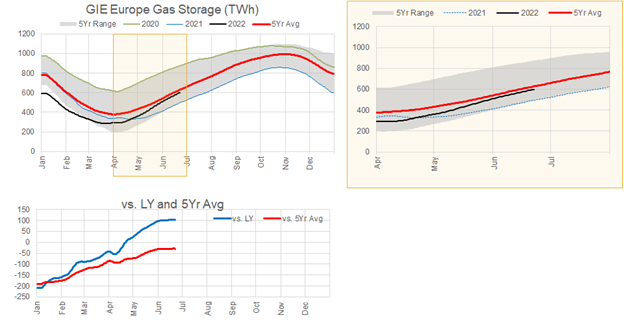

This week we look to dive into the storage situation unfolding in Europe. Russia escalated the gas crisis with the EU by reducing flows along key pipelines, specifically cutting Nord Stream flows by 60%. This comes ahead of annual maintenance on Nord Stream, which will entirely halt flows for two weeks in July. Europe is now once again scrambling to fill gas storage sites to acceptable levels before the winter, which is pushing TTF to peak premiums to other global benchmarks.

Here is a chart showing the rolling prompt contract for TTF, NBP, JKM, and HHub. This level of elevated price flows through the entire term structure until Summer 2023.

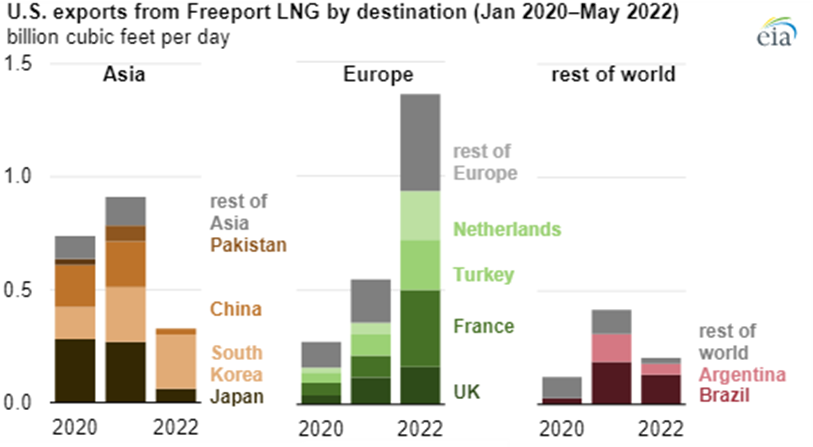

Up until the Freeport fiasco, prices were starting to calm down as European storage sites were filling at a tremendous rate despite dicey flows coming in from Russia. The loss of Freeport for at least 90 days was a big hit. Here are some data points from an EIA report this past week detailing Freeport LNG’s operations.

“In a shift from historical trends in LNG export destinations, and similar to other U.S. LNG export facilities, almost three-quarters (72%) of exports from Freeport LNG were shipped to Europe (including Turkey) during the first five months of this year, compared with 29% on average during 2021. During January–May 2022, LNG exports from Freeport LNG to Asia declined by 64% compared with 2021 and averaged 0.3 Bcf/d (17% of the total exports).”

As seen above, Freeport had been moving approximately 1.4 Bcf/d to Europe between Jan and May. This helped storage reach 50.6% full, and nearly 100 TWh ahead of last year on the day of the Freeport event.

Since the event, European storage has continued to fill will tankers already in transit. We expect the YoY surplus to be impacted starting in July as US-origin imports will fall off.

