From: Wagner, Jonathan

Sent: Friday, August 31, 2018 6:32:44 AM (UTC-06:00) Central Time (US & Canada)

To: Curves

Subject: ION Morning Rundown

Good morning. Oil prices are lower to start the day following in the footsteps of global equites as the dollar trades near unchanged. Further trade war fears between China, and the EU are talking points this morning as well as Trumps’ comments yesterday saying he is threatening to pull the US out of the WTO. Comments seen yesterday afternoon pointed to Trump raising the stakes on the trade war with China buy possibly increasing tariffs to $200B of Chinese goods. The white house however declined to comments cited in the Bloomberg report. "So-called hardline, pressure-exerting methods of the U.S. side won’t work on China and are not helpful to resolving the problem," Chinese foreign ministry spokeswoman Hua Chunying said on Friday when asked about the report. According to the report, A public comment period on the proposal is set to end on Sept. 6, and Trump plans to impose the tariffs after that deadline. European Commission President Junker said that the EU will respond in kind if Trump reneges on a pledge to refrain from imposing car tariffs. Trump rejected on Thursday an EU offer to eliminate tariffs on cars and said the EU’s trade policies are "almost as bad as China", Bloomberg News reported. Trump had agreed in July to hold back on threatened 25-percent car tariffs while the United States and Europe talked about cutting other trade barriers. And not to forget Iran… While Trump is claiming that he could singlehandedly be the cause for Iranian Governments collapse, Iran has given ballistic missiles to Shi’ite proxies in Iraq and is developing the capacity to build more there to deter attacks on its interests in the Middle East and to give it the means to hit regional foes according to a Reuters article. Iran has previously said its ballistic missile activities are purely defensive in nature and currently both the Iranian and Iraqi military has declined to comment. In terms of Aug production levels, IFX sources say that Russia produced 11.2m b/d in August which is in line with their July figures. According to an OPEC source, Saudi production increased to 10.424m b/d in August compared to 10.288m b/d in July. Crude supply in August was 10.467 million bpd, the OPEC source said. That’s compared to 10.380 million bpd in July. Middle east crude priced moved a touch lower as we end the month with Cash Dubai falling 2c to +82c over swaps. A total 78 partials were traded on Friday. Chinaoil will deliver an Oman cargo to Vitol following the convergence of 20 Dubai partials. Kuwait plans to publish monthly official selling prices for its new grade Kuwait Super Light Crude starting with cargoes loading in October. Survey estimates are looking for Saudi Aramco to raise its OSP for Arab Light crude by 15c/bbl m/m to Asian customers for Oct. sales. Last month, Saudi reduced Arab Light differential by 70c/bbl versus an expected cut of 60c.

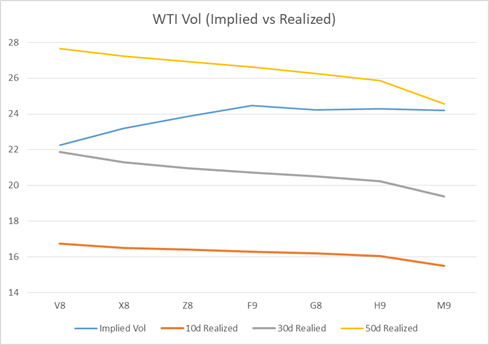

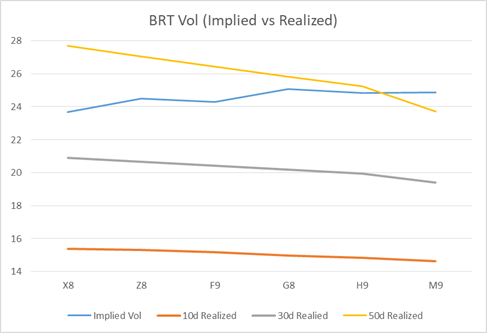

Vols finished the day higher across the curve yesterday with front end risk reversals continuing to move towards the call. Wingy front end WTI calls are now trading 1 vol over atm while X8 and Z8 10d brt calls are trading between 1.5 and 2 vols over atm’s. This morning there has been good interest buy side interest in front end wti puts. The v8 69 put has traded 2k while the z8 69 and 67 puts have traded 4k so far. We are also seeing interest further out the curve to own low delta q1 ’19 wti puts.

Top stories out this morning

OPEC to review monitoring of crude oil output deal in Algiers in September – Platts

Saudi oil production in August rose to 10.424 mln bpd – OPEC source – Reuters News

Middle East Crude-Benchmarks ease on expiry – Reuters News

Aramco May Raise Oct. Asia Arab Light Oil OSP by 15C M/M: Survey

French call for more Iran negotiations "bullying and excessive" – Iran – Reuters News

Top US, India officials to discuss Iran sanctions waiver next week in New Delhi – Platts

Iran moves missiles to Iraq in warning to enemies – sources – Reuters News

Trump Says EU Offer for No Auto Tariffs Is ‘Not Good Enough’

EU deeply disagrees with U.S. on trade despite detente – Reuters News

Juncker vows to lift auto tariffs if Trump reneges on agreement – Reuters News

Trump threatens to withdraw U.S. from World Trade Organization – Reuters News

‘I like and respect’ Fed’s Powell, Trump tells Bloomberg News – Reuters News

Emerging Markets Tumble as Argentina Struggles to Stop Bleeding

China Qingdao Crude Port Stockpiles at Highest Since 2014: SCI99

Most of Chinese State Refineries Increase Run Rates, SCI99 Says

Shanghai crude futures eat into Western benchmarks as China pushes yuan – Reuters News

KOREA OIL: SK’s July WTI Crude Imports Climb to Highest in 2018

Mexico’s state-run Pemex pauses light crude exports -data, source – Reuters News

Texas’ oil output drops in June for first time since Feb. 2017 – Reuters News

U.S. Cash Crude-WTI Midland sinks to fresh six-year low, coastal grades firm – Reuters News

U.S. Coast Guard responding to oil spill near Corpus Christi, Texas – Reuters News

Trans Mountain Delay Supports Wide WTI-WCS Differential: Goldman

U.S. Cash Products-Group Three gasoline falls to 8-wk low ahead of futures contract expiry – Reuters News

Motiva Port Arthur gasoline unit resumes operations – sources – Reuters News

Exxon to shut unit at Britain’s Fawley refinery for maintenance – traders – Reuters News