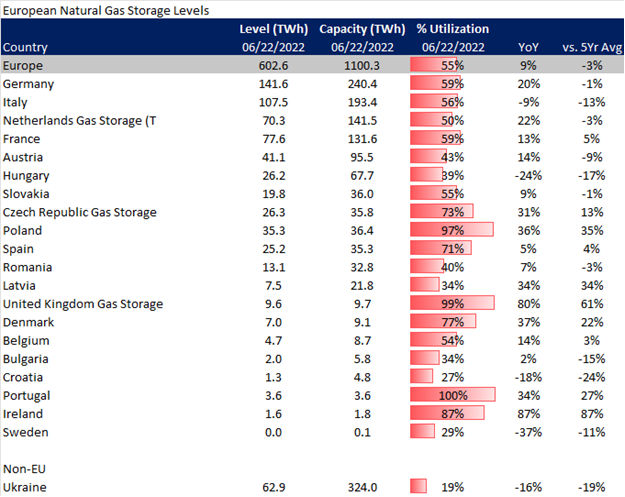

We can dive into the country-by-country storage levels to see which EU countries have the highest storage capacity and where they are in their fill cycle.

As seen, Germany has the largest amount of storage capacity and they are currently 20% ahead of last year’s levels. With the recent event outlined above, there are concerns that Germany will not reach its targeted 90% level by November. Germany activated the “alert” phase of its emergency plan in response to reduced Russian flows and LNG imports. During the “alert phase,” Germany is stepping up efforts to monitor consumption and secure storage levels. This phase does not include any conservation measures. This would only be enacted if the government concludes that “large-scale supply disruptions can be foreseen over the long term and there is no appropriate alternative supply option”. This would be the “emergency phase.”

NatGas Storage Fundamentals:

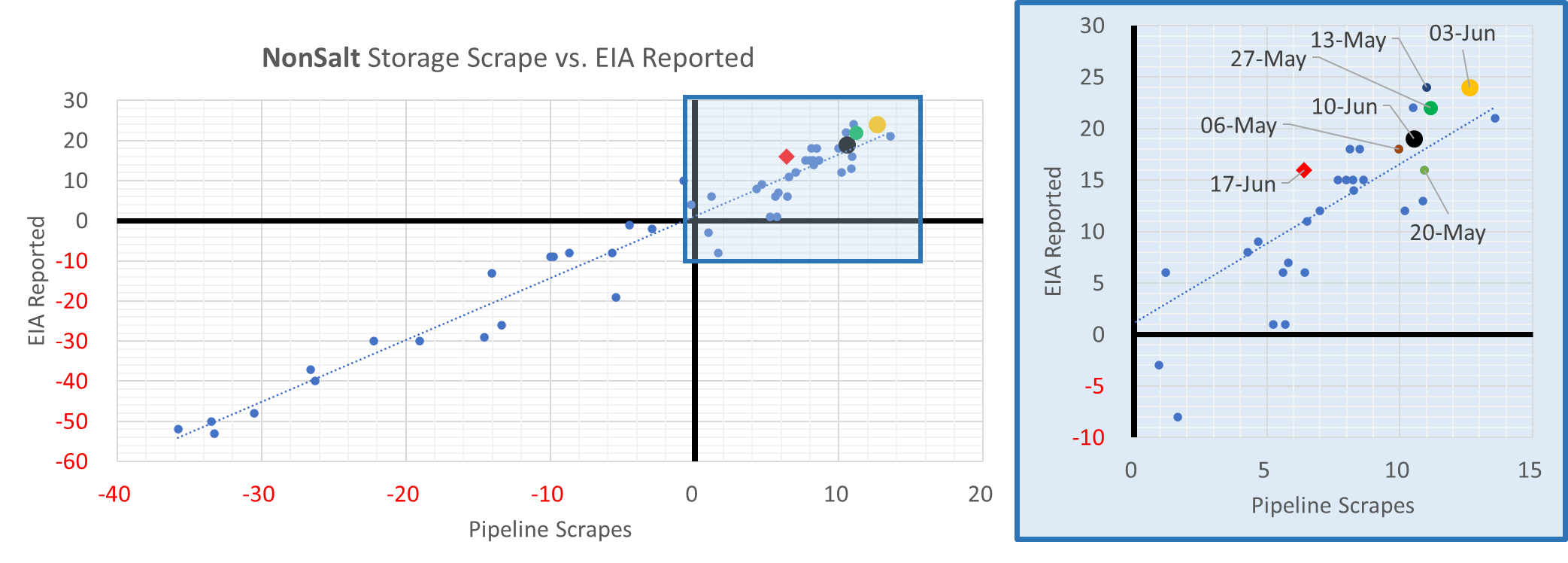

The EIA reported a +74 Bcf injection for the week ending June 10th, which came in much higher than the market consensus. The range for this week’s report was quite wide, but the final number came in well beyond the high side to point to very loose conditions. This storage report takes the total level to 2169 Bcf, which is 305 Bcf less than last year at this time and 331 Bcf below the five-year average of 2,500 Bcf. Overall, we estimate this +74 Bcf injection is ~2.4 Bcf/d loose vs last summer (wx adjusted).

This storage report, fortunately, did not include any revisions but caught the market off guard. The market was already under pressure due to the Freeport outage and easing heat conditions, but this loose number took the entire strip much lower.

In this report, all the regions looked fair to us except the SC once again. In particular, non-Salt SC storage threw off our estimate once again by 5-7 Bcf over the week. As we have noted in the past, we have been noticing non-salt storage coming in stronger than our flow model since the start of summer.

As we noted before, the simple and most obvious answer is Texas production. It is very likely that we are not seeing and modeling the full production picture due to the vast network of intrastate pipelines that pick up production. As most of you know, the daily pipeline receipt and delivery data we see only covers the interstate pipelines; hence for Texas, we cannot necessarily see production that is received on an intrastate pipeline and potentially delivered to a storage facility or an end consumer within the state.

Based on the current storage report miss, it is likely we are not modeling up to 1 Bcf/d of dry gas production from this region. If this production was to continue through the summer, we could easily erase the current storage deficit – with the help of the Freeport outage of course. [3 Bcf/d x 129 days of summer left = 387 Bcf]