Storm Brewing Near Puerto Rico May Drench Gulf Region Next Week

Argentina May Send First LPG Cargo to China on Trade War: Kpler

Shanghai Port to Start Tighter Marine-Fuel Sulfur Cap on Oct. 1

|

Implied Vol |

Realized Vol |

|||||||

|

WTI Vol |

29-Aug |

30-Aug |

Change |

Breakeven |

10d |

30d |

50d |

|

|

V8 |

21.96 |

22.24 |

0.28 |

0.99 |

16.74 |

21.88 |

27.67 |

|

|

X8 |

23.01 |

23.2 |

0.19 |

1.02 |

16.50 |

21.30 |

27.25 |

|

|

Z8 |

23.58 |

23.86 |

0.28 |

1.05 |

16.42 |

20.97 |

26.93 |

|

|

F9 |

24.2 |

24.46 |

0.26 |

1.07 |

16.30 |

20.73 |

26.62 |

|

|

G8 |

24.02 |

24.24 |

0.22 |

1.06 |

16.20 |

20.50 |

26.26 |

|

|

H9 |

24.08 |

24.29 |

0.21 |

1.06 |

16.04 |

20.24 |

25.88 |

|

|

M9 |

24.1 |

24.2 |

0.1 |

1.04 |

15.50 |

19.40 |

24.57 |

|

Implied Vol |

Realized Vol |

|||||||

|

BRT Vol |

29-Aug |

30-Aug |

Change |

Breakeven |

10d |

30d |

50d |

|

|

X8 |

23.41 |

23.68 |

0.27 |

1.17 |

15.37 |

20.89 |

27.68 |

|

|

Z8 |

24.18 |

24.48 |

0.3 |

1.2 |

15.30 |

20.65 |

27.06 |

|

|

F9 |

24.15 |

24.27 |

0.12 |

1.19 |

15.16 |

20.43 |

26.43 |

|

|

G8 |

24.8 |

25.07 |

0.27 |

1.23 |

14.96 |

20.17 |

25.82 |

|

|

H9 |

24.6 |

24.84 |

0.24 |

1.21 |

14.82 |

19.94 |

25.22 |

|

|

M9 |

24.78 |

24.87 |

0.09 |

1.20 |

14.63 |

19.40 |

23.71 |

WTI Most Actively Traded Options

Brent Most Actively Traded Options

ICE Trade Recap

BRT X18 75 Put x77.65 TRADES 90 400x 27d

BRT X18 75 Put x77.75 TRADES 87 800x 29d

BRT Z18 75/70 Put Spread x77.50 TRADES 125 500x 20d

BRT Z18 90 Call x77.50 TRADES 29 700x 6d

WTI Z18 68/73 Fence x69.35 TRADES 84 750x 72d

BRT F19 70/85 Fence x77.55 TRADES 12 500x 39d

BRT G19 90 Call x77.10 TRADES 80 750x 13d

BRT M19 58/65/72 Put Fly x76.35 TRADES 86 600x 4d

BRT M19 65/85 Fence x76.50 TRADES 70 400x; TRADES 69 1,150x 50d

BRT M19 60/66 Put Spread x76.15 TRADES 125 2,250x 9d

BRT M19 60/55 1×2 Put Spread TRADES 2 200x; TRADES 1 300x

WTI U19 70 Put x75.25 TRADES 490 1,600x 30d

BRT Z19 65/60 Put Spread x74.30 TRADES 145 2,375x 6d

BRT Z19 55/45 1×2 Put Spread x74.50 TRADEAS 75 800x 5d

WTI Z/Z20 80 Call Roll x74.25/70.60 TRADES 5 250x 43d/40d

CME Trade Recap

WTI V18 66/71 Fence x69.65 TRADES 52 500x 49d

WTI V18/M19 70 Call Roll x70.00/67.50 TRADES 287 1,300x 52d/52d

WTI V18/M19 70 Call Roll LIVE TRADES 276 1,500x

WTI V18 70 Call x69.90 TRADES 132 300x; TRADES 134 200x 51d

WTI Z18 62/75 Fence x69.25 TRADES 28 500x 38d

WTI G19 60/75 Fence x68.40 TRADES 35 400x 45d

WTI H19 60/75 Fence x68.20 TRADES 21 500x 49d

WTI Z19 100 Call TRADES 49 1,550x

WTI Z19 60/55 Put Spread x65.50 TRADES 158 1,000x 5d

WTI Z20 60/65 Fence x62.00 TRADES 60 1,000x 86d

CSO/ARB/APO Trade Recap

WTI CSO V/X18 Flat/0.25 Put Spread (WA) TRADES 7 1,000x

WTI CSO V/X18 0.25 Put (WA) TRADES 8 500x

WTI CSO V/X18 Flat Put (WA) TRADES 2.5 500x

ARB Z18 -9.00 Put TRADES 76 500x

WTI APO Z18 65 Put x68.90 TRADES 197 100x 31d

WTI APO U18 69 Put x69.80 TRADES 84 1,000x 38d

BRT APO Cal19 62/67 Put Spread x75.40 TRADES 127 500x 7d

WTI Skew change (d/d)

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

V8 |

2.6 |

1.9 |

0.95 |

0.4 |

22.24 |

-0.1 |

0.05 |

0.5 |

1.05 |

|

V8 (8/29) |

2.7 |

2 |

1.05 |

0.5 |

21.96 |

-0.15 |

-0.05 |

0.25 |

0.65 |

|

|

-0.1 |

-0.1 |

-0.1 |

-0.1 |

0.28 |

0.05 |

0.1 |

0.25 |

0.4 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

X8 |

2.55 |

1.9 |

1.1 |

0.5 |

23.2 |

-0.2 |

-0.05 |

0.45 |

1.15 |

|

X8 (8/29) |

2.45 |

1.85 |

1.15 |

0.55 |

23.01 |

-0.25 |

-0.2 |

0.15 |

0.7 |

|

Change |

0.1 |

0.05 |

-0.05 |

-0.05 |

0.19 |

0.05 |

0.15 |

0.3 |

0.45 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

Z8 |

2.9 |

2.25 |

1.4 |

0.7 |

23.86 |

-0.4 |

-0.4 |

-0.05 |

0.5 |

|

Z8 (8/29) |

2.9 |

2.25 |

1.45 |

0.75 |

23.58 |

-0.4 |

-0.5 |

-0.25 |

0.25 |

|

Change |

0 |

0 |

-0.05 |

-0.05 |

0.28 |

0 |

0.1 |

0.2 |

0.25 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

F9 |

3.05 |

2.45 |

1.6 |

0.85 |

24.46 |

-0.55 |

-0.65 |

-0.35 |

0.2 |

|

F9 (8/29) |

2.95 |

2.45 |

1.65 |

0.9 |

24.2 |

-0.55 |

-0.7 |

-0.45 |

0.05 |

|

Change |

0.1 |

0 |

-0.05 |

-0.05 |

0.26 |

0 |

0.05 |

0.1 |

0.15 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

G9 |

3.4 |

2.85 |

2 |

1.1 |

24.24 |

-0.65 |

-0.8 |

-0.55 |

0 |

|

G9 (8/29) |

3.35 |

2.85 |

2 |

1.15 |

24.02 |

-0.7 |

-0.85 |

-0.6 |

-0.05 |

|

Change |

0.05 |

0 |

0 |

-0.05 |

0.22 |

0.05 |

0.05 |

0.05 |

0.05 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

H9 |

3.85 |

3.3 |

2.4 |

1.35 |

24.29 |

-0.85 |

-1.05 |

-0.8 |

-0.25 |

|

H9 (8/29) |

3.85 |

3.3 |

2.35 |

1.3 |

24.08 |

-0.85 |

-1.05 |

-0.8 |

-0.3 |

|

Change |

0 |

0 |

0.05 |

0.05 |

0.21 |

0 |

0 |

0 |

0.05 |

|

WTI Skew |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

M9 |

4.6 |

4.1 |

3.05 |

1.75 |

24.20 |

-1.1 |

-1.4 |

-1.15 |

-0.65 |

|

M9 (8/29) |

4.6 |

4.1 |

3.05 |

1.75 |

24.10 |

-1.15 |

-1.45 |

-1.25 |

-0.75 |

|

Change |

0 |

0 |

0 |

0 |

0.1 |

0.05 |

0.05 |

0.1 |

0.1 |

Brent Skew Change (d/d)