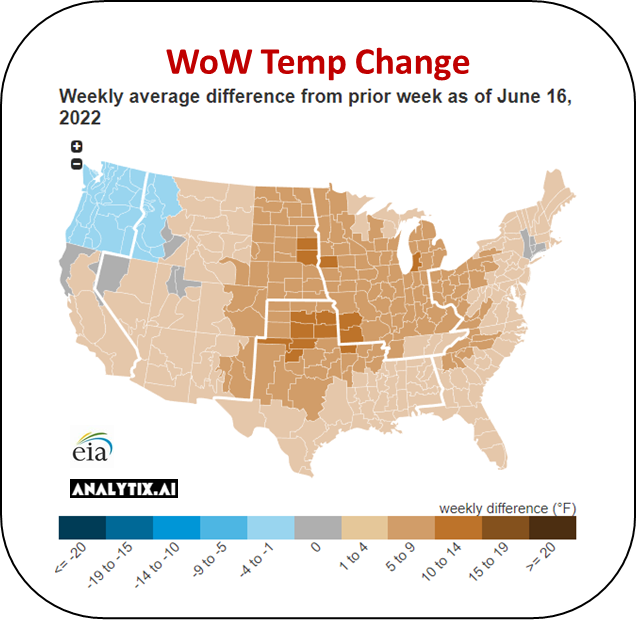

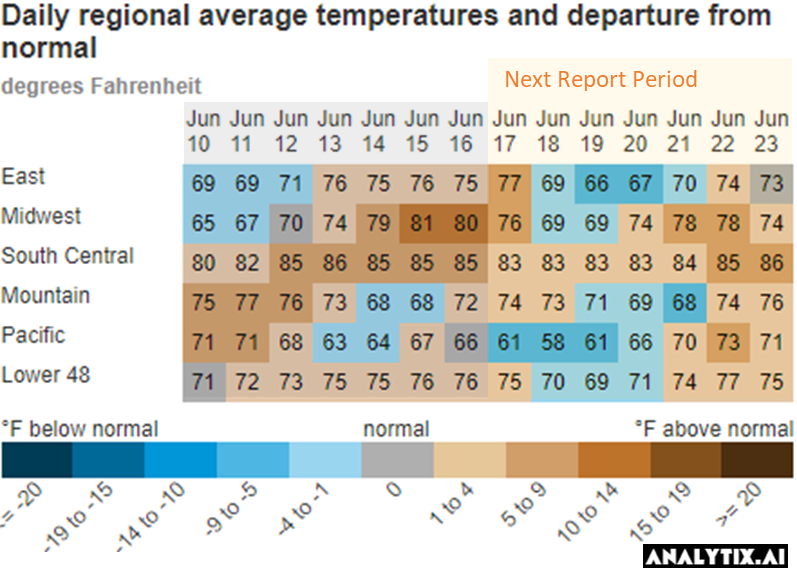

The lower injection week-on-week was due to more heat arriving across most of the country. Other than the Pacific Northwest, the rest of the country averaged well above normal.

This week we are unable to share details on generation with no update to the EIA 930 dataset from the EIA. The EIA is experiencing some major IT issues halting the update of many key datasets.

For the week ending June 24th, our early view is +80 Bcf. This reporting period will take L48 storage level to 2,249 Bcf (-298 vs LY, -324 vs. 5Yr). Last week’s number shifted our estimated higher.

During the past week, we heat retread to more normal levels, specifically in the ERCOT and Midwest regions. The two coasts turned cooler easing off power demand. The net result was a drop in population wt. CDDs by 1.5F relative to the previous week.

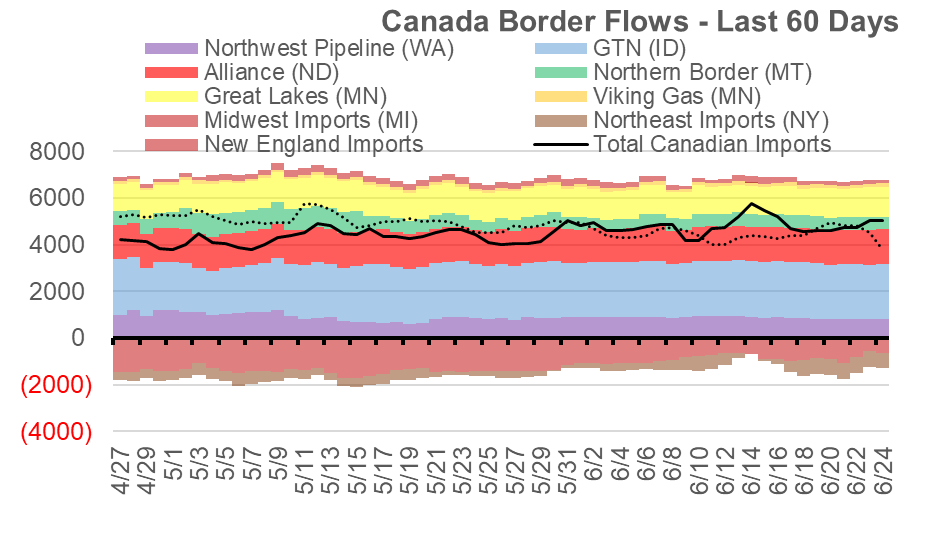

Domestic dry gas production was flat week-on-week, with some minor fluctuations at the regional level. The big change in supply came from net Canadian imports. It appears we had IT flows last week with the strong cash prices as a result of the heat. The week-on-week change shows small drops in flow across multiple routes from West to East.