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

X8 |

1.95 |

1.25 |

0.5 |

0.15 |

23.68 |

0.15 |

0.45 |

1.05 |

1.75 |

|

X8 (8/29) |

1.7 |

1.15 |

0.5 |

0.2 |

23.41 |

0.05 |

0.3 |

0.75 |

1.4 |

|

Change |

0.25 |

0.1 |

0 |

-0.05 |

0.27 |

0.1 |

0.15 |

0.3 |

0.35 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

Z8 |

2.15 |

1.3 |

0.65 |

0.25 |

24.48 |

0 |

0.15 |

0.65 |

1.65 |

|

Z8 (8/29) |

2.25 |

1.4 |

0.7 |

0.3 |

24.18 |

-0.05 |

0.05 |

0.45 |

1.25 |

|

Change |

-0.1 |

-0.1 |

-0.05 |

-0.05 |

0.3 |

0.05 |

0.1 |

0.2 |

0.4 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

F9 |

2.75 |

1.95 |

1 |

0.45 |

24.27 |

-0.1 |

0.05 |

0.45 |

1.05 |

|

F9 (8/29) |

2.65 |

1.9 |

1.05 |

0.5 |

24.15 |

-0.15 |

-0.1 |

0.2 |

0.7 |

|

Change |

0.1 |

0.05 |

-0.05 |

-0.05 |

0.12 |

0.05 |

0.15 |

0.25 |

0.35 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

G9 |

3.05 |

1.95 |

1.2 |

0.65 |

25.07 |

-0.35 |

-0.45 |

-0.05 |

1 |

|

G9 (8/29) |

3.05 |

1.95 |

1.2 |

0.65 |

24.8 |

-0.4 |

-0.5 |

-0.2 |

0.75 |

|

|

0 |

0 |

0 |

0 |

0.27 |

0.05 |

0.05 |

0.15 |

0.25 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

H9 |

3.3 |

2.35 |

1.6 |

0.9 |

24.84 |

-0.5 |

-0.5 |

0.05 |

1.1 |

|

H9 (8/29) |

3.35 |

2.4 |

1.65 |

0.9 |

24.6 |

-0.5 |

-0.6 |

-0.15 |

0.8 |

|

|

-0.05 |

-0.05 |

-0.05 |

0 |

0.24 |

0 |

0.1 |

0.2 |

0.3 |

|

Brent |

10DP |

15DP |

25DP |

35DP |

50D |

35DC |

25DC |

15DC |

10DC |

|

M9 |

4.2 |

3.5 |

2.45 |

1.35 |

24.87 |

-0.75 |

-0.85 |

-0.3 |

0.55 |

|

M9 (8/29) |

4.3 |

3.55 |

2.5 |

1.4 |

24.78 |

-0.85 |

-0.95 |

-0.5 |

0.3 |

|

|

-0.1 |

-0.05 |

-0.05 |

-0.05 |

0.09 |

0.1 |

0.1 |

0.2 |

0.25 |

OPEC to review monitoring of crude oil output deal in Algiers in September – Platts

OPEC and its allies on Thursday vowed to review the monitoring mechanisms of its output agreement at the Joint Ministerial Monitoring Committee meeting in Algiers on September 23 but said it sees the current oil market as largely balanced. The JMMC, which is responsible for closely monitoring the market and recommending appropriate response measures, said in a statement that in Algiers "it will review the plan for monitoring overall market fundamentals and conformity levels for the remainder of 2018, as well as the framework of cooperation to be established in 2019 and beyond. The JMMC said it was satisfied that recent market fundamentals showed a "good balance between supply and demand considering seasonal factors. "Conformity levels of the participating countries was 109% in July compared to 121% in June, but still higher than what the alliance had agreed to at its meeting in late June, the statement said. The six-country committee, which is chaired by Saudi Arabia’s energy minister Khalid al-Falih and includes ministers from Russia, Kuwait, Venezuela, Algeria and Oman, will be present at the Algiers meeting along with Iran’s oil minister Bijan Zanganeh. OPEC and its partners agreed in late June to raise output by 1 million b/d. Given some countries are unable to pump more, a split has emerged on how to proceed. OPEC’s largest oil producer Saudi Arabia argues that the agreement should use a collective production ceiling, with the JMMC responsible for reallocating production quotas. Iran’s oil minister Bijan Zanganeh maintains that the OPEC/non-OPEC production deal does not allow countries to produce more than their individual quotas. This meeting is scheduled just six weeks before US sanctions that could shut in 1 million b/d or more of Iran’s crude sales are scheduled to take effect in November.

Saudi oil production in August rose to 10.424 mln bpd – OPEC source – Reuters News

Saudi Arabia’s crude oil production in August rose to 10.424 million barrels per day (bpd) compared to 10.288 million bpd in July, an OPEC source said on Friday. Crude supply in August was 10.467 million bpd, the OPEC source familiar the kindgom’s output plans said, compared to 10.380 million bpd in July. Supply to the market – domestically and for export – may differ from production depending on the movement of barrels in and out of storage. "This reflects customers needs, and is in accordance with the OPEC+ agreement," the OPEC source said, referring to the deal between the Organization of the Petroleum Exporting Countries, Russia and other producers to rein in production. The source said the drop in July output was due to lower exports after Riyadh halted oil shipments through Bab al Mandeb, following an attack by Yemen’s Houthi movement on Saudi oil tankers in the waterway between the Indian Ocean and Red Sea. OPEC and its allies pledged on June 22-23 to return to 100 percent compliance with their agreement to reduce their combined output by 1.8 million bpd. The pact was first implemented in January 2017.

Middle East Crude-Benchmarks ease on expiry – Reuters News

Middle East crude benchmarks eased on Friday, the last day of trade for this month.

WINDOW: Total will deliver a Murban crude oil cargo to Shell following the convergence of 20 partials in Platts cash Oman, several trade sources said. This is the first delivery of a Murban cargo following trades in crude oil partials on the Platts window that assesses the benchmark for Middle East and some Russia crude grades, they said. Earlier this month, Total had also offered for the first time 2 million barrels of Murban crude for delivery to Singapore from a supertanker on window. It eventually sold the oil to a Japanese end-user. Cash Dubai’s premium to swaps eased 2 cents to 82 cents a barrel. A total 78 partials were traded on Friday. Chinaoil will deliver an Oman cargo to Vitol following the convergence of 20 Dubai partials.

KUWAIT: Kuwait plans to publish monthly official selling prices (OSP) for its new grade Kuwait Super Light Crude (KSLC) starting with cargoes loading in October, two sources with knowledge of the matter said.

The price is expected to be announced next month along with the OSP for Kuwait Export Crude (KEC), the OPEC producer’s flagship export grade, they said. KSLC has so far been sold only on spot basis at prices close to that of Saudi’s Arab Extra Light crude, sources said, adding that having a monthly price would enable Kuwait Petroleum Corp (KPC) to sell the oil through long-term contracts. Term supplies may start at the end of this year or early next year, one of the sources said. Last month, KPC sold 100,000 barrels per day of KSLC for September loading to buyers in North Asia

JAPAN: Japan’s crude oil imports last month dropped 12.8 percent from a year earlier to 2.92 million barrels per day, or 14.4 million kilolitres, the lowest volumes for the month of July since 1985, monthly data from the trade ministry showed. Japan imported Kuwait Super Light crude for the first time last month, and imported Tapis crude from Malaysia for the first time since December 2015, a trade ministry official said.

Aramco May Raise Oct. Asia Arab Light Oil OSP by 15C M/M: Survey

Saudi Aramco may raise its official selling price for Arab Light crude by 15c m/m to Asian customers for Oct. sales, according to median estimate in Bloomberg survey of 5 traders.

- Oct. Arab Light OSP forecast to rise to $1.35/bbl premium to Oman-Dubai benchmark vs $1.20 premium in Sept.

- Three respondents expect 15c/bbl increase m/m, one expects an increment of 10c-15c while another estimates +20c

- Last month, Saudi reduced Arab Light differential by 70c/bbl versus an expected cut of 60c

French call for more Iran negotiations "bullying and excessive" – Iran – Reuters News

Iran’s foreign ministry on Friday dismissed a French call for more negotiations with Tehran over the international nuclear accord and said some of France’s partners are "bullying and excessive," a seeming reference to the United States. There was no need for the 2015 agreement between Iran and six world powers to be renegotiated, foreign ministry spokesman Bahram Qassemi said, according to the Islamic Republic News Agency (IRNA). "In the conditions when all of Iran’s efforts with other world powers is nullified through the bullying and excessive demands of some of the partners of the French foreign minister and their own inability … there is no reason, need, reliability or trust for negotiations on issues that are non-negotiable," Qassemi said. French Foreign Minister Jean-Yves Le Drian said on Thursday that, following the U.S. pullout from the agreement, Tehran should be ready to negotiate on its future nuclear plans, its ballistic missile arsenal and its role in wars in Syria and Yemen. "French and international officials know well that Iran’s regional policy is in pursuit of peace and regional and international security and combating terrorism and extremism," Qassemi said. The agreement, reached after years of painstaking negotiations, limited Iran’s nuclear development programs in exchange for an easing of sanctions. Western powers had been concerned that Tehran was building towards nuclear weapons, although the Islamic Republic maintained the program was for peace purposes. U.S. President Donald Trump backed out of the agreement in May, throwing its survival into doubt. Paris and Tehran have already locked horns this week. France told its diplomats and foreign ministry officials to postpone indefinitely all non-essential travel to Iran, citing a foiled bomb plot and a hardening of Tehran’s attitude towards France, according to an internal memo seen by Reuters.

Top US, India officials to discuss Iran sanctions waiver next week in New Delhi – Platts

High-level talks between the US and Indian governments next week in New Delhi will likely include discussion of India’s request to continue importing some Iranian crude oil after US sanctions resume in November. As one of Tehran’s top oil customers, India’s post-sanctions import plans will play a major role in how much Iranian exports drop in the coming months. India recently signed its first term contract for US crude exports to lock in low prices, a topic that might also come up during the meeting between the US and Indian defense and foreign ministers. "We have been discussing regularly with India issues related to both Iran and [US sanctions against Russia] and are looking, as with other partners, to identify ways to cooperate to support our policy goals with regard to both those issues," a senior State Department official said Thursday during a background briefing, on condition of anonymity. Iran is already seeing its oil exports fall ahead of the November 5 resumption of US secondary sanctions as a result of President Donald Trump pulling the US out of the Iran nuclear deal in May. S&P Global Platts Analytics estimates Iranian crude and condensate exports will fall to 1.47 million b/d in November, a cut of 1.44 million b/d from April levels and a cut of 874,000 b/d from July. US Secretary Mike Pompeo and Defense Secretary Jim Mattis will meet their Indian counterparts External Affairs Minister Sushma Swaraj and Defense Minister Nirmala Sitharaman during the "2+2 ministerial dialogue" on September 6. The State Department would not say if India has formally requested a waiver to the Iran sanctions in exchange for making significant cuts to its Iranian imports, but one of the senior officials said the two countries have engaged frequently on the issue in recent weeks. "We continue to discuss our Iran policy with our Indian counterparts and speak to them, certainly, about the implications of our re-imposition of sanctions," the senior official said. "The president has made very clear that the United States is fully committed to enforce all our sanctions, and that starting on November 5th, sanctions on Iran’s energy sector, Central Bank of Iran, and Iran’s shipping sectors will come into effect." Next week’s meeting will focus on strategic partnerships between the US and India in the areas of military, economy and bilateral trade, which the State Department said expanded by $12 billion last year to $126 billion. "We want to continue to grow the trade relationship to our mutual benefit, but to ensure the trade is fair and reciprocal," the official said. "It is no surprise that tariff and non-tariff barriers have been the subject of longstanding concern, and the US government is working with the government of India to address market access challenges."

Iran moves missiles to Iraq in warning to enemies – sources – Reuters News

Iran has given ballistic missiles to Shi’ite proxies in Iraq and is developing the capacity to build more there to deter attacks on its interests in the Middle East and to give it the means to hit regional foes, Iranian, Iraqi and Western sources said. Any sign that Iran is preparing a more aggressive missile policy in Iraq will exacerbate tensions between Tehran and Washington, already heightened by U.S. President Donald Trump’s decision to pull out of a 2015 nuclear deal with world powers. It would also embarrass France, Germany and the United Kingdom, the three European signatories to the nuclear deal, as they have been trying to salvage the agreement despite new U.S. sanctions against Tehran. According to three Iranian officials, two Iraqi intelligence sources and two Western intelligence sources, Iran has transferred short-range ballistic missiles to allies in Iraq over the last few months. Five of the officials said it was helping those groups to start making their own. "The logic was to have a backup plan if Iran was attacked," one senior Iranian official told Reuters. "The number of missiles is not high, just a couple of dozen, but it can be increased if necessary." Iran has previously said its ballistic missile activities are purely defensive in nature. Iranian officials declined to comment when asked about the latest moves. The Iraqi government and military both declined to comment. The Zelzal, Fateh-110 and Zolfaqar missiles in question have ranges of about 200 km to 700 km, putting Saudi Arabia’s capital Riyadh or the Israeli city of Tel Aviv within striking distance if the weapons were deployed in southern or western Iraq. The Quds Force, the overseas arm of Iran’s powerful Islamic Revolutionary Guard Corps (IRGC), has bases in both those areas. Quds Force commander Qassem Soleimani is overseeing the programme, three of the sources said. Western countries have already accused Iran of transferring missiles and technology to Syria and other allies of Tehran, such as Houthi rebels in Yemen and Lebanon’s Hezbollah. Iran’s Sunni Muslim Gulf neighbours and its arch-enemy Israel have expressed concerns about Tehran’s regional activities, seeing it as a threat to their security. Israeli officials did not immediately respond to requests for comment about the missile transfers. Israeli Prime Minister Benjamin Netanyahu said on Wednesday that anybody that threatened to wipe Israel out "would put themselves in a similar danger".

MISSILE PRODUCTION LINE

The Western source said the number of missiles was in the 10s and that the transfers were designed to send a warning to the United States and Israel, especially after air raids on Iranian troops in Syria. The United States has a significant military presence in Iraq. "It seems Iran has been turning Iraq into its forward missile base," the Western source said. The Iranian sources and one Iraqi intelligence source said a decision was made some 18 months ago to use militias to produce missiles in Iraq, but activity had ramped up in the last few months, including with the arrival of missile launchers. "We have bases like that in many places and Iraq is one of them. If America attacks us, our friends will attack America’s interests and its allies in the region," said a senior IRGC commander who served during the Iran-Iraq war in the 1980s. The Western source and the Iraqi source said the factories being used to develop missiles in Iraq were in al-Zafaraniya, east of Baghdad, and Jurf al-Sakhar, north of Kerbala. One Iranian source said there was also a factory in Iraqi Kurdistan. The areas are controlled by Shi’ite militias, including Kata’ib Hezbollah, one of the closest to Iran. Three sources said Iraqis had been trained in Iran as missile operators. The Iraqi intelligence source said the al-Zafaraniya factory produced warheads and the ceramic of missile moulds under former President Saddam Hussein. It was reactivated by local Shi’ite groups in 2016 with Iranian assistance, the source said. A team of Shi’ite engineers who used to work at the facility under Saddam were brought in, after being screened, to make it operational, the source said. He also said missiles had been tested near Jurf al-Sakhar. The U.S. Central Intelligence Agency and the Pentagon declined to comment. One U.S official, speaking on condition of anonymity, confirmed that Tehran over the last few months has transferred missiles to groups in Iraq but could not confirm that those missiles had any launch capability from their current positions. Washington has been pushing its allies to adopt a tough anti-Iran policy since it reimposed sanctions this month. While the European signatories to the nuclear deal have so far balked at U.S. pressure, they have grown increasingly impatient over Iran’s ballistic missile program. France in particular has bemoaned Iranian "frenzy" in developing and propagating missiles and wants Tehran to open negotiations over its ballistic weapons. Foreign Minister Jean-Yves Le Drian said on Thursday that Iran was arming regional allies with rockets and allowing ballistic proliferation. "Iran needs to avoid the temptation to be the (regional) hegemon," he said. In March, the three nations proposed fresh EU sanctions on Iran over its missile activity, although they failed to push them through after opposition from some member states. "Such a proliferation of Iranian missile capabilities throughout the region is an additional and serious source of concern," a document from the three European countries said at the time.