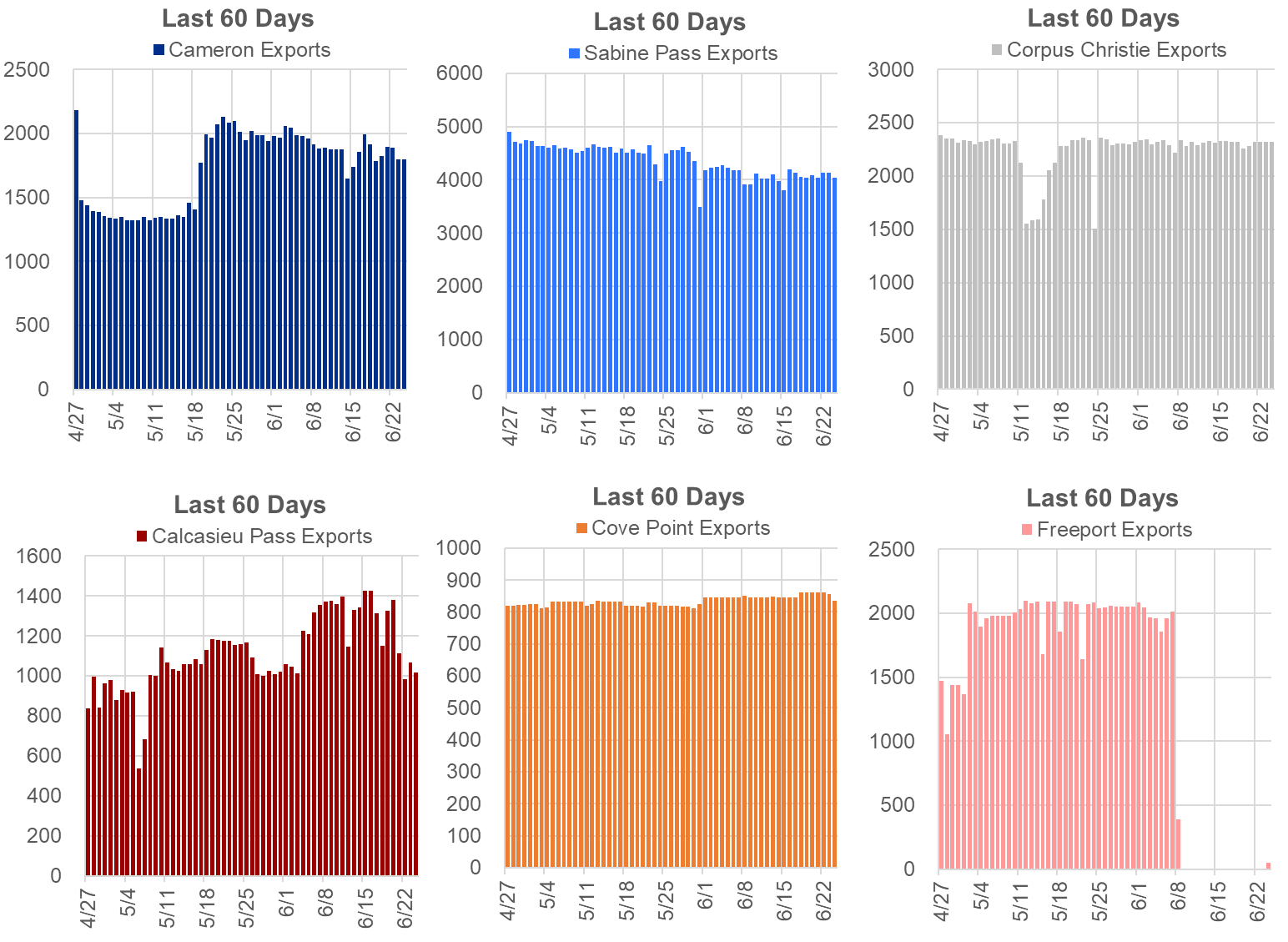

Deliveries to LNG facilities averaged 10.6 Bcf/d last week. Freeport deliveries remained 0 all week, while Sabine and Calcasieu Pass had some minor swings. Calcasieu Pass deliveries fell this week back to 1.0 Bcf/d, after peaking over 1.4 Bcf/d last week.

The net balance was +1.3 Bcf/d looser week-on-week.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.