MESSAGE TO FOES

A regional intelligence source also said Iran was storing a number of ballistic missiles in areas of Iraq that were under effective Shi’ite control and had the capacity to launch them. The source could not confirm that Iran has a missile production capacity in Iraq. A second Iraqi intelligence official said Baghdad had been aware of the flow of Iranian missiles to Shi’ite militias to help fight Islamic State militants, but that shipments had continued after the hardline Sunni militant group was defeated. "It was clear to Iraqi intelligence that such a missile arsenal sent by Iran was not meant to fight Daesh (Islamic State) militants but as a pressure card Iran can use once involved in regional conflict," the official said. The Iraqi source said it was difficult for the Iraqi government to stop or persuade the groups to go against Tehran. "We can’t restrain militias from firing Iranian rockets because simply the firing button is not in our hands, it’s with Iranians who control the push button," he said. "Iran will definitely use the missiles it handed over to Iraqi militia it supports to send a strong message to its foes in the region and the United States that it has the ability to use Iraqi territories as a launch pad for its missiles to strike anywhere and anytime it decides," the Iraqi official said. Iraq’s parliament passed a law in 2016 to bring an assortment of Shi’ite militia groups known collectively as the Popular Mobilisation Forces (PMF) into the state apparatus. The militias report to Iraq’s prime minister, who is a Shi’ite under the country’s unofficial governance system. However, Iran still has a clear hand in coordinating the PMF leadership, which frequently meets and consults with Soleimani.

Trump Says EU Offer for No Auto Tariffs Is ‘Not Good Enough’

President Donald Trump rejected a European Union offer to scrap tariffs on cars, likening the bloc’s trade policies to those of China. “It’s not good enough,” Trump said of the offer from Brussels during an Oval Office interview with Bloomberg News. “Their consumer habits are to buy their cars, not to buy our cars.” Trump’s comments come just hours after Trade Commissioner Cecilia Malmstrom told European Parliament lawmakers that the EU would be “willing to bring down even our car tariffs to zero, all tariffs to zero, if the U.S. does the same.” Autos were previously excluded from the discussions that focused on manufactured products bought and sold between the two markets. Trump compared the EU to China, where the president is engaged in another escalating trade war. “The European Union is almost as bad as China, just smaller,” Trump said. Last month, the U.S. and EU agreed not to impose new tariffs on each other after Trump and European Commission President Jean-Claude Juncker met at the White House. The two sides agreed to open discussions about a trade agreement on industrial goods but at U.S. insistence left out cars. Trump has set achieving zero tariffs, zero subsidies and zero non-tariff barriers for industrial goods as part of those talks. European leaders and the continent’s auto industry have been offering to drop the EU’s 10 percent tariff on passenger vehicles, a persistent target of Trump’s complaints. He has used the gap between that EU duty and the U.S.’s own 2.5 percent tariff on passenger cars to justify his plan to impose an import tax of as much as 25 percent on imported cars and parts. But that complaint ignores the much higher 25 percent tariff the U.S. applies on light trucks, the most profitable segment for the U.S. auto industry. Eliminating tariffs on U.S. auto imports would do little for General Motors Co. and Ford Motor Co., but would lend a major boost to Germany’s BMW AG and Daimler AG. SUVs assembled by the German carmakers in the American South dominate the models exported to Europe from the U.S. BMW for example is projected to sell nearly 70,000 X3 SUVs in Europe made in its South Carolina factory this year, according to data from LMC Automotive. Compare that to roughly 15,000 units of Tesla Inc.’s Model S sedan, which LMC, an industry data consultancy, projects will be the top-selling model in Europe assembled in the U.S. by an American automaker. Trump has ordered his Commerce Department to investigate whether car imports imperil national security, under the same provision he invoked to impose global tariffs on steel and aluminum earlier this year. The findings of the auto study are due by February, though the president could decide to act before then. This week, Trump threatened Canada with auto tariffs if the country failed to join his trade deal with Mexico to replace Nafta.

EU deeply disagrees with U.S. on trade despite detente – Reuters News

The European Union’s detente on tariffs with the United States has not put to rest "profound disagreements" on trade policy, the European commissioner in charge of trade said on Thursday. In Washington, U.S. President Donald Trump rejected an EU offer to eliminate tariffs on cars and said the EU’s trade policies are "almost as bad as China," Bloomberg News reported. Trump agreed in July to refrain from imposing car tariffs while the two sides sought to cut other trade barriers, in a move described then by the European Commission chief as a major concession. Speaking to the trade committee of the European Parliament on Thursday, European Trade Commissioner Cecilia Malmstrom discussed a group that she and U.S. Trade Representative Robert Lighthizer will lead to determine how tariffs might be removed on industrial goods. "We are not negotiating anything, we have a working group. We have profound disagreements with the United States on trade policy," Malmstrom said. A number of the European lawmakers were fierce critics of a planned EU-U.S. Transatlantic Trade and Investment Partnership (TTIP), negotiations which ended after Trump’s election victory in 2016. "We are not restarting TTIP … This could be a more limited trade agreement, focused on tariffs on goods only," Malmstrom said. She also said the European Union would be willing to reduce its car tariffs to zero, if the United States did the same, going beyond the provisional agreement struck in July which referred only to "non-auto industrial goods". "We would do it if they do it. That remains to be seen," she said, adding she hoped a deal could be finalized by the end of the Commission’s five-year term running until Oct. 31, 2019. Trump, in an interview with Bloomberg, said of the EU proposal to scrap auto tariffs: "It’s not good enough." "Their consumer habits are to buy their cars, not to buy our cars," Trump added, according to Bloomberg. "The European Union is almost as bad as China, just smaller," Bloomberg quoted Trump as saying. The European Union remains at odds with the United States over U.S. blocking of the appointment of judges at the World Trade Organization, over tariffs set for reasons of national security and over Washington’s tough stance towards China. Malmstrom said many U.S. companies and politicians were voicing concerns over goods becoming more expensive in the United States as a result of tariffs. The European Union shared U.S. criticism of China over industry subsidies, state intervention and forced technology transfers, but believed its approach was wrong, she said. "We share those concerns, but we do not agree with their methods of imposing massively billions of tariffs on China, as they have also done with Turkey. We do not share U.S. view that trade wars are good and easy to win," the commissioner said.

Juncker vows to lift auto tariffs if Trump reneges on agreement – Reuters News

The European Union will respond in kind if U.S. President Donald Trump reneges on a pledge to refrain from imposing car tariffs, European Commission President Jean-Claude Juncker said, as trade tensions between Europe and the United States rose again. Juncker told German broadcaster ZDF on Friday that the EU would not let anyone determine its trade policies. If Washington decided to imposed auto tariffs after all, he said, "then we will also do that". Trump rejected on Thursday an EU offer to eliminate tariffs on cars and said the EU’s trade policies are "almost as bad as China", Bloomberg News reported. Juncker said he had negotiated a "ceasefire agreement" with Trump in July and while such deals were often jeopardized, they were generally respected. The EU remains at odds with the United States over U.S. blocking of the appointment of judges at the World Trade Organization, over tariffs set for reasons of national security and over Washington’s tough stance towards China. Trump had agreed in July to hold back on threatened 25-percent car tariffs while the United States and Europe talked about cutting other trade barriers, but U.S. officials have grown frustrated about the slow pace of progress. Speaking to the trade committee of the European Parliament on Thursday, European Trade Commissioner Cecilia Malmstrom said the EU had "profound disagreements" with the United States. Malmstrom said a working group that she and U.S. Trade Representative Robert Lighthizer will lead on the issue was not engaged in formal negotiations. She also said the EU would be willing to reduce its car tariffs to zero if the United States did the same, going beyond the provisional agreement struck in July which referred only to "non-auto industrial goods". In the Bloomberg interview, Trump said of the EU proposal to scrap auto tariffs: "It’s not good enough."

Trump threatens to withdraw U.S. from World Trade Organization – Reuters News

U.S. President Donald Trump threatened in an interview with Bloomberg News on Thursday to withdraw from the World Trade Organization if "they don’t shape up," in his latest criticism of the institution. Such a move could undermine one of the foundations of the modern global trading system, which the United States was instrumental in creating. "If they don’t shape up, I would withdraw from the WTO," Trump said. Trump has complained the United States is treated unfairly in global trade and has blamed the WTO for allowing that to happen. He has also warned he could take action against the global body, although he has not specified what form that could take.

‘I like and respect’ Fed’s Powell, Trump tells Bloomberg News – Reuters News

U.S. President Donald Trump said he respected Federal Reserve Chairman Jerome Powell even though the central bank was not helping him out in trade disputes, Bloomberg News reported on Thursday. "I put a man in there who I like and respect," Trump told Bloomberg in an interview that included a seeming nod by the president to the importance of the Fed’s independence in setting monetary policy. "We are not being accommodated" by the Fed when it comes to trade disputes, Trump said, according to Bloomberg. "That being said … I’m not sure the currency should be controlled by a politician." Trump nominated Powell as Fed chairman late last year, and he took over from Janet Yellen in February. The president has several times in recent weeks criticized the Fed for raising interest rates, most recently saying in an interview with Reuters that he was "not thrilled" with the Fed’s policies and what they might mean for his economic program. The Fed has been tightening credit as the economy recovers with low unemployment and steady inflation, steps Powell and other policymakers say are appropriate if only to bring rates back from the ultra-low levels during the 2007-2009 economic crisis. But that can make borrowing more expensive for businesses and households, and also make U.S. exports less competitive by strengthening the dollar against other currencies. Other presidents have criticized the Fed, and Trump’s comments raised the usual concerns about possible political interference at the central bank. Fed officials, including Powell in remarks last week, have made clear that their rate hike plans remain on track despite Trump’s comments.

Emerging Markets Tumble as Argentina Struggles to Stop Bleeding

A selloff in emerging markets deepened as Argentina and Turkey struggled to shore up global investor confidence. The peso tumbled to a record low, prompting Argentine policy makers to boost rates to 60 percent. In Turkey, a report that the central bank’s deputy governor was set to resign sank the lira. South Africa’s rand volatility soared amid a controversial land reform debate. An expanded foreign-exchange intervention in Brazil brought some relief to both the real and its peers. A little later, currencies extended losses as President Donald Trump was said to move ahead with a plan to impose new tariffs on China as soon as next week. Emerging markets got pummeled again amid concern that Argentina and Turkey’s struggles to bolster their currencies will sink economic growth further — while embroiling the rest of the developing world. That comes at a really bad time when considering the other challenges that investors face — the end of an era of cheap money, prospects of a global trade war, American sanctions and deep political uncertainties in places such as Brazil. “These currencies are infecting emerging markets,” said Shamaila Khan, director of emerging-market debt at Alliance Bernstein in New York, referring to the Turkish lira and the Argentine peso. “There will be volatility around headlines, and today is one of the negative days.”

China Qingdao Crude Port Stockpiles at Highest Since 2014: SCI99

Crude oil inventories at Qingdao port rose 23% w/w to ~23.1m bbls in week to Aug. 31, highest since at least Jan. 31 2014 when data was first available, according to industry researcher SCI99.

- Including Qingdao, stockpiles at 7 ports in Shandong rose 3.9% w/w to ~46.2m bbl, highest since June 8

- Fuel oil stockpiles at Shandong ports -17% w/w to 926.8k bbl

- Inventories at Qingdao -32% w/w to 397.2k bbl

Most of Chinese State Refineries Increase Run Rates, SCI99 Says

Operating rates at state refineries in Southwest China were 83.19% as of Aug 30, up 0.16 ppt from Aug. 16, according to data from Shandong-based industry researcher SCI99.

- Refinery runs in Northeast China +0.01 ppt to 73.34%

- East China runs +0.02 ppt to 82.38%

- South China +0.06 to 82.67%

- Northwest China +0.02 ppt to 74.88%

- Central China -5.82 ppt to 77.05%

- North China +2.89 ppt to 64.04%

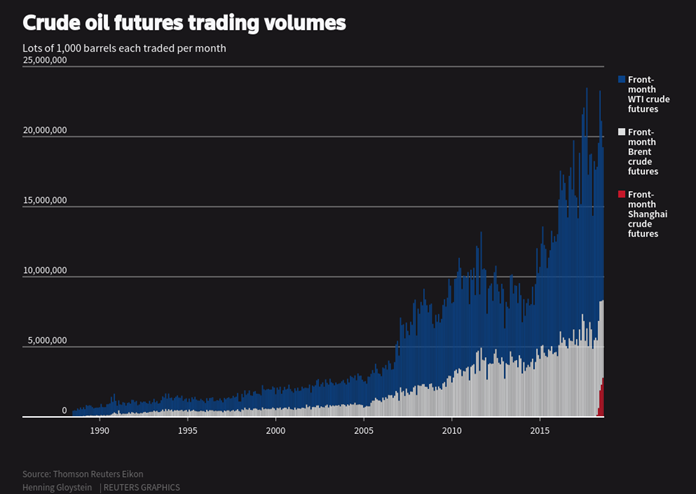

Shanghai crude futures eat into Western benchmarks as China pushes yuan – Reuters News

The launch of China’s first crude futures contract in Shanghai has added a long-awaited Asian benchmark to the global oil sector, challenging the dominance of Western price-markers and threatening ramifications far beyond the energy industry. Since their launch in March 2018, Shanghai crude futures have stolen market share from the incumbent benchmarks – Europe’s Brent and U.S. West Texas Intermediate (WTI) – which trade oil derivatives worth trillions of dollars every year. Volumes have also far bypassed other crude futures, such as those that the Dubai Mercantile Exchange (DME) launched in 2007 with the goal of creating a Middle East/Asian price benchmark. This shift in oil markets could have far-reaching implications, including in foreign exchange markets. "It’s significant. Given the prominence of China in oil markets, we could see more use of the Shanghai contract," said Stephen Innes, head of Asia-Pacific trading at futures brokerage OANDA in Singapore. He said foreign exchange markets were also "taking notice of any yuanification." Since launching in late March, front-month volumes in Shanghai crude futures have risen to trade almost 2.8 million lots of 1,000 barrels in July. This gave the contract a market share for July of 14.4 percent, compared with 28.9 percent for Brent and 56.7 percent for WTI crude futures. "Shanghai crude has good liquidity due to its high volatility and its correlation with international oil futures. It has become a good investment for speculators," said Zhang Huiyao, Deputy General Manager for crude oil trading at Huatai Futures in Guangzhou. Despite this early success, operator Shanghai International Energy Exchange is playing it cool. "China’s crude oil futures remain … behind the mature contracts in Europe and the U.S.," President Jiang Yan told Chinese media this month. "For the contract to have greater impact, it requires … greater participation by foreign companies," he said. Zhang Huiyao of Huatai Futures said more industrial players and pure trading companies would also help. "We are hoping the exchange will create more derivatives contracts linked to the current crude oil futures to engage more diverse investors," she said. Commodity exchanges often build futures volumes by introducing related contracts, which could include buy/sell options, forward contract time spreads or, in the case of a crude contract, derivatives for refined fuel products.

IRAN SANCTIONS

Given China’s status as the world’s biggest oil importer, some analysts say the rise of Shanghai crude futures as a benchmark was inevitable. Yet there has been a more immediate reason for its fast rise: U.S. sanctions against Iran. Washington re-imposed sanctions on Tehran in May, including its financial sector and transactions in the U.S. dollar. From November, the sanctions will also target Iranian oil exports, and Washington has put pressure on companies and governments around the globe to fall in line. As Iran’s biggest customer and amid its trade dispute with Washington, Beijing is expected to ignore U.S. demands. China is already shifting some of its crude futures trading activity away from the dollar and into its own yuan. "I’m convinced China’s strategy on the trade war is it will continue to purchase crude from Iran in yuan, hedging (in) Shanghai," Innes said, eliminating the currency risk of buying oil in the U.S. dollar. Given Russia’s own disputes with Washington, Innes said it could also be interested in selling oil to China in the yuan.

END OF A DUOPOLY?

Shanghai crude futures could eventually remake global oil markets. Beyond an active take-up from domestic retail traders, China’s large oil firms have moved some futures positions out of Brent and into Shanghai crude, said Barry White, senior vice president for derivatives sales at U.S. financial services firm INTL FCStone. Chinese oil refiners find the medium to sour Middle East crude underlying Shanghai futures "more in line with their imports and usage" than Brent, which is priced off North Sea crude grades that tend to be lighter in quality, White said. The first front-month contract since the Shanghai oil futures were launched is due for delivery in September, with Chinese oil-trading majors like Unipec, China National Petroleum Corp (CNPC) and Zhenhua Oil accounting for most of the volume. CNPC declined to comment, while Unipec and Zhenhua Oil did not immediately respond to queries. Western commodity merchants and banks have also been doing test trades in Shanghai crude futures, brokers and company sources said, and are planning to start playing a bigger role. While other futures like DME’s Oman crude have had some success as a benchmark for physical oil prices, their take-up by the financial industry has been limited. China’s new benchmark could change this, potentially breaking the Brent-WTI financial duopoly that has dominated oil trading for decades, requiring international traders to get used to dealing some crude futures in yuan. "The internationalization of the yuan will continue to pick up the pace as mainland markets become more accessible and transparent, and the Shanghai oil contract is an excellent start to that process," said OANDA’s Innes.

KOREA OIL: SK’s July WTI Crude Imports Climb to Highest in 2018

SK Energy buys 2.58m bbl of West Texas Intermediate from U.S. for arrival in July, up 70% from a month earlier, according to Bloomberg calculations based on data obtained from state-run Korea National Oil.

- That’s the biggest purchase of the grade SK made this year

- Other crudes SK imported in July vs June:

- Eagle Ford 499k bbl vs nill; CPC Blend +102% to 2.13m bbl; Forozan +65% to 2.07m bbl; Basrah Light +94% to 2.01m bbl; Basrah Heavy +20% to 2.49m bbl; Kuwait +4.2% to 9.19m bbl; Arab Extra Light -62% to 1.3m bbl

- GS Caltex:

- CPC Blend +96% to 2.1m bbl; Eagle Ford +2.4% to 1.02m bbl; WTI Midland 996k bbl vs nill; Basrah Light +0.4% to 2.98m bbl; Basrah Heavy -50% to 2.92m bbl; Dubai +100% to 1m bbl; Murban +18% to 3.64m bbl; Das -20% to 1.7m bbl; Arab Light -1.1% to 1.5m bbl

- Hyundai Oilbank:

- CPC Blend +104% to 2.15m bbl; Maya -1.1% to 2m bbl; Forozan +1.6% to 559k bbl; Basrah Light -16% to 789k bbl; Arab Light +430% to 1.21m bbl; Arab Extra Light -25% to 608k bbl; Forties +91% to 2m bbl

- S-Oil:

- Arab Super Light +41% to 2.1m bbl; Arab Medium -27% to 6.78m bbl; Arab Light -21% to 8.22m bbl; Saharan Blend little changed at 601k bbl

Mexico’s state-run Pemex pauses light crude exports -data, source – Reuters News

Mexico’s state-run oil firm Pemex has not exported light crude since May, according to a source and export data seen by Reuters on Thursday, as it gears up to process more of the oil at its domestic refineries. Mexico’s President-elect Manuel Andres Lopez Obrador has said he wants to reduce the country’s crude exports and increase domestic production of gasoline and diesel despite a persistent lack of investment in refinery expansion and modernizing. Pemex’s domestic refining network has underperformed again this year, increasing the need for imported fuel. Mexico has bought 1.19 million barrels per day (bpd) of U.S. fuel this year, a 12 percent increase versus the 1.06 million bpd imported in 2017, according to the U.S. Energy Information Administration (EIA). Pemex’s lightest crude grades, Isthmus and Olmeca, were traditionally offered and sold on a spot basis, not through long-term supply contracts, so the pause should not affect specific customers, according to a trader from a company that made purchases last year. In recent years, Olmeca and Isthmus crudes were mostly exported to customers in Asia, according to the trader and Reuters trade flows data. "Those crude are for our refineries," said the Pemex source who was not authorized to speak publicly about the matter. Exports of Isthmus crude declined to an average of 53,000 bpd this year versus 86,000 bpd in 2017, while no barrels of Olmeca have been exported during 2018 compared with 19,000 bpd sold last year, according to Pemex figures. Conversely, exports of Maya heavy crude, Mexico’s flagship crude grade, has averaged 1.157 million bpd this year versus 1.07 million bpd in 2017. Most Maya crude exports ended up in the United States. Pemex’s crude output declined to 1.84 million bpd last month, including 1.07 million bpd of heavy grades. Its refineries worked in July at about 40 percent of their joint capacity of 1.6 million bpd, down from 57 percent of capacity for all of 2017.

Texas’ oil output drops in June for first time since Feb. 2017 – Reuters News

Texas oil production fell in June from a year earlier for the first time in 16 months, according to figures released on Thursday by the state’s energy regulator, a fresh sign that a lack of pipeline space in the nation’s largest shale field may be curbing production. Texas June oil production was 98.9 million barrels, down about 2 percent from the same month last year and off 7 percent from the previous month, the Texas Railroad Commission estimated in a monthly report. So far this year, the state’s crude output had been rising 10.4 percent annually. The slowdown comes as oil prices in West Texas, home of the oil-rich Permian Basin, have fallen to near four-year lows as production outpaces takeaway capacity, including pipelines, local refineries and rail cars. This week, West Texas Intermediate (WTI) in Midland, Texas, traded at a more than $18-a-barrel discount to the U.S. benchmark, its lowest level since August 2014. Back then, local oil prices also sank because there were not enough pipelines to carry away production. Some West Texas producers have said they will pull back on activity and delay well completions as a result of falling local oil prices. The number of drilled but uncompleted wells (DUCs) in the Permian rose by 167 in July, to 3,470, accounting for around 43 percent of all DUCs in the United States, the U.S. Energy Information Administration said this month. Keane Group, which hydraulically fractures shale wells, last month said it expected DUCs to rise as operators continue to drill wells to hold onto specialized rigs. When prices are weak, producers will hold off completing wells and grow their DUC count. The U.S. Department of Energy forecasts West Texas oil production will grow next month, despite the weaker prices and transportation bottlenecks. It calls for output to rise by 34,000 barrels per day to 3.42 million, the EIA said this month.

U.S. Cash Crude-WTI Midland sinks to fresh six-year low, coastal grades firm – Reuters News

U.S. West Texas Intermediate at Midland differentials sank to a fresh six-year low on Thursday, reflecting a temporary pipeline shut-in earlier in the week in a region already facing crude oil bottlenecks, dealers said. WTI Midland traded as low as an $18.25 per barrel discount to U.S. crude futures, dealers said, the lowest since November 2012. Transportation bottlenecks have weighed on Midland prices for months on a lack of pipeline capacity to carry crude to markets along the Gulf Coast. The coming end of the U.S. summer travel season and refinery maintenance season also are weighing on Midland crude prices, dealers said. "During turnarounds, crude oil is typically weak and products are strong because refineries aren’t outputting product," one broker said. "There is less demand for crude at those times and less supply of product." Tuesday’s temporary closure of Plains All American’s Basin pipeline due to a fire at a storage facility near Wichita Falls, Texas, also weighed on prices, traders said. "They’re pretty darn close to max capacity, so having a pipeline go down for any amount of time is not good," one broker said. Meanwhile, crude inventories at the Cushing, Oklahoma, oil hub rose to 26.8 million barrels, up about 870,000 in the week through Tuesday, dealers said, citing data from market intelligence firm Genscape. The spread between U.S. crude and global benchmark Brent ended the day narrower on Thursday, but it initially widened, strengthening coastal crude grades because export demand typically rises when U.S. crude is cheaper than the international standard. Light Louisiana Sweet strengthened to a $6 per barrel premium to U.S. crude while WTI at East Houston rose 25 cents to the highest level since June 22.

- Light Louisiana Sweet WTC-LLS for October delivery rose 25 cents to a midpoint of $6 per barrel and traded between $5.50 and $6.50 a barrel premium to U.S. crude futures.

- Mars Sour WTC-MRS fell 30 cents to a midpoint of $2.45 and traded between $2.20 and $2.70 a barrel premium to U.S. crude futures.

- WTI Midland WTC-WTM fell 25 cents to a midpoint of $17.75 per barrel and traded between $18.50 and $17 a barrel discount to U.S. crude futures.

- West Texas Sour WTC-WTS dropped $1 to a midpoint of $18 and traded between $18.25 and $17.75 a barrel discount to U.S. crude futures.

- WTI at East Houston WTC-MEH traded at $5.60 and $5.90 over U.S. crude futures.

U.S. Coast Guard responding to oil spill near Corpus Christi, Texas – Reuters News

The U.S. Coast Guard said about 1,176 gallons of oil was spilled from an overloaded barge moored at Flint Hills east dock near Corpus Christi, Texas Thursday evening. Multiple crews were involved in the clean-up efforts, the Coast Guard said. The agency, however, did not say if there were any waterway closures due to the spill.

Trans Mountain Delay Supports Wide WTI-WCS Differential: Goldman

Given risk to the in-service timeline of the Trans Mountain Expansion pipeline, Goldman Sachs reiterates its view that WTI-WCS differentials will remain wider than 2017 levels, analysts led by Neil Mehta say in note.

- Additionally, WCS spreads will continue being driven wider on ramping Canadian crude production (from Fort Hills and Horizon Phase 3), existing pipeline constraints (apportionment on Enbridge’s Mainline network), and challenges in signing long-term pacts

- Sees WTI-WCS differentials of $25/$22/$25 in 4Q2018/2019/2020 respectively, vs spot levels near $27/bbl; suggests risk to forecast is to the upside

- Could be tailwind for U.S. refiners and Canadian rails, while headwind for Canadian oil producers

U.S. Cash Products-Group Three gasoline falls to 8-wk low ahead of futures contract expiry – Reuters News

U.S. Group Three gasoline cash differentials fell to an eight-week low on Thursday as market participants readjusted positions the day before the September gasoline futures benchmark on NYMEX expires. Group Three gasoline lost 2.00 cents a gallon to trade at 6.25 cents per gallon below the gasoline futures benchmark on the New York Mercantile Exchange, traders said. The product has not traded that low since July 6, when it traded at 6.75 cents per gallon below futures. Elsewhere in the Midwest, Chicago CBOB gasoline fell a half penny to trade at 7.25 cents per gallon above futures. On the Gulf Coast, A2 CBOB gasoline lost a quarter of a cent to trade at 0.75 cent per gallon below futures. Heating oil in the region lost a half penny to trade at 13.50 cents per gallon below the heating oil futures benchmark. In New York Harbor, F2 RBOB gained a quarter of a penny to trade at 2.50 cents per gallon above futures, market participants said. Ultra-low sulfur diesel gained a quarter of a cent, trading flat with the futures benchmark. Phillips 66 reported flaring at its 258,000 barrels-per-day Bayway, New Jersey, refinery due to a unit startup on Thursday. The RBOB futures contract on NYMEX rose 3.75 cents to settle at $2.1435 a gallon on Thursday. NYMEX ultra-low sulfur diesel futures gained 0.62 cent to settle at $2.2483 a gallon. Renewable fuel (D6) credits for 2018 traded between 19 and 20 cents each on Thursday, unchanged from Wednesday, traders said. Biomass-based diesel credits (D4) traded at 41 cents each, unchanged from Wednesday, traders said.

Motiva Port Arthur gasoline unit resumes operations – sources – Reuters News

The 82,000-barrel-per-day (bpd) gasoline-producing fluidic catalytic cracking unit (FCCU) at Motiva Enterprises’ 603,000-bpd Port Arthur, Texas refinery, returned to normal operations on Thursday, said sources familiar with the plant. Motiva is preparing to shut the Lube Catalytic Dewaxer unit by the middle of next week for a month-long overhaul, sources said. The FCCU fell out of production on Sunday because of a malfunction and returned to normal operations on Monday before a seal failure again took it out of production, sources added. The seal was repaired late on Wednesday. The FCCU uses catalyst under high pressure and high heat to convert gas oil to gasoline. The dewaxer also uses a catalyst to improve lube oils and produce feedstock for distillates.

Exxon to shut unit at Britain’s Fawley refinery for maintenance – traders – Reuters News

U.S. major ExxonMobil Corp plans to shut the gasoline-making fluid catalytic cracker at its Fawley refinery in Britain for around six weeks from Sept. 28, according to three trading sources

The unit has a capacity of 75,000 barrels per day (bpd) while the overall refinery has a capacity of 270,000 bpd

Storm Brewing Near Puerto Rico May Drench Gulf Region Next Week

A loose collection of thunderstorms near Puerto Rico may gather enough strength to form a weak tropical system next week as it moves toward oil and natural gas rigs in the U.S. Gulf of Mexico and drenches the coast. “There is certainly potential,” said Dan Kottlowski, a hurricane forecaster with AccuWeather Inc. in State College, Pennsylvania. “But it would be a rather weak system. It will probably just be mostly a rain producer for the Gulf Coast.” Forecasts will become clearer through the weekend, Kottlowski said. If a storm does develop, it likely won’t reach land until September 6 or 7. It would be the second tropical storm to threaten the region this year, in what has been an unusually quiet season for the Atlantic. Meanwhile, a second system off the coast of Africa now appears to be heading away from North America. The other storm has triggered warnings for the southern islands of Cabo Verde — it could reach tropical strength Friday and be a hurricane Sunday, according to the National Hurricane Center. After that, the forecast calls for it to wander into the mid-Atlantic, far from land. “For all intents and purposes, once it gets past the Cabo Verde Islands it will be mainly a fish storm,” Kottlowski said.

Invest 90L Likely to Develop in Eastern Atlantic Off African Coast; Caribbean Wave Will Be Monitored in Gulf of Mexico Next Week

Argentina May Send First LPG Cargo to China on Trade War: Kpler

Argentina’s Compania Mega is expected to load 40k tons of LPG from Bahia Blanca on Sept. 24 for delivery to a port in China by end-October, according to Kpler report emailed Aug. 31.

- Co. had awarded cargo to Sinopec in a tender; the LPG will be loaded on Oriental Energy’s ship, Bu Sidra

- If the delivery takes place as planned, it will be the first cargo from Argentina to China

- “Now that U.S.-sourced LPG is no longer going to China, local companies appear to be looking for alternative sources": Kpler

Shanghai Port to Start Tighter Marine-Fuel Sulfur Cap on Oct. 1

All ships entering, anchoring and operating within Shanghai port are required to use bunker fuel oil with 0.5% or lower sulfur content from Oct. 1, according to Shanghai Maritime Safety Administration.

- Vessels traveling in inland rivers should use compliant diesel, the administration says in statement posted on its website Thursday

- Ships could also use qualified clean energy or de-sulfurization technology to meet emission control requirement

- Requirements valid until Dec. 31, 2020 and will be adjusted in line with relevant national rules

Jonathan Wagner

Ion Energy Group

88 Pine Street, Suite 15

New York, NY 10005

Direct: 212-709-2261

Cell: 914-843-6986